UNIVERSITY OF SOUTH ALABAMA Basic Financial Statements and Supplementary Information

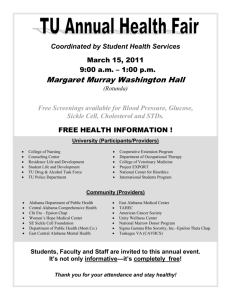

advertisement