MIT Sloan School of Management Working Paper 4249-02 ly 2002 Ju

advertisement

MIT Sloan School of Management

Working Paper 4249-02

July 2002

BIDDING LOWER WITH HIGHER

VALUES IN MULTI-OBJECT AUCTIONS

David McAdams

© 2002 by David McAdams. All rights reserved. Short

sections of text, not to exceed two paragraphs, may be quoted without explicit permission

provided that full credit including © notice is given to the source.

This paper also can be downloaded without charge from the

Social Science Research Network Electronic Paper Collection:

http://ssrn.com/abstract_id=317980

Bidding Lower with Higher Values in

Multi-Object Auctions

David McAdams∗

MIT Sloan School of Management

This version: July 17, 2002

First draft: June 2002.

Abstract

Multi-object auctions differ in an important way from single-object

auctions. When bidders have multi-object demand, equilibria can exist in which bids decrease as values increase! Consider a model with

n bidders who receive affiliated one-dimensional types t and whose

marginal values are non-decreasing in t and strictly increasing in own

type ti . In the first-price auction of a single object, all equilibria are

monotone (over the range of types that win with positive probability)

in that each bidder’s equilibrium bid is non-decreasing in type. On

the other hand, some or all equilibria may be non-monotone in many

multi-object auctions. In particular, examples are provided for the asbid and uniform-price auctions of identical objects in which (i) some

bidder reduces his bids on all units as his type increases in all equilibria and (ii) symmetric bidders all reduce their bids on some units

in all equilibria, and for the as-bid auction of non-identical objects in

which (iii) bidders have independent types and some bidder reduces

his bids on some packages in all equilibria. Fundamentally, this difference in the structure of equilibria is due to the fact that payoffs

fail to satisfy strategic complementarity and/or modularity in these

multi-object auctions.

∗

I thank Susan Athey for starting me to thinking about monotone equilibria in auctions

and Phil Reny for catching an error in a previous version. E-mail: mcadams@mit.edu.

Post: MIT Sloan School of Management, E52-448, 50 Memorial Drive, Cambridge, MA

02142

1

1

Introduction

To what extent does single-object auction theory extend to auctions of multiple objects? Some basic insights drawn from the single-object theory certainly continue to apply. For example, Ausubel and Cramton (1998) show

that bidders with private values in the uniform-price auction of identical

objects generally bid below their true value. Bid-shading extends to the

multi-unit setting because its logic extends: bidders will shade their bids

down whenever those bids may determine their own payment upon winning.

The main point of this paper, however, is that other basic single-object insights do not extend to the multiple-object setting. In particular, I focus on

the issue of whether bidders adopt monotone strategies and how this relates

to strategic complementarity and modularity of payoffs.

For illustration purposes, consider a simple model in which two riskneutral bidders compete in a first-price auction. Bidder i’s valuation is

given by vi (t), where t is a vector of affiliated, one-dimensional bidder types

and vi is non-decreasing in t and strictly increasing in ti . Let πi (b, t) =

(vi (t) − bi )1{i wins} represent bidder i’s ex post payoff. In this case, it is

well-known that bidder i always has a non-decreasing best response strategy

whenever j adopts a non-decreasing strategy. (See Athey (2001).) Less well

appreciated is that, ultimately, this property derives from the fact that ex

post payoff πi satisfies a form of strategic complementarity, single-crossing in

bi , bj (shorthand SC(bi , bj )), as well as modularity in bi . (See page 5 of the

introduction for definitions of these and other terms.)

To see why πi (b; t) satisfies SC(bi , bj ) (for all states t), consider for example the incremental return to b0i = 80 versus bi = 60 as a function of

opponent’s bid. When bj < 60, then either bid wins, so i gets negative

incremental return 60 − 80; when bj ∈ (60, 80) i gets incremental return

vi (t) − 80; when bj > 80 i is obviously indifferent between the bids since

they both lose; and when bj = 60 or 80, i’s incremental return is an average

of the returns in these regions. Thus, πi (b0i , bj ; t) ≥ πi (bi , bj ; t) implies that

πi (b0i , b0j ; t) ≥ πi (bi , b0j ; t) whenever b0i > bi , b0j > bj . An implication of this

fact is that πi (bi , bj (tj ); t) satisfies SC(bi , tj ) (for all ti and all non-decreasing

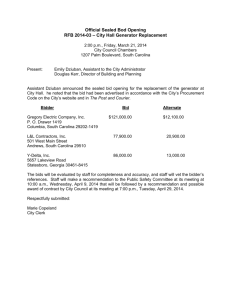

opponent strategies bj (·)). Figure 1 graphs the incremental return to b0i = 80

versus bi = 60 as a function of opponents’ type.1 Finally, when combined with

an assumption of affiliated types, this implies in the two-bidder case that in1

I thank Susan Athey for explaining this set of ideas to me using this sort of figure.

2

f (80, t2 )

−f (60, t2 )

−20

b

r

b

−1

−1

bj (60) bj (80)

b r

b

t2

Figure 1: SC(b1 , t2 ) of f (b1 , t2 ) = π1 (b1 , b2 (t2 ), t1 , t2 )

terim expected payoff Etj |ti [πi (bi , bj (tj ), t)|ti ] satisfies SC(bi , ti ) whenever the

other bidder follows a non-decreasing strategy. (Athey (2001) Theorem 7.)

Armed with this “single-crossing condition”, Athey (2001) proves in the

case of n = 2 bidders that a monotone pure strategy equilibrium exists in

the first-price auction, i.e. each bidder’s bid is non-decreasing in his type.

In related work, McAdams (2001) and Kazumori (2002) prove existence of a

monotone pure strategy equilibrium in auctions of multiple identical objects

with n bidders and multi-dimensional types but only in the case of independent types and risk-neutral bidders. Reny and Zamir (2002) prove existence

of monotone pure strategy equilibrium in the first-price auction with affiliated types n > 2 bidders with affiliated types.2 In this setting, Athey’s

single-crossing condition fails. When others follow non-decreasing strategies,

a bidder may prefer b0 to b when he has type ti but prefer b to b0 when he

has type t0i for some bid levels b0 > b and types t0i > ti . Reny and Zamir

(2002) show, however, that this is not possible if type ti gets non-negative

expected payoff from the higher bid b0 . This observation allows them to apply

Athey (2001)’s method of proof of existence since that method only requires

2

Reny and Zamir (2002) also provide an example with 3 bidders having multidimensional affiliated types in which the unique equilibrium is non-monotone.

