ECON 3410/4410: Introductory Dynamic Macroeconomics. Term paper, autumn 2007.

advertisement

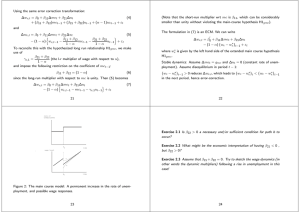

ECON 3410/4410: Introductory Dynamic Macroeconomics. Term paper, autumn 2007. This term paper will be marked as ’passed or ’failed’. To get a ’pass’ you must answer question 1 and some of question 2 and 3. You can write an individual paper, or hand in joint work (’gruppebesvarelse’). However we do not allow more than 3 students in each group! You can write in English, Norwegian, Danish or Swedish. Tehcnical requirements: Use a Times Roman font, size 12, for all standard text. Mathematical formulae can be handwritten, and graphs may be handdrawn. Note that special requirements apply to question 1 ( the number of words, see below). Full name(s) should be clearly printed at the top of the first page of your term paper, together with the name of the course (For example: Home assignement to ECON 3410, by NN and NN.) Where and when to hand in: Tuesday 9 October 2007. See cover page for details. If a student believes that she or he has a good cause not to meet the deadline (e.g. illness), she or he should report the matter to the course teacher and seek a formal extension. Normally extension will only be granted when there is a good reason backed by supporting evidence (e.g. medical certificate). 1. Discuss the following statement: “Dynamic models are essential to macroeconomic analysis”. The number of words should not exceed 2500 words. Give the number of words (for example using the word count function in MS-Word) in a footnote. Graphs and formulae do not count as words. Good answers (“essays”) show big variation here, so take courage from (or adapt to) the comments (margin notes) to your own work. At a general level it is advisable to cover 2-3 central moments. For example: i) The definition(s) of a dynamic and a static model. ii) The two interpretations of a static model: (a) very swift adjustment; and b) a hypothetical steady state.iii) Persistence as a fact of many macroeconomic variables,that models should be able to replicate and explain. iv) Possible causes of persistence (not instantaneous adjustment). You may use mathematics in the essay if this effectively communicates understanding. However, care must be taken not to indulge, because at your school exam you do not have the time (use “small” models if you use them). A combination of verbal discussion, and examples in the form of graphs and/or algebra, is a good blend for most. 1 2. Consider the two equation model: (1) Xt = a Pt + b0 + b1 zt + εd,t , demand, and (2) Xt = c Pte + d + εs,t , supply. <0 >0 where the symbols take the same meaning as in quotation (1.1) and (1.2) in IDM with the following modifications: Pte denotes the expected price in period t. b0 is the intercept term of the demand equation, b1 > 0 is the partial derivative of demand with respect to the exogenous economic variable zt . Consider two hypotheses for Pte : H1) Pte = Pt and H2) Pte = Pt−1 . (a) Comment briefly on the possible economic interpretations of the two hypotheses. H1: Supply can be adjusted instantaenously at the start of period 1. H2: Supply is predetermined (example: agriculture products). (b) Compare how the two endogenous variables react to a one-period positive shock to demand, depending on whether H1) or H2) applies. Can do this without maths. Graphical discussion like in IDM, Ch1. is effective. But can alternatively derive multipliers.Good answers will point out that the system is not always stable, and give economic interpretation in tems of slope of demand and supply. (c) Compare how the two endogenous variables react to a permanent shock to demand, depending on whether H1) or H2) applies. As b. (d) Give the mathematical conditions for stability of the system in the case of H2) Pte = Pt−1 . Derive final equation and show that autoregressive coeff is (c/a), which needs to be less than 1 in absolute value. 3. Assume a small open economy with a fixed exchange rate, and that one single wage rate applies to all sectors of the economy. The natural logarithm of the wage rate in period t is denoted wt . Let mct denote the main-course variable (as explained in IDM), and let Ut denote the rate of unemployment (not in logs). Assume the following model for the wage rate: (3) ∆wt = β w0 + β w1 Ut + β w2 ∆mct − (1 − αw )(wt−1 − mct−1 ) + εw,t where εw,t represents an exogenous (and random) disturbance term. Remember that ∆wt = wt − wt−1 , and ∆mct = mct − mct−1 . Assume that Ut is an endogenous variable, and that the following equation: (4) Ut = β u0 + αu Ut−1 + β u1 (w − mc)t−1 + β u2 zt + εu,t β u1 ≥ 0 together with (3) define a system that determines wt and Ut . zt denotes an exogenous variable, representing government policy for example. 2 (a) Give signs to the coefficients of the system (ie. those not already signed), and explain your reasoning very briefly. Discuss (briefly!) the slope coefficients, in the light of theory. For example β w1 < 0 in almost any theory of wage formation, the bargaining model specifically, but theory also suggest that β w1 may be close to zero if insiders are strong (but this is background knowledge, if you have it). 0 < αw < 1 in bargaining model but not in Phillips curve theory (Usually in questions like this, you are only expected to discuss the slope coefficients, because it is understood that economic theory has little to say about intercepts. This was the intention here as well!. But as many pointed out, since the intercepts have implication for the sign of the longrun values of U for example, it is meaningful to try to discuss the intercepts here. But it is not necessary, or expected) (b) Assume that the system is dynamically stable. What are the effects of a permanent change in zt ? Assume stability and solve. Easiest for a steady state defined by ∆wt = ∆mc = gmc : β w1 U = β 0w0 1 − αw −β u1 (w − mc) + (1 − au )U = β u2 z (w − mc) − β w1 z 1 − αw (w − mc) = β (1 − αu ) − β u1 w1 1 − αw 0 β u1 β w0 + β u2 z U = β (1 − αu ) − β u1 w1 1 − αw (1 − αu )β 0w0 + β u2 and take derivatives. Assume β u2 > 0 (for example). (c) Replace (3) with a wage Phillips curve. How does this change in the model specification affect your answers to (b)? In this case the stationary value of U is unaffected. w − mc decreases. (d) Is there a “natural rate of unemployment” in one of both of these models (meaning that the equilibrium level of unemployment is independent of the rate of inflation)? If “natural rate of unemployment” is to be a meaning operational concept, then it must correspond to something that we can observe or estimate. If we know the coefficients of the models (in practice this will be after estimation, but never mind that) we can “observe” the steady-state, so in this question it is sensible to equate the “natural rate of unemployment” with the steady-state solution. The steady state of U depends on gmc in both models. gmc is the sum of foreign inflation and e-sector productivity growth. Hence it depends on inflation (but that inflation rate is exogenous!) in both models. However with β w2 = 1, U becomes independent of inflation in both models. 3 (e) Simplify the system by setting αu = 0. What are the dynamic responses of wt , Ut , and ∆wt to a permanent increase in the main-course variable mct ? It is possible to give very good qualitative answers, but many (also) attempt an algebraic part. Setting zt = εw,t = εu,t = 0 gives the following (final) equation for wt : wt = β wo + β w1 β u0 + (αw + β w1 β u1 )wt−1 + β w2 mct + [(1 − αw ) − β w2 − β w1 β u1 ] mct−1 Ut = β u0 + β u1 (β wo + β w1 β u0 ) +β u1 (αw + β w1 β u1 )wt−2 + (β u1 β w2 − β u1 )mct−1 +β u1 [(1 − αw ) − β w2 − β w1 β u1 ] mct−2 From this you can find the effect on wt and ∆wt first, then effect on Ut. 4