Analysis of Global Channel Costs for... Industry JUN 3 0 2009 LIBRARIES

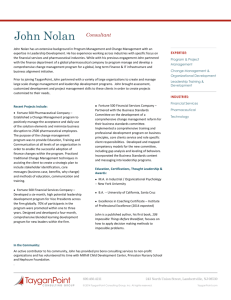

advertisement