taxing exhaustible resources: evidence from California oil production Nirupama S. Rao NYU Wagner

advertisement

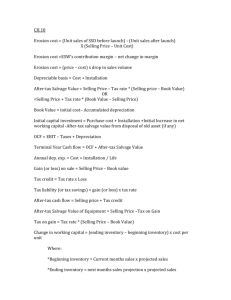

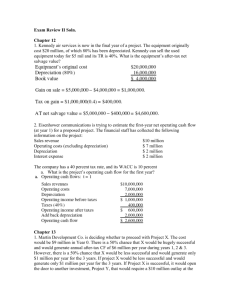

taxing exhaustible resources: evidence from California oil production Nirupama S. Rao NYU Wagner June 2011 Taxes play an important role in the production and consumption of fossil fuels • Recent price escalation renewed discussion of new federal sur-taxes. – Several 2008 bills and proposals – 2005 Markey-Emanuel, 1990 bills • 21 U.S. states and many other nations levy severance taxes on oil. • In 2009, the U.S. collected $38B in excise taxes on fossil fuels. • Potentially important for climate change policy Taxing exhaustible resources is different than taxing other production • Key distinction: the intertemporal sum of services from a given stock is finite. – Producers face a ‘pump today or pump tomorrow’ decision, linking production each period. – There is an opportunity cost to pumping today. – Need to take the re-timing of production into account when assessing the deadweight loss. Preview of Results • Estimate an after-tax price elasticity of 0.24. – Micro-data are key to estimating the supply response. • Only minor exit response. – Producers do not shut wells to avoid taxes. • Estimates suggest that the dynamic inefficiency cost of a 15% temporary excise tax is between 1% and 5% of original producer surplus. – Each dollar of revenue costs between $1.13 and $1.66 in lost producer surplus. Impact of Temporary Tax • Some wells will shut down early • Wells that continue to pump will tilt their extraction paths forward, reducing producer surplus. – Delay reduces the PDV of profits – Operators will extract sub-optimally 200 180 Extraction Rate 160 140 120 100 Original Extraction Path 80 60 Extraction Path After Introduction of Temporary Tax 40 20 0 0 5 10 15 20 25 Time 30 35 40 45 Past Work on Supply Elasticities • Estimates from previous studies referred to as generally unreliable and implausible by a recent CRS study. • Relying on aggregate data and time-series price variation, they find small and sometimes implausible negative elasticities. Aggregate Time-Series Variation May Not Identify the Appropriate Elasticity • Underlying price and taxes may be of different persistence. – If taxes are viewed as less (more) persistent, price elasticities will overstate (understate) tax response since in reality adjustment is costly. • Longterm price considerations are important. – Current price changes inform producer expectations of longterm price. 1980 “Windfall Profit” Tax provides rich variation in after-tax price • Instituted following the de-control of oil prices. • Levied on only domestically produced oil. – Transport costs are minimal, meaning full incidence born by domestic oil producers. • Raised a substantial amount of revenue. – At its height in 1982 generated $44B in gross revenue, or almost half as much as the corporate income tax. Timing of Decontrol and WPT Windfall Profit Tax New (06/79) 1979 Very Heavy (09/79) Heavy (01/80) Old (02/81) 1980 1981 Old--Phaseout WPT was not a profit tax! τ it (Pit − Bi ) if Pit > Bi WPT tax it = 0 otherwise W (1− τ Corp )(Pit − τ it (Pit − Bi )) if Pit > Bi t ATPit = Corp (1− τ t )Pit otherwise WPT payments were deductible from corporate taxable income Tax rates differed across wells Tier I: Old Oil Tier II: Stripper Oil Tier III: New Heavy Well produced in 1978 τ = 0.70 Produces < 10 bbl/day for 12 consecutive months τ = 0.60 Zero Production in 1978 API Gravity<16 τ = 0.30* τ = 0.30 *Tax rate for new wells were further reduced to 0.225 starting in 1982. Tax rates based on well characteristics • Differences across wells that are correlated with production and tax rates bias estimates. – Operating costs could vary by specific gravity, or easier to pump formations may have been tapped earlier. – Makes flexibly controlling for well characteristics important. Before- and