CBOE Holdings, Inc. Annual Meeting of Stockholders May 21, 2015, 9:30 a.m.

advertisement

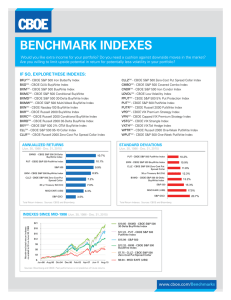

CBOE Holdings, Inc. Annual Meeting of Stockholders May 21, 2015, 9:30 a.m. Remarks of Edward Tilly, CBOE Chief Executive Officer Thanks Bill and thank you to everyone here, and those listening in for joining us today. Before I begin, let me remind you that this presentation does contain some forward-looking statements, which involve risks and uncertainties. Actual results may vary. Please refer to our filings with the SEC for more detailed information about the risks and uncertainties. 2014 was a year for the record books at CBOE Holdings. A total of 1.3 billion futures and options contracts traded, an all-time high and an increase of 12 percent over the previous year. Increased trading across all product lines drove new highs in key financial metrics, including revenue, earnings and operating margin. We continued to reward stockholders through increased quarterly dividends and share repurchases and to fund strategic growth initiatives. The groundwork laid by our team -- to develop new products, educate customers and broaden access to our marketplace -- positioned CBOE Holdings to increase futures trading by 26 percent and options trading by 11 percent, outpacing industry growth by several percentage points. We were especially gratified to see record trading in our proprietary products, S&P 500 Index (SPX) options and CBOE Volatility Index® (VIX® Index) futures and options. Thus far in 2015, we’ve seen a much different trading environment. CBOE Holdings' total volume is down 14 percent through May 15 th, compared with the same period in 2014. The decline generally mirrors trading levels in futures and options industrywide, with the exception of a sharper decrease in VIX options. Naturally, we’ve worked closely with customers to monitor this trend. Nothing we’ve learned has altered our expectations for the ongoing, long-term growth in VIX options trading. Volatility trading tends to work especially well as a hedge against sharp market declines, but thus far in 2015 the market continues to steadily grind upward. In this environment, market dips are viewed as buying opportunities rather than signs of a sustained reversal. As a result, investors find fewer reasons to hedge with volatility products and instead use other index options -- such as SPX options -- for directional exposure to stock prices. I should note that SPX volume is up one percent to date in an otherwise down period. Market participants generally expect volume and open interest to pick up as conditions change, as do we. Low volume cycles are part of trading. We don’t like to see them, but they are to be expected. Our ongoing disciplined approach to cost-management enables us to weather the inevitable troughs and to lay the foundation for even greater growth when market conditions change. We never waiver from our core mission to create value for stockholders with a focus on generating industry-leading profit margins and growth rates through a diversified portfolio of risk management products and services. Our team brings that mission to life through an alchemy that is uniquely CBOE: Collaborate, Create and Connect. Product innovation is the cornerstone of our growth strategy. We continue to grow and define the volatility space by creating new VIX products. In November 2014 we launched futures on the CBOE/CBOT 10-year Treasury Note Volatility Index (TYVIX). Interest rates represent the largest asset class in the OTC market, and TYVIX represents the first exchange-traded volatility benchmark in that space. Educating this new customer base is an ongoing effort and opportunity for CBOE. More recently, we announced plans to introduce Weekly VIX options and futures. Pending regulatory approval, we plan to launch the futures this July, with the options to follow. Short-term trading has increased dramatically industrywide and VIX Weeklys will provide investors with new opportunities to establish short-term VIX positions. Expertise in product innovation has enabled CBOE to successfully leverage partnerships with the world’s leading index providers since creating the first index option with Standard and Poor’s in 1983. We recently entered into licensing agreements with two major index providers. These collaborations enable us to significantly expand CBOE’s product line across new asset classes and markets and create new and compelling trading opportunities for our customers. In December, we partnered with MSCI Inc., a leading provider of global investment tools, to enable CBOE to be the only U.S. exchange to list options on MSCI indexes. Our April launch of options on MSCI’s EFA and Emerging Markets indexes brings an added global dimension to our index options franchise and introduces new trading opportunities across our unique product set. In February 2015, we entered into a licensing agreement with the London Stock Exchange Group, making CBOE the exclusive U.S. provider for listed options on more than two dozen FTSE and Russell Indexes. Russell Indexes represent key benchmarks of U.S.