Fisher College of Business AMIS 4220 Nonprofit and Governmental Accounting Spring 2014

advertisement

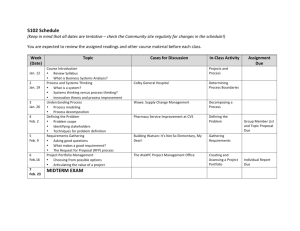

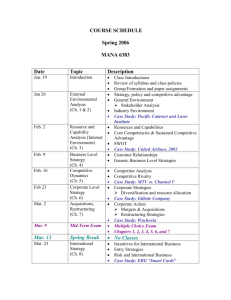

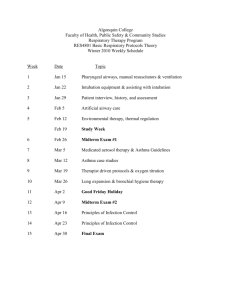

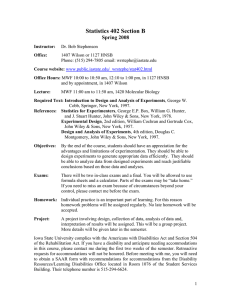

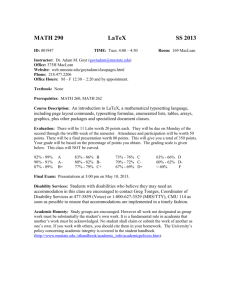

Fisher College of Business AMIS 4220 Nonprofit and Governmental Accounting Spring 2014 Instructor: Brian Mittendorf Room 454, Fisher Hall Phone: 292-1720 Email: mittendorf.3@osu.edu Office Hours: Tuesday/Thursday 10:00-11:00 and by appointment Course Description: This course centers on financial aspects of nonprofit and governmental organizations, beginning with their financial reports. The course focuses on (1) the financial reporting concepts and standards that are applicable to nonprofit and governmental organizations; (2) ratio and other summary indicators used to evaluate the financial condition and financial performance of nonprofit and governmental organizations; and (3) the analysis and interpretation of financial statements of selected nonprofit and governmental organizations. Optional Supplementary Textbooks: Not-for-Profit Accounting Made Easy, Ruppel, Wiley Governmental Accounting Made Easy, Ruppel, Wiley Core Concepts of Government and Not-For-Profit Accounting, Granof and Wardlow, Wiley Course Format: Class sessions will consist of lectures and case discussions. The first part of the course will rely heavily on lectures of accounting concepts for nonprofit organizations. The second part of the course will focus on the accounting concepts of governmental organizations. Case Assignment: Students are expected to form groups of four or five by the second week of class. Please confirm your group composition by emailing the group list to the instructor. Each group will choose a nonprofit on which to focus. The groups will prepare a short presentation and lead a discussion on the financial issues facing this organization at the completion of the nonprofit portion of the course. Quizzes: Throughout the semester, students will be required to complete five miniquizzes posted on Carmen. The quizzes are open book and open notes but must be completed individually. Final Exam: The final exam is an individual take-home assignment that will be distributed in the final weeks of the semester. The assignment consists of financial statements for two organizations. The student is expected to prepare a written analysis of the financial performance and outlook of the two organizations. This write-up should employ many of the concepts included in the course and should be 6-12 pages. Grading: 25% -- attendance and participation 25% -- quizzes 25% -- group assignment 25% -- take-home final Schedule: Class/Day Topic Jan 7 Course overview and introduction to nonprofit accounting Jan 9 No In-class session – See Materials on Carmen Jan 14 Accounting differences between for profit and nonprofit; Financial Statement Analysis Jan 16 Receivables and Contributions Fundraising Activities Jan 21 Split Interest Agreements Jan 23 Investments and Investment Income Jan 28 Debt and Interest Payments Jan 30 Affiliated Organizations Feb 4 Cost Allocation Feb 6 Pensions and Leases Feb 11 Foundations Feb 13 Museums Health and Welfare Organizations Feb 18 Heath Care Providers Colleges and Universities Feb 20 Group Presentations Feb 25 Group Presentations Feb 27 Group Presentations Mar 4 Group Presentations Mar 6 Group Presentations Mar 11 No Class – Spring Break Mar 13 No Class – Spring Break Mar 18 Overview of Governmental Accounting; Accounting differences between governmental and non-profit entities Mar 20 Fund Accounting and Governmental Financial Statements Mar 25 Revenues Mar 27 Expenditures and Expenses Apr 1 Capital Projects and Debt Service Apr 3 Capital Assets and Long-Term Investments Apr 8 Long Term Obligations Apr 10 Business-Type Activities and Internal Service Apr 15 Permanent Funds and Fiduciary Funds Apr 17 Case: Comparing Ohio and Kentucky