After-Tax Price Well 120005: Livermore Field Old Oil, API Gravity of 23; Stripper starting 10/1982 (70% tax rate until 10/1982, then 60% until 1986) Before- and After-Tax Price Well 120005: Livermore Field 70 60 50 40 30 Real Posted Price After-Tax Price Before Corp. Tax After-Tax Price Well Mean Residual--Well FE Residual--Well, Time FE 20 10 0 -10 -20Jan-77 Jan-78 Jan-79 Jan-80 Jan-81 Jan-82 Jan-83 Jan-84 Jan-85 Before- and After-Tax Price Well 120005: Livermore Field 70 60 50 40 30 Real Posted Price After-Tax Price Before Corp. Tax After-Tax Price Well Mean Residual--Well FE Residual--Well, Time FE 20 10 0 -10 -20Jan-77 Jan-78 Jan-79 Jan-80 Jan-81 Jan-82 Jan-83 Jan-84 Jan-85 Before- and After-Tax Price Well 120005: Livermore Field 70 60 50 40 30 Real Posted Price After-Tax Price Before Corp. Tax After-Tax Price Well Mean Residual--Well FE Residual--Well, Time FE 20 10 0 -10 -20Jan-77 Jan-78 Jan-79 Jan-80 Jan-81 Jan-82 Jan-83 Jan-84 Jan-85 Before- and After-Tax Price Well 1300071: Brentwood Field New Oil, API Gravity of 40.7; Never Stripper (30% tax rate until 1982, then decreases to 22.5%) Before- and After-Tax Price Well 1300071: Brentwood Field 80 70 60 50 Real Posted Price After-Tax Price Before Corp. Tax After-Tax Price Well Mean Residual--Well FE Residual--Well, Time FE 40 30 20 10 0 -10 -20Jan-77 Jan-78 Jan-79 Jan-80 Jan-81 Jan-82 Jan-83 Jan-84 Jan-85 Data • Production data comes from the California Department of Conservation. – Describes monthly production, specific gravity, pumping method, location, status and completion date for all wells in California, 1977-2008. – 30M observations describing 141K wells • Price data comes from Platt’s Oil Price Handbook and Oilmanac – Monthly posted price for major producers by field. • Price control provisions and tax rates from the 1977-1986 Code of Federal Regulations Summary Statistics Mean Oil Production (barrels) Oil Production if Producing After-tax Price ($) WPT Tax Rate Purchase Price API Gravity (degrees) Number of Wells Observations 443.3 666.1 18.3 0.21 41.1 18.2 75,342 6,517,140 Standard Deviation Overall Within-Well 3071.1 2858.5 3745.0 3460.5 4.1 3.5 0.24 0.19 10.1 9.78 6.8 1.4 Quantity Regression Specification • Specifications of the general form: Qi t = β0 + β1(1 − τ Ct )( B i t + (1 − τiWt )( Pt − B i t )) + β2agei t + σ t + δi + εi t where Qit is the quantity extracted. • Specification is in the spirit of other studies. Identification • Identification achieved from within-well deviations in after-tax price driven by the lifting of price controls and the introduction of the WP tax, less common time-varying factors. – Nets out heterogeneity in productivity that is constant over the life of the well. – Nets out secular common factors, such as expectations of future price, that vary over time. Key Assumptions for Identification • The specification will not identify the response to after-tax price if well productivity is affected by unobserved factors that are: – Time-varying and well-specific – (Correlated with the rescindment of price controls or the introduction or the WP tax) Table 2: Well-Specific Output: Panel Data Estimates After-tax Price Well Age (1) 8.730 (1.082) -1.269 (0.069) Well Age Squared Well FE Time FE API Gravity Decile FE API Gravity Time Trends After Tax-price Elasticity Number of Wells Observations Y Y N N 0.237 (0.029) (2) 8.741 (1.082) -1.228 (0.081) -(0.0003) (0.0002) Y Y N N 0.238 (0.029) (3) 7.659 (0.979) 6.531 (1.885) (4) 9.598 (0.765) -1.258 (0.050) Y Y Y Y 0.208 (0.027) Y Y N N 0.261 (0.021) 75,342 75,342 75,342 73,548 6,517,140 6,517,140 6,517,140 6,350,820 Table 3: Well-Specific Output, Panel Data Estimates Flowing vs. Pumped Wells After Tax-price Elasticity p-value 95% Confidence Intervals After-tax Price Well Age Number of Wells Observations (1) Baseline (2) Pumped (3) Flowing 0.237 (0.029) 0.000 0.356 (0.024) 0.000 -0.101 (0.088) 0.253 [0.180, 0.295] [0.083, 0.108] [-0.274, 0.072] 8.730 (1.082) -1.269 (0.069) 