3

that single-crossing holds for pairs or bids b0 > b and pairs of types t0i > ti

such that b0 is a best response for type ti , given non-decreasing strategies by

others. They call this single-crossing condition BR-SCC since it only applies

when the higher bid is a best response for the lower type.

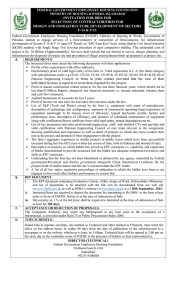

b2

b0

b2

b

t2

6

I 0

b wins @

b wins, b loses Figure 2: Bids b0 , b against non-monotone b2 (·)

In Section 2, I prove that all equilibria in the first-price auction must be

monotone over the range of types who win with positive probability in the

general affiliated values model with n bidders and one-dimensional types.

(A mixed-strategy equilibrium is monotone iff the highest bid played with

positive probability by a lower type is less than or equal to the highest bid

played with positive probability by a higher type.) In particular, for each

bidder i there exists some type b

ti such that all types above (below) b

ti win with

positive (zero) probability and bidder i’s strategy is monotone over the range

of all types greater than or equal to b

ti . At the heart of this positive result is

my observation that single-crossing holds for all pairs b0 > b and t0i > ti such

that b0 is a best response for type ti and b is less than or equal to b−i , the

“lowest trough” in the bid functions of any bidder other than i. I call this

condition NM-SCC since it applies even when others follow non-monotone

strategies. NM-SCC is a strengthening of Reny and Zamir (2002)’s BR-SCC

condition since b−i = ∞ whenever others follow non-decreasing strategies.

4

Figure 2 illustrates the lowest trough b2 in bidder 2’s non-monotone bid

function; see the Appendix for a formal definition. The essence of the proof is

to exploit this limited single-crossing property to show that the lowest trough

of any given bidder’s equilibrium bid function must be strictly higher than

the lowest trough of some other bidder’s bid function. This of course leads

to a contradiction unless all bidders are following non-decreasing strategies.

On the other hand, in Section 3, I show why McAdams (2001) and Kazumori (2002)’s results for multiple identical-object auctions can not possibly

extend to cover the case of affiliated types (even with private values) by providing examples in which all equilibria are non-monotone. In Examples 1

and 3, some bidder reduces his bids on all units as his type increases in all

equilibria. In Example 2, symmetric bidders all reduce their bids on some

units in all equilibria. And in Example 4 of Section 4, some bidder reduces

his bids on the individual objects in all equilibria given independent types

and non-identical objects. Fundamentally, as discussed next in Section 1.1,

these negative examples flow from the fact that bidders’ ex post payoffs fail

to satisfy SC(bi , b−i ) in identical object auctions and also fail to be modular in own bid in non-identical object combinatorial auctions. Lastly, in the

paper’s conclusion, I share my thoughts on where I believe these negative

results should lead future multi-unit auction research.

1.1

Single-crossing and modularity

Definition (Single-crossing for (x0 , x; t0 , t), single-crossing for (x0 , x)).

Let X, T be partially ordered sets with elements x0 > x in X and t0 > t in

T . g : X × T → R satisfies (strict) single-crossing for (x0 , x; t0 , t) iff

g(x0 , t) ≥ g(x, t) ⇒ g(x0 , t0 ) ≥ (>)g(x, t0 )

Similarly, g : X → R satisfies (strict) single-crossing for x0 , x iff

g(x) ≥ 0 ⇒ g(x0 ) ≥ (>)0

Note that “single-crossing for (x0 , x; t0 , t)” explicitly specifies which pair of

elements x0 , x are being compared and with respect to which pair of elements

t0 , t. The more standard “single-crossing in (x, t)” requires SC(x0 , x; t0 , t) for

all comparable pairs x0 , x and t0 , t:

5

Definition (Single-crossing in (x, t)). Let X, T be partially ordered sets.

g : X × T → R satisfies single-crossing in (x, t) (shorthand SC(x, t)) iff

g(x0 , t) ≥ g(x, t) ⇒ g(x0 , t0 ) ≥ g(x, t0 )

for all x0 > x ∈ X and all t0 > t ∈ T .

Definition (Modularity in x). Let X be a lattice. g : X → R is modular

in x iff

g(x0 ) + g(x) = g(x0 ∨ x) + g(x0 ∧ x)

for all x0 , x ∈ X.

Note that when X is a sublattice of Euclidean space, modularity in x =

(x1 , ..., xk ) is equivalent to additive separability in x1 , ..., xk . Modularity of

payoffs in bi is trivially satisfied in single-object auctions since bids are onedimensional.

Payoffs are not modular in own bid in combinatorial auctions because

increasing one’s bid on a bundle will typically make one more likely to win

the bundle the more that one simultaneously lowers bids on individual units.

Thus, one can not apply McAdams (2002)’s monotone equilibrium existence

theorem. (Quasisupermodularity in own bid also fails.) As mentioned earlier, payoffs are modular in own bid in most commonly studied auctions of

identical objects (given risk-neutral bidders). As a consequence, when bidder

types are independent a monotone equilibrium exists and if bidder values are

also strictly increasing in own type, then one can prove that all equilibria are

monotone over the range of all types who win with positive probability. Even

in this case, however, the conditions of the monotone equilibrium existence

theorem may fail when bidder types are positively or negatively correlated.

The reason for this is that payoffs fail to satisfy single-crossing in own bid

and others’ bids. The purpose of most of the examples in the paper is to

illustrate why this property fails. Since a graphical intuition is helpful, I

include here an example drawn from McAdams (2001).

