Fisher College of Business AMIS 4220 Nonprofit and Governmental Accounting Spring 2013

advertisement

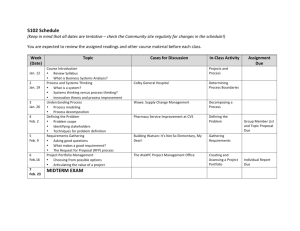

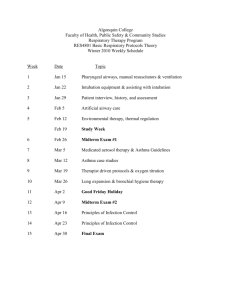

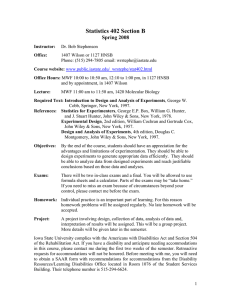

Fisher College of Business AMIS 4220 Nonprofit and Governmental Accounting Spring 2013 Instructor: Brian Mittendorf Room 454, Fisher Hall Phone: 292-1720 Email: mittendorf.3@osu.edu Office Hours: Tuesday/Thursday 10:00-11:00 and by appointment Course Description: This course centers on financial aspects of nonprofit and governmental organizations, beginning with their financial reports. The course focuses on (1) the financial reporting concepts and standards that are applicable to nonprofit and governmental organizations; (2) ratio and other summary indicators used to evaluate the financial condition and financial performance of nonprofit and governmental organizations; and (3) the analysis and interpretation of financial statements of selected nonprofit and governmental organizations. Optional Supplementary Textbooks: Not-for-Profit Accounting Made Easy, Ruppel, Wiley Governmental Accounting Made Easy, Ruppel, Wiley Core Concepts of Government and Not-For-Profit Accounting, Granof and Wardlow, Wiley Course Format: Class sessions will consist of lectures and case discussions. The first part of the course will rely heavily on lectures of accounting concepts for nonprofit organizations. The second part of the course will focus on the accounting concepts of governmental organizations. Case Assignment: Students are expected to form groups of four or less by the second week of class. Please confirm your group composition by emailing the group list to the instructor. Each group will choose a nonprofit on which to focus. The groups will prepare a short presentation and lead a discussion on the financial issues facing this organization at the completion of the nonprofit portion of the course. Quizzes: Throughout the semester, students will be required to complete five miniquizzes posted on Carmen. The quizzes are open book and open notes but must be completed individually. Final Exam: The final exam is an individual take-home assignment that will be distributed in the final weeks of the semester. The assignment consists of financial statements for two organizations. The student is expected to prepare a written analysis of the financial performance and outlook of the two organizations. This write-up should employ many of the concepts included in the course and should be 6-12 pages. Grading: 25% -- attendance and participation 25% -- quizzes 25% -- group assignment 25% -- take-home final Schedule: Class/Day Topic Jan 8 Course overview and introduction to nonprofit accounting Jan 10 Accounting differences between for profit and nonprofit; Financial Statement Analysis Jan 15 Receivables and Contributions Jan 17 Fundraising Activities Jan 22 Split Interest Agreements Jan 24 Investments and Investment Income Jan 29 Affiliated Organizations Jan 31 Cost Allocation Feb 5 Pensions and Leases Feb 7 Foundations Feb 12 Museums Health and Welfare Organizations Feb 14 Heath Care Providers Feb 19 Colleges and Universities Feb 21 Group Presentations Feb 26 Group Presentations Feb 28 Group Presentations Mar 5 Group Presentations Mar 7 Group Presentations Mar 12 No Class – Spring Break Mar 14 No Class – Spring Break Mar 19 Overview of Governmental Accounting; Accounting differences between governmental and non-profit entities Mar 21 Fund Accounting and Governmental Financial Statements Mar 26 Revenues Mar 28 Expenditures and Expenses Apr 2 Capital Projects and Debt Service Apr 4 Capital Assets and Long-Term Investments Apr 9 Long Term Obligations Apr 11 Business-Type Activities and Internal Service Apr 16 Permanent Funds and Fiduciary Funds Apr 18 Case: Comparing Ohio and Kentucky