Creating Timely, Accurate Financial Statements

advertisement

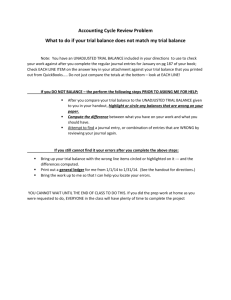

Creating Timely, Accurate Financial Statements Cathedral views financial statements as foundational for properly operating a business. A company’s financial statements need to be timely as well as accurate. This paper discusses the process used to create timely and accurate financial statements. Role of the Process Financial statements come from a data collection and input process. The process needs to gather all of the information for the revenue and expenses of the period, such as the month. For example, all revenue generated in the month should be in the financial statement. This should include all invoices that were sent, regardless of if they were paid in that period. Likewise all expenses incurred in the month should be in the financial statements. Whether the rent is paid on March 31 or April 1 is irrelevant. The bill, like all others received, should be recorded in the month they were received. This is the accrual method of financial reporting. For more information on the accrual method, please read our June Topic of the Month paper on Cash vs. Accrual Accounting. The Entry Process If data is entered correctly into the financial software of choice, often QuickBooks for small businesses, the reporting output is relatively simple. The challenge is in the accuracy of the data entry. Because QuickBooks is relatively simple to use, many owners mistake simplicity for easeof-use and neglect proper training of the software at the outset. This typically results in mistakes that are caught at the level of reconciliations which causes accounting knowledge to be necessary in order to untangle the entries. The first step in accurate data and reports is to ensure that the person doing the data entry receives basic software training. Numerous websites provide QuickBooks training for free, as well as at Intuit.com. Paid classes are also available for those wishing to have a hands-on learning experience. Nearly every financial software available offers training at some level. The second step is to ensure that the software is set up correctly. This goes to the Chart of Accounts, service lists, pricing, category classification, etc. While this can be altered at a later date, information on reports may no longer be available if categorization is changed. The entry process should be systematized so that all documentation relating to company finances are submitted to the person doing the data entry. This includes information for invoicing, bills, receipts, timesheets or payroll stubs, bank, merchant account, and credit card statements. Inventory tracking may also be required depending on the nature of the business. Mechanically, the company will establish a reporting flow that will allow for the bookkeeping process to have the necessary revenue and expense information in a timely fashion. When the data entry is done correctly, the report entries will flow automatically. For example, invoices Cathedral Consulting Group, LLC Page 1 done through QuickBooks would create accounts receivable on the Balance Sheet. Payments of invoices would be recorded showing the paydown of accounts receivable and increase of cash. Expenses can be a bit more challenging because bills received for the month are often after month end. This is where the rule of practicality applies. If the expense is recurring or the amount known, a placeholder expense entry could be made and later edited in QuickBooks or may be accrued and expensed later in true accounting software. Accuracy of financial statements needs to be balanced against practicality both as to time and as to information. As will be seen below, time means a cut-off date and orderly processing so that the financial information can be used to better manage the enterprise. While it is nice to have every item tied down, time generally does not allow for this. Further tying things down costs effort, and generally expense management does not allow for this. Instead, a reasonableness approach needs to be taken; the key being that all relevant information is systematically captured during the year. Month-to-month variations may be tolerated, so long as any particular month’s results are not so misstated as to be unusable for management guidance. Timely Financial Statements To be timely, financial statements must be produced close enough to the related time period to give input into management in time to make changes. For example, monthly financial statements that are produced several months after the month in question make it difficult to adjust operations. Therefore, monthly financial statements should be produced by mid-month of the following month. In order for these timeframes to be consistent, the bookkeeping process should include a checklist for daily, weekly, monthly, quarterly, and annual activities (see the last page for a Sample Bookkeeping Checklist). For example, most companies reconcile bank and credit card statements on a monthly basis. However, deposits are likely made daily. In order for the financial statements to be a part of the management process, they should be provided to management around the same time