Liquid Real Estate Investment Fund in Latin America:

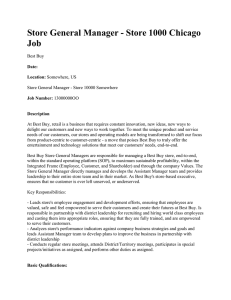

advertisement