BFG 201

Money, Central Banking in

India and International

Financial Institutions - I

SPECIAL GROUP : D - Banking and Finance Group

M. Com (M 17) – Part I

Semester - II

YASHW

ANTRA

O CHA

VAN MAHARASHTRA OPEN UNIVERSITY

ASHWANTRA

ANTRAO

CHAV

Dnyangangotri, Near Gangapur Dam, Nashik 422 222, Maharashtra

Copyright © Yashwantrao Chavan Maharashtra

Open University, Nashik.

All rights reserved. No part of this publication which is material

protected by this copyright notice may be reproduced or transmitted

or utilized or stored in any form or by any means now known or

hereinafter invented, electronic, digital or mechanical, including

photocopying, scanning, recording or by any information storage

or retrieval system, without prior written permission from the

Publisher.

The information contained in this book has been obtained by

authors from sources believed to be reliable and are correct to the

best of their knowledge. However, the publisher and its authors

shall in no event be liable for any errors, omissions or damage

arising out of use of this information and specially disclaim any

implied warranties or merchantability or fitness for any

particular use.

YASHWANTRAO CHAVAN MAHARASHTRA OPEN UNIVERSITY

Vice-Chancellor : Dr. M. M. Salunkhe

Director (I/C), School of Commerce & Management : Dr. Prakash Deshmukh

State Level Advisory Committee

Dr. Pandit Palande

Hon. Vice Chancellor

Dr. B. R. Ambedkar University

Muaaffarpur, Bihar

Dr. Suhas Mahajan

Ex-Professor

Ness Wadia College of Commerce

Pune

Dr. V. V. Morajkar

Ex-Professor

B.Y.K. College, Nashik

Dr. Mahesh Kulkarni

Ex-Professor

B.Y.K. College, Nashik

Dr. J. F. Patil

Economist Kolhapur

Dr. Ashutosh Raravikar

Director, EDMU,

Ministry of Finance, New Delhi

Dr. A. G. Gosavi

Professor

Modern College,

Shivaji Nagar, Pune

Dr. Madhuri Sunil Deshpande

Professor

Swami Ramanand Teerth Marathwada

University, Nanded

Dr. Prakash Deshmukh

Director (I/C)

School of Commerce & Management

Y.C.M.O.U., Nashik

Dr. Parag Prakash Saraf

Director, Institute of Management

Science, Pimpri, Pune

Dr. S. V. Kuvalekar

Associate Professor and

Associate Dean (Training)(Finance )

National Institute of Bank Management,

Pune

Dr. Surendra Patole

Assistant Professor

School of Commerce & Management

Y.C.M.O.U., Nashik

Dr. Latika Ajitkumar Ajbani

Assistant Professor

School of Commerce & Management

Y.C.M.O.U., Nashik

Authors & Editors

Dr. Parag Prakash Saraf

Director, Institute of Management Science, Pimpri, Pune

Dr. Latika Ajitkumar Ajbani

Assistant Professor, School of Commerce & Management, Y.C.M.O.U., Nashik

Instructional Technology Editing & Programme Co-ordinator

Dr. Latika Ajitkumar Ajbani

Assistant Professor, School of Commerce & Management, Y.C.M.O.U., Nashik

Production

Shri. Anand Yadav

Manager, Print Production Centre

Y.C.M. Open University, Nashik - 422 222.

Copyright © Yashwantrao Chavan Maharashtra Open University, Nashik.

(First edition developed under DEC development grant)

q First Publication

:

September 2015

q Type Setting

:

Avinash R. Varpe (Sangamner, Mob.9960252514)

q Cover Print

:

q Printed by

:

q Publisher

:

Dr. Prakash Atkare, Registrar, Y.C.M.Open University, Nashik - 422 222.

INTRODUCTION

I am very please to placing the first and enlarge edition of this study material

on 'Money, Central Banking in India and International Financial Institutions' to the

students and practitioners of this subject. This book is design as per the revise

syllabus prescribed by the YCMOU Nashik from August 2015. It gives equal

importance to the theoretical aspects as well as to the practical case studies. Hence

this edition will be an ideal companion not only to the scholars but also to the average

students. I am sure that this present work a result of my sincere and dedicated

efforts would subserve the genuine interest of all the students concerned in enriching

their knowledge of this ever-growing Auditing discipline.

I have made a sincere attempt to make the subject easy to understand. For

this purpose. The theory on each topic is written in a simple and lucid language to

enable the students to grasp the essence of subject.

It gives me great pleasure to introduce you to the world of Money, Central

Banking in India and International Financial Institutions. This book has got knowledge

oriented and exam oriented approach. I am tried to cover all Banking Regulation

Act and provisions of it. I am very much thankful to Prof.Gopal Kalantri of Dhruv

Academy, Sangamner and Prof.Shubhangi Kulkarni of Sangamner College for their

co-operation. Ofcourse blessing of my parents Mr.Prakash Saraf & Mrs.Shubhada

Saraf is important for completion of this work...

So let's start this lovely journey of learning in a positive way.

Any suggestions will be appreciated.

I am confident, that students will welcome new edition of this book.

With knowledge, hard work, marvelous success is just around the corner.

All The Best!

- Dr.Parag Prakash Saraf

Index

Unit No. Unit Name

Page No.

1

EVOLUTION OF MONEY

9

2

FUNCTIONS OF MONEY

16

3

MEASUREMENT OF MONEY SUPPLY

24

4

THEORY OF MONEY

31

5

MODERN MONETARISM

43

6

THEORY OF INFLATION

55

7

CENTRAL BANKING - I

63

8

ORGANIZATION AND DEPARTMENTS

OF RBI

71

9

ROLE AND FUNCTIONS OF RBI

78

10

MONETARY POLICY AND

RESERVE BANK OF INDIA

85

FRAMEWORK AND PROCEDURE

OF MONETARY POLICY

93

MECHANISM OF MONETARY POLICY

106

11

12

Money, Central Banking in India and

International Financial Institutions - I

1) EVOLUTION OF MONEY

Barter Economy, Evolution of Money

2) FUNCTIONS OF MONEY

Functions of Money, Significance of Money, Demand

for Money, Supply of Money

3) MEASUREMENT OF MONEY SUPPLY

The Concept of Money Supply and its Measurement,

Four Measures of Money Supply, Determination of Money

Supply

4) THEORY OF MONEY

Price and Economy, Confusion between prices and costs

of production, Other price terms, Fishers Quantity theory of

Money, Quantity Theory of Money: The Cambridge Cash

Balance Approach

5) MODERN MONETARISM

Keynesian theory - Income Approach, Monetarism: An

Introduction, Keynes's Reformulated Quantity Theory of Money

6) THEORY OF INFLATION

Meaning of Inflation, Demand-Pull Inflation, Cost-Push

Inflation

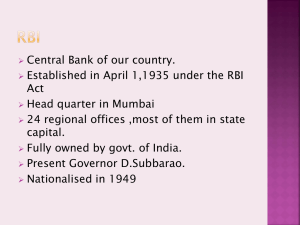

7) CENTRAL BANKING - I

Overview of central Bank, Objectives of Central Bank,

Reserve Bank of India, Role and Function of Reserve Bank of

India (RBI)

