Federal Income Taxation Chapter 7 Receipt Subject to Offsetting Liability Professors Wells

advertisement

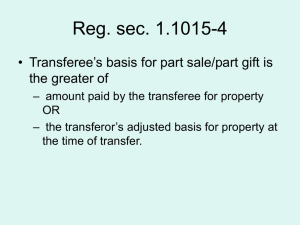

Presentation: Federal Income Taxation Chapter 7 Receipt Subject to Offsetting Liability Professors Wells September 21, 2015 Transactions with Borrowed Funds p.437 No income realized upon the receipt of loan proceeds. Why? No “accession to wealth”? Remember personal balance sheet calculation: Assets minus liabilities = net worth When borrowing occurs what happens to (1) assets and (2) liabilities on one’s personal balance sheet? Deduction when loan repaid? No. 2 Debt Cancellation p. 437 What income tax treatment occurs when debt is cancelled by the lender (rather than being repaid)? Does an accession to wealth arise? United States v. Kirby Lumber 3 Debt Cancellation: Relief Provisions p.439 What income tax treatment occurs when debt is cancelled by the lender (rather than being repaid)? Does an accession to wealth arise? See §61(a)(12) providing that cancellation of indebtedness income is included in gross income. But is this always the case? Note 1 (p.441): a) A promises to make a gift to her son. Her son releases her from the promise. b) B promises to make a $1,000 contribution to a church. Subsequently the church agrees to accept $500 in full satisfaction of the pledge. c) C Corporation issues bonds in payment of a dividend. It subsequently buys back the bonds for 90 cents on the dollar. d) D receives a bill from his lawyer for $1,000. In the following year, D complains about the bill and the lawyer agrees to accept $600 instead of $1,000. e) H had borrowed $100,000 from a bank. In order to improve H’s credit standing, the bank surrendered H’s note in exchange for a $100,000 note executed by H’s wife, W. Later the bank sold W’s note to H’s brother, X, for $50,000. X obtained the funds for the purchase from H and W 4 and tore up the note immediately after buying it. Code §108 Insolvency / Bankruptcy Exceptions p.439 §108(a)(1)(A): exception to §61(a)(12) for debt cancelled in bankruptcy. §108(a)(1)(B): an exception from §61(a)(12) for debt cancelled to the extent of taxpayer’s insolvency. But, §108(b) requires tax attribute reduction including potential basis reduction under §1017. Question: Do you see for symmetry reasons we must have attribute and/or basis reduction if an exception is given for COD Income? 5 Code §108 Purchase Price Reduction p.442 An exception from COD income treatment exists for purchase money debt. Code §108(e)(5) – no COD income resulting from a purchase price reduction. What effect on tax basis of the acquired asset? Cf., a third party rebate and eligibility under §108(e)(5). 6 Student Loan Forgiveness p.442 §108(f)(2) provides GI does not include forgiveness of certain student loans. Student loans as made by US or other government (or an intermediary). Public interest job required? See Rev. Rul. 2008-34 regarding law school loan forgiveness programs. 7 Zarin case Gambling Debt Compromised p.442 Discharge of gambling indebtedness. Taxpayer delivered his personal checks for $3.435 million and the checks were invalid. State court collection action was filed. Settled action for $500,000 and IRS asserts $2.9 million COD income to the taxpayer. Was the debt enforceable???? Tax Court: Inclusion as debt cancellation income (but reversed on appeal). Note: Tannenwald dissent – no genuine debt. 3rd Circuit reverses Tax Court and treats the cancelled debt as a disputed debt or a contested liability. Treated as if the initial loan were for the eventual settled amount. 8 Claim of Right Doctrine p.453 North American Oil Consolidated v. Burnet FACTS: In 1916, $171,979.22 placed with receiver. In 1917, funds paid to taxpayer but government continues to contest liability. In 1922, government claims are terminated. Tax Rates: 1916: 2% 1917: 6% plus 20%-60% surtax 1922: 12.5% with no surtax Issue: When are the funds taxable to North American Oil Consolidated? 1) Taxpayer receives earnings under a “claim or right” (and, therefore, to be included in gross income) 2) Deduction if subsequently repaid. 3) What if tax rates changed in the interim? 9 Claim of Right Doctrine United States v. Lewis p.455 Consider: 1) Taxpayer receives earnings under a “claim or right” (and, therefore, to be included in gross income) 2) Deduction if subsequently repaid. 