Accounting Syllabus

Course:

Year:

Instructor:

Tutoring:

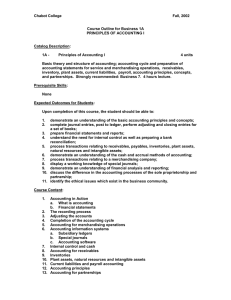

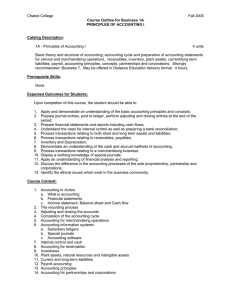

Accounting 201 (Davenport University) Credits: 4

2015-16

Mrs. Andersen

Tuesday, 3:30-4:15

Room: 253

Course Description

12104 Accounting

Accounting courses introduce and expand upon the fundamental accounting principles and procedures used in business. Course content typically includes the full accounting cycle, payroll, taxes, debts, depreciation, ledger and journal techniques, and periodic adjustments. Students may learn how to apply standard auditing principles and to prepare budgets and final reports.

Calculators, electronic spreadsheets, or other automated tools are usually used. Advanced topics may include elementary principles of partnership and corporate accounting and the managerial uses of control systems and the accounting process.

**This is a concurrent-enrolled class through Davenport University. All students must receive a 73% in order to receive college credit.**

This class is also used for a 4 th year math class

Learning Outcomes

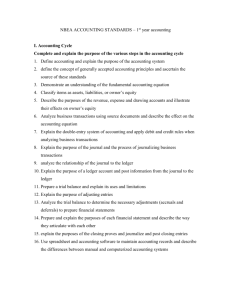

Upon successfully completing this course, the student will be able to:

1. Demonstrate knowledge of Generally Accepted Accounting Principles via oral and written presentations.

2. Demonstrate problem solving by gathering, organizing and interpreting data.

3. Examine and record business events for sole-proprietorships.

4. Prepare financial statements.

5. Describe and discuss proper accounting treatment and reporting of cash, receivables, inventory, plant assets, and current liabilities.

6. Examine partnership transactions and properly record addition/deletion of partners and partnership liquidations

DU Excellence System

The Davenport University Excellence System consists of nine learning outcomes that demonstrate professional competencies necessary for graduates to engage in life-long learning and succeed in their chosen profession. These learning outcomes are reinforced throughout the curriculum of each academic program and are assessed at the course and program levels, where appropriate. The Excellence System covers:

Global and Intercultural Competence

Civic and Social Responsibility

Ethical Reasoning and Action

Critical and Creative Thinking

Analysis and Problem Solving

Leadership and Teamwork

Information and Technology Proficiency.

Written Communication

Professional Communication

Textbook:

978-0-07-782178-4

Fund. Accounting Principles , 21 st Edition

Textbook Policy:

All textbooks and supplemental works are the property of ATA. Books will be assigned to students by a specific number. All books must be returned to ATA at the time of the final exam or withdrawal from

ATA. If the book assigned to the student is not returned, it is the obligation of the student, parent or guardian to pay for the assigned book.

Materials Needed

Calculator with basic functions and with a percent key

Number of pencils (only pencils will be used on class work)

Folder to keep all returned paper and papers needed for test reviews

Notebook

Requirements:

Student will be required to do the following

Keep detailed notes of lecture

Participate in class discussions

Copy and keep examples of problems

Keep all returned papers to be used for test reviews

Keep up on all assignments

Grading:

Assignments

Comprehensive Problems

Test/Projects

Semester Exam

35%

15%

50%

20%

**Late Assignments can be turned in 1 day late (reduction of 25%), 2 days late (reduction of

50%), no late work accepted after 3 days. **

Standardized Grade Scale

The following grading scale is a University standard for courses in this area of study:

A 100 – 93

A- 92 – 90

B+ 89 – 87

B 86 – 83

B- 82 – 80

C+ 79 – 77

C 76 – 73

C- 72 – 70

D+ 69 – 67

D 66 – 63

F 62 – 0

Note: A grade of C or better is required to pass this course successfully

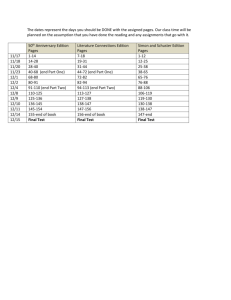

Schedule

***All dates and assignments are subject to change for the benefit of student learning***

Teacher website will display the latest assignments/projects and test schedules

Semester 1:

