AGENCY COSTS, BALANCE SHEETS AND THE BUSINESS CYCLE

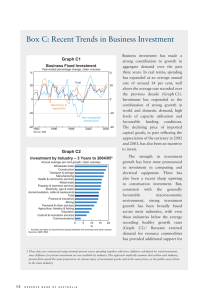

advertisement