UTILITIES LUKE FRIEDMAN & GENO FRIS S ORA

advertisement

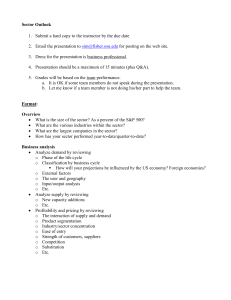

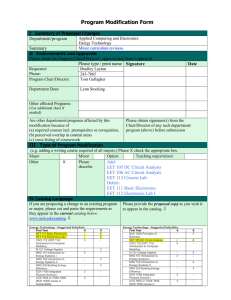

UTILITIES LUKE FRIEDMAN & GENO FRISSORA RECAP RECOMMENDED ADDING 23 BP TO UTILITIES Utilities 3.34% Utilities 3.57% SIM Weighting Materials 3.40% Telecom 3.53% Industrials 9.78% Materials 3.73% Technology 21.22% Consumer Discretionary 7.46% Financials 12.27% Consumer Staples 11.98% Energy 11.13% Health Care 13.19% S&P Weighting Technology Financials Energy Health Care Consumer Staples Consumer Discretionary Industrials Utilities Materials Telecom Telecom 2.73% Industrials 10.95% Technology 19.60% Consumer Discretionary 10.83% Financials 14.11% Consumer Staples 10.87% Energy 11.92% Health Care 11.69% Technology Financials Energy Health Care Consumer Staples Consumer Discretionary Industrials Utilities Materials Telecom POSITIONS Current Positions • XEL – Xcel Energy Inc. (SELL) • PPL – PP&L Corporation (SELL) Recommendations • NRG – NRG Energy Inc. (BUY) • BIP – Brookfield Infrastructure Partners (BUY) XCEL ENERGY INC .( X E L) Overview • Energy Transmission and Generation via Electricity (82% of Rev) and Natural Gas (17% of Rev) • Operates in 8 different states across the U.S. • Ex. Minnesota, Colorado and New Mexico • Operating Revenue last year of $10.3 B • Net Income last year of $756 M • Dividend of 4% Supply Factors • Potential Legislation • Ex. Cross State Air Pollution Rule (CSAPR) • Commodity Prices difficult to predict Demand Factors • General Population • Programs to reduce domestic demand Gross Margins • Excellent at 50% Performance to date has been good X EL VS. S& P 500 • Fairly Consistent prior to August • Room for correction • XEL Flat-lining X EL DISCOU NT E D CA SH FLOW A NA LYSIS Assumptions • 4% Revenue Growth • 5% Earnings Growth • Ve r y h i g h e a r m a r k e d c a p i t a l expenditures • Decreases Cash Flow • Good Gross Margins • Te r m i n a l D i s c o u n t v a l u e o f 9% • Te r m i n a l F C F G r o w t h r a t e o f 3.5% • I m p l i e d E q u i t y Va l u e o f 35.3% X EL RELATIVE VALUATION Relatively expensive compared to the Industry Tr a d i n g a t a P r e m i u m • Relatively expensive compared to the S&P 500 • Tr a d i n g a t a Premium X EL A BSOLUTE VA LUAT ION OVERPRICED! Valuation Type P/Forward E P/S P/B P/EBITDA P/CF Analyst Median Analyst Mean DCF Weight 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% Valuation 24.21 20.82 23.20 21.80 20.31 27.00 27.50 17.12 Weighted Value 3.03 2.60 2.90 2.73 2.54 3.38 3.44 2.14 22.75 P P L OVERVIEW Overview • Provides diversified power generation and transmission • Operates in the Northeastern US, Montana, and the UK • Operating Revenue last year of $3.026 B • Net Income last year of $1.594 B • Dividend of 5% Fundamental Positives • Pennsylvania State Rate Cap removed • Low input costs due to generation operations • Good growth opportunities from recent acquisitions Fundamental Negatives • Extremely high capex over the coming years • • High degree of share dilution • • 26% of expected revenue in next two years 53% new shares issues since 2009 Goodwill of $5.179 B on balance sheet • Representing 12% of assets P P L VS. S& P 500 •Outperformed the S&P •Expected mean reversion •Likely range bound P P L DISCO U NT E D CA SH FLOW A NA LYSIS Assumptions • Optimistic Revenue Forecast with growth falling from 13% - 4% • Earnings Growth around 5% • Capex falling from 26.5% to 14% • Negative