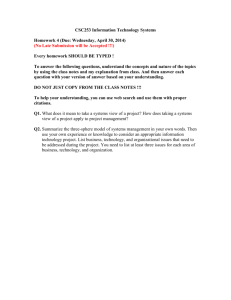

Do General Managerial Skills Spur Innovation?

advertisement