Introduction to Dynamic Models. 7 The error correction model

advertisement

7

Introduction to Dynamic Models.

The error correction model

In the consumption function example,where the long-run multiplier is 1.00, the

estimated coefficient in the static model was 0.99. This is not a coincidence:

the dynamic model accommodates a static model known as a steady-state

relationship.

Slide set #2 (Ch 1.7-1.10 in IDM).

Hence, apart from the fact that a static model is a special case an ADL model

(corresponding to a set of parameter restrictions) a static model can also be

derived as the steady-state solution of the ADL. This static model, has a

completely different interpretation than the static model in the typology.

Ragnar Nymoen

University of Oslo, Department of Economics

January 21, 2005

2

1

Transformation of ADL to an error correction model (ECM)

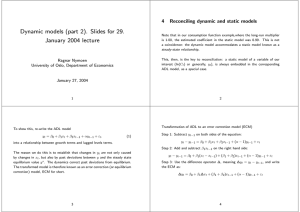

To show this, we re-write the ADL model

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt.

(1)

to a so called error correction form, ECM.

The transformed model will show that changes in yt are not only caused by

changes in xt, but also by past deviations between y and the steady state

equilibrium value y ∗. The dynamics correct past deviations from equilibrium.

The transformed model is the error correction (or equilibrium correction) model,

ECM, in the model typology.

3

Step 1: Subtract yt−1 on both sides of the equation:

yt − yt−1 = β0 + β1xt + β2xt−1 + (α − 1)yt−1 + εt

Step 2: Add and subtract β1xt−1 on the right hand side:

yt − yt−1 = β0 + β1(xt − xt−1) + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

Step 3: Use the difference operator ∆, meaning, for example, ∆yt = yt − yt−1,

and write the ECM as:

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

4

If yt and xt are measured in logarithms (like consumption and income in our

consumption function example) ∆yt and ∆xt are their respective growth rates.

Hence, for example, in the previous section

∆ ln Ct = ln(Ct/Ct−1) = ln(1 +

Ct − Ct−1

Ct − Ct−1

)≈

.

Ct−1

Ct−1

The model

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

(3)

is therefore explaining the growth rate of consumption by, first, the income

growth rate and, second, the past levels of income and consumption.

Note: Since the disturbance term εt is the same in (1) as in (3), the statistical

properties are unaffected.

The error correction interpretation, becomes clearer if we first collect the level

terms yt−1 and xt−1 inside a bracket:

½

¾

β + β2

∆yt = β0 + β1∆xt − (1 − α) y − 1

+ εt,

(4)

x

1−α

t−1

and next assume that the following long-run relationship characterizes a situation with stable growth in y and x:

y ∗ = k + γx,

(5)

where y ∗ denotes the equilibrium value of yt. Comparison with (4) shows that

we can identify the parameter γ as

β + β2

γ≡ 1

, −1<α<1

(6)

1−α

since the long-run slope coefficient γ must logically be identical to the long-run

multiplier of the ADL model of yt.

Memo:

β + β2

δlong−run = 1

, −1<α<1

1−α

6

5

The expression inside the brackets in (4) can be rewritten as

β + β2

y− 1

x = y − γx = y − y ∗ + k.

1−α

Using (7) in (4) we obtain

∆yt = β0 − (1 − α)k + β1∆xt − (1 − α) {y − y ∗}t−1 + εt,

(7)

− 1 < α < 1 (8)

Next,consider a called steady-state situation with constant growth ∆xt = gx

and ∆yt = gy , and zero disturbance: εt = 0 (the mean of the disturbance

term). Imposing this in (8), and noting that {y − y ∗}t−1 by definition of the

steady-state equilibrium, give

gy = β0 − (1 − α)k + β1gx,

2. the correction of the last period’s disequilibrium, the deviation between

yt−1 and the last periods equilibrium level yt∗.

This means that k in the theoretical model y ∗ = k + γx depends on the two

growth terms.

−gy + β0 + β1gx

k=

, if − 1 < α < 1

(9)

1−α

In the case of a stationary steady-state (no growth): with gx = gy = 0, (9)

simplifies to k = β0/(1 − α).

