reserve bank of india an introduction

advertisement

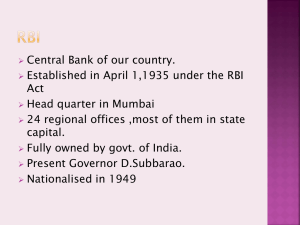

RESERVE BANK OF INDIA AN INTRODUCTION • RBI is the central bank of the country • It is the apex institution of country’s monetary and financial system • It was established on the recommendations of hilton young commission as a body corporate under the RBI act 1934 • It plays a leading role in organising, running, supervising, regulation and developing the monetary and financial system Continued…… • The design and conduct of monetary and credit policy are its special responsibility. • It was in 1948, through the Reserve bank(Transfer of public ownership) Act,1948 the entire share capital was acquired by central govt • Its head office located at Mumbai ORGANISATION AND MANAGEMENT OF RBI 1. Central board- The general superintendence and direction of the banks affairs is in the hands of central board of directors. It comprises of a governor, four deputy governors and 15 directors. 2. Local board- there is a local board with headquarters at mumbai, kolkata, delhi and chennai for each of the regional areas of the country i.e. east, west, north and south METHODS OF CREDIT CONTROL TECHNIQUES USED BY RBI QUANTITATIVE OR GENERAL METHODS QUALITATIVE METHODS MARGIN REQUIREMENTS REGULATION OF CONSUMER CREDIT BANK RATE OPEN MARKET OPERATIONS CHANGE IN CRR AND SLR RATIONING OF CREDIT DIRECT ACTION MORAL SUASION MONETARY POLICY • Monetary policy refers to that policy through which the central bank of the country controls:• The supply f money • Availability of money and • Cost of money i.e. rate of interest, in order to achieve a set of objectives oriented towards the growth and stability of the country Objectives of monetary policy • i) controlled expansion of money supply • It is needed to restrain the inflationary forces of the economy. It is essential for growth with stability which can be achieved through monetary policy of RBI. • Ii) sectoral allocation of funds