BUDGET SUPPLEMENT CARRYOVER INSTRUCTIONS

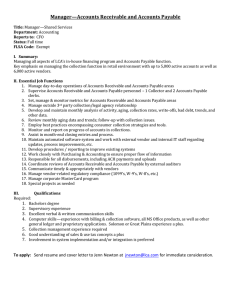

advertisement

BUDGET SUPPLEMENT CARRYOVER INSTRUCTIONS The budget carryover should be submitted for approval by the end of October. Each county must submit a carryover supplement for each fund maintained by the Board during the prior fiscal year. Information on the carryover supplement must agree to the figures presented in the annual financial statements. (WVDE 11-10-10) The attached combined balance sheet and budget carryover entry illustrate the carryover for the general current expense, special revenue and ARRA funds. The figures in the fund balance section on the combined balance sheet are supplemented into the subsequent year’s budget for each fund. The amount of estimated fund balance used in the proposed budget ($100,000) is subtracted from the unassigned fund balance off the financial statements and the OPEB liability is added to the unassigned fund balance to arrive at the carryover supplement amount for that account. The budget carryover entry shows the fund balance account balances are credited and the individual expenditure accounts are debited to offset those amounts. The unassigned fund balance may be offset by an entry to Reserved for Contingencies in part or in total. In addition to the fund balance section, the reimbursements receivable in the special revenue funds are re-budgeted in order to track incoming revenues in the subsequent year. Budget Carryover Instructions.wpd SAMPLE BUDGET CARRYOVER ENTRY FOR FY 12 Dr. 11.XXYXX.XXXXX.XXX Cr. 11.00000.00772.007 Various expenditures Unassigned Fund Balance 30,448 30,448 From Outstanding Encumbrance Report - the encumbrances could not be reported as assigned because it would have caused unassigned to be negative. Dr. 11.XXYXX.XXXXX.XXX Cr. 11.00000.00771.007 Various expenditures Committed fund balance 10,000 10,000 Dr. 11.XXYXX.XXXXX.XXX Various expenditures 170,557 Cr. 11.00000.00772.007 Unassigned fund balance 170,557 (or you could budget this to reserved for contingency, 76321.842 and transfer to specific line items later) Formula: (285,802) + 586,807 - 100,000 -30,448 = 170,557 Total for Fund 11 Dr. 61.XXYXX.XXXXX.XXX Cr. 61.00000.00752.007 Various expenditures Restricted Fund Balance 211,005 211,005 149,168 149,168 From Outstanding Encumbrance Report - the encumbrances could not be reported as assigned because encumbrances of restricted funds are included in restricted fund balance. Dr. 61.00000.00752.007 Cr. 61.41YXX.04511.009 Cr. 61.43YXX.04511.009 Cr. 61.74YXX.04511.009 Restricted fund balance Title I receivable IDEA Part B receivable GEAR UP receivable 368,537 Dr. 61.00000.00752.007 Cr. 61.47311.04511.009 Restricted fund balance 122,667 145,800 74,620 148,117 JOBS outstanding encumbrance for which no corresponding revenue could be recognized Formula: 26,501 -149,168 = (122,667) Total for Fund 61 122,667 640,372 640,372 Dr. 71.XXYXX.XXXXX.XXX Cr. 71.00000.00752.007 Various expenditures Restricted Fund Balance 13,323 13,323 From Outstanding Encumbrance Report - the encumbrances could not be reported as assigned because encumbrances of restricted funds are included in restricted fund balance. Dr. 71.00000.00752.007 Cr. 71.41YXX.04511.009 Cr. 71.43YXX.04511.009 Restricted fund balance Title I receivable IDEA Part B receivable Dr. 71.00000.00752.007 Cr. 71.41YXX.04511.009 Restricted fund balance 310,432 201,553 108,879 13,323 Title I outstanding encumbrance for which no corresponding revenue could be recognized Formula: 0 -13,323 = (13,323) Total for Fund 71 13,323 337,078 337,078 SAMPLE COUNTY, WEST VIRGINIA, BOARD OF EDUCATION BALANCE SHEET - GOVERNMENTAL FUNDS AS OF