Evolution of Hedge Funds

Leadership Forum

Managed Funds Association

Feb. 6,2006

Ginger Szala, Futures Magazine

Darwin and the Dollar

What defines a hedge fund?

1) Leverage

2) Long/short abilities

3) Broader markets

4) Structure provides freedom for

manager to pursue multiple strategies

Estimated Number of Hedge Funds

1990 – 2005

9,000

8,661

8,000

7,436

7,000

6,297

Number of Funds

6,000

5,379

5,000

4,454

3,873

4,000

3,617

3,325

2,990

3,000

2,781

2,383

1,945

2,000

1,514

1,105

1,000

821

610

0

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

Extract from HFR Industry Report –

2000

2001

2002

2003

2004

2005

Estimated Growth of Assets / Net Asset Flow

Hedge Fund Industry 1990 – 2005

$1,200,000

$1,105,385

$1,100,000

$1,000,000

$972,608

$900,000

$820,009

Assets (In $MM)

$800,000

$700,000

$625,554

$600,000

$539,060

$490,580

$500,000

$456,430

$400,000

$367,560 $374,770

$300,000

$256,720

$185,750

$200,000

$167,790 $167,360

$95,720

$100,000

$38,910

$58,370

$8,463 $27,861

$99,436

$91,431

$57,407

$36,918

$0

$55,340

$14,698

$70,635

$73,585

$46,545

$46,907

$23,336

$4,406

($1,141)

($100,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

Estimated Growth of Assets / Net Asset Flow

Fund of Funds 1990 – 2005

$450,000

$394,629

$400,000

$358,646

$350,000

$293,293

$300,000

Assets (In $MM)

$250,000

$206,937

$200,000

$150,000

$102,546

$100,000

$75,413

$74,592

$74,033

$56,347

$50,000

$19,902

$15,394

$36,797

$75,783

$76,094

$103,398

$83,535

$59,430

$52,525

$18,479

$28,453

$33,183

$18,024

$14,812

$1,898

$1,840

$229

$9,512

$7,138

$0

($850)

($3,272)

($16,219)

($50,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

In Comparison

Managed Futures Growth ($billions)

140

120

100

80

60

40

20

0

1980 1984 1988 1992 1996 2000 2004

MUM

Comparison of performance

HFRI fund weighted comp. Index

Barclay CTA Index

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

5/29/2016

5.81

32.19

21.22

30.88

4.10

21.50

21.10

16.79

2.62

31.29

4.98

4.62

(1.45)

19.55

9.03

9.35

21.02

3.73

(0.91)

10.37

(0.65)

13.64

9.12

10.89

7.01

(1.19)

7.86

0.84

12.36

8.69

3.30

1.71

Evolution of hedge fund styles

Makeup in 1990s

Macro

71.1%

Equity Hedge

5.3%

Event Driven

3.8%

Fixed Income (total)

3.3%

Distressed securities

2.4%

Equity market neutral

1.7%

Equity non-hedge

0.6%

Merger arbitrage

0.6%

Convertible arb

0.5%

Emerging markets (total) 0.4%

Sector (total)

0.3%

Short selling

0.1%

5/29/2016

Make up in 2005

Equity Hedge

Event Driven

Relative value arb

Macro

Fixed Income (total)

Distressed securities

Equity non-hedge

Sector (total)

Convertible arbitrage

Emerging markets

Equity market neutral

Merger arb

Market Timing

Short selling

Regulation D

29.0%

13.5%

12.6%

11.1%

8.1%

4.7%

4.4%

4.3%

4.3%

3.5%

2.4%

1.5%

0.4%

0.3%

0.2%

Estimated Growth of Assets / Net Asset Flow

Macro 1990 – 2005

$200,000

$178,474

$175,000

$150,740

$150,000

$136,874

$123,373

$125,000

$136,880

$128,360

$121,420

$118,078

$115,418

$107,405

$102,457

Assets (In $MM)

$100,000

$71,402

$70,743

$75,000

$58,548

$47,367

$50,000

$33,772

$27,642

$17,023

$25,000

$28,146

$24,571

$18,437

$14,014

$10,521

$4,242

$5,336

$4,001

2004

2005

$0

($8,297)

