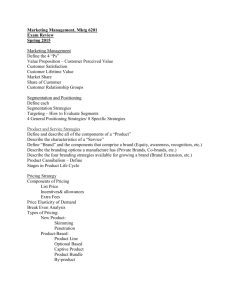

Pricing Strategy

advertisement

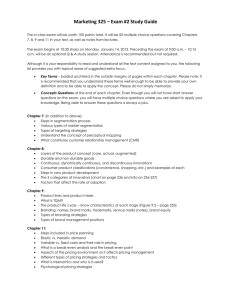

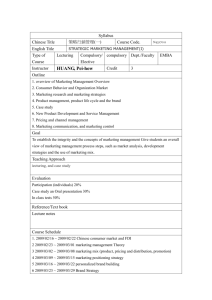

Pricing Strategy With the downturn in the economy placing pressure on profits, a pricing strategy becomes more important. A pricing strategy helps your business maximize net income. In this paper, Cathedral discusses the steps to create a basic pricing strategy and to develop a systematic approach to adjusting price. Bottom-Up Pricing The best place to start a pricing review is by understanding your costs. Costs can be broken down into three main categories: 1. Direct Costs: An expense that can be completely attributed to the production of specific goods or services. These costs are also called variable costs. If a product or service is not sold, then the cost is not incurred. Some direct costs do not vary directly with each unit sold; such costs are referred to as step variable costs. 2. Related Overhead: All costs not including or related to direct labor, materials or administration costs that relate to the production, delivery of the product or services. These costs are generally fixed in that these costs do not vary directly with the volume of activity. This group of costs is essential to the production or delivery of the products or services. 3. Selling, General and Administrative (SG&A): The sum of all direct and indirect selling expenses and all general and administrative expenses of a company. In many cases selling costs should go into the #1 direct cost category. Where selling costs are commissions and tied to volume sold, it makes more sense to put them into #2. Where selling costs are general marketing expenses, then this category works. The idea of this category is that these costs tend to be fixed and do not directly contribute to the delivery of the product or service. After categorizing expenses into the above grouping, the price of each product or service is reviewed to see its level of cost coverage. This analysis is often referred to as a gross margin analysis. The gross margin on a product or service is its price less its direct costs. Pure accounting would include both category #1 and #2 costs. For this paper, we will separate the analysis. The price should cover the direct costs. To be avoided is the statement of “we lose money on each, but we will make it up in volume.” Realistically, direct costs need to include both #1 and #2 categories. The allocation of #2 costs is the challenge. It is not enough to just cover the direct costs. Many business owners think they are ‘home’ if these expenses are covered, as the remaining expenses are spread throughout the company’s portfolio offering. The gross margin must be sufficient to contribute to a portion of related overhead and/or SG&A costs. Cathedral Consulting Group, LLC Page 1 Below is an example of a company with a suite of 4 products. Total Overhead and SG&A expenses have been divided evenly among the products: Product Product A Product B Product C Product D Price Direct Cost $ 15.00 $ 8.00 $ 10.00 $ 5.00 $ 25.00 $ 11.00 $ 8.00 $ 9.00 Direct Gross Margin 47% 50% 56% -13% Related Overhead $ $ $ $ 5.00 5.00 5.00 5.00 Gross Margin $ $ $ $ 2.00 9.00 (6.00) Total Cost SG&A $ $ $ $ 2.00 2.00 2.00 2.00 $ $ $ $ 15.00 12.00 18.00 16.00 Profit $ $ (2.00) $ 7.00 $ (8.00) The following is a bottom-up assessment of each product: Product A: Direct costs are covered with a direct gross margin of 47%. Related overhead shows a Gross Margin of $2. This means that each unit contributes $2 to covering SG&A. On an even allocation, the fully loaded “total cost” is just covered, but there is not profit for the firm. Product B: Direct costs are covered with a direct gross margin of 50%, which is often viewed as a good number. But related overhead shows a Gross Margin of $0, meaning no contribution to SG&A or profits. Product C: Direct costs are covered with a stronger direct gross margin of 56% and a gross margin of $9, leaving profits of $7. Product D: Direct costs are not covered with the remaining expenses adding to the losses. A rational that company owners will often use is that although one or two products within the portfolio are not profitable, there are stronger products that compensate for the weaker. However, if the losing products do not add to the sales of the profitable products, then the product should be eliminated. At this point many will want to challenge a couple of items. The first should be the allocations of the related overhead and the SG&A. Proration is not an adequate approach. However, in the interest of time and simplicity it remains a good place to start. Second, should be the worry that volume does matter. Third will be the customer relationship to