JUNE 30, 2011 NOTE: $100,000 was budgeted as undesignated fund balance in the proposed budget for FY 12 General Current Expense ASSETS Cash and cash equivalents Investments Deposit with Workers Compensation Taxes receivable, net Food service receivable, net Other receivables Due from other governments: State aid receivable PEIA allocation receivable Reimbursements receivable Due from other funds Total assets $ $ $ $ $ 310,432 AY 368,537 2,362,861 $ 633,979 $ 310,432 1,512,356 586,807 607,477 2,638,663 607,477 10,000 (285,802) (275,802) 2,362,862 $ 26,501 26,501 633,979 W 182,214 $ General Current Expense Fund 30,448 310,432 310,432 (0) $ (0) 310,432 Special Revenue ARRA Special Fund Revenue Funds 149,168 $ $ 357,286 Outstanding Encumbrance Listing N 223,995 41,447 EW Nonspendable Restricted Committed Assigned Unassigned Total fund balances TOTAL LIABILITIES AND FUND BALANCES Total Governmental 46,979 Liabilities: Salaries payable and related payroll liabilities Other post employment benefits payable Fund Balances: $ ARRA Projects Fund 201,810 LIABILITIES AND FUND BALANCES PEIA premiums payable Accounts payable Deferred revenue Cash overdraft Total liabilities 2,114,072 Special Revenue Fund 13,323 2,338,067 201,810 41,447 46,979 678,969 3,307,272 1,512,356 586,807 357,286 789,691 310,432 3,556,572 26,501 10,000 (285,802) (249,300) SAMPLE COUNTY, WEST VIRGINIA, BOARD OF EDUCATION BALANCE SHEET - GOVERNMENTAL FUNDS AS OF JUNE 30, 2010 NOTE: $100,000 was budgeted as undesignated fund balance in the proposed budget for FY 11 General Current Expense ASSETS Cash and cash equivalents Investments Deposit with Workers Compensation Taxes receivable, net Food service receivable, net Other receivables Due from other governments: State aid receivable PEIA allocation receivable Reimbursements receivable Due from other funds Total assets $ 223,995 Total Governmental $ 46,979 2,338,067 201,810 41,447 46,979 $ 2,362,861 678,969 3,307,272 $ $ 1,512,356 586,807 41,447 368,537 $ 633,979 310,432 $ 310,432 AY Liabilities: Salaries payable and related payroll liabilities Other post employment benefits payable $ $ 357,286 W 182,214 LD Fund Balances: Reserved for: Encumbrances Debt service Arbitrage payments Excess levies Capital projects Unreserved: Designated Undesignated Total fund balances TOTAL LIABILITIES AND FUND BALANCES $ ARRA Projects Fund 201,810 LIABILITIES AND FUND BALANCES PEIA premiums payable Accounts payable Deferred revenue Cash overdraft Total liabilities 2,114,072 Special Revenue Fund $ 607,477 310,432 310,432 30,448 149,168 13,323 10,000 (316,250) (275,802) 2,362,862 $ 357,286 789,691 310,432 3,556,572 607,477 2,638,663 (122,667) 26,501 633,979 $ 192,939 10,000 (452,239) (249,300) (13,323) (0) 310,432 17,178,967 O Amounts reported for governmental activities in the statement of net assets differ due to: Capital assets used in governmental activities are not financial resources and, therefore, are not reported in the funds Deferred charges are not reported in the funds Property taxes receivable and food service billings receivable will be collected this year but are not available soon enough to pay for the current period's expenditures, and are therefore deferred in the funds Long-term liabilities, including bonds payable, are not due and payable in the current period and, therefore, are not reported in the funds Bonds payable, due within one year Bonds payable, due beyond one year Accrued interest on bonds Capital leases payable Accrued sick leave payable Compensated absences Net assets of governmental activites See Notes to Financial Statements 1,512,356 586,807 795,463 $ (165,000) (555,000) (131,298) (34,835) 16,838,998