A for Oil and Gas Industry Applications 9 2009

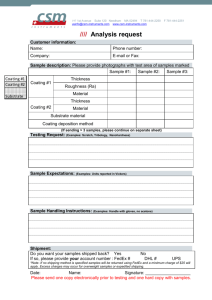

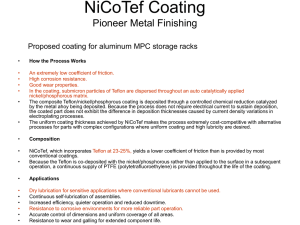

advertisement