8) ORGANIZATION AND DEPARTMENTS

OF RBI

Organization and Structure of RBI, Departments of RBI

9) ROLE AND FUNCTIONS OF RBI

Role of Reserve bank of India, Functions of Reserve

Bank of India

10) MONETARY POLICY AND RESERVE BANK OF

INDIA

Meaning of Monetary policy, Objectives of monetary

policy, Instruments of Monetary Policy, LIMITATIONS OF

MONETARY POLICY

11) FRAMEWORK

MONETARY POLICY

AND

PROCEDURE

OF

Monetary Policy Targets, Operating Procedures of

Monetary Policy in India, Evolution of the Operating Procedure

12) MECHANISM OF MONETARY POLICY

Transmission mechanism of monetary policy, How does

interest rate policy work?, Reforms in the Monetary Policy

Framework, Press, New Monetary Policy framework

UNIT - 1

EVOLUTION OF MONEY

Structure

1.1

Introduction

1.2

1.3

1.4

1.5

1.6

1.7

Objectives

Barter Economy

Evolution of Money

Summary

Exercise & Questions

Further Reference Books

EVOLUTION OF MONEY

NOTES

1.1 Introduction

The act of trading goods and services between two or more parties without

the use of money is called as barter system. In the barter system goods are

exchanged for other goods. This system prevailed throughout the world in the

olden times. This system suffered from many shortcomings, double coincidence of

wants is one of them. For exchange of goods, persons desiring to exchange goods

must specifically want those goods what others offered in exchange. Money has

removed this difficulty. In the ancient period many things such as clay, cowry,

shells, cattle, salt, stone, gold, leather etc. used as money.

CHECK YOUR

PROGRESS

What is

Economy?

Barter

1.2 Objectives

At the end of this unit, you will be able to a) Know the barter system.

b) Know the kinds used as money in the ancient period

c) Understand the evolution of money

1.3 Barter Economy

A barter economy is a cashless economic system in which services and

goods are traded at negotiated rates.

Barter-based economies are one of the earliest, predating monetary

systems and even recorded history. People can successfully use barter in many

almost any field. Informally, people often participate in barter and other reciprocal

systems without really ever thinking about it as such -- for example, providing web

design or tech support for a farmer or baker and receiving vegetables or baked

goods in return. Strictly Internet-based exchanges are common as well, for example

exchanging content creation for research.

Barter transactions occur when economic actors, such as individuals,

businesses and nations, exchange goods or services without the use of a monetary

medium. While a barter economy is considered more primitive than modern

economies, barter transactions still occur in the marketplace. Below are simple

examples of bartering for goods and services, along with a common contemporary

barter exchange.

DEFINE BARTER SYSTEM.

DEFINITION of 'Barter'

The act of trading goods and services between two or more parties without

(9)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

Steps in Evolution of

Money?

the use of money.Bartering benefits individuals, companies and countries that see

a mutual benefit in exchanging goods and services rather than cash.

Example 1: Bartering with Consumer Goods

In its most elementary form, bartering is the exchange of one valuable

product for another between two individuals. Person A has two chickens but wants

to get some apples; meanwhile, Person B has six apples but wants some chickens.

If the two can find each other, Person A might trade one of his chickens for three

of Person B's apples. No medium of exchange is used. The problem posed by

simple bartering is what economists call the double coincidence of wants. In this

case, Person A is not satisfied unless he crosses paths with a chicken-wanting

apple-carrier, while Person B needs an apple-wanting chicken-carrier.

Example 2: Bartering with Consumer Services

Bartering can also take place as an exchange for services. Services are

saleable acts, such as performing mechanical work or legal representation. If one

professional agrees to perform tax accounting for another professional in exchange

for cleaning services, this is a barter transaction. Much like with consumer goods,

a barter transaction involving consumer services has demand and supply limitations.

Example 3: Modern Advertising Services

The most common form of business-to-business bartering in modern

economies involves the trading of advertising rights. In these cases, one company

sells its available ad space to another company in exchange for the right to advertise

on the second company's space. These can be TV rights, radio rights, actual billboards

or Internet ad spaces.

1.4 Evolution of Money

Origin and Evolution of Money

1) Barter

Money, as we know it today, is the result of a long

process.

At the beginning, there was no money. People

engaged in barter, the exchange of merchandise for

merchandise, without value equivalence.

Then, a person catching more fish than the

necessary for himself and his group, exchanged his excess

fish for the surplus of another person who, for instance,

had planted and harvested more corn that what he would

need..

Goods used in barter are generally in their natural state, in line with the

environment conditions and activities developed by the group, corresponding to

elementary needs of the group's members. This exchange, however, is not free

from difficulties, since there is not a common measure of value among the items

bartered.

(10)

Money, Central Banking in

India and International

Financial Institutions - I

2) Commodity Money

Some commodities, for their utility, came to be

more sought than others are.

Accepted by all, they assumed the role of currency,

circulating as an element of exchange for other products

and used to assess their value. This was the commodity

money.

Cattle, mainly bovine, was one of the mostly used, and had the advantages

of moving for itself, reproducing and rendering services, although there was the

risk of diseases and death.

Salt was another commodity money, difficult

to obtain, mainly in the interior part of continents, also

used as a preservative for food. Both cattle and salt

left the marks in the Portuguese language of their

function as an exchange instrument. Similarly, the work

salário (salary,compensation, normally in money, due

by the employer for the services of an employee)

originates from the use of sal [salt], in Rome, for

payment of services rendered.

EVOLUTION OF MONEY

NOTES

WHICH COMMODITY WEWRE USED AS MONEY?

Brazil used, among other commodity

moneys, cowry - brought by Africans -, Brazil

wood, sugar, cocoa, tobacco and cloth,

exchanged in Maranhão in the 17th Century

due to the almost complete lack of money,

traded in the form of yarn balls, skeins and

fabrics.

Later, commodities became inconvenient for

commercial trades, due to changes in their values, the

fact of being indivisible and easily perishable, therefore

checking the accumulation of wealth.

3) Metal

As soon as man discovered

metal, it was used to made utensils

and weapons previously made of stone.

For its advantages, as the possibility of treasuring,

divisibility, easy of transportation and beauty, metal became

the main standard of value. It was exchanged under

different forms. At the beginning, metal was used in its

natural state, and later under the form of ingots and, still,

transformed into objects, from rings to bracelets.

The metal so traded required weight assessment and

assaying of its purity at each transaction. Later, metal money gained definite form

and weight, receiving a mark indicating its value, indicating also the person responsible

for its issue. This measure made transactions faster, as it saved the trouble of

weighing it and enabled prompt identification of the quantity of metal offered for

trade.

4) Money in the Form of Objects

Metal items came to be very valued commodities.

As its production required, in addition to knowledge of

melting, knowing where the metal could be found in nature, the

task was not at the reach of everyone.

The increased value of these objects led to its use as money and

the circulation as money of small-scale replicas of metal objects.

(11)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

This is the case of the knife and key coins

found in the East and the talent, a copper or bronze

coin with the form of an animal skin that circulated in

Greece and Cyprus.

NOTES

5) Ancient Coins

In the 7th century B.C. the first coins

resembling current ones appeared: they were small metal pieces, with fixed weight

and value, and bearing an official seal that is the mark of who has minted them and

also a guaranty of their value.

