Lecture Notes Belo, Xue, and Zhang (2013, Review of Financial Lu Zhang

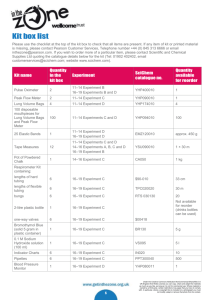

advertisement

Lecture Notes

Belo, Xue, and Zhang (2013, Review of Financial

Studies): A Supply Approach to Valuation

Lu Zhang1

1 The

Ohio State University

and NBER

BUSFIN 8250: Advanced Asset Pricing

Autumn 2013, Ohio State

Theme

A supply approach to valuation

Motivation

Cochrane (2011, “Presidential address: Discount rate”)

“[W]e have to answer the central question, what is the

source of price variation? When did our field stop being

‘asset pricing’ and become ‘asset expected returning’ ?

Why are betas exogenous? A lot of price variation comes

from discount-factor news. What sense does it make to

‘explain’ expected returns by the covariation of expected

return shocks with market market return shocks?

Market-to-book ratios should be our left-hand variable,

the thing we are trying to explain, not a sorting

characteristic for expected returns (p. 1063, our

emphasis).”

Motivation

What determines equity valuation? Immensely important

The standard demand approach to valuation:

Pit = Et

∞

X

4t=1

∞

X

Dit+4t

Yit+4t − dBit+4t

⇔ Pit = Et

1 + Rit+4t

1 + Rit+4t

4t=1

Accounting-based valuation, standard b-school curriculum:

Ohlson (1995), Lundholm and Sloan (2007), Penman (2010)

We explore the supply approach to valuation:

Pit = Qit Kit+1 − Bit+1

in which

Qit = f

Iit

,θ

Kit

Motivation

The supply versus demand approach to valuation

Parsimony:

Investment-to-capital as the only input

No need to estimate the discount rate

No terminal valuation assumptions

Reliability:

“Structural” parameters are likely more stable than

nonstructural parameters

Weakness: Only portfolio-level estimation, firm-level analysis

upcoming

Motivation

Weaknesses with the demand approach

Penman (2010, p. 666):

“Compound the error in beta and the error in the risk

premium and you have a considerable problem. The

CAPM, even if true, is quite imprecise when applied. Let’s

be honest with ourselves: No one knows what the market

risk premium is. And adopting multifactor pricing models

adds more risk premiums and betas to estimate. These

models contain a strong element of smoke and mirrors.”

Outline

1 The Model

2 Econometric Methodology

3 Empirical Results

4 Summary, Interpretation, and Future Work

Outline

1 The Model

2 Econometric Methodology

3 Empirical Results

4 Summary, Interpretation, and Future Work

The Model

The neoclassical investment model

Operating profits, Π(Kit , Xit ), constant returns to scale

Convex adjustment costs:

Φ(Iit , Kit ) =

1

ν

η

Iit

Kit

ν

Kit

B

One-period debt, Bit+1 , with pretax corporate bond return rit+1

Ba = r B

B

and after-tax corporate bond return: rit+1

it+1 − (rit+1 − 1)τt+1

Mt+1 : the pricing kernel, correlated with Xit+1

Firms maximize the cum-dividend market value of the equity

The Model

The valuation equation

"

Pit + Bit+1 = 1 + (1 − τt )η

Pit : ex-dividend market equity

Bit+1 : market value of debt

Kit+1 : capital

ν

Iit

Kit

ν−1 #

Kit+1

The Model

The investment Euler equation

ν−1

Iit

1 + (1 − τt )η ν

=

Kit

h

i

Yit+1

Iit+1 ν

ν−1

(1 − τt+1 ) κ K

+

η

+

δ

τ

it+1 t+1

ν

Kit+1

it+1

ν−1

Et Mt+1

Iit+1

ν

+(1 − δit+1 ) 1 + (1 − τt+1 )η Kit+1

The Model

The investment return = the WACC:

I

Ba

S

rit+1

= wit rit+1

+ (1 − wit )rit+1

Marginal benefits of investment at time t+1

z

}|

Yit+1

ν−1

Iit+1 ν

(1 − τt+1 ) κ

+

η

Kit+1

ν

Kit+1

|

{z

}

Marginal product plus economy

of

scale

(net

of

taxes)

"

#

Iit+1 ν−1

ν

+τt+1 δit+1 + (1 − δit+1 ) 1 + (1 − τt+1 )η

Kit+1

|

{z

}

I

rit+1

≡

1 + (1

|

Expected continuation value

ν−1

Iit

− τt )η ν

Kit

{z

}

Marginal costs of investment at time t

{

Outline

1 The Model

2 Econometric Methodology

3 Empirical Results

4 Summary, Interpretation, and Future Work

Econometric Methodology

Valuation tests

Test if the average Tobin’s q observed in the data equals the

average q predicted in the model:

"

#

ν−1 !