($13,587)

($25,000)

($50,000)

($17,735)

($47,010)

($60,978)

($75,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

Estimated Growth of Assets / Net Asset Flow

Equity Hedge 1990 – 2005

$350,000

$331,827

$300,000

$285,952

Assets (In $MM)

$250,000

$241,920

$197,840

$200,000

$172,837

$150,000

$133,061

$92,790

$100,000

$47,960

$50,000

$36,611

$18,727

$2,701

$2,054

$2,641

$351

1990

1991

1992

$47

$4,046

$969

$5,683

$1,594

$7,002

$910

$9,175

1993

1994

1995

1996

$20,403

$23,152

$39,617

$33,326

$25,004

$19,113

$13,649

$4,013

$1,283

$0

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

Estimated Growth of Assets / Net Asset Flow

Event-Driven 1990 – 2005

$152,247

$150,000

$128,673

$130,000

$110,000

Assets (In $MM)

$100,800

$90,000

$75,604

$70,000

$52,215

$50,000

$33,485

$25,599

$30,000

$21,911

$15,039

$10,000

$1,494

$1,446

$4,928

$2,624

$949

$4,553

$1,385

$353

1992

1993

1994

$7,300

$16,449

$15,566

$11,681

$13,738

$10,793

$10,071

$6,455

$4,801

$1,776

$3,293

$2,645

$518

1995

1996

1997

1998

($35)

($10,000)

1990

1991

Estimated Assets

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

Who invests in hedge funds?

Combined U.S and Non-US

1) Fund of hedge funds

2) High net worth

3) Institutions

4) Family Office

5) Private Banks

6) Foundations/Endowments

Source: UBS, Note: Based on percentage share of assets under management world wide

5/29/2016

40%

23%

12%

11%

10%

4%

New Rules

SEC registration

Feb. 1, 2006 deadline

Inside the numbers

Roughly 4000 managers globally, 714 registered with SEC. Another 70

pending.

Are we still evolving?

New worlds in hedge funds

New name?

Insight from insiders

Bruce Cleland, President and CEO of

Campbell & Co.

John Kelly, President and CEO of Man

Investments Inc.

Mark Rosenberg, Chairman and CIO of

SSARIS Advisors

Mark Rzepczynski, CEO of JWH & Co.

Other slides

Global assets

Structured assets

5/29/2016

Global Financial Assets & Derivatives

1993 – 2004

Year

Global Bonds +

Pen Funds +

Global

Total Global

Equities +

Insurance +

OTC + ET

Fin Assets &

Hedge

Managed

Hedge Funds +

Managed

Banks

Mutual Funds

Derivatives

Derivatives

Funds

Futures

Futures

$Tn

$Tn

$Tn

$Tn

$Bn

$Bn

$Bn

1993

59.2

18.5

16.3

93.9

168

26

194

1994

66.0

20.4

20.2

106.6

167

25

192

1995

72.3

23.4

27.0

122.7

186

23

209

1996

76.3

25.8

35.5

137.5

257

24

281

1997

79.1

27.9

41.4

148.4

368

33

401

1998

88.3

31.4

94.3

214.0

375

36

411

1999

101.1

37.4

101.8

240.3

456

41

497

2000

99.2

35.5

109.5

244.2

491

38

529

2001

98.0

35.9

135.0

268.9

539

41

580

2002

103.4

32.9

165.5

301.8

626

51

677

2003

126.1

43.3

234.0

403.4

820

87

907

2004

141.8

45.9

298.4

486.1

930

132

1,062

CAGR

7.55%

7.88%

27.45%

14.68%

15.33%

14.49%

15.22%

Sources:

• Bank for International Settlements

• Compeer

• Investment Company Institute

• OECD

•

•

•

•

Banker Magazine

Hedge Fund Research

J.P. Morgan

Swiss Re

• Bridgewell

• ING

• Merrill Lynch

• Cap Gemini

• International Financial Services London

• NYSE

structures in the US

Vehicles for investing in hedge funds

US legislation: 3(c)(1) (1949)

US legislation: 3(c)(7) (1996)

