SMALL BUSINESS PRACTICES IN MUNCIE

advertisement

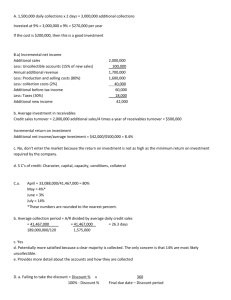

SMALL BUSINESS PRACTICES IN MUNCIE An Honors Thesis (ID 499) by Tamara Sample Thesis Director (advisor's signature) Ball State University Muncie, Indiana May 23, 1986 Expected date of graduation (Spring/1986) SMALL BUSINESS PRACTICES IN MUNCIE PURPOSE The purpose accounting of this practices determine whether of study small or not is to examine the finance and businesses in Muncie, and to their results will be in line with the findings of Grablowsky and Rowell six years ago. JUSTIFICATION From 1976 failed lion from to an 1982, original (Statistical approximately nearly out million of of the every United .3 f'e.c.Q~Sicn States). three small firms. mortality rate discourages many people from owning their own business. small businesses small business population of 4.3 mil- Abstract one 1.3 for what to p. 113). survive dream of Since 1982, business has been through As the country mayor may not be still another reces- sion, small businesses need to look for areas they can order This high pursuing a which pushed many small businesses under. prepares itself That is economic conditions (Posner, change in March 1986, By studying small businesses in the Muncie area, I hope to find some of the common problems. Once the problems have been pointed out, business managers can take steps to correct them. The shift toward small service and retail businesses last few years is another reason industry alone, small shops now market share (Buchsbaum, p.66). fastest growing sector small businesses of for the study. account And the American for 55% in the In the retail of the total service sector is the business today. As these become more and more competitive, managers will 2 want to know what they are failing to do and how they can change to run their business better. LITERATURE REVIEW Nearly all the literature clusion category. I read They concluded fell into that for one main con- the most part small business managers are focused on the short-term and for suggestions for successful Although no studies similar to Brigham and the unexpected. business strategies. Rowell's 1980 One survey offered were do not plan found, the following literature was analyzed related topics. A recent study by Brigham indicated that managers do in fact use very tory. little quantitative They primarily rely cludes quantitative analysis when they manage inven- on methods subjective could making the right choices when judgement. He con- reassure them that they are investing in one of the firm's most costly assets, inventory (Brigham, July 1984, p. 59). In another study by O'Neill and Duker, the findings indicate that the two most successful strategies prospector and defender strategies. maintain become sharp price important as for small firms are the The prospector strategy must competitiveness, so financial practices profit margins decrease. Defender strate- gists need solid financial practices because they must attention to their costs. pay close They focus on the product rather than the customer (O'Neill and Duker, Jan 1986, p. 30). My In 1980, survey was Professor developed Bernie based Grab10wsky on the following study. and Dexter R. Rowell of 3 Dominion University conducted a survey and analysis of small businesses in the Norfolk, Virginia area. They found that small businesses in that area indeed did not follow the practices which were taught. Their findings are listed Fundamentals of Financial Management. in Brigham's text, In summary, small business managers did not follow cash management strategies. have a credit policy per see balance inventory. Nor did they They had no quantitative method to They did take discounts for the most part but did not realize how much they were actually paying for trade credit. Most of the managers did present value, internal capital budgeting. investment, and term funds. The they failed to plan reason for such in the as net or even payback for firm was made to stated that involved in for the criteria such return, were being conclusions so heavily of equity no efforts The managers were rate not use the the owner's seek other long small business day-to-day functions that long-term which may have been the high mortality rates in small businesses (Cited from Brigham, p. 770). In another recent article Entrepreneurs Don't Plan," the in INC. author hypothesized based on his interviews that many entrepreneurs It is much easier than to try needs. to Richard for them determine magazine entitled "Real are actually to get into the business activities a long-term Chambers, president projection men don't for capital and chief operating officer of Nashville City Bank & Trust Co., stated, most small-business afraid to plan. even think "From my experience, about the forces that 4 affect them. And when those conditions begin to change, they don't know what's hit them, let alone what to do about it." (Posner, Nov 85, p. 130). The article concluded