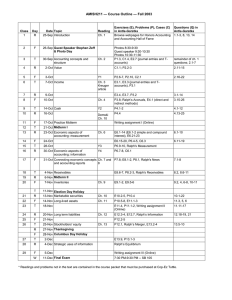

AMIS H212 Midterm I Name ___________________________________

advertisement

AMIS H212 Midterm I

Name ___________________________________

Look over the exam before beginning. If you detach any pages, be sure to put your name on each page.

A.(40 pts.) Ralph’s firm produces a single product at a level q. The manufacturing process requires inputs

z1, z2 and z3, whose prices are each $2. Ralph’s production technology is described by the following

constraints.

(1) z1 ≥ q

(2) 0.5 z2 + z3 ≥ q

1. Formulate the problem you must solve to obtain Ralph’s cost curve.

2. Fill in the table below. zi* denotes the optimal level of input zi.

q

0

1

2

3

4

z1*

z2*

z3*

C(q)

Average

Cost

Incremental

Cost

NA

3. Thinking about this further, Ralph realizes that z3 is fixed at 2 for now. Under this additional

assumption, fill in the table below.

Average

Incremental

q

z1*

z2*

z3*

C(q)

Cost

Cost

0

1

2

3

4

NA

4. What label would you give the cost curve in part 3, and what is its relation to the cost curve in part 2?

Provide an intuitive explanation for why they differ. Be concise but complete.

5. Explain economies of scale and scope, and their implications for interpreting product costs by a casual

user of financial statements. Be concise but complete.

1

AMIS H212 Midterm I

Name ___________________________________

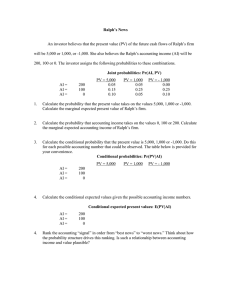

B. (80 pts.) Ralph’s firm faces considerable uncertainty and is evaluating whether it should expand its

operations Currently it only produces and sells Product A. Product B is well established but leaves little

room for growth. Product C is a new product with tremendous growth potential. Below are the state

contingent total net payoffs from each possible strategy, including staying with business as usual (not

expanding into either product market). Each state is equally likely.

Don’t expand

Expand into B

Expand into C

s1

1,089

900

3,025

s2

1,089

900

400

s3

1,089

1,156

400

s4

1,089

1,444

400

1. If Ralph makes his decision based on his beliefs as indicated above, what is his best decision? Assume

his utility function is square root of wealth. Show computations.

2. How does Ralph feel about risk? Explain carefully.

3. Suppose Ralph can hire a consultant for $300. The consultant can differentiate the low states of nature

{s1, s2} from the high states of nature {s3, s4}. Should Ralph acquire the services of the consultant? Be

sure to show computations.

4. Suppose Ralph were risk neutral. Would he be willing to pay $300 for the information system? Again

be sure to show computations.

5. Think about an accounting system as a special kind of information system. What do your answers to

parts 2 and 3 suggest about designing accounting systems, setting financial reporting standards, etc.?

C. (80 pts.) Ralph’s firm is just getting off the ground. Her accountant recommends she calculate product

costs under both normal full and normal variable costing. To facilitate this, they come up with the

following estimates of overhead.

MOV = 10,000 + 2 (DLH)

Normal volume = 1,000 Direct labor hours (DLH)

2

AMIS H212 Midterm I

Name ___________________________________

Ralph starts out with no inventories and undertakes the following activity in December.

(1) Purchased $8,000 worth of direct materials on credit. The cost of materials placed into production

during December was $1,000 for Job 1, $2,000 for Job 2 and $3,000 for Job 3.

(2) Laborers spend 500 hours on Job 1, 300 hours on Job 2 and 400 hours on Job 3. Workers on those

jobs earned an average of $12 per hour. Payroll disbursed $12,000 to factory workers.

(3) Job 1 was completed and sold for $20,000. Job 2 was completed but not sold. Job 3 was still

incomplete as of the end of December.

1. Record all of the above transactions using full costing with journal entries. Use individual work in

process accounts for each job.

2. Records eventually reveal the company incurred the following costs: sales supervisor salaries, $4,500,

rent on factory facilities, $5,000, overtime and idle time costs, $1,000, general and administrative

costs, $2,000, and factory depreciation $9,000. Record these facts using journal entries.

3. Prepare Ralph’s income statement using both full costing and also using variable costing.

4. Explain why the income numbers are different by using a reconciliation that analyzes the inventory

accounts. Show computations.

5. What would have been cost of good sold if the company had used full, actual costing? Show

computations.

6. Ralph’s accountant is recommending she prepare variable cost income statements because they will be

more helpful for decision making than full costing income statements. Comment on his

recommendation.

3