Partial recap of lecture 2

advertisement

Partial recap of lecture 2

1. We used the ADL model to make precise the concept of dynamic multiplier.

(a) Drew the distinction between responses to a permanent change in an

exogenous variable (a permanent rise in the oil price, a permanent taxcut) and a temporary change (or shock) that lasts one period.

Slides to Lecture 3 of Introductory Dynamic

Macroeconomics.

(b) Permanent shock: the dynamic multiplier can be interpreted as the

cumulated sum of the interim multipliers of a temporary shock.

Linear Dynamic Models (Ch 2 of IDM)

2. ADL model can be generalized

(a) Several explanatory variables, more flexible dynamics

Ragnar Nymoen

University of Oslo, Department of Economics

(b) Dynamic systems (this lecture)

3. Gave examples of how macroeconomic hypotheses can be specified as

ADLs.

4. A typology, which we start by repeating:

September 3, 2007

2

1

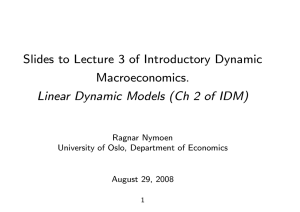

Table 2: A model typology.

Type

Equation

ADL

yt = β0 + β1xt + β2xt−1 + αyt−1.

Static

yt = β0 + β1xt

Random walk

yt = β0 + yt−1

DL

yt = β0 + β1xt + β2xt−1

Differenced data1

∆yt = β0 + β1∆xt

ECM

∆yt = β0 + β1∆xt + (β1 + β2)xt−1

+(α − 1)yt−1

Restrictions

None

−1 < α < 1

for stability

β2 = α = 0

1

The error correction model (Ch 2.5 in IDM)

The ECM and the Homogenous ECM are particularly useful in dynamic macroeconomics.

We start by showing how the ADL model

Homogenous ECM ∆yt = β0 + β1∆xt

+(α − 1)(yt−1 − xt−1)

1

3

∆ is the difference operator, defined as ∆zt ≡ zt − zt−1.

β1 = β2 = 0,

α = 1.

α=0

β2 = −β1,

α=1

Same as ADL

β1 + β2

= −(α − 1)

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt.

can be transformed to error correction form.

We then give an interpretation.

4

(1)

The ECM

Transformation of ADL to an error correction model (ECM)

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

brings into the open what is implicit in the ADL, namely that the growth of yt

is explained by the growth of the explanatory variable and the past levels of xt

and yt.

Step 1: Subtract yt−1 on both sides of the ADL equation, which gives

yt − yt−1 = β0 + β1xt + β2xt−1 + (α − 1)yt−1 + εt

Step 2: Add and subtract β1xt−1 on the right hand side:

yt − yt−1 = β0 + β1(xt − xt−1) + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

Step 3: Use the difference operator ∆, meaning for example ∆yt = yt − yt−1,

and write the ECM as:

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

(4)

The occurrence of both a variable’s growth and its level is a defining characteristic of genuinely dynamic models. In 1929 Frisch put this down as another

definitional trait of dynamic models:

(3)

Step 1-3 is a re-parameterization: If the values y0, y1, y2, y3.... satisfy (1), they

also satisfy (3).

“A theoretical law which is such that it involves the notion of rate

of change or the notion of speed of reaction (in terms of time) is a

dynamic law. All other laws are static.”

The transformation ADL to ECM shows that Frisch was right!

6

5

The name error correction, stems from the fact that

If yt and xt are measured in logarithms. ∆yt and ∆xt are their respective

growth rates (check the appendix to IDM if you are in doubt

For example

and the ECM version of the estimated ADL equation (1.18) in IDM is

7

embodies adjustments of yt with respect to deviations from the long-run equilibrium relationship between y and x. To make this interpretation clear, collect

yt−1 and xt−1 inside a bracket:

½

Ct − Ct−1

Ct − Ct−1

∆ ln Ct = ln(Ct/Ct−1) = ln(1 +

)≈

.

Ct−1

Ct−1

∆ ln Ct = 0.04 + 0.13∆ ln(IN Ct) + 0.21 ln IN Ct−1 − 0.21 ln Ct−1

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

(5)

¾

β + β2

∆yt = β0 + β1∆xt − (1 − α) y − 1

+ εt,

(6)

x

1−α

t−1

and assume the following long-run relationship for a situation with constant

growth rates (possibly zero) in y and x:

y ∗ = k + γx,

(7)

where y ∗ denotes the steady-state equilibrium of yt . We want equation (6) to

be consistent with a steady-state the dynamic model. The slope coefficient γ

must therefore be equal to the long-run multiplier of the ADL, that is:

β + β2

γ = δlong−run ≡ 1

, −1<α<1

(8)

1−α

8

Since y ∗ = k + γx, the expression inside the brackets in (6) can be rewritten

as

β + β2

y− 1

(9)

x = y − γx = y − y ∗ + k.

