File

advertisement

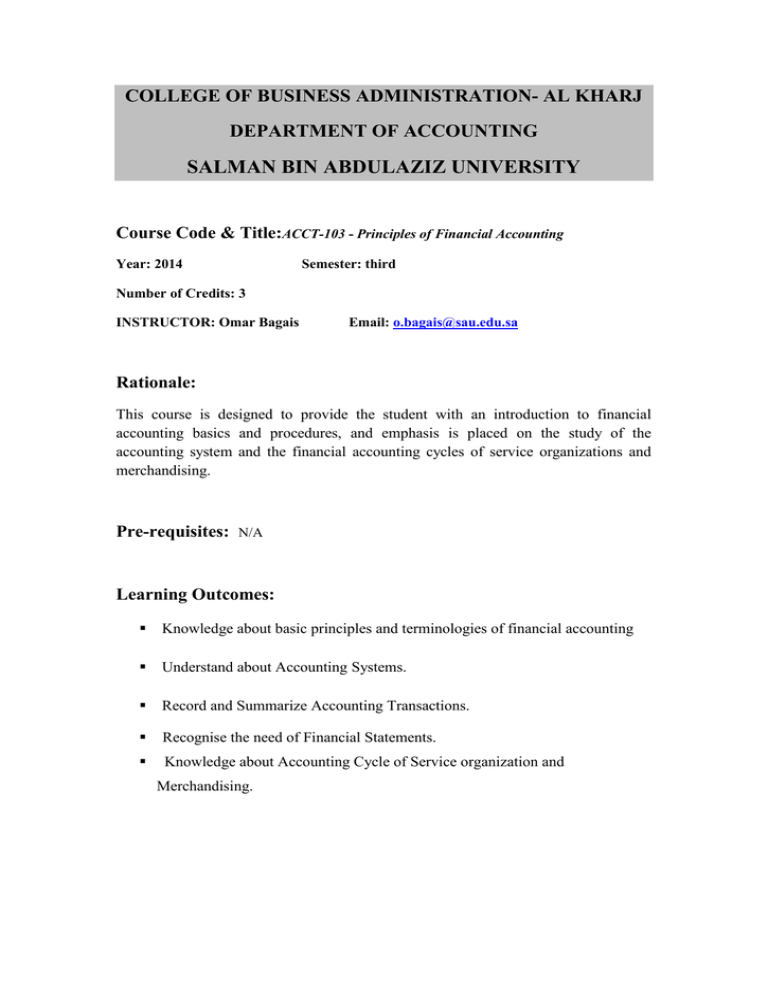

COLLEGE OF BUSINESS ADMINISTRATION- AL KHARJ DEPARTMENT OF ACCOUNTING SALMAN BIN ABDULAZIZ UNIVERSITY Course Code & Title:ACCT-103 - Principles of Financial Accounting Year: 2014 Semester: third Number of Credits: 3 INSTRUCTOR: Omar Bagais Email: o.bagais@sau.edu.sa Rationale: This course is designed to provide the student with an introduction to financial accounting basics and procedures, and emphasis is placed on the study of the accounting system and the financial accounting cycles of service organizations and merchandising. Pre-requisites: N/A Learning Outcomes: Knowledge about basic principles and terminologies of financial accounting Understand about Accounting Systems. Record and Summarize Accounting Transactions. Recognise the need of Financial Statements. Knowledge about Accounting Cycle of Service organization and Merchandising. Course Outline: Accounting in Action: Accounting, Internal and External users, booking distinguished from accounting, the accounting profession, basic equation of accounting, assets, liabilities, investment, drawings, revenue, and expenses as a building block, transaction identification process. Recording process of Accounting: The recording process: The accounts, basis form of account, debit and credit, double entry system, debit and credit effects-assets and liabilities, nominal balance-assets and liabilities, owner capital, owners drawing, revenue and expenses. The recording process: journal, journalizing, technique of journaling, simple and compound journal entries. The ledger, posting journal entry, trial balance and its limitations. Adjusting the Accounts: time period assumption, accrual basis of accounting, revenue recognition principles, the matching principles, GAAP relationship in revenue reorganization, adjustment entries: Types of adjusting entries, adjustment entries for prepayments, prepaid expenses, depreciation, unearned revenues, accrual, accrued revenues, accrued expenses, adjusted trial balance, preparation of the income statement and the owner's equity statement from the adjustment trial balance. Completion of the Accounting Cycle: worksheet, form and procedure for a work sheet, steps in preparing a work sheet, preparing of financial statement: income statement, owner's equity statement, balance sheet, temporary versus permanent account, closing entries, posting of closing entries, post closing trial balance, balance sheet classification: Current Assets, Investment, property plant and equipment, intangible assets, current liability, long term liabilities, owner's equity. Accounting for Merchandising Operations:merchandising company, measuring net income, income measurement process for a merchandising company, operating cycle for a service company and a merchandising company, inventory system, perpetual verses periodic, cost of good sold, purchases of merchandise, purchase returns and allowances, accounting for freights, purchase discounts, Sales transactions, sales return allowances, sales discounts, multi steps income statement,, worksheet for a merchandising company. Required Text: Accounting Principles, 11th Edition International Student Version by Donald E. Kieso, Paul D. Kimmel and Jerry J. Weygandt Suggested Readings: 1. Fundamental Accounting Principles: Wild; Larsen; Chappeta, Mc.Graw Hill, Edt.18th. 2. Financial Accounting IFRS 2010 Updated International Student Version, Weygandt, Kimmel &Kieso , John Wiley , 2011 3. Accounting principles II, Minbiole, Elizabeth A, IDG Books, 2012. 4. Accounting principles ,Weygandt, Jerry J ,D.E. Kieso, and P.D kimmel , John Wiley& Sons , 2012 Schedule of assessment tasks for students during the semester Assessment Assessment Task (e.g., Essay, Test, Group Project, Examination.) Number of times Proportion Final Assessment (Marks Distribution) Assignments 5* 15% Mid Term Examination – 1 1 15% Mid Term Examination – 2 1 15% Quizzes 5* 15% Final Examination 1 Total - 1 2 3 4 6 40% 100% *At least Updated : September 2014