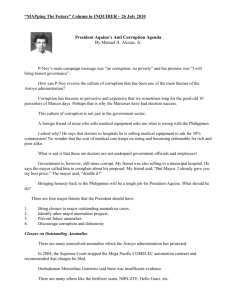

Figure 3 shows why ex post payoffs fail to satisfy single-crossing for

(Di0 (·), Di (·); Dj0 (·), Dj (·)) in the uniform-price auction in a simple example

with two bidders and S perfectly divisible units. The observation extends,

however, to settings with any number of bidders, indivisible units and/or

discrete price grid, and price-elastic supply. Other multi-unit auctions such

as the pay-as-bid auction also fail to possess strategic complementarity.

6

price

S − D20 (·) S − D2 (·)

v

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

Q

0

Q

Q

QD1 (·)

Q

Q D1 (·)

Q

Q

quantity

Figure 3: Single-crossing in own bid and others’ bids fails in uniform-price

auction

Example. For some type profile t, bidder 1 has a constant marginal value

v for shares, i.e. v1 (q; t) = qi v. S − D20 (·), S − D2 (·) are the residual

supply curves that would result if bidder 2 submits the bid D20 (·) or D2 (·).

The unlabelled curves in Figure 3, finally, are isoprofit curves of bidder 1.

Thus, D1 (·) is strictly preferred to D10 (·) when bidder 2 submits D20 (·) whereas

D10 (·) is strictly preferred to D1 (·) when bidder 2 submits D2 (·). This violates

SC(Di0 (·), Di (·); Dj0 (·), Dj (·)) of bidder 1’s ex post payoff.

2

First-Price Auction

First-price auction model: There are n bidders and one object. Each bidder has type ti ∈ [0, 1] and a randomization variable τi ∈ [0, 1], where t

is affiliated, τ is independent of t, and the joint density of (t, τ ) has full

support on [0, 1]n . (τi need not be independent of τj .) In particular, this

implies that for any T ⊂ [0, 1]2n−2 , Pr(t−i , τ−i ∈ T ) > 0 implies that

Pr((t−i , τ−i ) ∈ T |ti , τi ) > 0 for all ti , τi . Each bidder’s utility upon losing

is normalized to zero and upon winning has the form ui (vi (t) − bi ), where the

valuation vi is non-decreasing in t and strictly increasing in ti and utility ui

is strictly increasing in surplus. The set of permissible bids is {∅} ∪ [pmin , ∞)

where bidding {∅} ensures that one will never win the object. Ties are bro7

ken randomly when the high bid is at least pmin and the auction is cancelled

if the high bid is {∅}.

Theorem 1. A monotone pure strategy equilibrium exists in the first-price

auction and every equilibrium is monotone over the range of types who win

with positive probability. Specifically, if bb is played with positive probability

by type b

ti , Pr(bb wins) > 0, t0i > ti > b

ti , and b0 , b are played with positive

probability by types t0i , ti (respectively), then b0 ≥ b ≥ bb.

Proof. The proof is in the Appendix.

Reny and Zamir (2002) prove existence of a monotone pure strategy equilibrium, so my contribution is to prove that all equilibria must be monotone.

To illustrate the essential idea of the proof, I will focus on pure strategy equilibria with 3 bidders and consider only a special case in which several simplifying conditions are satisfied. Suppose that b∗ (·) is a pure-strategy equilibrium

with (a) no atoms in i’s bid, i.e. Pr(b∗i (ti ) = b) = 0 for all b, (b) all but the

lowest bids win, i.e. b > inf ti b∗i (ti ) implies that Pr(b > maxj6=i b∗j (tj )) > 0,

and (c) Pr(bi > b∗i (ti )) > 0, where

bi ≡ inf{b : b∗i (t0 ) < b, b∗i (t) > b for some t0i > ti }

≡ ∞ if this set is empty

bi is the level of the lowest “trough” of bidder i’s bid function and equals

∞ exactly when b∗i (·) is monotone non-decreasing. Thus, (c) amounts to

assuming (c1) b∗i (t) < bi over some interval of types including zero and (c2)

b∗i (·) is monotone non-decreasing over this range. (See Figure 2 on page 4.)

The proof proceeds by showing that b∗ (·) an equilibrium implies that

bi > minj6=i bj ≡ b−i whenever b−i < ∞. Thus, b1 = b2 = b3 = ∞ and any

equilibrium must be monotone! Why must the lowest trough in (say) bidder

1’s equilibrium bid function be higher than the lowest trough of some one

else’s equilibrium bid function? Recall the usual trade-off between bidding b0

versus b when others are following monotone strategies : (a) bidding b0 leads

bidder 1 to pay more in the event “b wins” and this event is a rectangle in

the lower corner of T−1 = [0, 1]n−1 ; (b) bidding b0 leads him to win sometimes

when b would have lost and the event “b0 wins” is also a product of intervals.

When others are following non-monotone strategies but b ≤ b−1 , the trade-off

is very similar. The event “b wins” is still a rectangle in the lower corner of

T−1 and the event “b0 wins” still has a product structure, although it is not

8

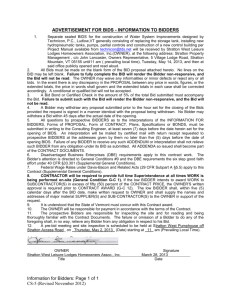

the product of intervals. Figure 4 provides an example of the structure of

“b wins” and “b0 wins” when there are three bidders and bidders 2,3 follow

a strategy with a single trough as in Figure 2 such that (i) b∗j (tj ) ∈ [0, b) for

all tj ∈ [0, t1j ), (ii) b∗j (tj ) ∈ (b, b0 ) for tj ∈ (t1j , t2j ) ∪ (t3j , t4j ), and (iii) b∗j (tj ) > b0

for tj ∈ (t2j , t3j ) ∪ (t4j , 1].

t3

t43

X 0,2

X 1,2

X 2,2

X 0,1

X 1,1

X 2,0

X 0,0

X 1,0

X 2,1

t33

t23

t13

t12

t22

t32

t42

t2

Figure 4: X 0,0 = “b wins”. ∪0≤m2 ,m3 ≤2 X m2 ,m3 = “b0 wins”