Gold and silver coins are minted in Greece, and

small oval ingots are used in Lydia, made of a gold and

silver alloy called electrum.

Coins reflect the mentality of a people and their

time. One may find political, economic, technological

and cultural aspects in coins. Through the impressions

found in coins, we are able to know the effigy of

personalities who lived centuries ago. Probably, the

first historic character to have his effigy registered in

a coin was Alexander the Great, of Macedonia, around

the year 330 B.C.

At the beginning, coin pieces were made by hand

in a very coarse way, had irregular edges, and were not absolutely equal to one

another as today's ones.

6) Gold, Silver and Copper

The first metals used in coinage

were gold and silver. Employment of these

metals happened for their rarity, beauty,

immunity to corrosion, economic value, and

for old religious habits. In primeval

civilizations, Babylonian priests,

knowledgeable about astronomy, taught to people the close relationship between

gold and the sun, silver and the moon. This led to a belief in the magic power of

such metals and of objects made with them.

Minting of gold and silver coins was common for many centuries, and

pieces were guaranteed by their intrinsic value, that is to say, by the trade value of

the metal used in their production. Then, a coin made with twenty grams of gold

was exchanged for goods of even value.

For many centuries, countries minted their most highly valued coins in

gold, using silver and copper for lesser value coins. This system was kept up to the

end of the last century, when cupronickel, and later other metallic alloys, became

used, and coins came to circulate for their extrinsic value, that is to say, for their

face value, which is independent from their metal content.

With the appearance of paper money, minting of metal coins was restricted

to lower values, necessary as change. In this new role, durability became the most

requested quality for coins. Large quantities of modern alloys appeared, produced

to support the high circulation of change money.

(12)

Money, Central Banking in

India and International

Financial Institutions - I

7) Paper Money

In the Middle Ages, the keeping of values with

goldsmiths, persons trading with gold and silver items,

was common. The goldsmith, as a guaranty, delivered

a receipt. With time, these receipts came to be used to

make payments, circulating from hand to hand, giving origin to paper money.

In Brazil, the first bank notes, precursors of the current notes, were issued

by Banco do Brasil in 1810. They had its value written by hand, as we today do

with our checks.

With time, in the same form it happened with coins, the government came

to conduct the issue of notes, controlling counterfeits and securing the power to

pay.

Currently, all countries have their central bank in charge of issuing coins

and notes.

Paper money experienced an evolution regarding the technique used in

their printing. Today, the printing of notes uses especially prepared paper and several

printing processes, which are complementary to each other, assuring to the final

product a great margin of security and durability conditions.

EVOLUTION OF MONEY

NOTES

Different Shapes

Money has greatly changed its

physical aspect along the centuries.

Coins had already very small

sizes, as the stater, which circulated in

Aradus, Phenicia, and some reached

large sizes, such as the thaler, a 17th

century Swedish copper piece.

Although today the circular form

is used in almost the whole world, there

had been oval, square, polygonal and

other shapes for coins. They were also minted in different non-metallic materials,

such as wood, leather and even porcelain. Porcelain coins circulated, in this century,

in Germany, when the country was under the economic hardships caused by the

war.

Bank notes were generally of rectangular lengthwise format, although with

great variety of sizes. There are, still, square notes and those with inscriptions

written in the vertical.

Bank notes depict the culture of the issuing country, and we may see in

them characteristic and interesting motifs as landscapes, human types, fauna and

flora, monuments of ancient and contemporary architecture, political leaders,

historical scenes, etc.

Bank notes bear, in addition, inscriptions, generally in the country's official

language, although several also bear the same inscriptions in other idioms. The

inscriptions, frequently in English, aim at

permitting the piece to be read by a larger

number of people.

Monetary System

The set of coins and bank notes

used by a country form its monetary

system. The system is regulated by

appropriate legislation and organized

from a monetary unit, its base value.

Currently almost all countries use a monetary system of centesimal basis,

in which the coinage dividing the unit represents one hundredth of its value.

8) Cheques

As coins and notes ceased to be convertible into precious metal, money

became more dematerialized and assumed abstract forms.

(13)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

What is Mobile

Payment?

One of these forms is the

cheques that, for simplicity of use

and security offered, is being

adopted by an increasing number

of people in their day-by-day

activities.

This document, by which

one orders payment of a certain amount to its bearer or to a person mentioned in it,

aims mainly at transactions with bank deposits.

The 21st century gave

rise to two disruptive forms of currency: Mobile payments and virtual currency.

9) Mobile payment

IT is money rendered for a product or service through a portable electronic

device such as a cell phone, smartphone or PDA. Mobile payment technology can

also be used to send money to friends or family members. Increasingly, services

like Apple Pay and Samsung Pay are vying for retailers to accept their platforms

for point-of-sale payments.

10) Virtual Currency

Bitcoin, invented in 2009 by the pseudonymous Satoshi Nakamoto, became

the gold standard--so to speak--for virtual currencies. Virtual currencies have no

physical coinage. The appeal of virtual currency is it offers the promise of lower

transaction fees than traditional online payment mechanisms and is operated by a

decentralized authority, unlike government issued currencies.

1.5 Summary

Barter transactions occur when economic actors, such as individuals,

businesses and nations, exchange goods or services without the use of a monetary

medium.

At the beginning, there was no money.

In the ancient period many things such as clay, cowry, shells, cattle, salt,

stone, gold, leather etc. used as money.

The first metals used in coinage were gold and silver.

In Brazil, the first bank notes, precursors of the current notes, were issued

by Banco do Brasil in 1810.

Money solves the various problems of barter system.

1.6 Exercise & Questions

Fill in the Blanks 1)

The act of trading goods and services between two or more parties without

the use of money is called as ------------ .

2)

-------------- currencies have no physical coinage.

3)

The 21st century gave rise to two disruptive forms of currency: -------------- and -----------.

4)

-------- has removed the problem of double coincidence.

(14)

Money, Central Banking in

India and International

Financial Institutions - I

Short Answer Questions.

1)

Write down any two example of Barter.

2)

Write down the name of any five commodity used as money in the ancient

period.

3)

4)

5)

Explain the concept of double coincidence.

Write down any four drawbacks of barter system.

Explain how money solve the problem of barter system?

C) Long Answer Questions

1)

Explain the evolution and origin of money.

2)

Explain barter economy with the help of example. Mention the drawbacks

of System.

EVOLUTION OF MONEY

NOTES

1.7 Further Reference Books

l Indian Financial System

- Dr. S Gurusamy

l Central Banking for Emerging Market Economies

- A. Vasudevan

l Money & Banking : Theory with Indian Banking

- Hajela T.N.

l International Financial Institutions and Indian Banking

- Autar Krishen and Mihir Chatterjee

(15)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

Describe Functions of

Money?

UNIT - 2

FUNCTIONS OF MONEY

Structure

2.1

Introduction

2.2

Objectives

2.3

Functions of Money

2.4

Significance of Money

2.5

Demand for Money

2.6

Supply of Money

2.7

Summary

2.8

Exercise & Questions

2.9

Further Reference Books

2.1 Introduction

The term money in English is derived from Latin word 'moneta' which

means roman goddess Juno or Moneta. Money is an important and indispensable

element of modern civilization. It is considered to be the basis of all economic

activities. It is one of the most basic and significant inventions of mankind. Money

speeds up the wheel of Industry and makes business a grand success. In ordinary

usage, what we use to pay for things is called money. In India the rupee is the

money, in America the dollar is the money.

