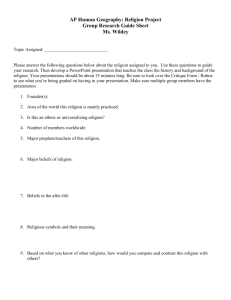

Learning about Consumption Dynamics

advertisement