each month. When financial statements vary widely in their production, the management usage becomes difficult. Likewise, the format should remain fairly consistent month-to-month for ease of readability. Accurate Financial Statements Making financial statements accurate involves two components. The first component is that all information that should be in the financials is included in the financial statements. This is the process requirement noted above. A good process means that the user can rely on the financials to have all of the essential information. Some key checks for accuracy are: The use of double entry accounting. Regardless of software, all accounting entries created require that entries record both sides of a transaction, keeping the financial statements complete. QuickBooks is designed to do this automatically without in-depth accounting knowledge required. However, any adjusting General Journal entries will require double entry level knowledge. The information is traceable to a reliable source. Generally revenue is traceable to the invoicing process and expenses traced to the check book, receipt, bill and other documentation. Cathedral Consulting Group, LLC Page 2 The final and key check is that the balance sheet cash can be tied to the bank statement. It is the bank statement that represents an independent data point for being sure that the financials tie to reality. With these checks, management can use the financial statements as reasonable representation of the business activity. The second aspect to accuracy is the coding of the data entered. Unfortunately management can never be fully comfortable that the data entered has been categorized properly. Therefore, management must always give financials a review to see if anything stands out as inappropriate. We need to remember that inappropriate could be either a coding error or an activity concern. Both should be corrected. Where coding is systematically done poorly, then management should make some adjustment in the coding process. It may be that the entry individual is not adequately trained or the categorization of items is confusing. The process must be continuously refined to minimize coding errors. The goal is to have financial statements that are timely and accurate so that management can rely on them for making decisions on the operations of the company. Action Items: 1. Review current process of creating financial statements. 2. Adjust current process if necessary. Articles for Further Reading 1. This article provides a comprehensive outline to understanding financial statements, illustrating the importance to the success of a small business. www.sba.gove/content/financial-statements 2. This small business financial status checklist provides a list of common tasks for accurate accounting. http://www.roguecc.edu/SBDC/art_financial_checklist.asp 3. “Beginners Guide to Financial Statements.” This article walks through the basics of financial statements and ratios. Unlike many sites, this article includes a good overview of the Cash Flow Statement. http://www.sec.gov/investor/pubs/begfinstmtguide.htm 4. Mulit-millionaire Norm Brodsky provides the 10 top lessons he learned over his 30 years in business, including important lessons on understanding financial statements and liquidity. http://www.inc.com/magazine/20081001/street-smarts-secrets-of-a-110-millionman.html Philip Clements is CEO of Cathedral Consulting Group, LLC and a Managing Director in the New York Office. Sharon Nolt is a former Senior Associate in the New York Office. For more information, please visit Cathedral Consulting Group LLC online at www.cathedralconsulting.com or contact us at info@cathedralconsulting.com. Cathedral Consulting Group, LLC Page 3 Bookkeeping Checklist Weekly Prior week cash collection or sales and AR Summary provided to Management Collect and provide all data to bookkeeper Bills Invoice Requests New Customer Information Payroll reports Pay bills Make deposits Monthly Collect and enter staff Expense Reports Print Credit Card Statements and categorize Enter and run payroll Reconcile bank, merchant account, credit card statements Make adjusting entries for accruals, depreciation, amortization, percentage billed, etc. Generate Firm Financial Report and send to Management Balance Sheet (Beginning and Ending) Cash Flow Statement P&L - For Firm, Vs. Budget, Vs. Prior Period, YTD Revenue by Partner/Sales Rep AR Summary AP Summary Review reports and create cover memo with Management Discussion & Analysis Enter and run payroll Quarterly Create utilization/realization report (professional service firms) Create the monthly Financial Report but augment with a quarterly review for Management. Annual Send email to staff with W-4 form and ask if anyone would like to make changes this year. Create and send all W-2 forms or coordinate with payroll provider Create and send all 1099 forms or coordinate with payroll provider File 1096 and W-3 with IRS or coordinate with payroll provider Send W-9 upon request to clients Generate YTD Bud vs. Actual P&L for budget creation Clean up database (i.e. former clients become Inactive, unneeded COA are hidden Digitize files (if space is a premium, this is critical)