2.2 Objectives

At the end of this unit, you will be able to 1) Know the meaning of Money.

2) Understand the functions of Money.

3) Understand the concept of demand and supply of money.

2.3 Functions of Money

Traditionally, money has been defined on the basis of its general acceptability

and its functional aspect. To modern economist, crucial function of money is serves

as a store of value. Functions of money classified into primary and secondary.

Primary and Secondary Functions of Money!

1. Primary Functions (Main or Basic Functions)

2. Secondary Functions (Subsidiary or Derivative Functions)

(16)

Money, Central Banking in

India and International

Financial Institutions - I

1. Primary Functions:

Primary Functions include the most important functions of money, which it

must perform in every country,

These are:

(i) Medium of Exchange:

The most important function of money is to serve as a medium of exchange

or as a means of payment. To be a successful medium of exchange, money must

be commonly accepted by people in exchange for goods and services. While

functioning as a medium of exchange, money benefits the society in a number of

ways:

(a) It overcomes the inconvenience of barter system (i.e., the need for double

coincidence of wants) by splitting the act of barter into two acts of

exchange, i.e., sales and purchases through money.

(b) It promotes transactional efficiency in exchange by facilitating the multiple

exchange of goods and services with minimum effort and time,

(c) It promotes allocation efficiency by facilitating specialization in production

and trade,

(d) It allows freedom of choice in the sense that a person can use his money

to buy the things he wants most, from the people who offer the best

bargain and at a time he considers the most advantageous.

What are the benefits of medium of exchange of money?

FUNCTIONS OF MONEY

NOTES

CHECK YOUR

PROGRESS

Describe Secondary

Functions of Money?

(ii) Measure of Value (Unit of Value):

Money as measure of value means that money works as a common

denomination, in which values of all goods and services are expressed.

1. By reducing the value of all goods and services to a single unit (i.e. price),

it becomes very easy to find out the exchange ratios between them and

comparing their prices.

2. This function facilitates maintenance of business accounts, which would

be otherwise impossible.

3. Money helps in calculating relative prices of goods and services. Due to

this reason, it is regarded as a Unit of Account'. For instance, 'Rupee' is

the unit of account in India, 'Pound' in England and so on.

2. Secondary Functions:

These refer to those functions of money which are supplementary to the

primary functions. These functions are derived from primary functions and, therefore,

they are also known as 'Derivative Functions'.

The major secondary functions are:

(a) Standard of Deferred Payments:

Money as a standard of deferred payments means that money acts as a

'standard' for payments, which are to be made in future. Every day, millions of

transactions take place in which payments are not made immediately. Money

encourages such transactions and helps in capital formation and economic

development of the economy.

This function of money is significant because:

1. Money as a standard of deferred payments has simplified the borrowing

and lending operations.

2. It has led to the creation of financial institutions.

(b) Store of Value (Asset Function of Money):

Money as a store of value means that money can be used to transfer

purchasing power from present to future. Money is a way to store wealth. Although

wealth can be stored in other forms also, but money is the most economical and

convenient way. It provides security to individuals to meet contingencies,

(17)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

What is Significance

of Money?

unpredictable emergencies and to pay future debts. Under barter system, it was

difficult to use goods as a store of wealth due to perishable nature of some goods

and high cost of storage.

Money as store of value has the following advantages:

1. Money is available in fractional denomination, ranging from Rs 1 to Rs

1,000.

2. Money is easily portable. So, it is easy and economical to store money as

its storage does not require much space.

3. Money has the merit of general acceptability so; it can be easily exchanged

for goods at all times.

4. Savings in terms of money are much more secured than in terms of

goods.

In dynamic sense, money serves following functions.

(c) Transfer of Value:

Money also functions as a means of transferring value. Through money,

value can be easily and quickly transferred from one place to another because

money is acceptable everywhere and to all. For example, it is much easier to

transfer one lakh rupees through bank draft from person A in Amritsar to person B

in Bombay than remitting the same value in commodity terms, say wheat.

(D)Distribution of National Income:

Money facilitates the division of national income between people. Total

output of the country is jointly produced by a number of people as workers, land

owners, capitalists, and entrepreneurs, and, in turn, will have to be distributed among

them. Money helps in the distribution of national product through the system of

wage, rent, interest and profit.

(E) Maximization of Satisfaction:

Money helps consumers and producers to maximize their benefits. A

consumer maximizes his satisfaction by equating the prices of each commodity

(expressed in terms of money) with its marginal utility. Similarly, a producer

maximizes his profit by equating the marginal productivity of a factor unit to its

price.

(F) Basis of Credit System:

Credit plays an important role in the modern economic system and money

constitutes the basis of credit. People deposit their money (saving) in the banks

and on the basis of these deposits, the banks create credit.

(G) Liquidity to Wealth:

Money imparts liquidity to various forms of wealth. When a person holds

wealth in the form of money, he makes it liquid. In fact, all forms of wealth (e.g.,

land, machinery, stocks, stores, etc.) can be converted into money.

Explain the store of value function of Money

2.4 Significance of Money

(18)

Money, Central Banking in

India and International

Financial Institutions - I

Money occupies a central position in our modern economy. Money is

everywhere and for everything in the modern economic life. Money has become

the religion of the day in the ordinary business of life.

As Marshall rightly put: "Money is the pivot around which economic science

clusters." And, "the major part of the subject matter of economics is concerned

with the functioning and malfunctioning of money."

1. Money has Facilitated Exchange and Promoted Trade:

In the first place by serving as a medium of exchange and a common

measure of value, money has removed the difficulties of the barter system and

promoted trade in the economy. The difficulties of the barter system, namely, lack

of double coincidence of wants, lack of division and lack of common measure of

value are well known. By removing these difficulties, money has greatly facilitated

the process of exchange. In the absence of money, trade and exchanges must

have been few and far between and entailed a great waste of time and energy.

FUNCTIONS OF MONEY

2. Money Promote Division of Labour and Productivity:

Money is of great importance as it promotes division of labour and

productivity in the modern economies. Since under the barter system, exchange

was difficult, a man had to be self-sufficient, that is, produced most of the goods

for himself. In the absence of money there were great difficulties in exchanging

goods and services. This worked as an obstacle to the division of labour and

specialisation among various individuals and nations.

Long ago Adam Smith clearly brought out in his now well-known book

"Wealth of Nations" how the division of labour and specialisation enhance

productivity and efficiency of labour force. It is this division of labour and

specialisation that has made the use of more efficient machines and advanced

technology possible for production of goods. Indeed, it is because of the outputaugmenting effect of division of labour that Adam Smith regarded increase in the

division of labour as progress in technology.

By opening up the opportunities of effecting division of labour, and through

facilitating exchange and trade of goods and services money contributes to the

expansion of production. Therefore, money enables the increase in the amount of

production and variety of goods and services produced. "If a modern economy

was somehow deprived of the monetary mechanism and was driven back to a

system of barter, the level of output would be much lower and the variety of goods

and services much smaller than is enjoyed with a money system."