Free Cash Flow • Operating margins at 20% • Terminal Discount value of 9.5% • Terminal FCF Growth rate of 3% • Implied Equity Value of $30.59 • 7.1% upside P P L RELATIVE VALUATION Relative to Industry P/Trailing E P/Forward E P/B P/S P/CF Relative to S&P 500 P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 1.5 1.5 1.6 1.7 1.8 .68 .63 1.0 .9 .8 1.1 .95 1.3 1.1 1.5 .79 .88 1.0 .9 .8 High Low Median Current 1.3 1.7 1.5 2.6 1.4 .53 .49 .6 .9 .6 .95 .99 1.0 1.4 1.0 .78 .91 .7 1.0 .6 • Valuations all on low end • Looks undervalued • Could be due to fundamental concerns • Share dilution not shown by these metrics • More toward median levels with S&P • Still looks undervalued • Share dilution not shown by these metrics P P L A BSOLUTE VA LUAT ION Absolute Valuation A. P/Forward E P/S P/B P/EBITDA P/CF High B. 21.6 3.0 3.9 9.41 15.0 Low C. 7.4 1.1 1.4 3.32 5.1 Median D. 12.3 1.5 2.1 6.37 9.0 Current E. 12.2 1.3 1.5 3.71 5.9 #Your Target Multiple F. 12.3 1.4 1.7 5.0 6.5 *Your Target E, S, B, etc/Sha re G. $2.33 $21.89 $18.97 $7.67 $4.82 Current Price = $28.40 Discounted Cash Flows = $30.59 Implied Upside = 7.7% Your Target Price (F x G) H. $28.66 $30.65 $32.25 $38.35 $31.33 •Fairly Valued •P/B distorted because of high amount of Goodwill •P/EBITDA does not include interest expense NRG OVERVIEW Overview • Diverse Power Generation Portfolios including Natural Gas • Operating Revenue last year of $8.85 B • Net Income last year of $476 M • Recently announced a 2% dividend for first time Supply Factors • Commodities, specifically Natural Gas Gross Margins • 32 % UNDERVALUED! NRG Fairly high negative correlation with the capacity of Electric and Natural Gas Utilities NRG Fairly high negative correlation with the production of Oil and Natural Gas NRG Fairly high correlation with the price the firm charges for Natural Gas NRG VS. S& P 500 Looks to be undervalued compared to the S&P 500 NRG DISCOU NTE D CA SH FLOW A NALYSIS Assumptions • 0% Revenue Growth a f t e r 2 01 2 ( E x t r e m e l y conservative) • Decent Gross Margins • Price of Natural Gas • Te r m i n a l D i s c o u n t value of 9% • Te r m i n a l F C F G r o w t h rate of 3.5% • I m p l i e d E q u i t y Va l u e o f 6 7. 2 % BIP OVERVIEW Overview • Operates in Utilities, Transports & Energy, and Timber • Transports include: Pipelines, Rail & Port construction etc. • Exposure to Global Infrastructure • Operating Revenue last year of $803 M • Net Income last year of $187 M • Dividend of 5.1% • Planned distribution growth of 3-7% Income • • • • 80% of cash flow regulated or contractual Transmits electricity to 98% of Chile Current $600 M Australian Railroad project 419,000 acres of Timberland • Exports to Asia increased 47% in 2011 Growth • $5 B of potential organic growth projects under consideration Gross Margins • Excellent at 48.1% BIP VS. S& P •Outperformed the S&P •Reasonably new company with great earnings potential •Lots of room to grow BIP DISCO U NTE D CA SH FLOW A NA LYSIS Assumptions •15% Revenue Growth •2027% in 2010 •158% in 2011 •32% Operating margin •20% Tax Rate •Capex falling from 10% to 7% •Dep. Rising fom 3.2% to 7% •Terminal Disc. Rate at 11% •Terminal FCF Growth 4% •Implied Equity value $36.04 •20.2% upside RECOMMENDATIONS • NRG – ADD 232 BP • Undervalued • Natural Gas correlation is very high (inexpensive) • BIP– ADD 125 BP • High Growth Revenues • Undervalued due to expected growth • Highly diversified WHAT QUESTIONS DO YOU HAVE?