1−α

Using (9) in (6) we obtain

∆yt = β0 − (1 − α)k + β1∆xt − (1 − α) {y − y ∗}t−1 + εt,

As a point of detail, consider the steady-state situation with constant growth

∆xt = gx and ∆yt = gy , and zero disturbance: εt = 0 (the disturbance term is

set to its average value). Imposing this in (10), and noting that {y − y ∗}t−1 =

0 by definition of the steady-state equilibrium, give

− 1 < α < 1 (10)

showing that ∆yt is explained by two factors:

1. the change in the explanatory variable, ∆xt, and

2. the correction of the last period’s disequilibrium y − y ∗.

One can argue that it would be more logical to use the acronym ECM for

equilibrium correction model, since the model implies that ∆yt is correcting in

an equilibrating way. But the term error correction seems to have stuck.

gy = β0 − (1 − α)k + β1gx,

This means that k in the theoretical model y ∗ = k + γx depends on the two

growth terms.

−gy + β0 + β1gx

k=

, if − 1 < α < 1

(11)

1−α

In the case of a stationary steady-state (no growth): with gx = gy = 0, (11)

simplifies to k = β0/(1 − α).

10

9

The homogenous ECM

The ECM shows that there are important points of correspondence between

the dynamic ADL model and a static relationship for long-run:

1. A theoretical linear relationship, y ∗ = k + γx, represents the steady-state

solution of the dynamic model (1).

2. The theoretical long-run slope coefficient γ is identical to the corresponding

long-run multiplier

3. Conversely, if we are only interested in quantifying a long-run multiplier

(rather than the whole sequence of dynamic multipliers), it can be found

by using the identity in (8).

As we have seen, the ECM is a “1-1” transformation of the ADL. It is a

reparameterization which allows us to relate the changes in yt to exogenous

developments (∆xt) and to past deviations from equilibrium.

If the long-run slope coefficient γ is restricted to 1, we get the Homogenous

ECM, the last model in the Typology.

γ = 1 ⇐⇒ β1 + β2 = −(α − 1) as in Typology

The name refers to the property that a permanent unit increase in the exogenous variable leads to a unit long- run increase in y (as with homogeneity of

degree one of equilibrium market prices in a general equilibrium model).

That γ = 1 fits the data cannot be taken as granted, but in our example of a

Norwegian consumption function, it fits quite well. From (5) we have

∆ ln Ct = 0.04 + 0.13∆ ln(IN Ct) − 0.21 {ln C − ln IN C}t−1

implying that the steady-state savings rate in independent of income. The next

slide gives the details argument.

11

12

2

ln(C) = k + γ ln(IN C), in a steady-state.

C

ln(

) = k + (γ − 1) ln(IN C)

IN C

C

) = k + (γ − 1) ln(IN C)

ln(1 − 1 +

IN C

ln(1 −

IN C − C

) ≈ (−1) · savings-rate, (remember ln(1 + x) ≈ x).

IN C

Therefore the steady-state consumption function implies:

savings-rate = k + (1 − γ) ln(IN C)

13

PPP ambiguity

Static models reconsidered ( Ch 2.6 in IDM)

As noted in the first lecture, a static relationship has two distinct interpretations

in macroeconomics

1. As an (approximate) descriptions of dynamics

This corresponds to simplifying the ADL by setting β2 = 0 and α = 0 in

the Typology.

In Frisch terminology, this is the case of “infinitely great speed of reaction”.

2. As a long-run relationship which applies to a steady-state situation.

The validity of this interpretation only hinges on α being “less than one”

(−1 < α < 1).

Frisch: “static laws basically express what would happen in the long-run if

the static theory’s assumptions prevailed long enough for the phenomena

to have time to have time to react in accordance with these assumptions.”

14

If PPP is taken as a short-run proposition, then σt = σt−1 = k, and, for the

case of an exogenous Et:

It is important to be aware of the two interpretations of static models, and to

be able to distinguish between them.

ln Pt = − ln k + ln Et + ln Pt∗,

Consider for example the real-exchange rate, σ

which is a static price equation saying that the pass-through of a currency

change on Pt is full and immediate

EP ∗

P

where P ∗ denotes the foreign price level, E is the nominal exchange rate (Kroner/Euro) and P is the domestic price level.

