Behavioral economics and macroeconomic models

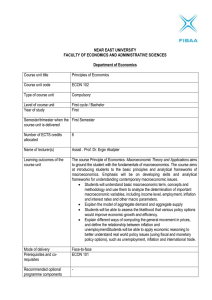

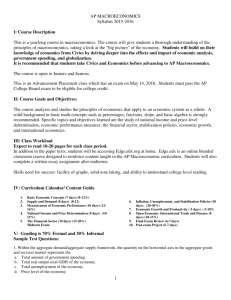

advertisement