AMIS 522 Intermediate Accounting Professor Doug Schroeder Winter 2012

advertisement

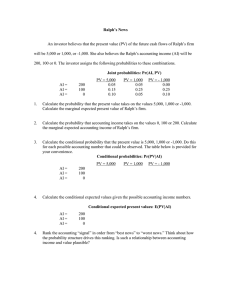

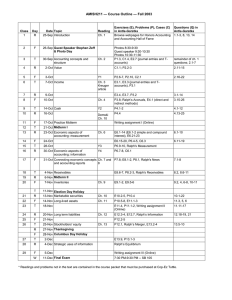

AMIS 522 Intermediate Accounting Winter 2012 Class meeting time: 1:30-3:18 TR 215 SB 5:30-7:18 TR 215 SB Office hours: 3:30-4:30 TR Professor Doug Schroeder Office: Fisher 424 schroeder_9@cob.osu.edu phone: 292-6427 General Description The course explores the science of accounting. In other words, we focus on theory and practice in the academic discipline of accounting. Although the course has an academic focus, it is not divorced from practical issues. Indeed, by reading and analyzing scholarly work from the academic literature, students gain a keener understanding of the ways in which accounting is practiced. Approach There are many possible ways to approach the study of accounting. This course emphasizes an information content approach in which accounting reports represent one among many sources of information in a society. In this approach, we examine the structure, language or scaling choices, and comparative advantage of accounting reports as an information source. Uncertainty will be central to our discussions. Class preparation is vital and involves reading and carefully working the examples. Students are expected to be actively involved discussions. Each class session will test our understanding of accounting. The course involves a substantial time commitment (at least two to three hours outside of class for each hour in class). Text and Reading Materials an intermediate accounting text. Assignment material is posted at the following web address: http://fisher.osu.edu/~schroeder_9/AMIS522/ Recommended (optional): Christensen, J. and J. Demski (CD). Accounting Theory: An Information Content Perspective, Irwin McGraw-Hill, ISBN: 0072296917. Demski, J. (D) Managerial Uses of Accounting Information, revised edition, Springer, ISBN 9780387774503. While these materials are optional, suggested readings are identified in the attached course schedule. 1 Course Requirements and Grading Grades will be assigned based on cumulative performance in the course, using the following weights for the components: class discussion, homework, making a positive contribution to the learning environment Comprehensive final exam 50% 50% Homework Homework is collected at the beginning of each class. Homework is not graded but may be used to assess your preparation for class discussion. Homework will not be returned. Students should retain a copy of their homework to facilitate class discussion. Examination The final exam is a cumulative, closed-book, closed-note, in-class examination. Calculators are permitted but other electronic devices are not. Make-ups for the final exam will be given only for reasons acceptable according to University guidelines. The exam date is identified in the outline, mark it on your calendar. You must notify me in advance if you have a conflict with the exam time (including illness). Examinations are designed to serve two purposes: (1) to help you assess your comprehension of basic concepts, and (2) to help you evaluate your ability to integrate various topics discussed and to apply them. The examination will be challenging, and (hopefully) instructive. The exam format will primarily be problems and short essay. 2 Tentative schedule for AMIS 522 Winter 2012: week T Overview: accounting structure & scaling 1/2 notes on accounting & linear algebra; Ralph’s Structure Overview: valuation – scale & information CD ch. 3; D ch. 3; 1/9 Ralph’s Economic Income (P) Ralph's Income (S) 1/16 R Overview: accounting structure & information notes on accounting & linear algebra; Ralph’s Accounting Information Overview: performance evaluation information CD ch. 11; D ch. 13; Decentralized Ralph (P), Ralph's Incentive Contract (S) Accounting scale & private debt – notes Accounting scale & private debt – notes notes on directed graphs; Ralph’s Debt Securitization (P), Ralph's Note Ralph’s Accruals & Debt (S) Informativeness of accruals 1/23 Accounting scale & public debt – bonds notes on linear algebra; Ralph's Bonds notes on best depreciation schedules; Ralph’s Accruals (parts A-C) Accounting scale & leases 1/30 Ralph's Leases Valuation & private information D ch. 9,10; Ralph’s Heirloom (P) Accounting scale notes on residual income valuation; Ralph’s R&D Analyst (S) 3 week 2/6 2/13 T R Accounting scale & investments Accounting scale & multiple information sources CD ch. 10; CD ch. 10 appendix; Ralph’s Scale (P) Ralph’s Probability Assignment (S) Ralph’s Investment Contingent claims analysis & option Contingent claims & accounting scale valuation Rubinstein, 1994, “On the Accounting Cox, Ross, and Rubinstein, 1979, Valuation of Employee Stock “Option pricing: A simplified Options.” approach.” Ralph's Employee Stock Options Ralph's Employee Stock Options (part B) (part A) 2/20 Accounting standards & scale CD ch. 19-20; D ch. 19; Ralph’s 157 Dilemma (P) Ralph’s Belief Assignment (S) Accounting standards & information CD ch. 19-20; D ch. 19; Ralph's Regulation 2/27 Earnings management & scale CD ch. 8; D ch. 10; Ralph’s Accounting Reserves (P) Ralph’s Information Cascade (S) Accounting scale & owners’ equity Ralph’s EPS Financial statement analysis & information Arya, Fellingham, Glover, Schroeder, and Strang, 2000, “Inferring notes on a directed graph analysis of transactions from financial the cash flow statement; statements.” Ralph's Financial Statement Invertible Ralph Analysis Financial statement analysis & scale notes on accounting & linear algebra; 3/5 Final Exams 3/12 1:30 section M 3/12 1:303:18 5:30 section T 3/13 5:307:18 (P) primary focus of discussion (S) secondary, will be discussed if time permits 4