Dynamic models (part 2). Slides for 29. January 2004 lecture 4

advertisement

4

Dynamic models (part 2). Slides for 29.

Reconciling dynamic and static models

January 2004 lecture

Note that in our consumption function example,where the long-run multiplier

is 1.00, the estimated coefficient in the static model was 0.99. This is not

a coincidence: the dynamic model accommodates a static model known as a

steady-state relationship.

Ragnar Nymoen

University of Oslo, Department of Economics

This, then, is the key to reconciliation: a static model of a variable of our

interest (ln(Ct) or generally, yt), is always embedded in the corresponding

ADL model, as a special case.

January 27, 2004

2

1

Transformation of ADL to an error correction model (ECM)

To show this, re-write the ADL model

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt.

(1)

into a relationship between growth terms and lagged levels terms.

Step 1: Subtract yt−1 on both sides of the equation:

yt − yt−1 = β0 + β1xt + β2xt−1 + (α − 1)yt−1 + εt

Step 2: Add and subtract β1xt−1 on the right hand side:

The reason we do this is to establish that changes in yt are not only caused

by changes in xt, but also by past deviations between y and the steady state

equilibrium value y ∗. The dynamics correct past deviations from equilibrium.

The transformed model is therefore known as an error correction (or equilibrium

correction) model, ECM for short.

3

yt − yt−1 = β0 + β1(xt − xt−1) + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

Step 3: Use the difference operator ∆, meaning ∆yt = yt − yt−1, and write

the ECM as:

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

4

If yt and xt are measured in logarithms (like consumption and income in our

consumption function example) ∆yt and ∆xt are their respective growth rates.

Hence, for example, in the previous section

∆ ln Ct = ln(Ct/Ct−1) = ln(1 +

Ct − Ct−1

Ct − Ct−1

)≈

.

Ct−1

Ct−1

The model

The error correction interpretation, becomes clearer if we first collect the level

terms yt−1 and xt−1 inside a bracket:

½

¾

β + β2

∆yt = β0 + β1∆xt − (1 − α) y − 1

+ εt,

(4)

x

1−α

t−1

and next assume that we have the following economic theory about the long-run

relationship between y and x:

y ∗ = k + γx

(5)

is therefore explaining the growth rate of consumption by, first, the income

growth rate and, second, the past levels of income and consumption.

Comparison with (4) shows that we can identify the parameter γ as

β + β2

γ≡ 1

, −1<α<1

(6)

1−α

meaning that the theoretical slope coefficient γ is identical to the long-run

multiplier of the dynamic model.

Note: Since the disturbance term εt is the same in (1) as in (3), the statistical

properties are unaffected.

Remember:

∆yt = β0 + β1∆xt + (β1 + β2)xt−1 + (α − 1)yt−1 + εt

(3)

β + β2

δlong−run = 1

, −1<α<1

1−α

5

6

Consider a steady state situation with constant growth ∆xt = gx and ∆yt = gy ,

and zero disturbance: εt = 0 (the mean of the disturbance term). Moreover,

in steady state: y ≡ y ∗ = k + γx. Imposing all this in (4) gives

In sum, there is an important correspondence between the dynamic model and

a static theoretical relationship

gy = β0 + β1gx − (1 − α) {y ∗ − γx}t−1 .

Solving for y ∗, and omitting the t − 1 subscript since we consider a steady

1. A theoretical linear relationship y ∗ = k + γx can be retrieved as the steady

state solution of the dynamic model (1).

state, we obtain

−gy + β0 + β1gx

+ γx.

(7)

1−α

This means that k in the theoretical model y ∗ = k + γx depends on the two

growth terms. Often we consider the simpler case of a stationary steady state

(no growth): with gx = gy = 0, we have

y∗ =

k=

β0

1−α

7

2. The theoretical slope coefficient is identical to the corresponding long-run

multiplier (of a permanent increase in the respective explanatory variables).

3. Conversely, if we are only interested in quantifying a long-run multiplier

(rather than the whole sequence of dynamic multipliers), it can be found

by using the identity in (6).

8

5

Role of static models

6

Why don’t we give up static equations altogether in macroeconomics? The

reason, for not taking this extreme view is that, after all, static models remain

the main workhorses of economic analysis, but we need to be clear about

their interpretation and limitation. Essentially, static models have two (valid)

interpretations in macroeconomics

1. As (approximate) descriptions of dynamics

This corresponds to simplifying

Solution and stability

Imagine that β0, β1, β2 and α are known numbers. Assume also that we know

(or are able to control) the sequences x0, x1, x2, ...xT and ε1, ε2, ...εT . A

solution to the ADL model is a sequence of numbers y1, y2, y2, .....yT which

satisfies the equation

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt,

yt = β0 + β1xt + β2xt−1 + αyt−1 + εt.

by setting β2 = 0 and α = 0, thus obtaining a static model as special

case. In the OEM book we will encounter a model where we believe that

such restrictions are valid (adjustments to shocks in the foreign exchange

market are immediate)

t = 1, 2, ...T .

