ACCT& 201

advertisement

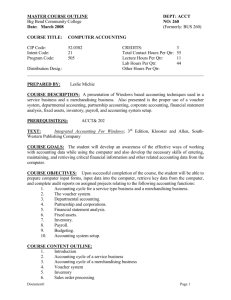

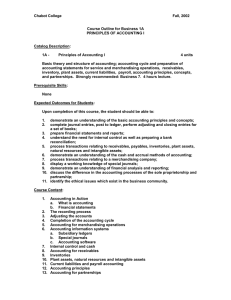

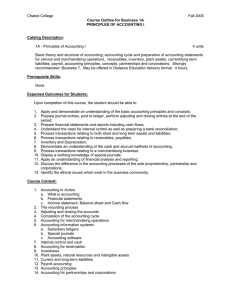

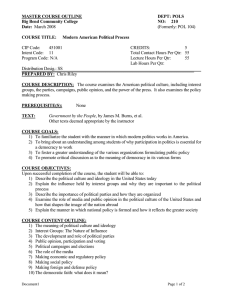

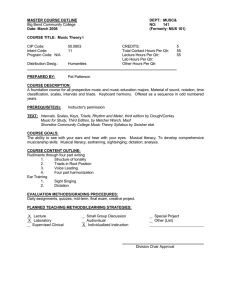

MASTER COURSE OUTLINE Big Bend Community College Date: March 2008 COURSE TITLE: PRIN OF ACCOUNTING I CIP Code: Intent Code: Program Code: 52.0302 21 505 Distribution Desig.: SE PREPARED BY: Preston Wilks DEPT: ACCT NO: 201 (Formerly: BUS 251) CREDITS: 5 Total Contact Hours Per Qtr: 55 Lecture Hours Per Qtr: 55 Lab Hours Per Qtr: Other Hours Per Qtr: COURSE DESCRIPTION: An introduction to the steps in the accounting cycle; accounting for merchandise; the adjusting process--deferrals and accruals; financial statements; cash transactions; receivables, inventories and internal controls. This course is the first in a three-course series designed for all accounting and business majors. PREREQUISITE(S): TEXT: ACCT 105 highly recommended Accounting, 19th Edition, Warren, Reeve, Fess, Southwestern Publishing Co. COURSE GOALS: The student will understand all of the steps in the accounting cycle for both service and merchandising businesses. Students will achieve limited entry-level skills for accounting upon completion of this course. COURSE OBJECTIVES: Upon successful completion of the course, the student will be able to: 1. Journalize business transactions in a sales journal, purchases journal, cash payments journal, cash receipts journal, and general journal 2. Summarize by posting from the above journals to the general ledger and to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare and complete worksheets, income statements, statements of owner’s equity, balance sheets, and cash flow statements. Then journalize and post adjusting, closing and reversing entries. 4. Record and post entries related to a petty cash fund, a change fund, a cash short and over account, and prepare a formal bank reconciliation. 5. Record entries related to the accounting for uncollectible receivables. Also, compute simple interest, discounts, maturity values, and due dates related to promissory notes. COURSE CONTENT OUTLINE: 1. Introduction to Accounting and Business 2. Analyzing Transactions 3. The Matching Concept and the Adjusting Process 4. Completing the Accounting Cycle 5. Accounting Systems and Internal Controls 6. Accounting for Merchandising Business 7. Cash Transactions 8. Receivables EVALUATION METHODS/GRADING PROCEDURES: Document1 Page 1 Total points possible are allocated as follows (approximately): Daily Assignments 15% Practice Set 10% Chapter Tests and Quizzes 60% Final Test 15% TOTAL 100% Grade determination will be as follows (approximately) 90% - 100% = A- to A 80% - 90% = B- to B+ 70% - 80% = C- to C+ 60% - 70% = D- to D+ Below 60% = Fail PLANNED TEACHING METHODS/LEARNING STRATEGIES: X Lecture Small Group Discussion X Special Project Laboratory X Audiovisual Other (List) Supervised Clinical X Individualized Instruction Division Chair Approval Document1 Page 2