T E C F

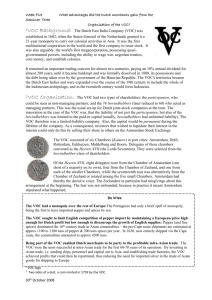

advertisement