As long as we have a known initial condition, y0, a solution exists. Note that

the initial condition is given “from history”, so the requirement for the existence

of a solution of the ADL model is really weak.

The solution can however be stable, unstable or explosive.

2. As corresponding to long-run relationships which apply to the special case

of a steady state.

10

9

All three types of solutions play a role in macroeconomics:

stable: often implicit in discussions about the effects of a changes in policy instruments, i.e., multiplier analysis. (example: interest rate effects on inflation)

unstable: sometimes macroeconomists believe that the effects of a shock linger

on after the shock itself has gone away, often referred to as hysteresis (see B&W

p 539, example: European unemployment?)

For simplicity, set β2 = 0 and xt = mx, εt = 0. For the three first periods we

obtain

y1 = β0 + β1mx + αy0

y2 = β0 + β1mx + αy1

= β0(1 + α) + β1mx(1 + α) + α2y0

= (β0 + β1mx)(1 + α) + α2y0

explosive: “bubbles” in capital markets.

y3 = β0 + β1mx + αy2

= (β0 + β1mx)(1 + α + α2) + α3y0.

The condition

−1 < α < 1

In the stable case there is asymptotically no trace left of the initial condition

y0. This is easy to see by starting with period 1 (treating y0 as known), and

solving the equation forward:

(8)

is the necessary and sufficient condition for the existence of a (globally asymptotically) stable solution.

showing that there is a pattern, which allows us to write yt as

yt = (β0 + β1mx)

t−1

X

αs + αty0, t = 1, 2, ...

s=0

which is the general solution.

11

12

(9)

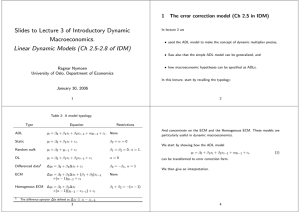

Stable solution −1 < α < 1. Since

t−1

X

1 as t → ∞, we have:

αs → 1−α

s=0

(β0 + β1mx)

(10)

1−α

where y ∗ denotes the equilibrium of yt. The solution can also be expressed

as (see notes).

y∗ =

y*

y

0

yt = y ∗ + αt(y0 − y ∗).

t

time

0

Unstable solution (hysteresis) When α = 1, we obtain from equation (9):

yt = (β0 + β1mx)t + y0, t = 1, 2, ...

y0

(12)

y

1

showing that the solution contains a linear trend and that the initial condition exerts full influence over yt.

t0

t1

time

Explosive solution When α is greater than unity in absolute value the solution

is called explosive, for reasons that become obvious when you consult (9).

Figure 1: Two stable solutions of 1 (corresponding to two values of α, and two

unstable solutions (corresponding to two different initial conditions, see text)

13

14

7

Exercise 6.1 Explain why the two stable solutions in 1 behave so differently!

Exercise 6.2 Indicate, in the graph for the unstable case, the predicted value

for y1 given the initial condition y0. What about ε1?

Dynamic systems

It is often quite easy to bring a system of dynamic equations on a form with

two reduced form ADL equations which are of the same form that we have

considered above.

Consumption function again. Convenient to use a linear specification:

Ct = β0 + β1IN Ct + αCt−1 + εt

Exercise 6.3 Sketch a solution path for the explosive solution in a diagram like

1.

(13)

together with the stylized product market equilibrium condition

IN Ct = Ct + Jt

(14)

where Jt denotes autonomous expenditure, and IN C is now interpreted as

GDP. We assume that there are idle resources (unemployment) and that prices

are sticky. The 2-equation dynamic system has two endogenous variables Ct

and IN Ct, while Jt and εt are exogenous.The ADL in (13) has an endogenous

variable on the right side.

15

16

Want to find and ADL for Ct with only exogenous and predetermined variables

on the right hand side, a so called final equation for Ct.

In this example: simply substitute IN C from (14) to give:

Ct = β̃0 + α̃Ct−1 + β̃2Jt + ε̃t

(15)

where β̃0 and α̃ are the original coefficients divided by (1 − β1), and β̃2 =

β1/(1−β1), (what about ε̃t?). (15) is the final equation for Ct in this example.

If −1 < α̃ < 1 the solution is stable. In that case, there is also a stable solution

for IN Ct, so we don’t have to derive a separate equation for IN Ct in order to

check stability of income.

The impact multiplier of consumption with respect to autonomous expenditure

is β̃2, and the long-run multiplier is β2/(1 − α̃).

17