Standard arguments prove that, when all others follow monotone strategies and bidder 1’s valuation v1 (t) is strictly increasing in t1 , bidder 1’s payoff

has strict single-crossing for (b0 , b; t01 , t1 ) whenever b0 , b both win with positive

probability and t01 , t1 find b0 , b to be best responses, respectively. Such a property implies that all of bidder 1’s best response strategies are monotone over

the range of types that win with positive probability. The key steps in the

proof are applications of standard facts about functions of affiliated random

variables, in particular Theorem 5 of Milgrom and Weber (1982) (hereafter

“MW”). The crucial elements of the problem that allow one to apply MW

are that “b wins” is a product of intervals including zero and that “b0 wins”

also has a product structure. Both of these elements carry over to the case

9

in which others follow non-monotone strategies, as long as the lower bid b is

less than or equal to the lowest trough in others’ bid functions. Thus, it is

impossible that b0 and b ≤ b−1 both win with positive probability and t01 , t1

find b0 , b to be best responses, respectively. By the definition of b1 , then,

b1 > b−1 .

3

Auctions of Identical Objects

Identical objects model: The examples in this section vary but they all fit into

the following framework. There are n risk-neutral bidders and two identical

objects being auctioned. Each bidder has type ti ∈ [0, 1] and t is affiliated.

Each bidder’s marginal values vi (1, t), vi (2, t) are non-decreasing in t.3 In

some examples, the set of permissible bids is a finite grid while in others bids

are allowed on a continuum and the tie-breaking rule varies.

Note also that I maintain the assumption of one-dimensional, affiliated

types. These assumptions are less natural in the multi-unit context4 but useful from an expository point of view. When types are negatively correlated or

multi-dimensional, the first-price auction sometimes possesses non-monotone

equilibria for very natural reasons. (See Jackson and Swinkels (2001) for an

example with negative correlation, Reny and Zamir (2002) for an example with multi-dimensional affiliated types.) Maintaining these assumptions

helps me to isolate important differences between single- and multi-object

auctions, namely the non-monotonicity of equilibria that is caused by the

failure of payoffs to satisfy strategic complementarity and/or modularity.

Finally, one may easily concoct examples of non-monotone equilibria in

which the non-monotonicity occurs because some bidder is indifferent to sub3

Marginal values are not necessarily strictly increasing in own type. In some examples,

each bidder has only finitely many types. One may reinterpret each such type as corresponding to a range of types in the unit interval (while maintaining affiliation). Over this

range, values are constant in own type.

4

Bidder types may be multi-dimensional if different information is relevant to the value

of different objects or (in the identical object case) to initial versus later units, among

other reasons. For example, suppose that a buyer may consume one unit himself at utility

t1i and/or resell any units that he wins at price t2i . The affiliation assumption may also

become less natural in that t1i , t2i may be negatively correlated (even if ti , tj are positively

correlated). In an auction of rare coins, for instance, it seems plausible that dealers who

expect to be able to resell the coins at a high price may have a relatively low personal

willingness to pay for the coins. Such dealers may have a relatively large inventory and

hence already possess a personal collection that satisfies them.

10

mitting a range of bids. I want to avoid such examples. As a consequence,

in my examples I focus on equilibria in weakly undominated strategies.

3.1

Non-Monotone Equilibria: Examples

Monotonicity of equilibria does not extend to multi-object settings! The

simplest example that I have found applies to the so-called uniform N + 1-st

price auction in which price equals the highest losing bid. (Examples 1 and

2 each apply to the uniform N + 1-st price auction which does not extend

the first-price rule. Similar logic applies in the as-bid and uniform N -th

price auctions, however, which each do extend the first-price rule. See also

Example 3.)

Example 1 (Uniform N + 1-st price auction). There are two identical

objects for sale and two bidders. Bidder 1 has unit demand and private

value v1 ∈ [0, 1]. Bidder 2 has (constant) marginal value v2 = 1 for both

units and receives a signal s2 ∈ {H, L} that is informative about 1’s value.

In particular, the conditional density of v1 given s2 is f (v1 |s2 = L) = 2 − 2v1 ,

f (v1 |s2 = H) = 2v1 .

Claim. An equilibrium in weakly undominated strategies exists and all such

equilibria are non-monotone in this example.

Proof. Bidder 1 bids v1 on the first unit and zero on the second unit and

bidder 2 bids his true value v2 = 1 on a first unit in any equilibrium in

weakly undominated strategies. (Note however that bidder 2’s first unit bid

never sets the price.) Bidder 2 has two basic options for his bid on the

second unit: (a) concede one unit to bidder 1 and bid 0, thereby winning

one unit at price 0, or (b) attempt to win two units and bid b > 0, thereby

sometimes winning one unit at price b (if v1 > b) and other times winning

two units at per unit price v1 (if v1 < b). Under option (a), bidder 2’s profit

equals 1. Under option (b), bidder 2’s profit and marginal return to a higher

second-unit bid are

Z b

πi (b, s2 ) =

(2 − 2v1 )f (v1 |s2 )dv1 + (1 − b) Pr(v1 > b|s2 )

0

∂πi /∂b(b, s2 ) = (2 − 2b)f (b|s2 ) − (1 − b)f (b|s2 ) − Pr(v1 > b|s2 )

When s2 = L, f (v1 |L) = 2 − 2v1 , Pr(v1 > b|L) = (1 − b)2 , and ∂πi /∂b(b, L) =

(1 − b)2 > 0 for all b < 1. Thus, b∗2 (L) = (1, 1). On the other hand,

11

when s2 = H, f (v1 |H) = 2v1 , Pr(v1 > b|H) = 1 − b2 , and πi (b, H) =

−b3 /3 + b2 − b + 1 < 1 = πi (0, H) for all b ∈ (0, 1]. Thus, b∗2 (H) = (1, 0).

Note that this non-monotone equilibrium is the unique equilibrium in weakly

undominated strategies.

