BTR Global Macro Fund April 2006

advertisement

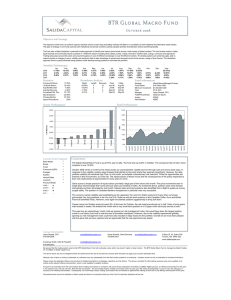

BTR Global Macro Fund April 2006 Objective and Strategy The Fund’s objective is to achieve exceptional absolute returns with low correlation to traditional and alternative asset classes. Suitable investors have a long-term horizon and a willingness to accept short-term volatility. Our systematic global macro strategy is designed to realize gains from price trends in global markets including currency, energy, agricultural, interest rate, metal and equity markets. The Fund systematically responds to market prices, volatility, portfolio risk and select external data by entering, exiting and re-sizing positions within its universe of markets. Monthly Performance Jan 8.46% 2006 2005 Feb 0.27% Mar 7.04% Statistics Apr 3.73%e May Jun Jul Aug 2.39% 4.17% Peak Sep-05 Valley Oct-05 Sep 1.59% Drawdown Analysis Avg Annual Return 12 Month Return Avg Monthly Gain Avg Monthly Loss Annualized Std. Dev Max Drawdown Winning Months Approx Roundturns 43.41% 39.37% 4.64% -7.02% 15.86% -7.02% 90.00% 2000 Depth -7.02% 4.03 -7.02% Nov 6.98% Dec 7.09% Year 20.75% 15.42% Fund Information Length Recovery 1 2 Strategy Firm Assets Fund Assets Minimum Investment Fees Manager FCM/Prime Broker Auditor Administrator Correlation Analysis S&P Managed Futures Index S&P Hedge Fund Index S&P 500 Price Index 0.35 0.58 0.55 Sector Performance -0.13822 Oct Global Macro/Managed Futures $550,000,000 USD $10,012,000 USD $100,000 USD 2% & 20% Jason Russell, CFA Goldman Sachs KPMG HSBC Fund Performance -0.557028152 -0.56% 3.00% 1450 2.50% -1.50% NAV 1.00% Prec. Metals 2.00% Energies Interest Rates 1050 3.00% 950 850 Current Sector Exposure Base Metals Bonds Crops Currencies (USD) Energies Equities Interest Rates Livestock Precious Metals LONG = Ï SHORT = Ð MIXED = Î Ï Ð Î Î Ï Ï Ð Ð Ï - k t 750 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec-05 Jan-06 Feb-06 Mar-06 Apr-06 i c. M etals Equities st Rates -1.00% Bonds 0.00% -2.00% OUT = Currencies Equities Crops -1.00% 1150 4.00% 0.00% -0.50% 1250 5.00% Base Metals 0.50% 6.00% Bonds 1.00% 1350 7.00% % Profit/Loss % Profit/Loss 1.50% -1.08% -0.73% -0.70% -0.56% -0.18% 0.14% 0.14% 1.29% 5.72% Livestock Bonds Inte re st Rate s Equities Pre c. Me tals Live stock Base Me tals Curre ncie s Crops Ene rgie s 2.00% Commentary The BTR Global Macro Fund earned 3.73% for the month of April. This compares to 6.36% for the S&P Managed Futures Index. Since inception, the fund has earned 39.37% vs 12.30% for the index. Precious and base metals had an extremely strong month in April. While we maintained an exposure, our systems reduced the size of our positons several times throughout the month for risk management purposes. These are decisions that are hard to make in the short term when markets are running away. However, our experience and research have shown that at this stage of the market, risk management and discipline is critical. The energy markets surged strongly in April and the fund quickly reacted early in the month to capture large gains in the sector. Meanwhile, bond yields continue to rise and our short positions in global bond markets benefited nicely. Some long standing and very profitable short positions in some grain markets turned last month. We had already reduced positions before this month and continue to do so as the turnaround progresses. While on the topic of turnarounds, the US dollar seems to be losing long term strength. While many are predicting a very weak dollar, our models are reserving judgement until there is real follow through after the recent decline in the dollar. Contact Information: Jason Russell, CFA 416-849-2569 jrussell@salidacapital.com www.salidacapital.com Salida Capital 2 Bloor St. W, Suite 2700 Toronto, ON M4W 3E2 Be assured that the trading system used by the BTR Global Macro Fund will continually evolve which may result in higher or lower returns. The above returns are net of management fees and performance fees but do not take into account other fees that may apply such as early redemption fees. Although care is taken in arriving at estimates (e), estimates may vary substantially from the final number posted for a month/year - investors should not rely on estimates for investment decisions. Please review the applicable offering memorandum for detailed descriptions of strategies, objectives and risk factors. The above is provided for informational purposes only and is qualified in its entirety by the relevant offering memorandum, which is only available to qualified investors. Pursuant to an exemption from the Commodity Futures Trading Commission in connection with pools whose participants are limited to qualified eligible persons, an offering memorandum for this pool is not required to be, and has not been, filed with the Commission. The Commodity Futures Trading Commission does not pass upon the merits of participating in a pool or upon the adequacy or accuracy of an offering memorandum. Consequently, the Commodity Futures Trading Commission has not reviewed or approved the offering of the Fund or any offering memorandum for this pool. Past performance may not be indicative of future results and there is no assurance that any of the Fund’s investment objectives will be met.