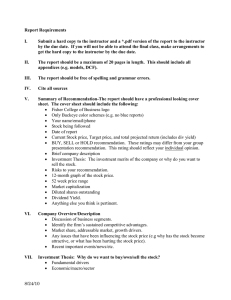

Company Presentation May 31, 2011 Tim Williamson Jiang Zhu

advertisement

Company Presentation May 31, 2011 Tim Williamson Jiang Zhu Agenda • • • • • • Sector Summary NII Holding Analysis Verizon Analysis VimpelCom Analysis Conclusion Recap of Recommendations Sector Holdings Current SIM Weighting Telecom 4.19% Target SIM weighting Telecom 2.98% Target Prices Company Current Price Target Price Dividend Upside or Downside NIHD $43.41 $58 N/A +34% VZ $36.67 $35 5.3% -5% VIP $13.79 $21 2.1% +53% NIHD Overview • Founded in 1995 as Nextel International, Inc. in Virginia and changed its name to NII Holdings, Inc. in December 2001 • Providing integrated wireless communication services only in Latin American markets • Currently operating in Argentina, Brazil, Mexico, Peru and Chile NIHD Business Analysis • Market Cap of $7.12b • Cyclical; Beta of 1.92 • Company in good shape – – – – Relatively high growth Relatively high leverage: D/A=59% High liquidity: Current ratio=2.25 High efficiency: Gross margin=60% NII’s Segment Information Handsets in commercial service (in thousands) Country 2010 2009 Brazil 3,319 2,483 2009 (inside) & 2010 (outside) segment revenue composition 6% 12% 6% 10% Mexico 3,361 2,987 Argentina 1,154 1,030 Peru 1,128 841 Chile 65 44 Total 9,027 7,385 40% 46% 38% 42% Brazil Mexico Argentina Peru Chile NIHD Financial Analysis Sales Growth Rate Sales 45.00% 10,000,000 9,000,000 40.00% 8,000,000 35.00% 7,000,000 30.00% 6,000,000 25.00% 5,000,000 20.00% 4,000,000 15.00% 3,000,000 10.00% 2,000,000 5.00% 1,000,000 0.00% 0 2006 2007 2008 2009 2010 2011E 2012E 2013E 2007 2008 2009 2010 2011E 2012E 2013E NIHD DCF Analysis Discount rate: 11% Terminal FCF growth: 4.75% Target Price: $55.25 Undervalued 27% NIHD Sensitivity Analysis Terminal FCF Growth NIHD Price Discount Rate 9.00% 9.50% 10.00% 10.50% 11.00% 11.50% 12.00% 3.00% 65.27 59.77 55.06 50.99 47.44 44.31 41.54 3.50% 69.25 63.00 57.72 53.2 49.3 45.89 42.89 4.00% 74.03 66.82 60.82 55.75 51.42 47.67 44.40 4.50% 79.87 71.40 64.49 58.73 53.87 49.71 46.12 5.00% 87.17 77.01 68.89 62.25 56.73 52.07 48.08 5.50% 96.55 84.01 74.24 66.48 60.11 54.82 50.34 NIHD Valuation Analysis Absolute Valuation High Low B. C. A. Median Current D. #Your Target Multiple E. F. *Your Target E, S, B, etc/Share G. Your Target Price (F x G) H. P/Forward E 34.3 6.7 17.6 15.3 17 2.6 44.2 P/S 5.6 0.5 2.5 1.2 2 37.9 75.8 P/B 16.8 1.2 7.9 2.2 5 16.4 82 P/EBITDA P/CF 20.86 32.8 0.17 2.7 7.84 12.4 4.49 7.5 6 11 9.3 6.6 55.8 72.6 Average price based on multiples: $66 Weighted price under DCF and multiple method (75% on DCF & 25% on multiples): Final Target Price $58 (undervalued 34%) Potential Catalysts & Risks Catalysts • Global economic recovery Risks • Exchange rates • Growth of emerging markets • Possible double dip recession • Expansion of 3G and 4G markets • Regulation limit by foreign governments Foreign currency to USD Argentine Peso to USD Verizon Overview Currently the largest mobile provider in the U.S. Second biggest company in Telecom-Domestic industry Two major business lines: • Domestic wireless Offers voice and data services in addition to device sales for use on its vast network that covers 292 million Americans. • Wireline Provides voice, Internet, broadband, IP network, long distance, and various other services to consumers in the United States, as well as to businesses, governments, and carriers both in the U.S. and in 150 countries around the globe. VZ Business Analysis • Market Cap of $103.6b • Beta: 0.57 • Company has reached mature phase – Growth rate of wireless segment is declining – Wireline provides little to no growth prospects • Economic factors affecting potential growth – GDP growth – Consumer confidence – Unemployment rate VZ DCF Model Discount rate: 9.5% Terminal FCF growth: 1% Target Price: $35.70 Overvalued 2.65% VZ Valuation Analysis Absolute Valuation High Low Median Current Target Multiple Target Value Target Share Price P/Forward E 17.3 8.2 12.7 14.13 14.12 2.35 33.23 P/S 2.1 0.7 1.2 0.99 0.96 37.15 35.66 P/B 3.9 1.5 2.4 2.71 2.6 13.64 35.46 P/EBITDA 5.85 2.8 3.76 3.75 3.7 9.6 35.52 P/CF 6.7 3.1 4.3 4.6 4.3 8.1 34.83 Average Price: $35 Weighted Price under DCF and Multiple method (75% on DCF & 25% on multiples): Final Target Price $35 (overvalued 5%) VZ Summary Catalysts: Risks: • • • • 4G LTE rollout is ahead of schedule Apple iPhone now available on Verizon network Smartphone penetration and data sales continue to climb • • Wireline segment is in a state of serious decline moving toward obsolesence Regulatory environment setup to keep competition in the marketplace Wireless segment is moving toward the mature stage VimpelCom Ltd (VIP) • Market Cap: 17.81B • Industry: Wireless Communications • Provides voice and data services mainly in the nations of the former Soviet Union, but also in Europe, Asia, and Africa • Second largest mobile carrier in Russia with better growth prospects than MTS • Went public on NYSE in 2010 VIP Relative to S&P 500 P/Trailing E High Low Median Current .96 .63 .75 .74 P/Forward E .6 .59 .6 .6 P/B 1.0 .1 .8 .7 P/S 1.6 .2 .2 1.6 P/CF 1.1 .1 .2 1.1 VIP Discount rate: 14% Terminal FCF growth: 4% Target Price: $23.24 Undervalued 68.56% VIP Absolute Valuation High Low Median Current Target Target E, Multiple S, B, etc/Shar e 12 1.38 Target Price (F x G) P/Forward E 13.7 9.5 11.0 10.4 P/S 2.1 .3 .3 2.1 2.1 10.28 21.59 P/B 2.1 .2 1.7 1.6 2 8.96 17.92 16.56 Average Price: $19 Weighted Price under DCF and Multiple method (75% on DCF & 25% on multiples): $21 (undervalued 53%) Stocks in Comparison Conclusion Options: • Sell 119 bps of NIHD to take SIM holding to 3% Or • Allocate some of the excess funds back to Telecom and: Keep NIHD at current weight Or Take SIM to 400 bps and hold 200 each of NIHD and VIP Q&A