Business Model Transformation for the International

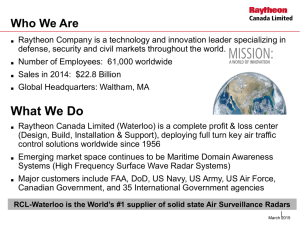

advertisement