Iit

Kit+1

ν

E qit − 1 + (1 − τt )η

=0

Kit

Ait

in which qit ≡ (Pit + Bit+1 )/Ait

Econometric Methodology

Comparison with investment regressions

Matching average Tobin’s q differs critically from investment

regressions:

Portfolio level estimation mitigates the impact of measurement

errors in q

Average q moments alleviate the impact of temporal

misalignment between investment and q

Flexible adjustment costs allow nonlinear marginal costs of

investment

Econometric Methodology

Joint estimation of valuation moments and expected return

moments

Test whether the average stock return equals the average levered

investment return:

h

i

S

Iw

− rit+1

=0

E rit+1

in which

Iw

rit+1

≡

I

Ba

rit+1

− wit rit+1

1 − wit

Econometric Methodology

Joint estimation of valuation moments and the investment Euler

equation moments

E

ν−1

1 + (1 − τt )η ν KIitit

−

h

ν i

Yit+1

I

(1 − τt+1 ) κ Kit+1 + ν−1

η Kit+1

+ δit+1 τt+1

ν

it+1

ν−1 Iit+1

ν

+(1 − δit+1 ) 1 + (1 − τt+1 )η Kit+1

Ba +(1−w )r S

wit rit+1

it it+1

Kit+1

Ait = 0.

Econometric Methodology

Tobin’s q deciles as testing assets

Ait : Total assets

Kit : Net property, plant, and equipment

Iit : Capital expenditure minus sales of property, plant, and

equipment

Yit : Sales

Bit : Long-term debt and short-term debt

Pit : Market value of common equity

δit : Depreciation divided by capital

B : Impute bond ratings, assign corporate bond returns of a

rit+1

given rating to all firms with the same rating

Outline

1 The Model

2 Econometric Methodology

3 Empirical Results

4 Summary, Interpretation, and Future Work

Empirical Results

Descriptive statistics

Mean Low

qit

Iit

Kit

Kit+1

Ait

2

3

4

5

6

7

8

9 High H−L

[t]

1.56 0.44 0.65 0.77 0.89 1.02 1.19 1.43 1.80 2.52 4.94 4.50 12.11

0.22 0.15 0.16 0.16 0.17 0.18 0.20 0.22 0.25 0.29 0.39 0.24 14.70

0.43 0.30 0.40 0.44 0.46 0.48 0.49 0.49 0.47 0.41 0.40 0.10 3.44

Empirical Results

Parameter estimates and overidentification tests

Panel A: Point estimates and the χ2 tests

η

[t]

4.15 18.64

[t]

pν=2

Φ/Y |eiq |

3.75 18.62

0.00

4.78 0.07

ν

χ2 d.f.

7.63

pχ2

8

0.47

9

High H−L

Panel B: Valuation errors for individual deciles

Low

eiq

[t]