The key feature driving Example 1 is that the multi-unit demand bidder

faces a decision about whether to bid with an eye toward winning both units

or just one unit (i.e. “conceding”). Given the particular structure of the

example – two goods, one opponent who only wants a single unit – it is

clear that conceding becomes relatively more attractive the higher that the

opponent bids. Since types are affiliated and the opponent’s bid is increasing

in its type, then, it is natural that the two-unit demander’s bid may fall with

his own type, even if higher own type were also to somewhat increase his

own value for the objects.

One feature of Example 1 is that bidder 2 can “lock in” a unit by making

the minimal possible bid, but this is not crucial. Suppose that we add an

additional unit-demand bidder (call it bidder 0) who has private value v0 .

Let fv (x|s2 ) be the conditional density of v ≡ max{v0 , v1 } and fv (x|s2 ) the

conditional density of v ≡ min{v0 , v1 }. Then 2’s profit as a function of his

bid b on the second unit is

Z b

πi (b, s2 ) =

(2 − 2x)fv (x|s2 )dx + (1 − b) Pr(b ∈ (v, v)|s2 )

0

Z 1

+

(1 − x)fv (x|s2 )dx

b

∂π/∂b = (2 − 2b)fv (b|s2 ) + (1 − b)(fv (b|s2 ) − fv (b|s2 ))

− Pr(b ∈ (v, v)|s2 ) − (1 − b)fv (b|s2 )

= (2 − 2b)fv (b|s2 ) − (1 − b)fv (b|s2 ) − Pr(b ∈ (v, v)|s2 )

(As always in the uniform-price auction in which price equals highest losing

bid, bidder 2’s weakly dominant strategy is to bid his true value on the

first unit.) Note that the term representing bidder 2’s marginal return to

increasing b differs from that in the previous example only in that the density

for v1 is replaced by the density for v and that Pr(v1 > b|s2 ) is replaced by

Pr(b ∈ (v, v)|s2 ). As long as the distribution of v0 is heavily weighted enough

by values near zero, then, the logic of the previous example carries through

without modification.

Another feature of Example 1 is that the bidders are asymmetric, but

this also is not crucial. More important is that, as the unit demander’s

12

type increases, the difference between his equilibrium bid on the first unit

and the second unit increases. As this difference in one’s opponents’ bids

increases, it increases the relative attractiveness of conceding a unit. In the

N +1-st uniform-price auction, it also tends to increase the relative likelihood

that one’s second-unit bid will set the price, thereby further increasing one’s

incentive to concede a unit. These points are illustrated with the following

symmetric example in the N + 1-st uniform-price auction.

Example 2 (Symmetric bidders). Two bidders receive types t1 , t2 ∈ [0, 1].

vi (1, ti ) = v1 (2, ti ) = 200ti for all ti ∈ [0, 1/2). vi (1, ti ) = 200ti and vi (2, ti ) =

100 for all ti ∈ (1/2, 1]. The joint density of t is given by f (t) = 2 when

t1 , t2 > 1/2 or t1 , t2 < 1/2 and f (t) = 0 otherwise. In other words, t1 >

(<)1/2 implies that t2 > (<)1/2 and t are independent conditional on both

being greater than or less than 1/2.

Claim. An equilibrium in weakly undominated strategies exists and all such

equilibria are non-monotone in this example.

Proof. Conditional on t1 , t2 < 1/2 or > 1/2, t1 , t2 are independent. Thus,

Kazumori (2002) proves that an equilibrium exists in “sub-auctions” in which

the types are less than or greater than 1/2. And any combination of equilibria in these sub-auctions is an equilibrium in the auction. Furthermore,

it is straightforward to prove that an equilibrium in undominated strategies

exists.5

In any equilibrium, b∗1 (1, t1 ), b∗2 (1, t2 ) ≥ 100 and b∗1 (2, t1 ) = b∗2 (2, t2 ) ≤ 100

for all t1 , t2 > 1/2. (If the second-unit bids are not tied with probability one

conditional on types greater than 1/2, then some bidder could sometimes

lower the uniform-price – without otherwise altering the auction outcome –

by lowering his bid.) Furthermore, b∗1 (2, t1 ) = b∗2 (2, t2 ) = 0 in any equilibrium

in weakly undominated strategies. On the other hand, it is straightforward

to show that b∗i (2, ti ) > 0 in any equilibrium when ti < 1/2.

5

Consider variations in which bidders submit random bids with positive probability.

Kazumori (2002) proves existence of isotone equilibria in each sub-auction given such

trembling. A limit of such equilibria, as the probability of trembling goes to zero, is an

equilibrium in undominated strategies without trembling. (A limit exists because the set

of isotone strategies is compact in the weak topology and this limit is an equilibrium since

expected payoffs are continuous with respect to this topology. See Athey (2001) for a

template of this argument in the context of the first-price auction.)

13

What about the pay-as-bid auction and the version of the uniform-price

auction in which price equals the lowest winning bid? As one probably

expects by now, similar examples can be constructed in which some or all

equilibria are non-monotone in these auctions as well. Calculating equilibria

becomes more cumbersome in these auctions since it is no longer true that

a multi-unit bidder will bid truthfully on the first unit. I provide here an

example that applies to both of these auctions at the same time.

Example 3 (Pay-as-bid auction or Uniform N -th price auction).

There are two bidders and two units for sale in the pay-as-bid auction or

in the uniform N -th price auction. Each bidder i wins at least one unit

if bi (1) > bj (2) and two units if bi (2) > bj (1); ties are broken randomly.

The set of permissible bids is {0, 10, 20} and each bidder receives a perfectly

correlated signal in the set {L, H}. Bidder i’s valuation for a kth unit given

signal s will be denoted vi (k, s).

v1 (1, L) = v1 (2, L) = 0, v1 (1, H) = 24, v1 (2, H) = 0

v2 (1, s) = v2 (2, s) = 24 for each s

Claim. An equilibrium in weakly undominated strategies exists in both the

pay-as-bid and the uniform N -th price auction and all such equilibria are

non-monotone.