September

September

September

October

October

November

Chapter 1

Chapter 2

Chapter 3

Chapter 4

Chapter 5

Chapter 6

November/December

December

January

Semester 2

Chapter 7

Chapter 7

Review for Semester Exams

February

February

February/March

March

March /April

April

May

May

May

Chapter 8

Comprehensive Problem

Chapter 9

Chapter 10

Chapter 11

Chapter 12

Comprehensive Problem

Final Exam Review

Senior Final Exams

27

27

28

29

30

19

20

21

22

22

2

2

2

3

3

6

7

8

8

4

5

CLASS

MTG CHAP

1

1

1

1

TOPIC

Introductions & Class Overview

Accounting in Business

CONNECT

1

2

3

2

3

Accounting in Business

Analyzing & Recording Transactions

Adjusting Accounts & Preparing Financial Statements

Analyzing & Recording Transactions

Adjusting Accounts & Preparing Financial Statements

3

4

Adjusting Accounts & Preparing Financial Statements

Completing the Accounting Cycle

4 Completing the Accounting Cycle

1-4 Review Chapters 1, 2, 3, 4

1-4

5

EXAMINATION NUMBER ONE (110 Min)

Accounting for Merchandising Operations

Quick Study Exercises

All

Problems Reading

1

Project / Other

Tutorial

Problems 1-3, 1-4, 1-5 In Class

All

All

All

1-2, 1-4, 1-6,

1-8, 1-12, 1-13

2-2, 2-3, 2-8

1-1A

2-12

3-3, 3-4, 3-7

2-2A, 2-5A

3-1A, 3-4A, 3-

5A

4-1, 4-3, 4-4

4-2A

4

2

3

All 5

9

10

10

11

12

12

5

5

5

6

6

7

Accounting for Merchandising Operations

Accounting for Merchandising Operations

Accounting for Merchandising Operations

Inventories & Cost of Sales

Inventories & Cost of Sales

Accounting Information Systems

All

5-2, 5-3, 5-4,

5-6, 5-7, 5-9

5-14

6-1, 6-3, 6-4,

6-8

5-2A, 5-3A

5-5A

6-1A, 6-3A

5A

6

7

All

7-1, 7-2, 7-3,

7-4, 7-5, 7-6,

7-7

7-10 7-3A, 7-4A

13

14

15

16

16

17

17

18

7

7

Accounting Information Systems

Accounting Information Systems

5-7 Review chapters 5, 6, 7

5-7

8

EXAMINATION NUMBER TWO (110 Min)

Cash and Internal Controls

8

9

Cash and Internal Controls

Project Kick-Off

Accounting for Receivables

All

All

8-2, 8-3, 8-5,

8-7, 8-11, 8-12 8-2A, 8-4A

8

9

Start Com prehensive Problem

9

9

Accounting for Receivables

Accounting for Receivables

8 - 9 Review chapters 8, 9

8 - 9 EXAMINATION NUMBER THREE (110 Min)

10 Plant Assets, Natural Resources, Intangibles All

9-1, 9-2

9-3, 9-4, 9-5,

9-6, 9-7, 9-10,

9-13, 9-14

9-3A, 9-5A

10

10-1, 10-2, 10-

3, 10-5, 10-6,

10-7, 10-9,

10-11, 10-13,

10-14 23

24

25

10 Plant Assets, Natural Resources, Intangibles

WORK ON PROJECTS IN CLASS

10 WORK ON PROJECTS IN CLASS

11 Current Liabilities & Payroll Accounting

26 11 Current Liabilities & Payroll Accounting

Project Due

All

11-1, 11-3,

11-4, 11-5,

11-8, 11-10,

11-11, 11-12,

11-14

Com prehensive Problem Due

11

12

12

1-12

1-12

Current Liabilities & Payroll Accounting

Accounting for Partnerships

Accounting for Partnerships

Review Chapters 1 - 12

FINAL EXAM (COMPREHENSIVE) 110 Min

All

11-1A,

11-3A, 11-

4A

12

12-2A, 12-3A