NOTES

CHECK YOUR

PROGRESS

Describe Money

promoters Saving?

3. Money Promotes Saving:

A great significance of money is that it contributes a great deal to the

increase in saving of the economy. Money has made saving easier than in the

barter system. Increase in saving leads to the increase in investment which

determines economic growth of a country.

Further, money has made easier the acts of borrowing and lending and has

given birth to various financial institutions which promote saving. Investment which

is made possible by saving raises the rate of capital formation in the economy. The

higher level of output in the modern economy is mainly due to the extensive use of

capital in the production process.

4. Money helps in Maximizing Satisfaction or Profits by Consumers and

Producers:

Money is of immense advantage both to the consumers and producers. To

the consumers money represents a general purchasing power. He can buy anything

with money he has and at any time convenient to him. Since the values of goods

are expressed in terms of common measure i.e. money, the consumer can easily

compare the relative money prices of the goods and expected utilities from them.

A consumer can easily spend his given money income on various goods in

such a way that marginal utilities goods are proportional to their prices. With this he

will be maximising his satisfaction from his given income. Thus the existence of

money helps the consumer to maximise his satisfaction by acting on the principle

of equi-marginal utility.

Money helps the producer too. The producer can easily compare the money

cost and money income of the different levels of output. He can thus easily decide

about the level of output which maximises his profits by equating marginal cost

with marginal revenue (MC = MR).

Employee want food, clothing, shelter and so many other things. The

(19)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

D e s c r i b e

Classification of

Money?

producer cannot supply them all these things easily. But what be can do is to pay

them in money with which they buy the commodities they like at their own convince

and when they need them.

5. Money can help in Reviving the Economy from Recession or Depression:

According to modern economists, money may play an important role in

bringing about real changes. They point out that at times of recession or depression

when there exists a lot of idle productive capacity and unemployment of labour,

expansion of money supply, say through Government's deficit budget financed by

the creation of new money will cause aggregate expenditure or demand to shift

upward. This increase in aggregate expenditure or demand will cause output and

employment in the economy to rise and thus will help the economy to recover from

recession or depression.

Beneficial effect on output and employment of expansion in money supply

can be obtained even if Central bank of a country takes steps to expand money

supply in the economy say through reduction in Cash Reserve Ratio (CRR) and

through buying securities in the open market.

These steps by the central bank aim at expansion in credit availability for

the businessmen. The greater credit availability will lead to more private investment

which through multiplier process will cause income, output and employment to

rise. It follows from above that money is not neutral in its effect on real income and

employment. In fact, as seen just above it plays an important role in the determination

of the level of real economic activity.

CLASSIFICATION OF MONEY Money can be classified on the basis of relationship between the value of

money and value of money as a commodity. Value of money means the face value

of money.

For example, the face value of five rupees coin is five rupees. Value of

money as a commodity means the value of the commodity of which money is

made of. For example, the commodity value of money of a five rupee coin is the

cost of material (metal) used of which the coin is made.

If face value and commodity value of coin are the same, it is called standard

coin. On the other hand, if face value is greater than the commodity value of coin,

it is called token coin. These days, coins are token coins.

Categories of Money:

1. Commodity (full-bodied) money:

Commodity money is that whose face value is equal to its commodity

value. This type of money was in existence when gold standard was prevalent. In

other words, face value of the coin was equal to its intrinsic (commodity) value.

But now this kind of money is not to be found anywhere in the world.

2. Representative (full-bodied) money:

Though in spirit it is like the commodity (full-bodied) money but in form it

is different. This kind of money is usually made of paper but equal to the face value

of the money gold is kept in reserve. This money saves the users from the

inconvenience of carrying money in heavy-weight in case of large quantity because

paper money can be conveniently carried.

(20)

Money, Central Banking in

India and International

Financial Institutions - I

3. Credit Money:

It is that money whose value of money (face-value) is greater than the

commodity value (intrinsic value) of money. Token coins and promissory notes are

part of credit money. Besides these, there are other forms of credit money also.

Various forms of credit money are the following:

(a) Token coins:

Token coins are those whose face value is more than their intrinsic value.

In India, coins of the money value of Rs. 5, Rs. 2, Rs. 1, 50 P, 25 P, 20 P, 10 P and

5 P are token coins.

(b) Representative Token Money:

This is usually of the form of paper, which is in effect a circulating ware

house receipt for token coins or an equivalent amount of bullion thus is backing it.

Not only this, the coin or bullion backing the representative token money is worth

less as a commodity than as money.

(c) Promissory Notes issued by Central Banks:

This is a major component of currency. It includes currency notes of all

denominations issued by Reserve Bank (excluding on rupee note). The system

governing note-issue in India is the Minimum Reserve System. Minimum Reserve

System stipulates that a minimum amount is kept in reserve in the form of gold and

foreign exchange. This means our currency is inconvertible.

(d) Bank Deposit:

Demand deposits (current and saving deposits) are the bank deposits which

can be withdrawn on demand. One can withdraw bank deposits at any time through

cheques. However, bank does not keep 100% reserves to meet the withdrawal of

demand deposits and hence these deposits are credit money.

What is the difference between face value and intrinsic value of money?

FUNCTIONS OF MONEY

NOTES

CHECK YOUR

PROGRESS

Describe Demand for

Money?

2.5 Demand for Money

In economics, the demand for money is generally equated with cash or

bank demand deposits. Generally, the nominal demand for money increases with

the level of nominal output and decreases with the nominal interest rate.

The equation for the demand for money is: Md = P * L(R,Y). This is the

equivalent of stating that the nominal amount of money demanded (Md) equals the

price level (P) times the liquidity preference function L(R,Y)--the amount of money

held in easily convertible sources (cash, bank demand deposits). Specific to the

liquidity function, L(R,Y), R is the nominal interest rate and Y is the real output.

Money is necessary in order to carry out transactions. However inherent

to the holding of money is the trade-off between the liquidity advantage of holding

money and the interest advantage of holding other assets.

When the demand for money is stable, monetary policy can help to stabilize

an economy. However, when the demand for money is not stable, real and nominal

interest rates will change and there will be economic fluctuations.

Impact of the Interest Rate

The interest rate is the rate at which interest is paid by a borrower (debtor)

for the use of money that they borrow from a lender (creditor). It is viewed as a

"cost" of borrowing money. Interest-rate targets are a tool of monetary policy. The

quantity of money demanded varies inversely with the interest rate. Central banks

in countries tend to reduce the interest rate when they want to increase investment

and consumption in the economy. However, low interest rates can create an economic

bubble where large amounts of investments are made, but result in large unpaid

debts and economic crisis. The interest rate is adjusted to keep inflation, the demand

for money, and the health of the economy in a certain range. Capping or adjusting

the interest rate parallel with economic growth protects the momentum of the

economy.

The demand for money is the relationship between the quantity of money

people want to hold and the factors that determine that quantity.

(21)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

Describe Supply of

Money?

2.5.1 Motives for Holding Money

To understand the factors that determine demand for money, it helps to

know the four main motives she might have for holding money at any given time.