If on the other hand, PPP is taken as a hypothesis of the long-run behaviour,

we have instead that σt = σ̄ in a steady-state situation, and

σ=

The purchasing power parity hypothesis, PPP, says that the real exchange rate

is constant.

But what is the time perspective of the PPP hypothesis?

15

∆ ln Pt = gE + π ∗

where gE and π ∗ denote the long-run constant growth rates of the nominal

exchange rates and of foreign prices. On this interpretation, PPP implies full

long-run pass-through, but PPP has no implications about the short-run pass

through of a change in Et on Pt.

16

Solution of ADL equations

3

Solution and simulation of dynamic models (Ch

2.7)

The existence of a long-run multiplier, and thereby the validity of the correspondence between the ADL model and long-run relationships, depends on the

autoregressive parameter α in (1) being different from unity.

We next show that the parameter α is also crucial for the nature and type of

solution of equation (1).

We loose little by considering the case of a deterministic autoregressive model,

where we abstract from xt and xt−1, as well as from the disturbance term (εt).

One way to achieve this simplification of (1) is to assume that both xt and εt

are fixed at their respective constant averages:

εt = 0 for t = 0, 1, ..., and

xt = mx for t = 0, 1....

We write the simplified model as

yt = β0 + Bmx + αyt−1, where B = β1 + β2.

(12)

In the following we assume that the coefficients β0, β1, β2 and α are known

numbers (how to estimate them is not a theme of this course).

17

18

The solution can be stable, unstable or explosive.

(12) holds for t = 0, 1, 2, .... Remember that t = 0 is the initial period.

When y0 is a fixed and known number there is a unique sequence of numbers

y0, y1, y2, ... which is the solution of (12).

The solution is found by first solving (12) for y1, then for y2 and so on. This

a recursive solution method which is the same as we used when we obtained

the dynamic multipliers. Follow the steps on page 51-52 in IDM and derive the

solution

yt = (β0 + Bmx)

t−1

X

αs + αty0, t = 1, 2, ...

s=0

(13)

stable: often implicit in discussions about the effects of a changes in policy instruments, i.e., multiplier analysis. Examples: interest rate effects on inflation,

income on consumption.

unstable: sometimes macroeconomists believe that the effects of a shock linger

on after the shock itself has gone away, often referred to as hysteresis.

explosive: Example: “bubbles” in capital markets.

The condition

−1 < α < 1

(14)

is the necessary and sufficient condition for the existence of a (globally asymptotically) stable solution.

19

20

Stable solution −1 < α < 1. Since

t−1

X

1 as t → ∞, we have:

αs → 1−α

5.10

8

DFystable_ar.m8

DFystable_ar.8

s=0

(β0 + Bmx)

(15)

1−α

where y ∗ denotes the equilibrium of yt. The solution can also be expressed

as (see page 53 of IDM).

6

5.05

y∗ =

4

5.00

2

200

yt = y ∗ + αt(y0 − y ∗).

205

DFyunstable

210

DFyunstable_201

200

205

210

DFyexplosive

15000

3.70

12500

Unstable solution (hysteresis) When α = 1, we obtain from equation (13):

10000

3.65

7500

yt = (β0 + Bmx)t + y0, t = 1, 2, ...

(17)

showing that the solution contains a trend, and that the initial condition

exerts full influence on all solution periods. Marked contrast to stable case.

Explosive solution When α is greater than unity in absolute value the solution

is called explosive, for reasons that become obvious when you consult (13).

21

ln(C), actual value

12.05

Solution based on:

11.95

a) observed values of ln(INC t ) and ln(INCt −1 ) for the period 1990(1)-2001(4).

b) zero disturbance εt for the period 1990(1)-2001(4).

c) observed values of ln(Ct −1 ) and ln(INCt −1 ) in 1989(4)

200

5000

205

200

210

220

230

Figure 1: Panel a) and b): Two stable solutions of (12), (corresponding to

positive and negative values of α. Panel c): Two unstable solutions (corresponding to different initial conditions). Panel d). An explosive solution, See

the text for details about each case. 22

Simulation of dynamic models

Solution of estimated ADL for Norwegian consumption

12.00

3.60

In applied macroeconomics it is not common to refer to the solution of an ADL

model. The common term is instead simulation.

