CBOE Press Breakfast at FIA Boca Raton, FL March 11, 2015

CBOE Press Breakfast at FIA

Boca Raton, FL

March 11, 2015

Edward Tilly, Chief Executive Officer

John Deters, Chief Strategy Officer

Bill Speth, Vice President, Research

1

Forward-Looking Statements

This presentation may contain forward-looking statements, within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are those statements that reflect our expectations, assumptions or projections about the future and involve a number of risks and uncertainties. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause actual results to differ materially from that expressed or implied by the forward-looking statements, including: the loss of our right to exclusively list and trade certain index options and futures products; increasing price competition in our industry; compliance with legal and regulatory obligations, including our obligations under the Consent Order; decreases in trading volumes or a shift in the mix of products traded on our exchanges; legislative or regulatory changes; increasing competition by foreign and domestic entities; our dependence on third party service providers; our ability to operate our business without violating the intellectual property rights of others and the costs associated with protecting our intellectual property rights; our ability to accommodate trading volume and transaction traffic, including significant increases, without failure or degradation of performance of our systems; our ability to protect our systems and communication networks from security risks, including cyber-attacks; the accuracy of our estimates and expectations; economic, political and market conditions; our ability to maintain access fee revenues; our ability to meet our compliance obligations, including managing potential conflicts between our regulatory responsibilities and our for-profit status; our ability to attract and retain skilled management and other personnel; our ability to manage our growth effectively; and the ability of our compliance and risk management methods to effectively monitor and manage our risks.

More detailed information about factors that may affect our performance may be found in our filings with the SEC, including in our Annual Report on Form 10-K for the year ended December 31, 2014 and other filings made from time to time with the SEC.

CBOE HOLDINGS 2

CBOE HOLDINGS

Collaborate Create Connect

3

2014

2

CBOE HOLDINGS

1/1/14

4

2015

*Pending Hong Kong regulatory approval

CBOE HOLDINGS

*

3/9/15

5

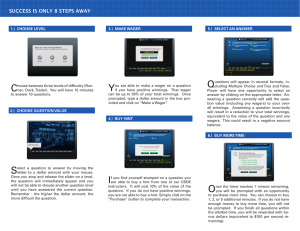

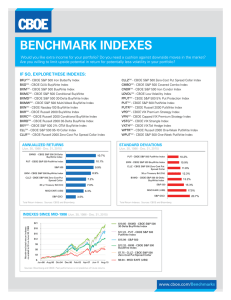

Collaborate

Growing roster of CBOE index providers

CBOE HOLDINGS 6

Collaborate

CBOE is

the

home for index options

CBOE created the first index option with Standard and Poor’s in 1983

CBOE’s S&P 500 Index (SPX) options remain the most-actively traded index option in the U.S.

Record SPX options trading volume in 2014, the 31 st year for the product

Continually seeking ways to further develop and grow index options trading

CBOE HOLDINGS 7

Collaborate

CBOE entered into MSCI licensing agreement in December

Combines CBOE’s product development and options expertise with MSCI’s global benchmark indexes

Makes CBOE exclusive U.S. exchange for trading MSCI Index options

MSCI Indexes cover global equity and emerging markets

CBOE HOLDINGS 8

Collaborate

CBOE entered into LSEG licensing agreement in February

Combines CBOE’s product development and options expertise with LSEG’s leading index franchises

Makes CBOE exclusive U.S. provider for cash-settled options on LSEG-owned FTSE and Russell Indexes

FTSE Indexes cover European and Asian international equities

Russell Indexes cover benchmarks on U.S.-based stocks

CBOE HOLDINGS 9

Create

CBOE-MSCI products

First CBOE-MSCI options* planned to launch in 2015:

MSCI EAFE Index (Europe, Australasia, Far East)

MSCI Emerging Markets Index

Additional CBOE-MSCI options* products planned to launch in 2015:

MSCI ACWI Index

MSCI USA Index

MSCI World Index

MSCI ACWI ex-USA Index

Opportunity to create new volatility indexes

*Pending regulatory approval

CBOE HOLDINGS 10

Create

CBOE-Russell products

Includes options on the Russell 2000 Index (RUT ) # , the premier measure of the performance of U.S. small-cap stocks

Other CBOE-Russell products* to include options on:

•

Russell 1000 Index

•

Russell 1000 Value Index

•

Russell 1000 Growth Index

CBOE Russell 2000 Volatility Index (RVX) options and futures already trading

Opportunity to create new volatility indexes

# Currently trading semi-exclusively at CBOE, will be exclusively traded at CBOE on April 1, 2015

*Pending regulatory approval

CBOE HOLDINGS 11

Create

CBOE-FTSE products

Includes options on the FTSE 100 Index, a closely followed index of blue-chip companies traded on the London Stock Exchange

Other CBOE-FTSE products* to include options on:

FTSE GEIS

FTSE EPRA/NAREIT

FTSE China 50

Opportunity to create new volatility indexes

CBOE HOLDINGS

*Pending regulatory approval

12

Connect

CBOE’s expanding suite of index products will allow market participants to trade and hedge:

Global Volatility

Global Stock Market

Broad U.S. Stock Market

U.S. Small-Cap Market

European and Asian International Equities

World’s Emerging Markets

CBOE HOLDINGS 13

Connect

CBOE connects uniquely with customers, domestically and abroad, through:

Investor education

Customer engagement

Broadening access to our marketplace

CBOE HOLDINGS 14

Connect

Connecting with customers through industry-leading educational forums

CBOE Risk Management Conference (RMC)

Premier financial industry conference for institutional users of equity and volatility derivatives

United States: 31 st year

Europe: 4 th year

Asia: 1 st year

CBOE Options Institute

Teaching investors around the world through an extensive curriculum of classroom and online programs

30 th anniversary in 2015

CBOE HOLDINGS 15

Connect

Leveraging CBOE’s customer reach across highly trafficked communications outlets

CBOE.com

CBOE TV

The Options Hub, CBOE’s social media platform

CBOE’s Mobile App

CBOE HOLDINGS 16

Connect

Connecting with customers through extended trading hours (ETH)

Near 24-hour trading in VIX futures began last June

Currently, about 9% of VIX futures trading takes place during non-U.S. trading hours

ETH for VIX options began Monday, March 2; ETH for SPX options began

Monday, March 9

New session runs from 2:00 a.m. to 8:15 a.m. CT, Monday through Friday

ETH initiatives pave the way to trade additional index products in non-U.S. hours in the future

17 CBOE HOLDINGS

Q&A

CBOE

400 South LaSalle Street

Chicago, Illinois 60605 www.cboe.com

@CBOE