BTR Global Macro Fund October 2008 Objective and Strategy

advertisement

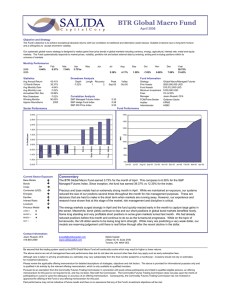

BTR Global Macro Fund October 2008 Objective and Strategy The objective of this fund is to achieve superior absolute returns in both rising and falling markets with little to no correlation to both traditional and alternative asset classes. This type of strategy is commonly used by both institutional and private investors seeking valuable portfolio diversification without sacrificing liquidity. The fund uses a highly disciplined, systematic trading approach to identify and capture price trends across a wide variety of global markets. The fund invests mainly in highly liquid financial and commodity futures contracts in 7 differrent sectors including stock indices, bonds, metals, short-term interest rates, energy, currencies and agriculture. Trading takes place around-the-clock and around-the-globe on over 25 different exchanges in over 60 different markets. The trading systems are extremely agile, able to respond quickly to changes in price, volatility and sentiment data to take advantage of upward and downward price trends across a range of time frames. This disciplined approach aims to quickly eliminate losing positions while allowing winning positions to dominate the portfolio. Monthly Performance Jan 11.76% 2.10% 8.46% 2008 2007 2006 2005 Feb 12.10% -4.43% 0.27% Mar 3.98% -4.28% 7.04% Statistics Apr -2.38% 4.21% 3.78% May -3.21% 1.33% -5.78% Jun 7.08% 2.50% -4.32% Jul 2.02% -4.35% -13.80% 2.39% Aug -1.81% 1.85% -0.86% 4.17% Peak Apr-06 Jul-08 Sep-05 Mar-08 Valley Aug-06 Sep-08 Oct-05 May-08 Sep -11.64% 12.07% 2.94% 1.59% Drawdown Analysis Compound Return 12 Month Return Avg Monthly Gain Avg Monthly Loss Annualized Std. Dev Max Drawdown Winning Months Approx Roundturns 19.32% 30.44% 4.82% -4.95% 20.13% -22.96% 67.50% 2000 Depth -22.96% -13.24% -7.02% -5.51% Length 4 2 1 2 Oct 5.22%e 1.44% 4.80% -7.02% Nov Dec 6.73% 3.33% 6.98% -0.44% 3.03% 7.09% Year 22.75%e 18.97% 6.89% 15.42% Fund Information Recovery 15 0 2 1 Sector Performance Strategy Fund Assets Minimum Investment Fees Manager FCM/Prime Broker Auditor Administrator Global Macro/Managed Futures $19 million USD $1,000,000 USD 2% & 20% Jason Russell, CFA Goldman Sachs KPMG HSBC Fund Performance 2.50% 2150 2.00% 1950 1750 1.50% NAV % Profit/Loss 1550 1.00% 1350 0.50% 1150 LONG = SHORT = MIXED = OUT = - 950 Oct-08 Aug-08 Apr-08 Jun-08 Feb-08 Oct-07 Dec-07 Apr-07 Jun-07 Aug-07 Feb-07 Oct-06 Dec-06 Aug-06 Apr-06 Jun-06 Feb-06 Oct-05 Dec-05 Jun-05 750 Aug-05 Equities Interest Rates Currencies Bonds Crops Livestock Current Sector Exposure Base Metals Bonds Crops Currencies (USD) Energies Equities Interest Rates Livestock Precious Metals Base Metals -1.00% Prec. Metals -0.50% Energies 0.00% Commentary The Salida Global Macro Fund is up 22.75% year to date. The fund was up 5.22% in October. The compound rate of return since inception is now 19.32%. October 2008 will be a month for the history books as unprecedented volatility stormed through each and every asset class. In response to the volatility, position sizes dropped dramatically to the point where they seemed insignificant. However, the daily portfolio volatility still remained high.Thus, in mid month, we initiated a discretionary risk reduction. While the opportunities are extreme in this environment, so is the risk. The repercussions of these moves and the consequences of the policy responses to them will create plenty of opportunities for many years to come. Gains across a broad spectrum of equity indices provided a large part of the returns this month. The price movements seen in single days seemed larger than some previous years and certainly months. As mentioned above, position sizes were reduced dramatically and then eliminated by mid month. Interest rates and bond positions also benefited from a flight to quality as money sought safety. The position in Canadian Bankers Acceptances in particular was very successful. - The currency market volatility was breathtaking as the Japanese Yen and U.S. Dollar soared and many other currencies plummeted. Our long positions in the Yen and U.S. Dollar as well as short positions in the Canadian Dollar, Euro and British Pound all benefited nicely. However, once again we slashed positions aggressively to bring risk down. Copper came into October priced at nearly $3. At the lows for October, the red metal was almost cut in half. Years of price gains were erased in weeks. We entered the month with a very small short position on in Copper which obviously served us well. This was truly an extraordinary month. Had we ignored our risk management rules, this would have been the largest positive month in our history from both a real-time and a simulation standpoint. However, due to the volatility experienced globally, ignoring our risk management rules could have also resulted in large losses for the portfolio. Overall we are more than pleased with the gains that we have captured and we appreciate that the real opportunity lies ahead. Contact Information: Jason Russell, CFA 416-849-2596 jrussell@salidacapital.com Courtenay Wolfe, CEO & President 416-849-2543 cwolfe@salidacapital.com Susan Rumble, Client Services 416-849-2541 srumble@salidacapital.com 2 Bloor St. W, Suite 2700 Toronto, ON M4W 3E2 www.salidacapital.com Be assured that the trading system used by the BTR Global Macro Fund will continually evolve which may result in higher or lower returns. The BTR Global Macro Fund is managed by Salida Trading LP, an affiliate of Salida Capital Corp. The above returns are net of management fees and performance fees but do not take into account other fees that may apply such as early redemption fees. Although care is taken in arriving at estimates (e), estimates may vary substantially from the final number posted for a month/year - investors should not rely on estimates for investment decisions. Please review the applicable offering memorandum for detailed descriptions of strategies, objectives and risk factors. The above is provided for informational purposes only and is qualified in its entirety by the relevant offering memorandum, which is only available to qualified investors. Pursuant to an exemption from the Commodity Futures Trading Commission in connection with pools whose participants are limited to qualified eligible persons, an offering memorandum for this pool is not required to be, and has not been, filed with the Commission. The Commodity Futures Trading Commission does not pass upon the merits of participating in a pool or upon the adequacy or accuracy of an offering memorandum. Consequently, the Commodity Futures Trading Commission has not reviewed or approved the offering of the Fund or any offering memorandum for this pool. Past performance may not be indicative of future results and there is no assurance that any of the Fund’s investment objectives will be met.