11.90

11.85

Specifically, economists use dynamic simulation to denote the case where the

solution for period 1 is used to calculate the solution for period 2, and the

solution for period 2 is in its turn used to find the solution for period 3, and so

on. From what we have said above, in the case of a single ADL equation like

11.80

11.75

11.70

11.65

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt,

11.60

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

Figure 2: Solution of the ADL consumption function for the period 1990(1)2001(4). The actual values of log(Ct) are also shown, for comparison.

23

dynamic simulation amounts to finding a solution of the model.

Conveniently, the correspondence between solution and dynamic simulation

also holds for complex equations (with several lags and/or several explanatory

variables), as well as for systems of dynamic equations.

24

4

Dynamic systems (IDM ch 2.8)

In practice, macro models contain tens (or hundreds) of equations. Todays’

computer programs find the solution very fast.

Often in economics, the explanatory variable xt in the ADL model is not exogenous, but depends on yt (or yt−1). To model and understand the dynamics

of yt, we then need a system of two equations.

Having found a solution for one set of assumptions about xt and εt (t = 1, 2, ..),

it is easy to find a solution for a different time paths of xt and εt. The difference

between the two solutions is the dynamic multipliers.

In the Introduction of IDM, and in the seminar exercises we have already seen

an example of a dynamic system: the cobweb model of a perfectly competitive

commodity market.

In practice, we can construct “policy relevant” simulations by comparing the

solutions under different, but realistic assumptions about exogenous variables.

We take the income-expenditure model as our first macroeconomic example.

Here, it is most convenient to use a linear specification of the consumption

function.

Ct = β0 + β1IN Ct + αCt−1 + εt

Comment figure from Monetary Policy Report 1/07.

(18)

together with the product market equilibrium condition

IN Ct = Ct + Jt

(19)

where Jt denotes autonomous expenditure, and IN C is now interpreted as

GDP.

26

25

The 2-equation dynamic system has two endogenous variables Ct and IN Ct,

while Jt and εt are exogenous. The ADL in (18) has an endogenous variable

on the right hand side.

Want to find and ADL for Ct with only exogenous and predetermined variables

on the right hand side, a so called final equation for Ct.

In this example: substitute IN C from (19) to give:

Ct = β̃0 + α̃Ct−1 + β̃2Jt + ε̃t

β̃0 and α̃ are β0 and α divided by (1 − β1), and β̃2 = β1/(1 − β1).

(20)

(20) is the final equation for Ct. It is an ADL model, which we have learnt

how to solve.

If −1 < α̃ < 1 the solution is stable. In that case, there is also a stable solution

for IN Ct, so we don’t have to derive a separate equation for IN Ct in order to

check stability of income.

The method with a short-run and long-run model

Often the final quation is difficult (impossible) to derive manually–need a

computer to show that the system is stable (or not).

In these cases the method introduced in the first lecture of first analyzing the

short-run model, and then, as second step, the long-run model assuming that

a stable steady-state exists. This method can always be used to answer two

questions:

1. What is the short-run effect of a change in an exogenous variable?

2. What is the long-run effect of the change?

The impact multiplier of consumption with respect to autonomous expenditure

is β̃2, and the long-run multiplier is β̃2/(1 − α̃).

In the income-expenditure model the short-run model is already given by (18)

and (19).

27

28

The solution of the bivariate first order system

The long-run model is defined for the situation of Ct = C̄, IN Ct = I N̄ C,

Jt = J¯ and εt = 0.

β0

β1

+

I N̄ C

1−α 1−α

I N̄ C = C̄ + J¯

C̄ =

(21)

yt = α11yt−1 + α12xt−1 + β10wt + εyt,

(23)

(22)

xt = α21yt−1 + α22xt−1 + β20wt + εxt.

(24)

The impact multiplier of a permanent (or temporary) rise in Jt is obtained

from the short-run model (18) and (19), while subject to dynamic stability, the

long-run multipliers can be derived from the system (21)-(22).

It is a useful exercise to check that the long-run multipliers from the long-run

model are the same as the ones you obtained from the final equations of Ct

and IN Ct.

29

For reference, section 2.8.3 in IDM gives the analysis of the general two variable

model

which the systems so far (the cob-web and the income-expenditure model) are

special cases of!

You should now that, if the dynamic solution is stable, the solution of the

long-run model is

(α22 − 1)β10 − α12β20

mw ,

α11 + α22 − α11α22 + α12α21 − 1

−α21β20 + (α11 − 1)β10

x̄ =

mw .

α11 + α22 − α11α22 + α12α21 − 1

see IDM for details.

ȳ =

30

(25)

(26)