Proof. Pay-as-bid: Clearly, b∗1 (1, L) = b∗1 (2, L) = b∗1 (2, H) = 0. After either

signal, bidder 2’s unique best response is (0, 0) if bidder 1 bids (10, 0) or

(20, 0) since this ensures that he wins an expected 1 1/2 units one unit for

profit 3/2(v2 (s) − 0) > 2(v2 (s) − 10). Similarly, after either signal bidder

2’s unique best response is (10, 10) if bidder 1 bids (0, 0). After (0, 0) he

wins an expected 1 units for profit 24, after (10, 0) he wins an expected 1

1/2 units for profit 36 − 10, after (10, 10) he always wins two units for profit

2(24 − 10). After signal H, bidder 1’s best response is to bid (10, 0) as long

as b∗2 (2, H) < 20. Bidding (0, 0) rather than (10, 0) leads bidder 1 to lose

entirely if b∗2 (2, H) = 10 and to decrease expected winnings from 1 to 1/2 if

b∗2 (2, H) = 0, but 24 − 10 > 1/2(24 − 0). Thus, in the unique equilibrium in

weakly undominated strategies,

b∗1 (·, L) = (0, 0), b∗1 (·, H) = (10, 0), b∗2 (·, L) = (10, 10), b∗2 (·, H) = (0, 0)

Uniform N -th price: After either signal, bidder 2’s unique best response is

still (0, 0) if bidder 1 bids (10, 0) or (20, 0). One difference, however, is that

14

now bidder 2’s best response is to bid (10, 0) if bidder 1 bids (0, 0) since

3/2(24 − 0) > 2(24 − 10). After signal H, bidder 1’s best response to both

(0, 0) and (10, 0) remains to bid (10, 0) for the same reason as before. Thus,

in the unique equilibrium here in weakly undominated strategies,

b∗1 (·, L) = (0, 0), b∗1 (·, H) = (10, 0), b∗2 (·, L) = (10, 0), b∗2 (·, H) = (0, 0)

4

Non-Monotone Equilibria in Auctions of

Non-Identical Objects

Non-identical objects model: Same as identical objects model except that

each bidder has valuations for objects A, B separately and together, vi (A; ti ),

vi (B; ti ), vi (A, B; ti ).

Existence of non-monotone equilibria is perhaps not so surprising in combinatorial auctions of non-identical objects. After all, a bidder with a low

type may only bid seriously on an individual object whereas with a higher

type he may bid with an eye to winning a bundle. In this case, it may make

sense to withdraw one’s bid on individual objects to increase the chances

of winning the bundle. The logic of non-monotonicity here ultimately relies

on the fact that a bidder’s payoff is not additively separable in his bids on

various bundles: increasing one’s bid on the bundle will typically make one

more likely to win the bundle the more that one simultaneously lowers bids

on individual units. Consequently, while some sort of correlation of types is

necessary for all equilibria to be non-monotone in the identical objects case,

it is quite easy to construct examples with non-identical objects in which

types are independent and all equilibria are non-monotone.

Example 4. There are two bidders in the pay-as-bid combinatorial auction of two objects A, B. Each bidder i submits bids on all combinations:

bi (A), bi (B), bi (A, B) ∈ {0, 10, 20, ...}. If

max bi (A) + max bi (B) > (<) max bi (A, B),

i

i

i

then the goods are allocated separately (bundled) to the relevant high bidders with ties broken randomly; if these two allocations bring in the same

15

revenue, then the method of allocation is chosen randomly, again with subsequent ties broken randomly. All of the bidders have additive valuation

functions. Bidder 1 is a single-object demander and doesn’t receive any private information (his values are known): v1 (A) = 25, v1 (B) = 0. Bidder 2

may want both objects and receives signal t2 ∈ {L, H}, each with probability

1/2. v2 (A, L) = 0, v2 (B, L) = 25 whereas v3 (A, H) = v3 (B, H) = 100.

Claim. An equilibrium in weakly undominated strategies exists and all such

equilibria are non-monotone.

Proof. Obviously b∗1 (B) = b∗2 (A; L) = 0 in any equilibrium. Also, v2 (·, H)

is chosen to be so high that bidder 2 certainly wins both objects when his

type is high. Thus, b∗1 (A) = 10 in any equilibrium: 1 only wins if t2 = L

and the objects are sold separately and, in this case, bidding 0 leads to a

tie for expected payoff is 12 1/2 while bidding 10 leads to certain victory

for payoff 15. For the same reasons, b∗2 (B; L) = 10 in any equilibrium and

the objects are sold separately when t2 = L. If t2 = H, finally, bidder 2’s

unique best response is to bid b∗2 (A; H) = b∗2 (B; H) = 0 and b∗2 (A, B; H) = 20

thereby winning both units for certain. This equilibrium is non-monotone

since b∗2 (B; L) > b∗2 (B; H).

5

Conclusion

This paper has shown why all equilibria in the first-price auction are monotone when bidders have one-dimensional affiliated types but also why some

or all equilibria may be non-monotone in auctions of multiple identical objects given these same assumptions. In addition, I showed that all equilibria

may be non-monotone in non-identical object auctions even given independent types. In my mind, these negative results should spur and focus future

study into the important question of when and why bidders follow monotone

equilibrium strategies, especially in auctions of identical objects. Example

2 shows why assuming symmetric bidders and private values is not enough

to guarantee existence of a monotone equilibrium, but several other natural

conjectures remain to be tested. For instance, suppose that each of two bidders has constant marginal values, vi (1; t) = vi (2; t) = vi (t), for two objects

on sale. Will all (or some) equilibria in this setting be monotone and does

this remain true with n > 2 bidders and k > 2 objects? If not, what if there

16

are common values as well, v1 (t) = v2 (t)? In any event, there is a reassuring sense in which non-monotone equilibria are a phenomenon restricted to

settings with small numbers of bidders. Pesendorfer and Swinkels (2000)’s

results on asymptotic efficiency of auctions imply that any equilibrium with

many6 bidders must be monotone. Many important real-world auctions have

relatively few bidders, however, and it remains an important task to build a

more complete theory of multi-object auctions in such settings. This paper

serves to highlight one of the more prominent holes in the current theory.