2

3

4

5

6

7

8

−0.10 −0.11 −0.06 −0.03 −0.05 −0.03 0.01 −0.05 0.24 −0.05 0.05

−1.77 −2.18 −1.49 −0.90 −1.20 −0.93 0.23 −0.80 1.83 −1.88 1.21

Empirical Results

Predicted Tobin’s q versus realized Tobin’s q

5

10

Predicted

4

3

9

2

8

1

1

0

0

56

4

23

1

7

2

3

Realized

4

5

Empirical Results

9

9

8

8

7

7

6

6

Predicted

Predicted

Predicted q versus realized q, Tobin’s q deciles within the low

and the high terciles split by the Size-age index

5

4

10

5

3

2

2

4

6

Realized

8

9

4

3

9

8

7

1 23456

1

0

0

2

10

7

6

5

1

4

123

0

0

2

8

4

6

Realized

8

Empirical Results

9

9

8

8

7

7

6

6

Predicted

Predicted

Predicted q versus realized q, Tobin’s q deciles within the low

and the high terciles split by idiosyncratic volatility

5

4

10

3

0

0

5

4

9

3

2

1

10

7

3456

12

9

8

1

2

8

2

4

6

Realized

8

0

0

5

1234

67

2

4

6

Realized

8

Empirical Results

9

9

8

8

7

7

6

6

5

Predicted

Predicted

Predicted q versus realized q, Tobin’s q deciles within the low

and the high terciles split by cash flows

10

4

3

9

4

3

9

8

3 56 7

1 12 4

2

8

7

1 456

123

0

0

2

10

5

2

4

6

Realized

8

0

0

2

4

6

Realized

8

Empirical Results

9

9

8

8

7

7

6

6

Predicted

Predicted

Predicted q versus realized q, Tobin’s q deciles within the low

and the high terciles split by lagged investment

5

4

10

3

2

1

0

0

5

4

3

9

2

7

0

0

2

56

1 1234

678

345

2

1

2

10

4

6

Realized

8

8

9

4

6

Realized

8

Empirical Results

Predicted q versus realized q, Tobin’s q deciles, joint estimation

of valuation moments and expected return moments

35

5

30

25

Predicted

Predicted

4

3

9

2

1

0

0

1

10

6 4

20

7

32

15

8

56

34

12

1

7

8

10

5

10 9

5

2

3

4

5

0

0

5

10

15

20

25

30

35

Empirical Results

Predicted q versus realized q, Tobin’s q deciles, joint estimation

of valuation moments and investment Euler equation moments

10

4

Predicted

Marginal benefits of investment

5

3

9

2

1

0

0

56

34

2

1

1

7

8

2

3

Realized

4

5

5

4

10

3

9

2

7

1

6

45

3

2

1

0

0

1

8

2

3

4

Marginal costs of investment

5

Empirical Results

Predicted q versus realized q, 10 and 20 portfolios formed on

Tobin’s q, quadratic and nonquadratic adjustment costs

5

7

10

20

6

4

20

10

3

8

7

56

2

4 8

23 7

1 1 456

23

1

0

0

1

2

9

9

3

Realized

4

5

Predicted

Predicted

5

4

1617 18 19

131415

12

19

11

910

8

2 4567

1617 18

23 131415

12

11

1 1 5678910

324

1

3

0

0

2

4

Realized

6

Empirical Results

Predicted q versus realized q, 50 and 100 portfolios formed on

Tobin’s q, quadratic and nonquadratic adjustment costs

15

16

100

14

50

50

4748

4

6

40

45

43

39

3841

4244

35

37

36

31

30

29

34

32

33

24

47

28

27

26

22

23

21

25

18

20

19

15

170 4546 48

13

14

16

12

40

43

42356789111

3941

4244

38

37

35

36

31

32

29

34

30

33

28

24

27

26

123456789111

22

25

21

23

20

19

18

15

17

16

13

12

14

0

01

5

0

5

49

49

10

100

12

Predicted

Predicted

10

15

99

99

10

97

98

93949697

6

8991

929596 98

80

77

86

78

85

83

88

79

81

87

90

84

82

74

76

72

65

75

71

69

70

73

60

63

4 43

68

61

62

52

57

66

64

56

67

58

53

47

54

59

48

55

46

44

50

39

45

35

41

51

939495

42

49

36

29

37

38

40

32

30

33

25

34

27

26

24

31

23

28

17

18

16

19

14

22

15

20

91

21

92

89

9

1

0

80

7

11

4

12

13

86

8890

2 3568 65

83

79

85

81

78

77

84

87

82

71

75

74

76

73

69

72

62

63

60

70

61

68

56

57

66

52

64

12479111

67

58

59

55

54

53

47

50

43

48

45

39

44

46

41

42

35

51

49

32

37

38

40

29

36

30

33

34

25

27

26

24

14

31

17

16

15

23

19

18

28

20

22

21

0

12

13

8

5

6

0 123

8

0

5

10

15

Empirical Results

Tobin’s q quintiles, industry-specific estimation

Autos

Books

6

BusEq

6

4

4

2

0

0

2

4

6

2

34

12

0

0

2

Clths

0

4

6

4

0

0

0

2

4

6

0

2

4

6

0

0

1

4

2 3

4

6

2

6

4

123

0

0

2

123

0

4

6

0

Steel

6

4

4

1234

0

0

4

6

0

2

6

12

0

4

6

5

123

6

5

2

4

12

0

2

4

6

3 4

0

2

4

6

Whlsl

6

4

2

0

5

2

5

1234

0

6

4

4

Txtls

1234

4

2

Servs

5

0

4

2

0

6

0

6

6

0

3 4

Rtail

4

0

4

6

5

2

2

2

4

4

4

0

6

2

4

123

0

2

6

5

2

2

5

Trans

5

2

5

4

0

Mines

4

123

0

4

123

0

Telcm

6

2

6

6

4

0

4

4

6

2

4

2

2

6

2

4

5

2

0

4

4

2

6

34

12

Meals

6

4

5

2

0

4

5

2

0

Paper

6

4

6

5

3

12

Other

6

4

2

4

5

4

123

0

2

0

Food

6

2

4

6

4

6

0

0

Oil

4

6

2

4

2

2

Hshld

0

2

0

5

4

4

0

FabPr

34

12

Hlth

5

123

6

5

2

6

4

4

5

34

12

0

6

0

Games

6

2

2

2

5

ElcEq

5

4

123

1234

0

4

2

4

2

6

4

5

123 4

6

4

3 4

0

6

2

12

Cnstr

6

Chems

6

5

4

5

2

5

1234

Carry

6

1234

0

2

4

6

0

2

4

6

Outline

1 The Model

2 Econometric Methodology

3 Empirical Results

4 Summary, Interpretation, and Future Work

Conclusion

The market value of equity and investment data are well aligned on

average at the portfolio level

Interpretation: A supply approach to valuation

Future work: Firm level estimation, nonconvexity, financial frictions,

labor, intangible capital...