The Future of Portable Ultrasound: Business Strategies ... ARCHIVES

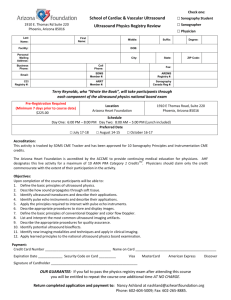

advertisement