Document 11613975

advertisement

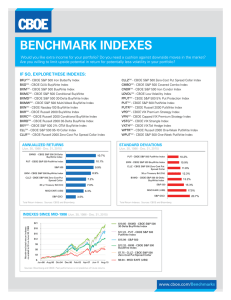

Edward Provost President & Chief Operating Officer, CBOE Holdings, Inc. CBOE Risk Management Conference U.S. Welcome Remarks and CBOE Update Tuesday, March 1, 2016 8:45 – 9:15 a.m. Thank you, Paul. And thanks to all of you for joining us for the 32 nd annual CBOE Risk Management Conference U.S. We are delighted to be in sunny Bonita Springs with you. First, let me dispense with a formality by saying that our comments may contain forward-looking statements, which involve some risks and uncertainties. Actual results may vary. Please refer to our filings with the SEC for more detailed information about the risks and uncertainties. I’m pleased to say that Paul and his team have created another high-caliber RMC agenda and, as usual, we limit the number of speakers per session so that topics are covered in depth. RMC sessions are conducted by and for market participants. Your participation makes our program unique, and I thank you for that. Before introducing our keynote speaker, I have a few CBOE updates I hope will be of interest. First, on the product development front, I’m pleased to announce that CBOE plans to launch FLEX index options with Asian and Cliquet style settlement. These will be of particular interest to RMC participants from the insurance world. Insurance companies that write indexed annuity contracts often have exotic option liabilities embedded within those contracts, including two common types of exotic options known as “Asians” and “Cliquets.” Companies looking to hedge embedded exotic options risk have historically traded in the over-the-counter market, but CBOE’s introduction of Asian and Cliquet FLEX index options are designed to give insurers an alternative hedging tool that provides exchange-traded benefits, including enhanced price discovery, transparency and centralized clearing. Transacting on an exchange may also provide insurance companies with improved execution prices on their hedges, while simultaneously reducing counterparty risk. We plan to launch the new products on March 21st. Copies of the press release on this subject are available in the back of the room and the release, with links to more information on our website, is also available on the RMC app. We continue to leverage partnerships with index providers to create new tools for trading. I’m pleased to note that representatives from three of our major index provider partners – S&P Dow Jones, FTSE Russell and MSCI -- have joined us here in Bonita Springs. I hope you will seek them out -- they welcome your questions and feedback. Our flagship SPX options continue to thrive and grow. Much of that growth has been fueled by SPX Weeklys trading and I’m pleased to say that last week we launched SPX Weeklys with Wednesday Expirations. Wednesday Weeklys not only increase SPX trading opportunities, they also align with the Wednesday expirations of VIX Weeklys futures and options, providing greater flexibility for the increasing number of customers who use both VIX and SPX products. Turning to VIX futures and options, we continue to leverage our VIX methodology to create new trading vehicles. Building on the inherent utility of Weeklys trading, we launched VIX Weeklys futures last July, followed by the October launch of VIX Weeklys options, where we’ve seen particularly strong trading. In other VIX news, we plan later this month to begin overnight dissemination of the spot VIX Index. As you know, VIX measures the implied volatility of S&P 500 options and our newly extended trading hours in SPX options – from 2 a.m. to 8:15 a.m. central time – now enable us to disseminate the spot VIX during that period, providing real-time volatility information when news breaks overnight. The earlier calculation and dissemination of the SPX-VIX volatility information allows overseas investors to reference VIX during their regular trading hours and better facilitates trading in the overnight session. An evolving VIX development of note involves our TYVIX Index, which given its construct, has the potential to anticipate relative performance across broad asset classes. We have collaborated with Applied Academics to leverage this potential by creating an asset rotation strategy index, called the Stabilis Index, which uses TYVIX and VIX as signals to dynamically allocate weights across equities, Treasuries, credit and cash. We are currently working with an investment bank to create an investable financial product based on this strategy, and we look forward to sharing more information with you as the product develops. Turning now to our growing FTSE Russell product line: CBOE became the sole U.S. provider of major FTSE Russell index products in 2015, beginning with Russell 2000 Index (RUT) options last April. We plan to launch the FTSE 100 and FTSE China 50 index options later this month, which, with our MSCI products, further enhances a growing international dimension to CBOE’s index options franchise. We continue to expand our products and markets with the ongoing goal to provide you with the world’s widest array of index and volatility products -- as well as deep, liquid markets in which to trade them. We also continue to form alliances that enable us to efficiently diversify our product and business lines across new regions and asset classes. We’ve partnered with the London Stock Exchange Group (LSEG) and major dealer banks to launch and develop the CurveGlobal interest rate platform, which will trade on the LSE Derivatives Market and clear through LCH.Clearnet. We anticipate a second-quarter launch of CurveGlobal with trading in futures contracts based on major European interest rates. Additional products, including potential new products from CBOE, are expected to become a part of CurveGlobal. In a venture we see as a potential