Maximum investors: 99

Maximum investors: 4992

Typical minimum investment: $1 million Typical minimum investment: $1 million

Investor qualifications: Accredited1

Individual

Investor qualifications: Qualified Purchasers

& Accredited

Development: Registered Hedge Funds

(early 2000)

Maximum investors: Unlimited

Typical minimum investment: $25,000

Investor qualifications: Accredited

Individual

- income in excess of $200,000 in each

of the preceding two years and expect

- natural person to have at least $5 million in

the same or more this year;

investments

Individual

or

or

-net worth (or joint net worth with

spouse) of $1 million

Entity: $5 million net worth

-certain other regulated high-net worth

institutions (insurance companies, employee

benefit plans, banks, etc.)

Entity: $25 million in investments

-a net worth of $1 million at the time of

purchase;

- income in excess of $200,000 in each of the

preceding two year and expect the same

income level in the current year

Entity: $1 million net worth

Source: Investment Company Act of 1940.

Schematic Illustration

1Additional qualification standards may be necessary if futures are traded.

2Although funds with an exemption under Section 3(c)(7) of the Investment Company Act of 1940, as amended, may have an unlimited number of investors, most funds will generally limit the total number of investors to

499 to avoid reporting requirements under the Securities Exchange Act of 1934, as amended. This is provided for informational purposes only and is not meant to be an exhaustive review of legal issues regarding hedge

fund exemptions. Please consult with legal counsel for additional information. There are risks inherent in hedge funds and funds of hedge funds.

5/29/2016

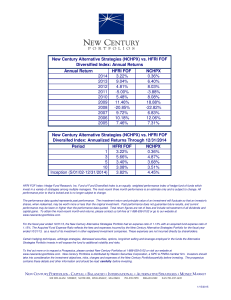

HFR Industry Products & Indic

Comprised of over 5400 funds and fund of funds, HFR Database is the definitive source of hedge fund performance

and information.

HFR FOF Database & Directory provides investors with up-to-the-moment quantitative data and two-page state-ofthe-art analytical reports on over 1800 Global Fund of Funds from HFR Database.

HFR Industry Report – Year End 2005

Over 140 charts and graphs - a snapshot of the state of the alternative investment industry.

The leading fully-transparent hedge fund index providing daily returns from eight distinct strategies representing the

entire industry.

The benchmarks of fund performance. 37 different categories by strategy, including the HFRI Fund Weighted

Composite, which accounts for over 1600 funds listed on the HFR Database. Also: HFR's exclusive HFRI FOF SubStrategy Indices.

HFRI Fund Weighted Composite Index – Historical Monthly

Performance

HFRI Fund Weighted Composite Index

Year

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Jan

(2.11)

2.59

3.84

2.32

2.50

(0.22)

2.89

3.17

(0.71)

2.24

0.64

3.39

0.45

0.65

1.98

(0.20)

Feb

1.54

4.02

2.14

1.34

(0.55)

1.31

1.23

1.03

3.27

(1.32)

6.16

(2.21)

(0.70)

0.02

1.19

1.83

Mar

3.21

4.95

0.59

3.06

(1.51)

1.65

1.46

(1.64)

3.00

3.14

0.93

(1.59)

1.91

0.14

0.51

(0.87)

Apr

(0.04)

1.34

0.30

1.49

(0.59)

2.10

3.96

(0.11)

0.96

4.50

(2.85)

1.95

0.28

2.64

(1.48)

(1.49)

May

3.05

1.98

1.84

2.60

0.68

1.70

3.05

4.38

(2.08)

0.72

(1.96)

1.19

0.04

3.58

(0.31)

1.04

Jun

2.10

0.41

(0.41)

2.62

0.27

2.48

0.18

2.70

(0.13)

3.63

3.68

0.29

(1.94)

1.35

0.75

1.59

Jul

1.50

2.62

2.08

2.09

1.35

3.20

(2.08)

3.87

(0.79)

0.52

(0.60)

(0.83)

(2.86)

1.30

(0.96)

2.30

Aug

(3.45)

2.06

(0.27)

2.93

2.46

2.20

2.28

0.34

(8.70)

(0.01)

3.81

(0.41)