Appendix

Proof of Theorem 1

Let b∗ (·) be an equilibrium. In my notation b∗i (ti ) is the set of bids made

by type ti with positive probability; I do not specify these probabilities since

they are not needed. When necessary, b∗i (ti , τi ) will refer to i’s actual bid for

some realization of his randomization variable τi . The only important fact is

that any bid in b∗i (ti ) is a best response.

Let blow

be the level above which j needs to bid to win with positive

j

probability and let bj be the level of the lowest “trough” in j’s bid function

over the range of types who win with positive probability:

blow

≡ sup{b : Pr(b ≥ max b∗i (ti , τi )) = 0}

j

i6=j

bj ≡ inf{b ≥

blow

j

: max b∗i (ti , τi ) > b > min b∗i (t0i , τi ) for t0i > ti ≥ e∗j )}

τi

τi

≡ ∞ if Z is empty

Z empty when e∗j = 1, i.e. j always loses or, more generally, when b∗j (·)

is non-decreasing over the range of types who submit a bid that wins with

positive probability.

Consider the following conditions on bidder j’s equilibrium bid (not assumptions!):

6

In their model, the number of objects and the number of bidders scales at the same

rate in a sequence of auctions. The limit of equilibrium outcomes is efficient so, at least

in the limit, all bidders’ strategies must be monotone in any model in which bidder values

are strictly increasing in own type. I suspect that their results could also be leveraged

to show that all equilibria must be monotone when there are n > N bidders, i.e. that

monotonicity is obtained along the sequence as well as in the limit.

17

1. Pr(b ∈ b∗j (tj )) = 0 for all b > blow

j .

2. ∃ e∗j such that Pr(b wins) = (>) 0 for all tj < (>) e∗j and all b ∈ b∗j (tj ).

3. e∗j < 1 implies b(e1 ) < b(e2 ) ≤ bj for some 1 ≥ e2 > e1 ≥ e∗j , all

b(e1 ) ∈ b∗j (e2 ), and all b(e2 ) ∈ b∗j (e1 ).

Conditions 1, 2, 3 are satisfied whenever b∗j (·) is non-decreasing and nonconstant. Condition 2 says that the set of types who win with positive

probability is an interval containing the highest possible type. Condition 3

has several important implications:

• blow

< bj .

j

• b∗j (·) is non-decreasing and less than bj over the range [e∗j , e1 ]. Proof:

b∗j (e1 ) ≥ b∗j (tj ) for all tj < e1 , else bj ≤ b∗j (e1 ) by definition of bj .

Similarly, b∗j (t0j ) < b∗j (tj ) for some e∗j ≤ t < t0 ≤ e1 implies that bj ≤

b∗j (t0 ) ≤ b∗j (e1 ).

• Pr(b∗j (tj ) < b) > 0 for all b ∈ (b∗j (e1 ), bj ).

• The set {tj : b∗j (tj ) ≤ b} is a non-empty lower-comprehensive set for all

b ∈ (blow

j , bj ).

The proof proceeds as follows. (Part 1) Any equilibrium in which each bidder’s equilibrium bid satisfying conditions 1, 2, 3 must be monotone over the

range of all types that win with positive probability. (Part 2) Any equilibrium

must satisfy these conditions.

Part 1: Let b0 > b, t01 > t1 be such that both bids win with positive

probability, b ≤ b−1 , type t1 finds b0 to be a best response, and type t01 finds

b0 to be a best response. I need to show that this leads to a contradiction,

since then b1 > b−1 or b1 = b−1 by the definition of b1 . This will complete

part 1 of the proof, since the same argument applies to each bidder and so

bi = ∞ for all i.

There are two cases to consider in which both b0 , b win with positive

probability: (a) Pr(b wins) > 0 and Pr(b0 wins, b loses) = 0, ruled out since

all types strictly prefer b to b0 . (b) Pr(b wins) > 0, Pr(b0 wins, b loses) > 0.

The rest of the proof addresses this case.

For each bidder j, let t+

j (b) be the set of types at which j’s bid crosses

−

b from below and tj (b) the set of types at which j’s bid crosses b from

18

∗

above. More precisely, t+

j (b) consists of types tj such that bj (tj − ε) < b and

∗

∗

bj (tj +ε) > b for all small enough ε > 0. (By condition 1, bj (·) is not constant

over any interval, so all crossings occur at specific types.) Elements of t−

j (b)

+

−

are defined similarly. For any x, the elements of tj (x), tj (x) clearly alternate:

there can not be two crossings from below without a crossing from above in

between them. Furthermore, the minimal element of t+

j (x) is less than the

−

minimal element of tj (x) (when the latter is non-empty) for all x ≥ b. This

is because each bidder j must bid less than b (and hence less than x) with

positive probability but all bids less than bj must be made on the lowest set

of types, over which j’s bid function is monotone non-decreasing. Finally, by

definition of b−1 , for all x < b−1 it must be that |t+

j (x)| = 1 (and there are

no crossings from above for such x) for all j 6= 1.

For simplicity I will treat t+

j (b) as having finitely many elements. (Extending the proof to the countable case is straightforward.) By convention,

∗

for b > maxtj b∗j (tj ) define t+

j (b) = 1. If bj (·)’s last crossing of x is from above,

then there are equally many crossings from below and from above; by conven+

−

tion in this case, let ∞ ∈ t+

j (x). This guarantees that |tj (x)| = |tj (x)| + 1.

(k+1)+

1+

1−

k−

Let t+

} and t−

j (x) = {tj , ..., tj } be ordered labellings

j (x) = {tj , ..., tj

of these sets. Observe that (up to a zero measure set)

b < b∗j (tj ) < b0 iff tj ∈ ∪km=1 Xjm

b∗j (tj ) < b iff tj ∈ Xj0 whereXj0 ≡ (0, t+

j (b)),

(m+1)+

1+ 0

m− 0

m

Xj1 ≡ (t+

j (b), tj (b )), Xj ≡ (tj (b ), tj

(b0 )) for 1 < m ≤ k

m

As shorthand, let X m ≡ Πj6=1 ∪km=0 Xj j for all m = (m2 , ..., mn ) ∈ {0, ..., k}n−1 .