Firstly, People often holds money in the form of cash or checking accounts

in order to buy goods and services. Economists call this the transactions demand

for money. For example, People keeps cash in her wallet so she can buy groceries,

something she does every week. The more cash she has in her wallet at any given

time, the less time she has to take to go to the bank, stand in line and withdraw

more cash.

Secondly, People sometimes hold money as a safety net for unexpected

expenses. Economists call that the precautionary demand for money. When people

keep extra cash under the mattress in case her favorite store has a sale or in case

her minivan needs an emergency repair, she does this as a precaution.

Thirdly, People may hold some of wealth in the form of investments, such

as bonds, that pay her interest. Economists call this the speculative demand for

money. Since cash and most checking accounts don't pay much interest, but bonds

do, money demand varies negatively with interest rates. That means the demand

for money goes down when interest rates rise, and it goes up when interest rates

fall.

What is meant by speculative motive of Money?

2.6 Supply of Money

Money supply plays a crucial role in the determination of price level and

interest rate. In economic analysis it is generally presumed that money supply is

determined by the policy of Central Bank of a country and the Government.

However, this is not fully correct as in the determination of money supply,

besides Central Bank and Government, the public and commercial banks also play

an important role. There are various measures of money supply depending upon

which types of deposits of banks and other financial institutions are included in it.

2.6.1 Importance of Money Supply

Growth of money supply is an important factor not only for acceleration of

the process of economic development but also for the achievement of price stability

in the economy. There must be controlled expansion of money supply if the objective

of development with stability is to be achieved. A healthy growth of an economy

requires that there should be neither inflation nor deflation. Inflation is the greatest

headache of a developing economy.

A mild inflation arising out of the creation of money by deficit financing

may stimulate investment by raising profit expectations and extracting forced

savings. But a runaway inflation is highly detrimental to economic growth. The

developing economies have to face the problem of inadequacy of resources in

initial stages of development and it can make up this deficiency by deficit financing.

But it has to be kept strictly within safe limits. Thus, increase in money

supply affects vitally the rate of economic growth. In fact, it is now regarded as a

legitimate instrument of economic growth. Kept within proper limits it can accelerate

economic growth but exceeding of the limits will retard it. Thus, management of

money supply is essential in the interest of steady economic growth.

2.7 Summary

(22)

Money, Central Banking in

India and International

Financial Institutions - I

Money is an important and indispensable element of modern civilization. It

is considered to be the basis of all economic activities.

At the beginning, there was no money. People engaged in barter, the

exchange of merchandise for merchandise, without value equivalence. A barter

economy is a cashless economic system in which services and goods are traded at

negotiated rates.

In the traditional sense, money serves as medium of exchange, measures

of value, store of value and standard of deferred payment.

In the modern economics, it serves dynamic functions like encouragement

to division of labour, Mobilization of Saving.

In economic analysis it is generally presumed that money supply is

determined by the policy of Central Bank of a country and the Government.

FUNCTIONS OF MONEY

NOTES

2.8 Exercise & Questions

Fill in the Blanks 1)

The term money in English is derived from ……………. word 'moneta'

which means roman goddess Juno or Moneta.

2)

money supply is determined by the policy of -----------.

3)

Money as a ……………….. Means that money can be used to transfer

purchasing power from present to future.

4)

---------- deposits (current deposits) are the bank deposits which can be

withdrawn on demand.

Short Answer Questions

1)

Define Money. Explain the role of money in economy.

2)

Money is liquid store of Value. Comment.

3)

How money has solved the problem of double coincidence of wants?

4)

Define Demand of Money.

5)

Explain the different motives of demand of Money.

Long Answer Questions

1)

Explain the Any Five functions of money.

2)

Explain the concept of demand and supply of money.

3)

Explain the significance of Money.

2.9 Further Reference Books

l Indian Financial System

- Dr. S Gurusamy

l Central Banking for Emerging Market Economies

- A. Vasudevan

l Money & Banking : Theory with Indian Banking

- Hajela T.N.

l International Financial Institutions and Indian Banking

- Autar Krishen and Mihir Chatterjee

(23)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

What is Concept of

Money Supply and its

Measurement?

UNIT - 3

MEASUREMENT OF MONEY SUPPLY

Structure

3.1

Introduction

3.2

Objectives

3.3

The Concept of Money Supply and its Measurement

3.4

Four Measures of Money Supply

3.5

Determination of Money Supply

3.6

Summary

3.7

Exercise & Questions

3.8

Further Reference Books

3.1 Introduction

Money supply plays a crucial role in the determination of price level and

interest rate. In economic analysis it is generally presumed that money supply is

determined by the policy of Central Bank of a country and the Government. Currency

with public and demand deposit are the two important component of money supply.

RBI classified stock of money on the basis of liquidity. 1979 the RBI

classified money stock in India in the four categories. The third RBI working group

redefined its parameter for measuring money supply and introduced new monetary

aggregates.

M1 is called as narrow money and M3 is called as broad money. M4has

been excluded from the scheme of new monetary aggregates.

3.2 Objectives

At the end of this unit, you will be able to a) Know the classification of stock of Money.

b) Know the different measures of money supply

c) Understand the difference between narrow and broad money.

d) Know the determinants of Money Supply.

3.3 The Concept of Money Supply and its

Measurement

By money supply we mean the total stock of monetary media of exchange

available to a society for use in connection with the economic activity of the country.

According to the standard concept of money supply, it is composed of the

following two elements:

1. Currency with the public,

2. Demand deposits with the public.

(24)

Money, Central Banking in

India and International

Financial Institutions - I

Before explaining these two components of money supply two things must

be noted with regard to the money supply in the economy.

First, the money supply refers 'to the total sum of money available to the

public in the economy at a point of time. That is, money supply is a stock concept

in sharp contrast to the national income which is a flow representing the value of

goods and services produced per unit of time, usually taken as a year.

Secondly, money supply always refers to the amount of money held by the

public. In the term public are included households, firms and institutions other than

banks and the government. The rationale behind considering money supply as held

by the public is to separate the producers of money from those who use money to

fulfill their various types of demand for money.

Since the Government and the banks produce or create money for the use

by the public, the money (cash reserves) held by them are not used for transaction

and speculative purposes and are excluded from the standard measures of money

supply. This separation of producers of money from the users of money is important

from the viewpoint of both monetary theory and policy.

Let us explain the two components of money supply at some length.

1) Currency with the Public:

In order to arrive at the total currency with the public in India we add the

following items:

1. Currency notes in circulation issued by the Reserve Bank of India.

2. The number of rupee notes and coins in circulation.

3. Small coins in circulation.

It is worth noting that cash reserves with the banks have to be deducted

from the value of the above three items of currency in order to arrive at the total

currency with the public. This is because cash reserves with the banks must remain

with them and cannot therefore be used for making payments for goods or by any

commercial banks' transactions.

It may further be noted that these days paper currency issued by Reserve

Bank of India (RBI) are not fully backed by the reserves of gold and silver, nor it

is considered necessary to do so. Full backing of paper currency by reserves of

gold prevailed in the past when gold standard or silver standard type of monetary

system existed.

According to the modem economic thinking the magnitude of currency

issued should be determined by the monetary needs of the economy and not by the

available reserves of gold and silver. As in other developed countries, since 1957

Reserve Bank of India follows Minimum Reserve System of issuing currency.