0.53

1.83

0.12

0.82

Sep

(1.96)

2.32

1.94

1.58

0.89

1.96

2.07

3.72

0.69

0.16

(1.24)

(2.83)

(1.54)

1.16

1.65

1.91

Oct

(0.04)

1.83

2.11

3.18

(0.03)

(0.65)

0.98

(1.53)

1.22

1.60

(1.79)

2.01

0.59

2.45

0.84

(1.42)

Nov

0.75

0.27

2.80

0.15

(1.27)

1.89

2.08

(0.93)

3.71

5.06

(3.49)

2.07

2.12

1.06

2.84

1.68

Dec

1.35

3.95

2.53

3.91

(0.08)

2.08

1.33

0.88

2.79

7.65

2.07

1.71

(0.21)

1.87

1.65

1.89

Annual

5.81

32.19

21.22

30.88

4.10

21.50

21.10

16.79

2.62

31.29

4.98

4.62

(1.45)

19.55

9.03

9.35

Media Reference Guide

Alternative Investment Industry Performance and Trends

Provided courtesy of Hedge Fund Research, Inc.

Date: 01/24/2006

Copyright 2006 – All Rights Reserved

Hedge Fund Research, Inc. is the industry's

most respected source for hedge fund data and

performance information.

Our flagship product offering, HFR Database, is

a comprehensive tool tailored for alternative

investment professionals seeking to analyze the

hedge fund universe.

The Data

The

database integrates with multiple

analytical software platforms and is updated biThe licensed/redistributed HFR Database, currently comprised of over 5400 funds and fund of funds, is available to all

weekly

with Information

new fund

accredited investors.

on ourinformation.

hedge fund universe of established and emerging managers is collected directly

from the fund managers and/or their respective offshore administrators, while other pertinent information is culled from

offering memoranda, onsite visits, and due diligence interviews.

HFR Database is the foundation for the HFRI Indices, the industry's most widely utilized benchmark of hedge fund

performance information. The HFRI Fund Weighted Composite alone is comprised of over 1600 funds from our

database universe.

Our staff

Hedge Fund Research believes that accurate information on fund managers is critical to any alternative investment

enterprise. To that end, our analysts have monitored and tracked performance and administrative data internally on over

9,000 domestic and international funds, offering comprehensive information not available from other commercial data

The HFR FOF Database combines HFR’s

industry-leading accurate and timely

hedge fund data with an accompanying

Directory of two-page state-of-the-art

analytical reports providing investors

with up-to-the-moment quantitative

HFR FOFDB Highlights:

data performance

and analysis

on every

FOFbyina BROAD

the spectrum of funds EACH and EVERY update

FRESH

data, RECENTLY

submitted

HFR works directly with FUND MANAGERS to gain the most up-to-date and accurate fund info possible. We do not

HFR Database.

work with third party data providers. HFR FOF Database is updated bi-weekly.

New FOFs added with every release

Since its commercial debut in April 2003, the Database has more than tripled its fund coverage and now includes over

1800 FOFs.

Two-page custom PDF profiles provide in-depth descriptive and graphical information on each fund

State-of-the-art quantitative and qualitative analytical reports included as part of the Database. Updated reports are

available bi-weekly for subscriber download.

Top 50 FOFs Rankings available to subscribers

Easy to Use listings sorted by Rate of Return, Sharpe Ratio, and Standard Deviation in 1, 3, and 5 year intervals give a

clear view of the best performing funds on a bi-weekly basis.

HFRI Monthly

Indices

Index

Jan-05

Feb-05

HFRI Convertible Arbitrage Index

(0.90)

(0.44)

HFRI Distressed Securities Index

0.15

1.37

HFRI Emerging Markets (Total)

1.48

4.02

HFRI Equity Hedge Index

(0.58)

2.13

HFRI Equity Market Neutral Index

0.64

1.16

HFRI Equity Non-Hedge Index

(1.60)

2.91

HFRI Event-Driven Index

(0.15)

1.39

HFRI Fixed Income: Arbitrage Index

0.56

0.73

HFRI Fixed Income: Convertible Bonds Index

(0.90)