11.520 (0.784) -1.570 (0.055) -12.180 (10.649) -0.377 (0.866) 75,342 6,517,140 72,797 5,698,198 13,198 818,942 Response Along the Extensive Margin: The Shut-in Decision • Shut-in likely means a permanent output gap. – Shutting-in risky – Re-opening costly • If the quantity response is driven by exit, then the the efficiency cost of the tax is higher. • Wells with high fixed or variable costs or little remaining life are most likely to shut. Shut-In Regression Specification • Specifications of the general form: Si t = β0 + β1(1 − τ Ct )( B i t + (1 − τiWt )( Pt − B i t )) + β2agei t + σ t + δi + εi t where Sit is 1 is the well is shut-in. • Estimated via conditional logit – Requires variation in shut-in for each well. Table 4: Well Shut-in Decisions (1) CL Shut-in Var. After-tax Price -0.0052 (0.0008) Well Age 0.0126 (0.0007) Well FE Y Time FE Y API Gravity Decile FE N API Gravity Time Trends N After Tax-price Semi-0.095 Elasticity (0.0148) Number of Wells 29,297 Observations (millions) 2.69 (2) CL Shut-in Var. (3) CL Drop NPR (4) OLS Shut-in Var. (5) OLS Full Sample -0.0064 -0.0060 -0.0043 -0.0015 (0.0002) (0.0009) (0.0004) (0.0002) 0.0455 0.0121 0.0014 0.0005 (0.0008) (0.0007) (0.0000) (0.0000) Y Y Y Y Y Y Y Y Y N N N Y N N N -0.117 -0.111 -0.080 -0.027 (0.0037) (0.0169) (0.0078) (0.0034) 29,297 29,297 29,297 75,342 2.69 2.69 2.69 6.52 Reconciliation with Previous Estimates Study Griffin (1985) Hogan (1989) Jones (1990) Sample Period 1971Q1– 1983Q3 1966–1987 1983Q3– 1988Q4 Elasticity Estimate -0.05 (0.02) 0.09 (0.03) 0.07 (0.04) Dahl and Yücel (1991) 1971Q1– 1987Q4 -0.08 (0.06) Ramcharran (2002) 1973–1997 0.05 (0.02) Reconciliation with Previous Estimates • Previous positive significant estimates are 60 to 80 percent smaller. • Time-series aggregate data yield smaller estimates: – DOE pre-tax price series suffers from significant measurement error. – Aggregation subsumes heterogeneity in well productivity. – Tax and price variation may differ in persistence. Table 6: Alternative Specifications Using National Average Pre-Tax Price Series WTI Price Well Age Time Well Dummies Time Dummies After Tax-price Elasticity p-value Number of Wells Observations (1) Baseline 8.730 (1.082) -1.269 (0.069) Y Y 0.237 (0.029) 0.000 75,342 6,517,140 (2) Within Well 0.320 (0.148) -0.124 0.101 Y N 0.021 (0.010) 0.030 75,342 6,517,140 (3) Pooled 0.365 (0.153) -0.148 0.081 N N 0.024 (0.010) 0.017 75,342 6,517,140 (4) Time-Series 11,223 (10,036) 48,874 (4,468) N N 0.017 (0.015) 0.263 75,342 108 Table 7: Alternative Specifications Using After-Tax Price (1) Baseline After-Tax Price Well Age Time Well Dummies Time Dummies After Tax-Price Elasticity p-value Number of Wells Observations (2) Pooled 8.730 -19.676 (1.082) (1.015) -1.269 (0.069) 0.315 (0.081) Y N Y N 0.237 -0.535 (0.029) (0.028) 0.000 0.000 75,342 75,342 6,517,140 6,517,140 (3) (4) (5) Time-Series Pooled Time-Series -58,302 13.432 158,262 (39,283) (4.946) (44,607) 0.098 -3.476 -56,305 (0.007) (0.362) (2,164) N N N N N N -0.036 0.149 0.208 (0.024) (0.055) (0.059) 0.138 0.000 0.000 20,699 108 1,090,659 108 Conclusion • Production is responsive to changes in after-tax price. – Little action on the shut-in margin. – Substantial evidence of retiming. • Exhaustibility complicates the DWL calculation. • Caveats: – Estimate based on California wells more than 20 years ago. – Estimate does not include changes in exploration or development. Policy Implications & Applicability • California has considered levying a 9.9% oil excise tax. – Reduce near-term CA production – Trigger minimal shut-in response • Consider exemptions for very low production wells – Increase reliance on (Venezuelan) imports Policy Implications & Applicability • National carbon pricing – $20 per ton CO2 => $4.77 per barrel of oil – 1.5% decrease in production? Not necessarily. • Would apply to domestic and imported oil. • Tax could affect pre-tax prices, leading to a smaller decrease in U.S. production.