CSCI-14 Lab #3, due 2/16/16

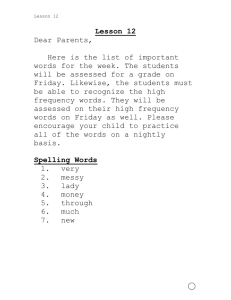

advertisement

CSCI-14 Lab #3, due 2/16/16 Please work in groups of two. You may not work with the same partner as a prior lab. Write a program to calculate the property tax for an assessed property. It will prompt for the value of the property, then calculate and prints both the assessed value of the property and the property tax due on the property with reasonable text. The assessed value of a property is 60% of the actual value of the property. The tax rate is then 64¢ per $100 of the assessed value of the property. For example, for a property valued at $10,000.00, the assessed value is $6,000.00. The tax on that $6000.00 is then going to be $38.40. Use <iomanip>, showpoint, fixed and setprecision() to round output to two decimal places. As usual, send me one e-mail per group with all group members' names in the subject line, e-mail body and the source code. Attach several test runs, including a run with my example values.