7

8

showing that ∆yt is explained by two factors:

1. the change in the explanatory variable, ∆xt, and

8

In sum, there is an important correspondence between the dynamic model and

a static relationship meant to describe the long-run:

1. A theoretical linear relationship, y ∗ = k + γx, represents the steady-state

solution of the dynamic model (1).

2. The theoretical slope coefficient is identical to the corresponding long-run

multiplier (of a permanent increase in the respective explanatory variables).

Role of static models

Why don’t we give up static equations altogether in macroeconomics? The

reason, for not taking this extreme view is that, after all, static models remain

the main workhorses of economic analysis, but we need to be clear about

their interpretation and limitation. Essentially, a static models has two (valid)

interpretations in macroeconomics

1. As an (approximate) descriptions of dynamics

This corresponds to simplifying

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt.

3. Conversely, if we are only interested in quantifying a long-run multiplier

(rather than the whole sequence of dynamic multipliers), it can be found

by using the identity in (6).

by setting β2 = 0 and α = 0, as in the Typology. In this case the static

model is a special case of the ADL.

2. As a long-run relationships which apply to a steady-state situation. The

validity of this interpretation only hinges on α being “different from one”.

9

10

It is important to be aware of the two interpretations of static models.

If PPP is taken as a short-run proposition, then σt = σt−1 = and, in the case

of exogenous Et,

Consider for example the real-exchange rate, σ

EP ∗

σ=

P

where P ∗ is the foreign price level, E is the nominal exchange rate (Kroner/Euro) and P is the domestic price level. The purchasing parity condition

(PPP) says that “the real exchange rate is constant”.

But what is the time perspective of the PPP?

11

ln Pt = − ln k + ln Et + ln Pt∗,

a static price equation which says that for example the pass-through of a currency change on Pt is full and immediate

On the other hand if PPP is a long run proposition, we have instead the

interpretation that σt = σ̄, and

∆ ln Pt = gE + π ∗

in a long-run. gE , π ∗ denotes the long-run constant growth rates of the nominal

exchange rates and foreign prices. In this case there is full long-run passthrough, but there are no implications about the short-run pass through (the

dynamic multipliers).

12

9

εt = 0 for t = 0, 1, ..., and

Solution and simulation of dynamic models

xt = mx for t = 0, 1....

The existence of a long-run multiplier, and thereby the validity of the correspondence between the ADL model and long-run relationships, depends on the

autoregressive parameter α in (1) being different from unity.

We next show that the parameter α is also crucial for the nature and type of

solution of equation (1).

9.1

We write the simplified model as

yt = β0 + Bmx + αyt−1, where B = β1 + β2.

(10)

In the following we proceed as if the the coefficients β0, β1, β2 and α are

known numbers.

(10) holds for t = 0, 1, 2, .... It is usual to refer to t = 0 as the initial period

or the initial condition.

y0 is a fixed and known number, then there is a unique sequence of numbers

y0, y1, y2, ... which is the solution of (10).

Solution of ADL equations

We first consider the simpler case of a deterministic autoregressive model,

where we abstract from xt and xt−1, as well as from the disturbance term (εt).

One way to achieve this simplification of (1) is to assume that both xt and εt

are fixed at their respective constant means:

The solution is found by first solving (10) for y1, then for y2 and so on. This

recursive method is the same as we used when we obtained the dynamic multipliers. See IDM (p 28) for an exposition of the general solution

yt = (β0 + Bmx)

t−1

X

αs + αty0, t = 1, 2, ...

(11)

s=0

14

13

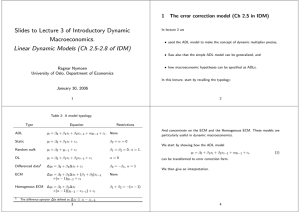

5.10

The solution can however be stable, unstable or explosive.

8

DFystable_ar.m8

DFystable_ar.8

6

5.05

stable: often implicit in discussions about the effects of a changes in policy instruments, i.e., multiplier analysis. (example: interest rate effects on inflation)

4

5.00

2

unstable: sometimes macroeconomists believe that the effects of a shock linger

on after the shock itself has gone away, often referred to as hysteresis (see B&W

p 539, example: European unemployment?)

200

205

DFyunstable

210

DFyunstable_201

210

12500

10000

explosive: “bubbles” in capital markets.