0.70

HFRI Fixed Income: Diversified Index

0.25

0.95

HFRI Fixed Income: High Yield Index

0.67

1.17

HFRI Fixed Income: Mortgage-Backed Index

0.98

0.88

HFRI Macro Index

(0.58)

1.81

HFRI Market Timing Index

(0.67)

3.36

HFRI Merger Arbitrage Index

(0.03)

0.72

HFRI Regulation D Index

(1.82)

3.17

HFRI Relative Value Arbitrage Index

0.30

0.78

HFRI Sector (Total)

(1.05)

1.78

HFRI Short Selling Index

2.47

0.11

HFRI Fund Weighted Composite Index

(0.20)

1.83

HFRI Fund of Funds Composite Index

0.00

1.36

Lehman Bros Gov't/Credit Agg Bond Index

S&P 500 w/ dividends

0.75

(2.44)

(0.71)

2.10

– Mar-05

2005 Monthly

Performance

Apr-05 May-05

Jun-05

Jul-05

(1.48)

0.30

(2.00)

(1.05)

0.10

(2.42)

(0.20)

0.19

(1.67)

(0.21)

(0.30)

0.50

(0.60)

(1.34)

0.12

0.84

(0.35)

(1.67)

3.16

(0.87)

(0.55)

(2.64)

(0.86)

(0.31)

(2.23)

(0.38)

(3.33)

(1.71)

(0.01)

(2.94)

(0.30)

(0.18)

0.78

(1.06)

(1.74)

(1.42)

(0.65)

(0.84)

(2.20)

3.70

(1.49)

(1.41)

(1.17)

0.23

0.60

1.55

0.58

3.17

1.20

0.18

(0.66)

0.39

(0.09)

0.57

0.35

1.71

1.62

0.67

(0.10)

2.12

(3.42)

1.04

0.24

1.03

1.38

1.59

1.96

0.84

2.88

1.33

0.52

1.89

0.79

0.78

0.65

1.06

1.51

1.14

3.68

0.96

2.23

1.08

1.59

1.36

1.08

1.65

2.94

2.95

0.82

4.10

2.35

0.97

2.62

0.87

1.17

0.75

0.74

3.23

1.12

3.60

1.34

3.50

(2.78)

2.30

1.74

Aug-05

0.58

1.32

1.99

0.74

0.56

(0.11)

0.89

0.39

0.48

0.35

0.67

0.38

0.73

1.82

0.71

3.43

0.69

0.65

2.73

0.82

0.84

(0.76)

(1.77)

1.62

(1.90)

1.35

3.18

0.70

0.14

(1.21)

3.72

1.61

(0.91)

Sep-05

1.23

1.10

4.81

2.25

0.94

2.08

1.00

0.77

1.12

1.05

0.34

0.72

2.12

2.75

0.62

(0.39)

1.15

1.71

1.44

1.91

1.55

Oct-05

(0.07)

(0.46)

(2.54)

(1.88)

(0.36)

(2.84)

(1.82)

0.34

(1.24)

(0.21)

(0.39)

0.66

(0.67)

(2.33)

(1.57)

(1.15)

(0.33)

(2.08)

1.42

(1.42)

(1.38)

Nov-05

0.03

0.98

3.14

2.14

0.69

3.47

1.26

0.09

1.51

0.46

0.25

0.24

1.67

3.27

1.20

1.60

0.88

1.66

(2.40)

1.68

1.66

Dec-05

0.88

0.99

3.70

2.38

0.82

1.99

1.40

0.61

1.48

0.58

0.89

0.31

1.23

1.87

1.38

(0.96)

1.68

2.55

(0.20)

1.89

1.78

2005

(1.94)

8.44

20.90

10.66

6.56

10.33

7.07

5.46

2.26

5.07

5.07

7.67

6.93

14.05

5.69

12.43

6.29

9.37

7.22

9.35

7.33

(1.41)

0.81

(0.92)

(1.67)

0.55

3.78

1.02

0.04

2.55

4.91

Extracts from HFR INDUSTRY REPORTS

HFR Industry Report – Year End 2005:

Industry insiders utilize HFR Industry Reports to gain a detailed picture of current trends

as well as a historical perspective of the hedge fund industry.

