FIN 3250 - UW Student Websites

advertisement

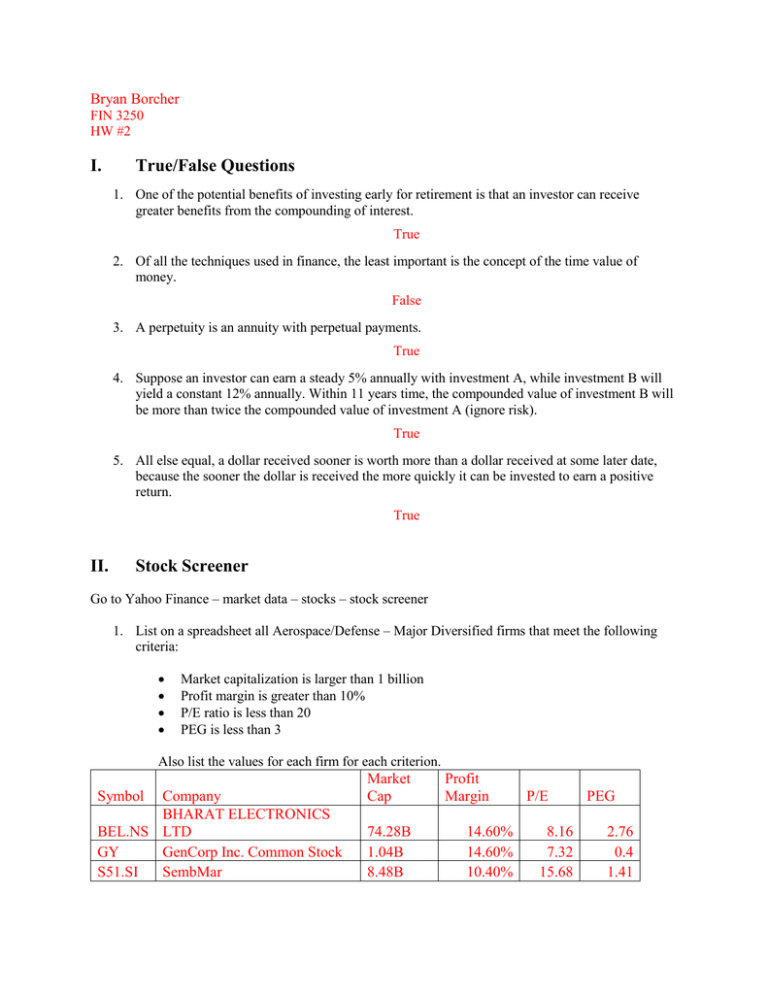

Bryan Borcher FIN 3250 HW #2 I. True/False Questions 1. One of the potential benefits of investing early for retirement is that an investor can receive greater benefits from the compounding of interest. True 2. Of all the techniques used in finance, the least important is the concept of the time value of money. False 3. A perpetuity is an annuity with perpetual payments. True 4. Suppose an investor can earn a steady 5% annually with investment A, while investment B will yield a constant 12% annually. Within 11 years time, the compounded value of investment B will be more than twice the compounded value of investment A (ignore risk). True 5. All else equal, a dollar received sooner is worth more than a dollar received at some later date, because the sooner the dollar is received the more quickly it can be invested to earn a positive return. True II. Stock Screener Go to Yahoo Finance – market data – stocks – stock screener 1. List on a spreadsheet all Aerospace/Defense – Major Diversified firms that meet the following criteria: Market capitalization is larger than 1 billion Profit margin is greater than 10% P/E ratio is less than 20 PEG is less than 3 Also list the values for each firm for each criterion. Symbol Company BHARAT ELECTRONICS BEL.NS LTD GY GenCorp Inc. Common Stock S51.SI SembMar Market Cap 74.28B 1.04B 8.48B Profit Margin 14.60% 14.60% 10.40% P/E 8.16 7.32 15.68 PEG 2.76 0.4 1.41 2. If all else is equal, which firm is the best based on the table? Why? The best firm according to the table is, GenCorp Inc. Common stock, because out of the three it has one of the highest profit margins. The P/E ratio is the lowest which is good because the price is good for the earnings, and the PEG ratio is closest to o which is good cause of the low premium for high growth to come. 3. Boeing is not listed on the table. Use yahoo finance’s reported financials and key statistics to determine why Boeing does not come through the screen. One of the reasons it was not on the list is because the price per earning share is high which means it cost a lot for not much earnings. Also the profit margin is less than 10%, and the PEG ratio is good but is still more than the GenCorp Inc. III. Book Problems Chapter 4, p 70-71 Problems 1, 2, 3, 4, 5, 6, 7, 9, 11, 12, 13, 15, 16, 20 Attached