1 AP MACROECONOMICS Syllabus 2015

advertisement

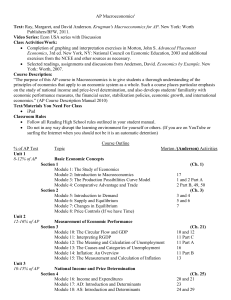

AP MACROECONOMICS Syllabus 2015-2016 I: Course Description This is a yearlong course in macroeconomics. The course will give students a thorough understanding of the principles of macroeconomics, taking a look at the “big picture” of the economy. Students will build on their knowledge of economics from Civics by delving deeper into the effects and impact of economic analysis, government spending, and globalization. It is recommended that students take Civics and Economics before advancing to AP Macroeconomics. The course is open to Juniors and Seniors. This is an Advancement Placement class which has an exam on May 14, 2016. Students must pass the AP College Board exam to be eligible for college credit. II: Course Goals and Objectives: The course analyzes and studies the principles of economics that apply to an economic system as a whole. A solid background in basic math concepts such as percentages, fractions, slope, and basic algebra is strongly recommended. Specific topics and objectives learned are the study of national income and price-level determination, economic performance measures, the financial sector, stabilization policies, economic growth, and international economics. III: Class Workload Expect to read 10-20 pages for each class period. In addition to the paper texts, students will be accessing Edge.edx.org at home. Edge.edx is an online blended classroom course designed to reinforce content taught in the AP Macroeconomic curriculum. Students will also complete a written essay assignment after midterms. Skills need for success: facility of graphs, solid note taking, and ability to understand college level reading. IV: Curriculum Calendar/ Content Guide 1. 2. 3. 4. 5. Basic Economic Concepts (7 days) (8-12%) Supply and Demand (8 days) (8-12) Measurement of Economic Performance (10 days) (1216%) National Income and Price Determination (9 days) (1015%) The Financial Sector (10 days) (15-20%) Midterm Exam 6. Inflation, Unemployment, and Stabilization Policies (10 days) (20-30%) 7. Economic Growth and Productivity ( 5 days) ( 5-10% 8. Open Economy: International Trade and Finance (8 days) (10-15%) 9. Final Exam Review (6-7 days) 10. Post-exam Project (6-7 days) V: Grading is 70% Formal and 30% Informal Sample Test Questions: 1. Within the aggregate demand/aggregate supply framework, the quantity on the horizontal axis in the aggregate goods and services market represents the a. Total amount of government spending. b. Total real output (real GDP) of the economy. c. Total unemployment of the economy. d. Price level of the economy. 1 2. In the loanable funds market, the true burden of borrowers and the true yield to lenders is the a. Real (inflation adjusted) interest rate. b. Nominal (money) interest rate. c. Inflation rate. d. Inflation premium rate (in money terms). 3. When AD is equal to SRAS at an output level equal to the LRAS curve, a. We are at long-run macroeconomic equilibrium. b. We are at the natural rate of unemployment. c. Both a and b are true. d. Neither a nor b is true. 4. Your grandmother gives you a $100 savings bond that will mature in fifteen years. The bank tells you that they will buy it from you today at a price of $24. If interest rates rise in the near future, the value of your bond a. Will fall and it will be worth less than $24. b. Will rise and it will be worth more than $24. c. Will remain unchanged at $24. d. This is a trick question; the value of a $100 bond is always $100. 5. A key statistic to measure economic growth is: a. the size of the government’s budget b. Real GDP per capita c. life expectancy d. the Dow Jones Stock Market Index 2