game changer in options trading, we recently partnered with The Vest Financial Group, Inc, an asset management firm that provides options-based packaged products and develops technology solutions for options-based investments. The Vest “managed-account” platform is accessible through financial advisors and designed to provide retail investors with access to the same investment tools and protections available to institutions and high net worth individuals. We are integrating CBOE’s products and strategy indexes within Vest’s platform, which substantially reduces the complexity of options trading while providing investors with targeted protection and enhanced returns. We’re pleased to welcome Karan Sood, co-founder of Vest, to his first RMC. Karan would be happy to demo the Vest platform for you, so please seek him out. Turning now to trading enhancements at CBOE. I am pleased to announce our new Frequent Trader program, a voluntary incentive program for trading in certain CBOE proprietary products that we plan to make available to asset managers, individuals, insurance companies, mutual funds and a host of other customers. Our Frequent Trader program is designed to provide rebates on CBOE customer transaction fees based on the trading activity of each individual user and apply to VIX, SPX, SPX Weeklys and SPXpm options. Detailed information sheets are available at the back of the room and on the RMC app. And, of course, the CBOE team will be happy to discuss this new program with you. We continue to enhance the trading experience at CBOE through our acquisition of the market data services and trading analytics platforms of Livevol, a leading provider of equity and index options technology, and market data services. Livevol’s options strategy backtesters, available through Fidelity’s Active Trader website, have been incorporated into our trade support technology. SPX options and VIX futures and options market data are included in Livevol’s analytics to better facilitate index and volatility trading at CBOE. We also continue to work closely with our partners from Tradelegs. We’re excited about their newly updated Derivatives Strategist software, which generates optimized trade ideas based upon an investor’s equity risk and return predictions, the investor’s capital constraints, and market data supplied by Tradelegs. Members of the CBOE Livevol team and representatives from our Tradelegs partners are here at RMC to answer your questions and to learn from your experience. In other technology news, we will begin rolling out CBOE Vector, our next generation of leading tradeengine technology, later this year. We opted to build CBOE Vector internally in order to engineer highly customized trading technology that delivers best-in-class functionality, low latency, ease of use and trading efficiency. It also will handle increased message traffic and industry demand for additional functionality, such as risk controls. We will begin rolling out CBOE Vector in 2016, beginning with futures at CFE, with development of Vector for options at CBOE and C2 to follow. On the educational front, we’ve recently released four new white papers on CBOE benchmark indexes. These are CBOE-commissioned papers written by outside experts that cover put-writing using the PUT and WPUT indexes, SPX-based benchmark indexes, Russell-based benchmark indexes and the CBOE Eurekahedge Volatility Indexes. Copies of each are available in the back of the room and on the RMC app. In addition to our educational commitment, CBOE continues to play an active role in investor advocacy. We’ve been working closely with the fund community to reduce barriers to the use of options, including Morningstar’s classifications for funds that use options, which many mutual funds find to be imprecise. In 2015, we provided Morningstar with a CBOE-commissioned study by Keith Black and Ed Szado, which included a list of 119 '40 Act funds that used options. I’m pleased to report that Morningstar found the study to be extremely helpful in their analysis and is considering a new classification for mutual funds that use options –called “option writing” – to be introduced this spring. We are hopeful the new classification will increase understanding of and interest in fund usage of options. Another advocacy topic I would like to highlight relates to the SEC’s proposed rule on the use of derivatives by registered funds. Again, we are working closely on this with the fund community and plan to issue a comment letter later this month. If you have comments or questions on the Morningstar categories or the SEC proposal, please speak with any CBOE rep here – particularly Paul Stephens or Matt Moran. In closing, I am pleased to note that we expanded RMC globally with the first annual CBOE RMC Asia, which successfully debuted in Hong Kong at the end of 2015. In September of this year, we will host our 5th annual RMC Europe in County Wicklow, Ireland. Our ability to take RMC to Europe and now to Asia was made possible by the success of our U.S. conference and the continued interest from investors around the world in our options and volatility products. RMC affords us the unique ability to learn from and work closely with customers like you, which helps us create products and services that add power to your trading experience and expertise. I encourage you to share your thoughts and questions with me or anyone from the CBOE team. The ability to connect with you one-on-one, formally or informally, is one of the many benefits of RMC. We look forward to getting to know you better in this wonderful setting. Thank you again for joining us. Certain information contained in this news release may constitute forward-looking statements. We caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made and are subject to a number of risks and uncertainties.