Document 11002326

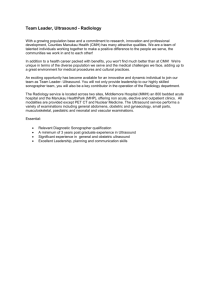

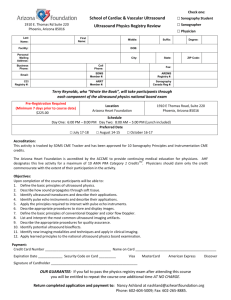

advertisement