Bidder 1 wins with bid b iff t−1 ∈ X 0 and wins with bid b0 iff t−1 ∈ ∪m X m .

The expected incremental return to b0 versus b, as a function 4(·) of 1’s

type, equals

X

4(x) ≡ Pr(X 0 |x)(b − b0 ) +

Pr(X m |x)E [v1 (t) − b0 |x, X m ] .

m6=0

Since type t1 finds b0 to be a best response, 4(t1 ) ≥ 0 and the expected

payoff to b0 is non-negative. I will show that 4(t01 ) > 0 for all t01 > t1 . Note

first that Milgrom and Weber (1982)’s Theorem 5 (“MW”) implies that

E [v1 (t) − b0 |t01 , X m ] ≥ E [v1 (t) − b0 |t1 , X m ]

19

for all m and in fact that this inequality is strict since v1 (t) is strictly increasing in t1 . Thus, using the fact that Pr(b0 wins, b loses) > 0,

X

4(t1 ) < Pr(X 0 |t1 )(b − b0 ) +

Pr(X m |t1 )E [v1 (t) − b0 |t01 , X m ]

(k2 ,k3 )6=(0,0)

= E [φ(t−1 )|t1 ] where

φ(t−1 ) ≡ (b − b0 ) if X 0

≡ E [v1 (t) − b0 |t01 , X m ] if X m

4(t01 ) = E [φ(t−1 )|t01 ], so it suffices to show that φ(t−1 ) is non-decreasing since

then we may again apply MW to conclude that E [φ(t−1 )|t01 ] ≥ E [φ(t−1 )|t1 ].

For any m 6= 0 and t0−1 ∈ X m , t−1 ∈ X 0 ,

φ(t0−1 ) = E [v1 (t) − b0 |X m , t01 ]

≥ E v1 (t) − b0 |X 0 , t01

= b − b0 + E v1 (t) − b|X 0 , t01

≥ b − b0 = φ(t−1 )

The first inequality follows from MW and the second from the working assumption that type t01 finds b to be a best response (and hence has nonnegative expected payoff). Finally, for all m0 > m 6= 0 in the product

0

order and t0−1 ∈ X m , t−1 ∈ X m , φ(t0−1 ) ≥ φ(t−1 ) follows from yet another

application of MW.

Part 2: Conditions 1, 2, 3 must be satisfied in any equilibrium. Condition

11: by standard arguments Pr(b ∈ b∗i (ti )) = 0 for all b > blow

j . Condition 2:

Also standard. Suppose that ti wins with positive probability and t0i > ti .

ti must get positive payoff from its bid implying that its expected utility

from winning is positive. Since types are affiliated, MW implies that t0i gets

weakly higher expected utility conditional from winning with this same bid,

so it must get positive payoff in equilibrium as well and hence win with

positive probability.

Condition 3: Define

I0 ≡ {i : b∗i (·) violates condition 2}

I1 ≡ {i : b∗i (·) satisfies condition 2}

Let i1 , i2 ∈ I0 . When e∗i = 1, condition 3 is satisfied trivially. Else, by

20

the definition of bi , there exists some type ti > e∗i such that b∗i (ti ) 3 bi .7 By

condition 2, it must be that Pr(bi wins) > 0 for all i. On the other hand, note

that Pr(min{bi1 , bi2 } wins) = 0 since Pr(b∗i1 (ti1 ) > bi1 ) = Pr(b∗i2 (ti2 ) > bi2 ) =

1. This is a contradiction unless #(I0 ) ≤ 1. Suppose finally that {i} = I0 .

Since all other bidders are following strategies satisfying conditions 1, 2, 3,

part 1 of the proof implies that bidder i’s incremental expected payoff from

bidding bi versus any b0 > bi has strict single-crossing in ti . This provides

the contradiction since b∗i (t0i ) 3 bi , b∗i (ti ) 3 b0 > bi .

References

Athey, S. (2001): “Single Crossing Properties and the Existence of PureStrategy Equilibria in Games of Incomplete Information,” Econometrica,

69(4), 861–889.

Ausubel, L., and P. Cramton (1998): “Demand Reduction and Inefficiency in Multi-Unit Auctions,” U. Maryland Working Paper, Available at

www.cramton.umd.edu.

Jackson, M., and J. Swinkels (2001): “Existence of Equilibrium in

Single and Double Private Value Auctions,” manuscript, Available at

http://masada.hss.caltech.edu/jacksonm.

Kazumori, E. (2002): “Toward a Theory of Strategic Markets with Incomplete Information: Existence of Isotone Equilibrium,” manuscript.

McAdams, D. (2001): “Monotone Equilibrium in Multi-Unit Auctions,”

Manuscript, MIT Sloan, Available at http://www.mit.edu/˜mcadams.

(2002): “Isotone Equilibrium in Games of Incomplete Information,” MIT Sloan Working Paper #4248-02, Available at

http://www.mit.edu/˜mcadams.

Milgrom, P., and R. Weber (1982): “A Theory of Auctions and Competitive Bidding,” Econometrica, 50(5), 1089–1122.

It is possible instead that there is a sequence of types ti (ε) converging to ti > e∗j with

converging to a set containing b. But one can show that the strict single-crossing

property holds when comparing any bid in the neighborhood of bi with b0 . To shorten the

proof, I leave out these details.

7

b∗i (ti (ε))

21

Pesendorfer, W., and J. Swinkels (2000): “Efficiency and Information

Aggregation in Auctions,” American Economic Review, 90(3), 499–525.

Reny, P., and S. Zamir (2002): “On the Existence of Pure Strategy

Monotone Equilibria in Asymmetric First-Price Auctions,” Available at

http://www.src.uchicago.edi/users/preny.

22