-based stocks, including the bellwether Russell 2000 Index. FTSE Indexes focus primarily on European and Asian international equities and include the flagship FTSE 100 Index. CBOE previously traded Russell 2000 (RUT) options on a semi-exclusive basis. Last year, more than 22 million RUT contracts traded industrywide. Under the new agreement, CBOE became the sole provider of RUT options on April 1st. We look forward to launching additional Russell and FTSE products later this year. The addition of MSCI, FTSE and Russell options to a product suite anchored by SPX options and VIX futures and options enables customers at CBOE to hedge and trade global volatility, the global stock market, the broad U.S. stock market, the U.S. small cap market, European and Asian international equities, and the world’s emerging markets. Each index enables us to create related volatility options and futures using our VIX methodology. The trading synergies afforded by a growing roster of complementary index products enables us to create new opportunities for our customers, to further concentrate index traders and liquidity at CBOE and to leverage significant cross-marketing efficiencies. CBOE Holdings connects uniquely with customers -- domestically and abroad -through investor education, customer engagement and broadening access to our marketplace. CBOE not only offers the world’s most comprehensive array of index options and volatility products, but is also the thought leader and the world’s “go-to” place for all things related to those products. Our ability to forge exclusive agreements with index providers is predicated, in part, on CBOE's educational expertise and ability to efficiently connect with index customers globally across a range of channels, including The Options Institute, CBOE TV, CBOE.com, CBOE’s social media platform and CBOE’s Risk Management Conferences. In 2014, we redesigned CBOE.com to further expand our online educational content and trading resources and launched the award-winning “CBOE Mobile” app. Both have tremendous reach and both will be further expanded in 2015. CBOE’s highly acclaimed Risk Management Conferences, held annually in the U.S. and Europe, continued to draw record numbers of attendees in 2014 and 2015. RMC attracts sophisticated and influential market participants who tend to be early adopters of new CBOE products and services. We look forward to expanding our RMC program beyond the U.S. and Europe with the first RMC Asia in Hong Kong this December. We made it easier for customers to connect with CBOE in June 2014 by expanding trading in VIX futures to nearly 24 hours a day, five days a week. As a result, more than 8 percent of all VIX futures trading now takes place outside of regular U.S. trading hours. In March, we extended trading hours in SPX and VIX options with the addition of a 2:00 a.m. to 8:15 a.m. CT trading session, five days a week. We are pleased to provide a growing worldwide customer base with increased access to three of our premium products. Going forward, we’ll look to lengthen the trading day in other products as well. Before closing, I will note here that CBOE’s unique culture of innovation applies to systems development. We recently announced that work has begun on CBOE Vector, our company’s next generation of trade engine technology. Systems development is deeply embedded in CBOE’s value proposition -- our trading technology has always been designed and built in-house to power innovation. CBOE Vector will be custom built to provide streamlined access to the most comprehensive array of options and volatility products in the world and the deep liquid markets in which they trade. The build out for CBOE Vector calls first for the implementation of new systems for CFE, which we project will be up and running in the second half of 2016, with CBOE and C2 to follow. We view CBOE Vector as an engine for growth, designed for maximum flexibility and scalability, enabling us to efficiently roll out new products and trading opportunities in a rapidly evolving marketplace. CBOE’s ability to collaborate, create and connect has fostered a unique culture of innovation and fueled a consistent track record of growth since we became a public company in 2010. Since our IPO, we have returned in excess of one billion dollars to stockholders through tender offers, dividends and share repurchases. We continue to capitalize on the favorable operating leverage inherent in our business through disciplined expense management and prudent allocation of capital, while continuing to grow our company through developing new products, engaging customers and broadening access to our marketplace. I will close with a “before and after” representation of the opportunities created by our progress in 2014 and thus far in 2015. We quite literally see a world of opportunities, both domestically, where we continue to increase our penetration and mine new markets, and internationally, where we have only begun to scratch the surface. CBOE Holdings is positioned to define and shape the options and volatility space for many years to come. For that, we thank our Board for their leadership and guidance. We thank our talented and dedicated staff for their commitment to deliver on our mission. We thank our customers for their continued trust and support of our marketplace. Most of all, we thank you, our stockholders, for your confidence in CBOE Holdings. ###