Employment Outcomes and the Interaction Between Product and

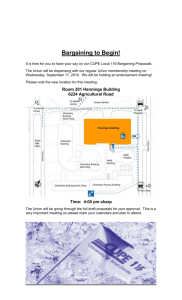

advertisement