Under this system, minimum reserves of Rs. 200 crores of gold and other

approved securities (such as dollars, pound sterling, etc.) have to be kept and

against this any amount of currency can be issued depending on the monetary

requirements of the economy.

RBI is not bound to convert notes into equal value of gold or silver. In the

present times currency is inconvertible. The word written on the note, say 100

rupee notes and signed by the governor of RBI that 'I promise to pay the bearer a

sum of 100 rupees' is only a legacy of the past and does not imply its convertibility

into gold or silver.

Another important thing to note is that paper currency or coins are fiat

money, which means that currency notes and metallic coins serve as money on the

bases of the fiat (i.e. order) of the Government. In other words, on the authority of

the Government no one can refuse to accept them in payment for the transaction

made. That is why they are called legal tender.

2) Demand Deposits with the Public:

The other important components of money supply are demand deposits of

the public with the banks. These demand deposits held by the public are also called

bank money or deposit money. Deposits with the banks are broadly divided into

two types: demand deposits and time deposits.

Demand deposits in the banks are those deposits which can be withdrawn

MEASUREMENT OF

MONEY SUPPLY

NOTES

(25)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

CHECK YOUR

PROGRESS

What are Four

measures of Money

Supply?

by drawing cheque on them. Through cheque these deposits can be transferred to

others for making payments from which goods and services have been purchased.

Thus, cheque makes these demand deposits as a medium of exchange and

therefore makes them to serve as money. It may be noted that demand deposits

are fiduciary money proper. Fiduciary money is one which functions as money on

the basis of trust of the persons who make payment rather than on the basis of the

authority of Government.

Thus, despite the fact that demand deposits and cheques through which

they are operated are not legal' tender, they functions as money on the basis of the

trust commanded by those who draw cheques on them. They are money as they

are generally acceptable as medium of payment.

Bank deposits are created when people deposits currency with them. But

far more important is that banks themselves create deposits when they give advances

to businessmen and others. On the basis of small cash reserves of currency, they

are able to create a much larger amount of demand deposits through a system

called fractional reserve system which will be explained later in detail.

In the developed countries such as USA and Great Britain deposit money

accounted for over 80 per cent of the total money supply, currency being a relatively

small part of it. This is because banking system has greatly developed there and

also people have developed banking habits.

On the other hand, in the developing countries banking has not developed

sufficiently and also people have not acquired banking habits and they prefer to

make transactions in currency. However in India after 50 years of independence

and economic development the proportion of bank deposits in the money supply

has risen to about 50 per cent.

3.4 Four Measures of Money Supply

(26)

Money, Central Banking in

India and International

Financial Institutions - I

Several definitions of money supply have been given and therefore various

measures of money supply based on them have been estimated. First, different

components of money supply have been distinguished on the basis of the different

functions that money performs.

For example, demand deposits, credit card and currency are used by the

people primarily as a medium of exchange for buying goods and services and

making other transactions. Obviously, they are money because they are used as a

medium of exchange and are generally referred to as M1. Another measure of

money supply is M3 which includes both M1 and time deposits held by the public in

the banks. Time deposits are money that people hold as store of value.

The main reason why money supply is classified into various measures on

the basis of its functions is that effective predictions can be made about the likely

affects on the economy of changes in the different components of money supply.

For example, if M1 is increasing firstly it can be reasonably expected that people

are planning to make a large number of transactions.

On the other hand, if time-deposits component of money-supply measure

M3 which serves as a store of value is increasing rapidly, it can be validly concluded

that people are planning to save more and accordingly consume less.

Therefore, it is believed that for monetary analysis and policy formulation,

a single measure of money supply is not only inadequate but may be misleading

too. Hence various measures of money supply are prepared to meet the needs of

monetary analysis and policy formulation.

Recently in India as well as in some developed countries, three concepts

of money supply have been distinguished. The definition of money supply given

above represents a narrow measure of money supply and is generally described as

M1. From April 1977, the Reserve Bank of India has adopted four concepts of

money supply in its analysis of the quantum of and variations in money supply.

The third RBI working group redefined its parameters for measuring money

supply. These are as follows.

1. Money Supply M1 or Narrow Money:

This is the narrow measure of money supply and is composed of the

following items:

M1 = C + DD + OD

Where

C = Currency with the public

DD = Demand deposits with the public in the Commercial and Cooperative Banks.

OD = Other deposits held by the public with Reserve Bank of India.

The money supply is the most liquid measure of money supply as the

money included in it can be easily used as a medium of exchange, that is, as a

means of making payments for transactions.

Currency with the public (C) in the above measure of money supply consists

of the followings:

(i) Notes in circulation.

(ii) Circulation of rupee coins as well as small coins

(iii) Cash reserves on hand with all banks.

Note that in measuring demand deposits with the public in the banks (i.e.,

DD), inter-bank deposits, that is, deposits held by a bank in other banks are excluded

from this measure.

In the other deposits with Reserve Bank of India (i.e., OD) deposits held

by the Central and State Governments and a few others such as RBI Employees

Pension and Provident Funds are excluded.

However, these other deposits of Reserve Bank of India include the

following items:

(i) Deposits of Institutions such UTI, IDBI, IFCI, NABARD etc.

(ii) Demand deposits of foreign Central Banks and Foreign Governments.

(iii) Demand deposits of IMF and World Bank.

It may be noted that other deposits of Reserve Bank of India constitute a

very small proportion (less than one per cent).

MEASUREMENT OF

MONEY SUPPLY

NOTES

2) Money Supply M2:

M2 is a broader concept of money supply in India than M1. Thus,

M2 = M1 + time liabilities portion of saving deposits with banks. + Certificate

of deposits issued by banks. + Time deposits maturing within a year excluding

FCNR.

The reason why money supply M2 has been distinguished from M1 is that

saving deposits with post office savings banks are not as liquid as demand deposits

with Commercial and Co-operative Banks as they are not chequable accounts.

However, saving deposits with post offices are more liquid than time deposits with

the banks.

3) Money Supply M3 or Broad Money:

M3 is a broad concept of money supply. Thus

M3 = M1 + Time Deposits with the banks maturity over one year+ term

borrowing of the banking system.

It is generally thought that time deposits serve as store of value and represent

savings of the people and are not liquid as they cannot be withdrawn through

drawing cheque on them. However, since loans from the banks can be easily

obtained against these time deposits, they can be used if found necessary for

transaction purposes in this way. Further, they can be withdrawn at any time by

(27)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

forgoing some interest earned on them.

It may be noted that recently M3 has become a popular measure of money

supply. The working group on monetary reforms under the chairmanship of Late

Prof. Sukhamoy Chakravarty recommended its use for monetary planning of the

economy and setting target of the growth of money supply in terms of M3.

Therefore, recently RBI in its analysis of growth of money supply and its

effects on the economy has shifted to the use of M3measure of money supply.

4) Money Supply M4:

M4 has been excluded from the scheme of new monetary aggregates

3.5 Determination of Money Supply

CHECK YOUR

PROGRESS

What

is

Determination of

Money Supply?

