ECONOMIC GROWTH AND TAX POLICY

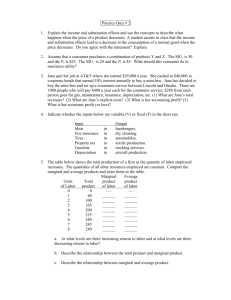

advertisement