3) What if tax rates changed in the interim? See §1341 re claim of right doctrine (p. 455) 10 Claim of Right Doctrine Alcoa v. United States p.458 FACTS: Alcoa produced waste from 1940-1987. Federal law required environmental clean-up, and Alcoa expended considerable amounts to clean up these sites. Taxpayer Position: claimed that Alcoa was entitled to rely on §1341 to claim the greater of a tax deduction or the higher amount allowed under §1341. IRS: claimed that Alcoa could not satisfy the first or second requirement for eligibility under the provision, i.e., (1) inclusion of an item in gross income under claim of right, and (2) later determination that the taxpayer did not have an unrestricted right to that item (restoration of that item). Court Holding: §1341 was not applicable because Alcoa was not required to restore funds held under claim of right. 11 Embezzled Funds James v. United States p.468 Do proceeds from embezzlement constitute gross income? Note Kirby Lumber (p. 181) that purchase by issuer of its own corporate bonds for less than the issue price constituted GI. But, embezzlement an obligation to repay? James (S. Ct. case) (p.468): unlawful gains are gross income. Note: Only if §501(c)(3) Organization 12 Embezzled Funds McKinney v. United States p.476 Plaintiff embezzled $91,702.06 in 1966, culminating a plan originated in 1956, and he reported that amount as miscellaneous income on his 1966 tax return and paid the tax due on it. Plaintiff was convicted in state court for the crime, and he repaid the embezzled money to his employer in 1969. Issue: Tax treatment in year of repayment. Court said repayment is not part of trade or business. Also, §1341 did not apply because must have a colorable claim of right. Why did government allow a loss deduction under §165(c)(2)? 13 Debt and Property Purchases p.479 What is the effect of debt on the income tax basis of an acquired property? Acquisition debt is to be included in the buyer’s tax basis for acquired property. This can include “seller financing” debt. Also, property can be acquired with debt attached, i.e., either (1) assumed debt, or (2) non-recourse debt, with property subject to debt (but no personal liability). Cf., post-acquisition debt (i.e., borrowing with existing property as collateral). 14 Effect of Debt on Basis and Amount Realized p. 479 Identifying types of debt: 1) Recourse – personal liability 2) Nonrecourse – debt secured only by the pledged asset. Crane case – p. 483 – recourse and nonrecourse debt is treated similarly for federal tax purposes. Here, taxpayer claimed debt (1) in basis but (2) not as amount realized upon disposition/debt relief. 15 Crane v. Commissioner p. 479 Facts: 1932: Property worth $262,042.50 inherited subject to non-recourse debt of $262,042.50 1932-1938: Property depreciated by $28,000 (25,500). 1938: Property sold subject to mortgage ($255,000) + $2,500 cash Taxpayer Position: Amount Realized of $2,500 less Zero Basis. IRS Position: A/R of $257,500 – Basis $233,997.40 = Gain $23,502.60 ($178,997.40 + $55,000) Court Holding: Taxpayer gain is $23,502.60. Relief of mortgage is as real a benefit as the receipt of cash. How do you read Footnote 37? 16 Parker v. Delaney p. 486 How would Justice Magruder have Decided Crane? Facts: 1932: Property worth $262,000 inherited subject to non-recourse debt of $262,000 1932-1938: Property depreciated by $28,000. 1938: Property sold subject to mortgage ($255,000) + $2,500 cash Original&Cost&(§1012) Addition&to&Basis Depreciation&Allowed Adjusted&Basis Amount&Realized Gain&Recognized& Crane&Rule $273,000 $0 C$45,000 $228,000 $259,000 $31,000 Magruder $0 $14,000 C$45,000 C$31,000 $0 $31,000 17 Tufts case Debt Exceeds Property FMV p.491 Facts: Property purchase for $1.85 million nonrecourse debt & initial tax basis of $1.85 mil. $400,000 depreciation claimed. Tax basis is reduced to $1.45 million (§1016). Property FMV at disposition was $1.4 million - $1.850 debt exceeds tax basis and the FMV of the property. Tax issues: Gain or other income? Loss? Tax character? How much? 18 Tufts choices for decision One or Two Transactions? Integrated transaction Two transactions 1.850 debt 1.450 basis 400 gain 1) (capital gain?) OR 2) 1.850 debt relief 1.400 value 450 COD income. 1.450 basis 1.400 value 50 capital loss. 19 Treasury Regulations & Nonrecourse Debt p.496 Reg. §1.1001-2(a)(1) - the amount realized includes the amount of liabilities from which the transferor is discharged. Reg. §1.1001-2(a)(4)(i) - the sale of property that secures a nonrecourse liability discharges the transferor from the liability. Reg. §1.1001-2(b) - the fair market value of the security is not relevant for determining the amount of liabilities being discharged. 20 Rev. Rul. 91-31 Debt Reduction - No Transfer p.501 Lender agreed to reduce the nonrecourse debt when the value of the building ($800,000) was less than the outstanding mortgage debt ($1 million). No insolvency. Reduction of the principal amount of the undersecured nonrecourse debt was made by the holder of debt who was not the seller. This debt reduction constitutes realization of COD income (even in the non-recourse debt context) - since no disposition of the collateral has occurred. 