(28)

Money, Central Banking in

India and International

Financial Institutions - I

In order to explain the determinants of money supply in an economy we

shall use M1 concept of money supply which is the most fundamental concept of

money supply. We shall denote it simply by M rather than M1. As seen above this

concept of money supply is composed of currency held by the public (Cp) and

demand deposits with the banks (D). Thus

M =CP + D….. (i)

Where

M = Total money supply with the public

CP = Currency with the public

D = Demand deposits held by the public

The two important determinants of money supply as described in (1) are

(a) the amounts of high-powered money which is also called Reserve Money by

the Reserve Bank of India and (b) the size of money multiplier.

1. High-Powered Money (H):

The high-powered money which we denote by H consists of the currency

(notes and coins) issued by the Government and the Reserve Bank of India. A part

of the currency issued is held by the public, which we designate as CP and a part

is held by the banks as reserves which we designate as R.

A part of these currency reserves of the banks is held by them in their own

cash vaults and a part is deposited in the Reserve Bank of India in the Reserve

Accounts which banks hold with RBI. Accordingly, the high-powered money can

be obtained as sum of currency held by the public and the part held by the banks as

reserves. Thus

H =CP + R …(2)

Where

H = the amount of high-powered money

CP = Currency held by the public R

D = Cash Reserves of currency with the banks.

It is worth noting that Reserve Bank of India and Government are producers

of the high-powered money and the commercial banks do not have any role in

producing this high-powered money (H). However, commercial banks are producers

of demand deposits which are also used as money like currency.

But for producing demand deposits or credit, banks have to keep with

themselves cash reserves of currency which have been denoted by R in equation

(2) above. Since these cash reserves with the banks serve as a basis for the

multiple creations of demand deposits which constitute an important part of total

money supply in the economy, it provides high poweredness to the currency issued

by Reserve Bank and Government.

A glance at equations (1) and (2) above will reveal that the difference in

the two equations, one describing the total money supply and the other high-powered

money is that whereas in the former, demand deposits (D) are added to the currency

held by the public, in the later it is cash reserves (R) of the banks that are added to

the currency held by the public. In fact, it is against these cash reserves (R) that

banks are able to create a multiple expansion of credit or demand deposits due to

which there is large expansion in money supply in the economy.

The theory of determination of money supply is based on the supply of and

demand for high- powered money. Some economists therefore call it 'The H Theory

of Money Supply. However, it is more popularly called 'Money-multiplier Theory

of Money Supply' because it explains the determination of money supply as a

certain multiple of the high-powered money.

The amount of high-powered money is fixed by RBI by its past actions.

Thus, changes in high-powered money are the result of decisions of Reserve Bank

of India or the Government which own and control it.

MEASUREMENT OF

MONEY SUPPLY

NOTES

2. Money Multiplier:

As stated above, money multiplier is the degree to which money supply is

expanded as a) result of the increase in high-powered money. Thus

m = M/H

Rearranging we have, M = H.m…. (3)

Thus money supply is determined by the size of money multiplier (m) and

the amount of high- powered money (H). If we know the value of money multiplier

we can predict how much money will change when there is a change in the amount

of high-powered money.

As mentioned above, change in the high-powered money is decided and

controlled by Reserve Bank of India, the money multiplier determines the extent to

which decision by RBI regarding the change in high-powered money will bring

about change in the total money supply in the economy.

3.6 Summary

Money is an important and indispensable element of modern civilization. It

is considered to be the basis of all economic activities.

In economic analysis it is generally presumed that money supply is

determined by the policy of Central Bank of a country and the Government. Currency

with public and demand deposit are the two important component of money suppl.

The money stock in India is divided into narrow money and broad money.

Narrow money excludes time deposits of the public with the banking system while

broad money includes it. M4 is excluded from stock.

The money supply refers 'to the total sum of money available to the public

in the economy at a point of time.

In economic analysis it is generally presumed that money supply is

determined by the policy of Central Bank of a country and the Government.

The two important determinants of money supply as described in (1) are

(a) the amounts of high-powered money which is also called Reserve Money by

the Reserve Bank of India and (b) the size of money multiplier.

3.7 Exercise & Questions

Fill in the Blanks 1)

………… is a broad concept of money supply.

2)

In------ the RBI classified money stock in India in the four categories.

(29)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

3)

4)

These ------------ deposits held by the public are also called bank money or

deposit money.

------- has been excluded from the scheme of new monetary aggregates.

Short Answer Questions

1)

Write a short note on Narrow Money.

2)

Distinction between Narrow Money and Broad Money.

3)

Explain the components of Narrow Money.

4)

Write a short note on High powered money.

Long Answer Questions 1)

Explain the different measurement of Money supply in India.

2)

Explain the determinants of Money Supply.

3)

explain the components of money supply.

3.8 Further Reference Books

l Indian Financial System

- Dr. S Gurusamy

l Central Banking for Emerging Market Economies

- A. Vasudevan

l Money & Banking : Theory with Indian Banking

- Hajela T.N.

l International Financial Institutions and Indian Banking

- Autar Krishen and Mihir Chatterjee

(30)

Money, Central Banking in

India and International

Financial Institutions - I

UNIT - 4

THEORY OF MONEY

THEORY OF MONEY

NOTES

Structure

4.1

Introduction

4.2

Objectives

4.3

Price and Economy

4.4

Confusion between prices and costs of production

4.5

Other price terms

4.6

Fishers Quantity theory of Money

4.6

Quantity Theory of Money: The Cambridge Cash Balance Approach

4.7

Summary

4.8

Exercise & Questions

4.9

Further Reference Books

CHECK YOUR

PROGRESS

Relationship with

Price and Economy?

4.1 Introduction

Money is an important and indispensible element of modern civilization. In

ordinary usage what we use to pay for thing is called money.

In ordinary usage, price is the quantity of payment or compensation given

by one party to another in return for goods or services.

4.2 Objectives

At the end of this unit, you will be able to 1) Know the meaning of Price

2) Know the difference between price and cost

3) Understand the quantity theory of money

4.3 Price and Economy

l

l

As the consideration given in exchange for transfer of ownership, priceforms

the essential basis of commercial transactions. It may be fixed by a contract,

left to be determined by an agreed upon formula at a future date, or discovered

or negotiated during the course of dealings between the parties involved.

In commerce, price is determined by what (1) a buyer is willing to pay, (2) a

seller is willing to accept, and (3) the competition is allowing to be charged.

In ordinary usage, price is the quantity of payment or compensation given

by one party to another in return for goods or services.[1]

In modern economies, prices are generally expressed in units of some

form of currency. (For commodities, they are expressed as currency per unit weight

of the commodity, e.g. euros per kilogram.) Although prices could be quoted as

quantities of other goods or services this sort of barter exchange is rarely seen.

Prices are sometimes quoted in terms of vouchers such as trading stamps and air

miles. In some circumstances, cigarettes have been used as currency, for example

in prisons, in times of hyperinflation, and in some places during World War 2. In a

(31)

Money, Central Banking in

India and International

Financial Institutions - I

Money, Central Banking in

India and International

Financial Institutions - I

NOTES

black market economy, barter is also relatively common.

In many financial transactions, it is customary to quote prices in other

ways. The most obvious example is in pricing a loan, when the cost will be expressed

as the percentage rate of interest. The total amount of interest payable depends

upon credit risk, the loan amount and the period of the loan. Other examples can be

found in pricing financial derivatives and other financial assets. For instance the