Storage and Capacity Rights Markets in the Natural Gas Industry by

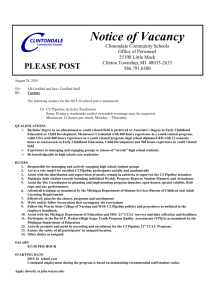

advertisement