the entire portfolio of products, before any one is eliminated. Adding Targeted Profits Even this is not enough. The bottom up approach has to include the targeted profits for the company. The bottom line is the bottom on which the pricing is built. Volume Function In discussing profitability, it is important to note the volume component of the equation. An increase in volume will drive direct costs, because these are variable. Overhead and SG&A should remain relatively stable, because these are fixed, allowing increased volume to create increased profitability for the company. Some overhead expenses and SG&A will increase, once capacity is reached with operating capacity. Part of a solid pricing strategy is estimating the needed volume to get the profit that is desired. Cathedral Consulting Group, LLC Page 2 A common mistake made by smaller businesses is reducing prices with the goal of increasing sales volume. The hope is that the sales volume generates more profits, even with the narrow margins. Pushed to the extreme a company will accept orders that just cover direct and overhead, on the theory that fixed costs are covered. What can happen is the full pricing required is lost and the SG&A and profit are not generated because too much of the product carries too low a price point. Market Validation After the bottom-up approach, the market for the price must be assessed. It is the market that actually set a price based on it perspective of the value of the product or service. In our August Topic of the Month (for the paper, click here), we discussed market positioning. The positioning will highlight the value of the products or services in the market. As we mentioned in our paper, there are several ways to accomplish this. An example could be surveying the company’s customer base. Another option is reviewing proposals and rejections. If the majority of proposals were rejected due to price sensitivity, there may be little room for a change in price. Upon the conclusion of this assessment in finding what the market will bear, it is important to circle back to the bottom-up analysis to see how the market value price relates to profitability. Role of Brand Brand does several things in a pricing discussion. However, smaller companies have limited market presence, therefore have limited brand effects. Investing to build brands is generally not recommended for the smaller company, because of what brands actually do. The survey discussion above is a good way to understand a smaller company’s brand and the merit of investment. First, a brand relates to the market’s value perception. Here a brand should allow for higher price. Second, brand aids in the speed of purchase; a brand can serve as a foothold in climbing the ‘trust barrier’. Here the brand should reduce marketing costs. Third, a brand will reduce competition. A brand keeps customers or clients from trying competitors, even if a lower price is offered. Here the brand should generate higher prices and reduced marketing costs. Changing Prices After the above assessments have been completed, a company must take the next step—adjust prices. It is important to note a large contributor in driving the need for a price increase: inflation. Inflation requires companies to increase price to maintain previous levels of profitability. However, without market validation or brand support, price increases may cause customers to jump to a competitor. This further underscores the need to go through the above steps in a systematic way before changing prices. Action Items Starting with the company’s major products or services: 1. Apply Bottom-up analysis. 2. Assess the market validation of the specific product/service. 3. Adjust price based on findings. Articles for Further Reading 1. Weinberg, Joyce. “Bottom-Up Pricing Method.” http://www.netplaces.com/startingcatering-business/pricing-your-services-and-menus/bottom-up-pricing-method.htm. 2. Weinberg, Joyce. “Top-Down Pricing Method.” http://www.netplaces.com/startingcatering-business/pricing-your-services-and-menus/top-down-pricing-method.htm. Cathedral Consulting Group, LLC Page 3 3. Abrams, Rhonda. “Competing on Price Alone.” http://www.inc.com/articles/2002/08/24551.html. August 2002. 4. Bradley, Steven. “The Perception of Value and The Decision to Buy.” http://www.vanseodesign.com/marketing/value-perception/. December 2006. Phil Clements is a Managing Director in the New York Office, Michael Leppellere is a former Associate in the Midwest Office and Susan Russell is a former Associate in the New Jersey Office. For more information, please visit Cathedral Consulting Group LLC online at www.cathedralconsulting.com or contact us at info@cathedralconsulting.com. Cathedral Consulting Group, LLC Page 4