The Report includes:

•Over 140 pages of charts and graphs provided in PowerPoint format

•Year End 2005 estimated total assets and net asset flows for entire industry and by

strategy

•Detailed breakout of Quarterly HFRI performance

•HFRI Annual Performance Matrix 1993-2005

•Onshore and Offshore asset analysis breakouts

•Risk/Return analysis by strategy: 1, 3 and 5-year summaries of Standard Deviation,

Sharpe Ratio, Sortino Ratio, Up/Down Capture, Returns Distribution and Market

Correlations

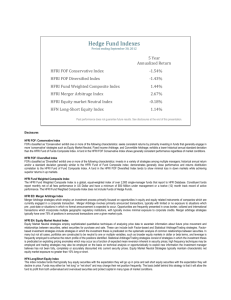

HFRI Index Risk Return Comparison

2005

25%

Emerging Markets (T otal)

20%

15%

Market T iming

Return (%)

Reg. D

Equity Hedge

10%

Fund Weighted Comp. Index

FI: Mortgage-Backed

Equity Market Neutral

FI: Arbitrage

FI: Diversified

5%

Sector (T otal)

Fund of Funds Comp

Distressed Securities

Event Driven

Macro

Relative Value Arb

Equity Non-Hedge

Short Selling

Merger Arbitrage

S&P 500

FI: High Yield

Lehman Gov/Credit

FI: Convertible Bonds

0%

Convertible Arbitrage

-5%

0%

1%

2%

STD (%)

Extract from HFR Industry Report –

3%

Estimated Growth of Assets / Net Asset Flow

Convertible Arbitrage 1990 – 2005

$50,000

$44,713

$45,000

$44,773

$40,000

$36,718

$35,000

$32,833

Assets (In $MM)

$30,000

$25,000

$20,132

$20,000

$15,000

$12,806

$10,887

$8,391

$10,000

$6,383

$5,000

$187

$0

$47

$91

$36

$388

$252

$499

$115

$679

$144

$1,290

$522

$2,256

$843

$3,013

$5,492

$6,346

$3,295

$2,883

$699

($115)

($5,000)

($7,665)

($10,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

Estimated Growth of Assets / Net Asset Flow

Distressed Securities 1990 – 2005

$55,000

$51,922

$50,000

$46,256

$45,000

$40,000

$35,556

Assets (In $MM)

$35,000

$29,279

$30,000

$25,000

$20,000

$14,426

$15,000

$10,000

$7,104

$5,000

$934

$364

$564

$149

$1,033

$317

$0

$1,008

$1,751

$596

$3,323

$1,246

$3,578

$215

$14,115

$7,886

$6,637

$5,671

$4,732

$1,203

$1,970

$1,714

$761

($24)

($366)

($1,945)

($5,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

Estimated Growth of Assets / Net Asset Flow

Merger Arbitrage 1990 – 2005

$16,000

$15,468

$14,572

$14,000

$14,472

$13,702

$12,614

$12,000

$9,862

Assets (In $MM)

$10,000

$8,000

$6,000

$4,588

$4,266

$3,734

$4,000

$2,375

$2,000

$637

$233

$56

$0

$58

$2

$78

$16

$138

$55

$410

$1,416

$1,619

$1,388

$1,021

$916

$649

$193

($23)

($146)

($520)

($971)

($2,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005

Estimated Growth of Assets / Net Asset Flow

Relative Value Arbitrage 1990 – 2005

$140,000

$130,454

$125,000

$121,541

$110,000

$98,591

$95,000

Assets (In $MM)

$80,000

$74,295

$65,000

$49,946

$50,000

$35,000

$23,082

$16,898

$20,000

$5,000

$3,922

$421

$596

$136

$873

$202

$840

$1,363

$441

$3,729

$2,023

$3,837

$10,472

$6,449

$13,302

$7,340

$91

$11,262

$8,908

$5,162

$1,434

($32)

($2,671)

($3,009)

($10,000)

1990

1991

1992

1993

1994

1995

1996

1997

Estimated Assets

1998

1999

2000

Net Asset Flow

Extract from HFR Industry Report –

2001

2002

2003

2004

2005