200x COD income. Or, should a tax basis reduction result? 21 Revenue Ruling 90-16 Bifurcation (Supp. pp. 56-57) Acquisition of property with recourse liability, i.e., personal liability. Property was transferred to lender and borrower was released from liability. Debt Property FMV Basis 45x 30x (15x COD income?) 10x (20x property gain?) Foreclosure proceeding: same result. 22 Disposition Hypotheticals Example 1: FMV=$100; R. Debt=$90; Cash=$10; Basis=$50 See Reg. §1.1001-2(a)(1) Example 2: FMV=$100; Non-R. Debt=$90; Cash=$10; Basis=$50 See Reg. §1.1001-2(a)(1) Example 3: FMV=$100; Non-R. Debt=$120; Basis=$50 See Tufts. Example 4: FMV=$100; R. Debt=$120; Basis=$50 See Rev. Rul. 90-16. 23 Woodsam Associates p. 504 Post-acquisition borrowing, using the appreciated property as collateral for a nonrecourse loan. Borrowing in excess of tax basis. Borrowing is not a realization event. 24 Estate of Franklin p.921 Purchase money debt includible in basis? Purchase of motel for only prepaid interest and a nonrecourse debt (with balloon payment). Warranty deed in escrow. Leaseback to sellers & lease payment equal to P&I amount. Value of property not shown, but presumably far less than the promissory note amount. Held: No investment in the property and no depreciation deduction and no interest expense deduction. 25 Pleasant Summit Land p. 926 Different approach than Franklin case. Deprecation deduction allowed to the extent that nonrecourse debt not exceeding FMV of the property – that amount effectively recognized as tax basis on the acquisition. Consider the tax basis to Bayse – the purchaser in the Tufts case. Basis limited as in the Franklin or Pleasant Summit cases? 26 Summary Non-Recourse Recourse 1. Acquisition NR Debt < FMV of Property: NR Debt gives basis (Crane) 1. Acquisition R. Debt gives basis (Crane) NR Debt > FMV. Split Estate of Franklin: Option to Purchase. No basis for NR debt Pleasant Summit Land: NR debt basis to extent of FMV. p.507 2. Post-Acquisition Pledge: No Basis increased in pledged property (Woodsam) 3. Disposal Bifurcated Approach RR 90-16, Reg.§1.1001-2(c) Example (8) 2. Post-Acquisition Pledge: No Basis increase Amt. Realized = FMV of Property in pledged property (Woodsam) COD Income = Debt discharge above FMV 3. Disposal Integrated Approach (Tufts result) 4. Forgiveness of portion of R. Debt: CODI Amt. Realized = NR Debt + Other (Tufts) or does a §108 exception apply? 4. Forgiveness of portion of NR Debt: CODI or does a §108 exception apply? Rev. Rul. 91-31. Gifts of Encumbered Property p.507 Estate of Levine v. Commissioner Gift (FMV= $925,000; B= $485,429.55) Encumbrances: $910,481.34 IRS Position: Gain= $910,481.92 - $485,429.55 = $425,051.79 Taxpayer Position: Crane inapplicable because gift, not sale. 28 Gifts of Encumbered Property Diedrich v. Commissioner p.514 Gift of property subject to an obligation on the donee to pay gift tax arising from the transfer. A satisfaction of a taxpayer’s liability by a 3rd party. Does the donor have (capital gain) income to the extent the gift tax amount paid exceeds tax basis for the transferred property? 29 Question re “Net Gift” Transaction p.517 Gift to Non-Charity Basis=$15x; fmv=$100x. Reg. §1.1001-1(e). • Gift conditioned on donee paying $20x of gift tax. • Gain of $5x ($20x of “amount realized” less $15x of basis) • Donee’s Basis: Greater of Donor Basis ($15x) or Amount Paid ($20x), so $20x. See Reg. §1.1015-4. Gift to Charity Basis=$20x; fmv=$100x. • Sold to charity for $20x. • Gain of $16x (i.e., $20x – [$20x basis * $20x/$100x] = $16x) • Cf., “bargain sale to charity” rule. §1011(b). 30 Review Questions 1. Parent, P, transfers to child, C, shares of stock with a value of $10,000 and a basis of $1,000. No gift tax is payable. P tells C that C is free to do what she wants with the property. C sells the shares. 2. P transfers the shares to C and tells C to sell the shares for her and use the proceeds to pay P’s $10,000 bill at the country club. 3. P transfers the shares to C and tells C that she can do as she wishes with them provided that she pays P’s $10,000 bill at the country club. 4. Same as #3 except that C must pay P’s $10,000 debt to the United States Treasury for income taxes. 5. Would the result have been different if the gift tax liability were imposed on the donee and not the donor? Would it matter whether the donee had funds with which to pay the tax without selling any of the shares? 31