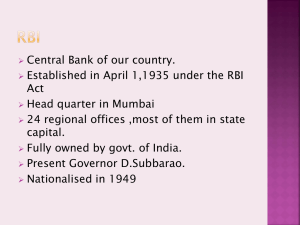

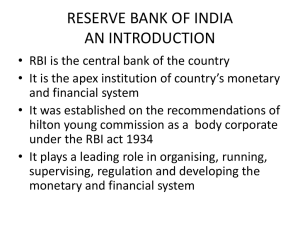

Module -7: Regulatory Authority-Rbi

advertisement

Module -7: Regulatory Authority-Rbi Quantitative and qualitative credit control measures . What is Credit Control: Credit Control is an important tool used by the Reserve Bank of India, a major weapon of the monetary policy used to control the demand and supply of money (liquidity) in the economy. Methods of credit control (1) Qualitative Method 1. Marginal Requirement 2. Rationing of credit 3. Publicity 4. Direct Action 5. Moral Suasion (2) Quantitative Method 1.Bank Rate 2.Open Market Operations 3. Repo Rates and Reverse Repo Rates 4. Cash Reserve Ratio 5. Statutory Liquidity Ratio 6. Deployment of Credit Functions of the RBI a) Monetary functions ( Central banking functions) 1. Bank of issue: RBI has the sole right to issue bank notes of all denominations. Coins – finance ministry of India, currency notes – RBI 2. Government banker: RBI acts as government banker , agent and advisor . The bank has the obligation to transact government business . 3. Banker’s bank and lender of the last resort: the provisions of RBI Act 1934, tells that every scheduled bank has to maintain cash balances with the RBI equal to 5% of its demand deposit and 2 % of its time deposit 4. Controller of Credit: has the power to influence the volume of credit created by the banks in India 5. Custodian of foreign exchange reserves: RBI has the responsibility to maintain the official rate of exchange b) Non- monetary functions: 1. Supervisory functions: has wide powers of supervision and control over all scheduled banks relating to licensing and establishment , branch expansion , liquidity od their assets etc. 2. Promotional functions: RBI promotes banking habits , extend banking facility to rural and semi urban areas and establish and promote new specialized agencies