7500

3.60

The condition

200

5000

205

200

210

220

230

(12)

is the necessary and sufficient condition for the existence of a (globally asymptotically) stable solution.

15

205

DFyexplosive

3.70

3.65

−1 < α < 1

200

15000

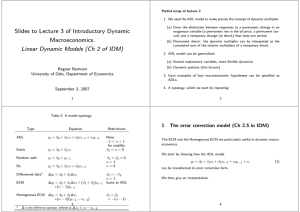

Figure 1: Panel a) and b): Two stable solutions of (10), (corresponding to

positive and negative values of α. Panel c): Two unstable solutions (corresponding to different initial conditions). Panel d). An explosive solution, See

the text for details about each case.

16

Stable solution −1 < α < 1. Since

t−1

X

1 as t → ∞, we have:

αs → 1−α

ln(C), actual value

12.05

s=0

(β0 + β1mx)

(13)

1−α

where y ∗ denotes the equilibrium of yt. The solution can also be expressed

as (see IDM).

y∗ =

yt = y ∗ + αt(y0 − y ∗).

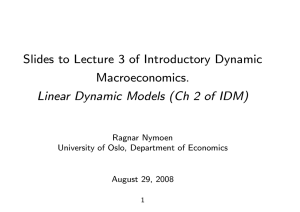

Solution of estimated ADL for Norwegian consumption

12.00

Solution based on:

11.95

a) observed values of l n (INC t ) and l n (INCt−1 ) for the period 1990(1)-2001(4).

b) zero disturbance ε t for the period 1990(1)-2001(4).

c) observed values of l n (Ct−1 ) and l n (INCt−1 ) in 1989(4)

11.90

11.85

11.80

11.75

Unstable solution (hysteresis) When α = 1, we obtain from equation (11):

yt = (β0 + β1mx)t + y0, t = 1, 2, ...

(15)

11.70

11.65

11.60

showing that the solution contains a linear trend and that the initial condition exerts full influence over yt.

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

Explosive solution When α is greater than unity in absolute value the solution

is called explosive, for reasons that become obvious when you consult (11).

Figure 2: Solution of the consumption function in equation (??) for the period

1990(1)-2001(4). The actual values of log(Ct) are also shown, for comparison.

17

18

9.2

Simulation of dynamic models

In applied macroeconomics it is not common to refer to the solution of a ADL

model. The common term is instead simulation.

Specifically, economists use dynamic simulation to denote the case where the

solution for period 1 is used to calculate the solution for period 2, and the

solution for period 2 is in its turn used to find the solution for period 3, and so

on. From what we have said above, in the case of a single ADL equation like

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt,

dynamic simulation amounts to finding a solution of the model.

Conveniently, the correspondence between solution and dynamic simulation

also holds for complex equations (with several lags and/or several explanatory

variables), as well as for the systems of dynamic equations which are used in

practice.

But use computer programs to find the solution.

19

10

Dynamic systems

It is often quite easy to bring a system of dynamic equations on a form with

two reduced form ADL equations which are of the same form that we have

considered above.

Consumption function again. Convenient to use a linear specification:

Ct = β0 + β1IN Ct + αCt−1 + εt

(16)

together with the stylized product market equilibrium condition

IN Ct = Ct + Jt

(17)

where Jt denotes autonomous expenditure, and IN C is now interpreted as

GDP. We assume that there are idle resources (unemployment) and that prices

are sticky. The 2-equation dynamic system has two endogenous variables Ct

and IN Ct, while Jt and εt are exogenous. The ADL in (16) has an endogenous

variable on the right side.

20

Want to find and ADL for Ct with only exogenous and predetermined variables

on the right hand side, a so called final equation for Ct.

In this example: simply substitute IN C from (17) to give:

Ct = β̃0 + α̃Ct−1 + β̃2Jt + ε̃t

(18)

β̃0 and α̃ are β0 and α divided by (1 − β1), and β̃2 = β1/(1 − β1), (what about

ε̃t?).

(18) is the final equation for Ct in this example.

If −1 < α̃ < 1 the solution is stable. In that case, there is also a stable solution

for IN Ct, so we don’t have to derive a separate equation for IN Ct in order to

check stability of income.

The impact multiplier of consumption with respect to autonomous expenditure

is β̃2, and the long-run multiplier is β2/(1 − α̃).

21