Macroeconomics in the Global Economy

advertisement

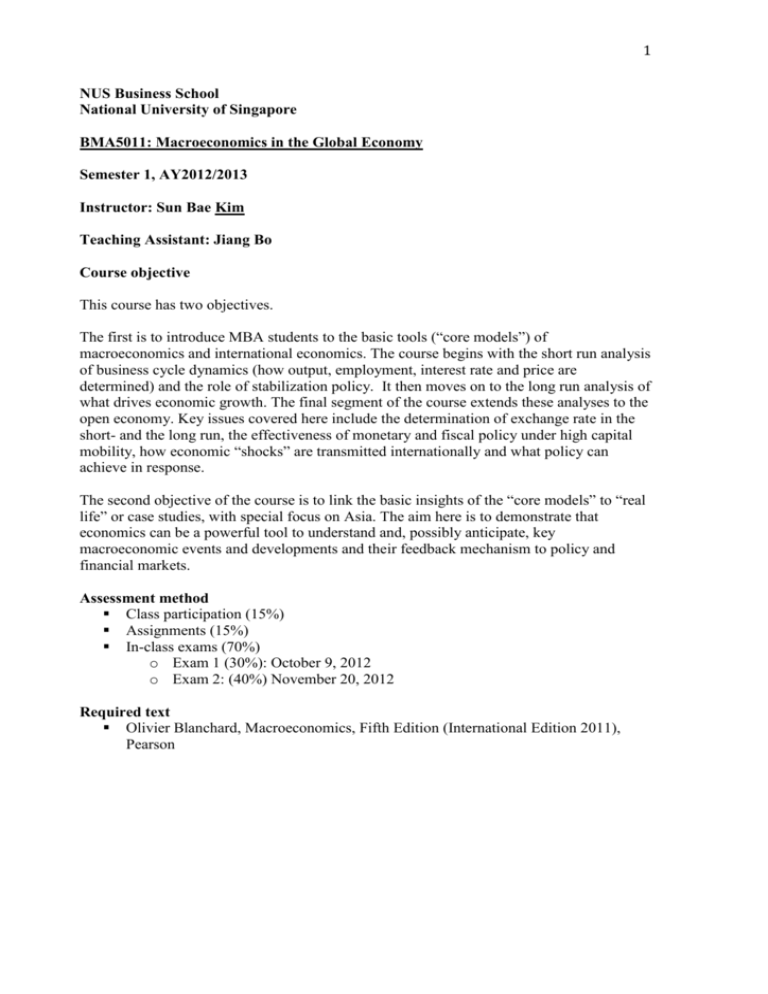

1 NUS Business School National University of Singapore BMA5011: Macroeconomics in the Global Economy Semester 1, AY2012/2013 Instructor: Sun Bae Kim Teaching Assistant: Jiang Bo Course objective This course has two objectives. The first is to introduce MBA students to the basic tools (“core models”) of macroeconomics and international economics. The course begins with the short run analysis of business cycle dynamics (how output, employment, interest rate and price are determined) and the role of stabilization policy. It then moves on to the long run analysis of what drives economic growth. The final segment of the course extends these analyses to the open economy. Key issues covered here include the determination of exchange rate in the short- and the long run, the effectiveness of monetary and fiscal policy under high capital mobility, how economic “shocks” are transmitted internationally and what policy can achieve in response. The second objective of the course is to link the basic insights of the “core models” to “real life” or case studies, with special focus on Asia. The aim here is to demonstrate that economics can be a powerful tool to understand and, possibly anticipate, key macroeconomic events and developments and their feedback mechanism to policy and financial markets. Assessment method Class participation (15%) Assignments (15%) In-class exams (70%) o Exam 1 (30%): October 9, 2012 o Exam 2: (40%) November 20, 2012 Required text Olivier Blanchard, Macroeconomics, Fifth Edition (International Edition 2011), Pearson 2 COURSE OUTLINE I. Introduction & Preliminaries 1. Why study macro? Goal of the course, roadmap, schedule 2. Use of models in economics 3. How to get the most out of the course 4. National income accounting and other major macroeconomic variables II. Introduction to Business Cycles: Output in the Short Run 1. Income and Spending: Keynesian Multiplier Model 2. Money, Interest, and Income: IS-LM Model 3. Aggregate Demand and Aggregate Supply 4. Monetary Policy and Inflation 5. Fiscal Policy 6. Case Studies (non-exhaustive) i. The Great Recession ii. Perspectives on Central Banking and Monetary Policy iii. Fiscal Sustainability and Sovereign Debt Crisis III. Economic Growth in the Long Run 1. Growth Accounting 2. Growth Theory: The Neoclassical Model 3. Case Studies iv. Perspectives on Asia’s Growth v. The Rise of BRICs IV. Open Economy Macro 1. Foreign Exchange and the Balance of Payments 2. Exchange Rate in the Short Run 3. Policy in an Open Economy: Mundell-Fleming Model 4. International Transmission of Shocks and Policy Options 5. Exchange Rate in the Long Run: Real Equilibrium Exchange Rate 6. Policies for Internal and External Balance 7. International Monetary System: Historical Perspectives 8. Case Studies (non-exhaustive) vi. Singapore’s Exchange Rate Framework vii. Global Imbalance and International Policy Coordination viii. “Twin Crises”: Asia vs. Europe