that the best way to beat the competition in the market place was to plan and be prepared for the unexpected even if it did not happen. METHODOLOGY To obtain data for my study, I contacted 50 small businesses in Muncie and conducted each business I phone interviews spoke responsible of those. At with the accountant, bookkeeper, owner- manager, or a combination ultimately with 30 of for the the three depending on who was determination and execution of various financial policies. The survey included 28 receivable, inventory, management policies. determination of questions accounts involving payable, and capital budgeting It also asked about sources and obtaining long-term funds. cash, accounts uses of the type of the firm, funds, and the policy for Each business was categorized by the number of employees including the owner-manager. The businesses small business. selected had to meet Brigham's definition of For retail stores the cutoff was $2.5 million in sales; and for service businesses, the cutoff was $2.0 million in sales. They also had to have queried about except one. policies for the areas which I But for the most part, all the firms did have definite practices in each of the areas. Realizing that businesses often do use certain techniques but may not use the same terms as I when referring to them, I did 5 explain the necessary. of the techniques involved in However, in doing so, I alternatives I tried to maintain a the questions tried not whenever to indicate which personally felt was the proper choice. neutral and unbiased role in I the ques- tioning. I found the names and numbers the yellow pages in the most phone directory. selected them. in the Rather for the small businesses in recent edition than call of the businesses at and location of the business. were mostly retail and categories because the Small service businesses. Those I chose I selected those Business Administration recognizes those groups as the primary areas of small business. were not random, I By doing so, I was able to obtain a wider variety type, size, select some local tele- that were well-known in so well-known, some that the city had many I tried to and others which employees and some that had few, and some which were located near the university and others which were not. The questions which I used in my survey are listed at the end of this report. RESULTS Considering the prepare any businesses type where test group of cash revenues as a budget. and whole, over Many expenses were were half did not from seasonal quite volatile. Nonetheless, they felt they just knew "from experience" they should spend and how much how much revenue they would pull in. addition, many had not even heard of such a budget. In 6 Of those firms which time sector within the did prepare a budget, the most common budget was a month. In this area they followed the standardized practice of annually preparing a budget for each month of the upcoming year. did prepare However, a few of the firms a budget for the year as a whole and for semi-annual periods rather than monthly ones. The most receivable. commonly complained about area was accounts Although 87% of the firms extend credit to customers to increase sales, nearly minimal credit half of checking policy. even ask for a reference or those do not have even a By minimal, I mean they do not query their other colleagues. This could lead easily to lending to bad-risk customers. Fifty-four checking percent procedure. of the Usually businesses customers do have simply fill a credit out application and their credit is checked at the local banks. feel that such a policy is with good necessary to an They protect themselves, and cause since they are carrying all of their receivables themselves. Unfortunately, three-fourths of not try had their other necessities if A very an most of receivables n/30. extending credit do to speed up the collection of their accounts receivable. Overall, I found that early. those few them did opportunity cost only the offered not realize that their and could be invested in receivables were collected discounts of 1/10, n/30 or 2/10, 7 Fifty percent accounts. had a finance charge of some type for overdue The typical charge was 1.5% per month. good intentions about discouraging over half of the managers fourth of For all their late payments, only a little actually enforced the policy. One- the managers enforced it leniently, often deferring it until after 60 days. The last quarter did not bother to enforce it at all. As far draw. as aging accounts receivable was concerned, it was a Half aged them; half did particular many of the computer software. their receivables not. However, in this area in small businesses mentioned a reliance on Some of the firms which do not presently age will soon do so, as they are in the process of installing an office computer system which will handle it. Inventory was typically experience. When asked about responded that in their sary. monitored through observation and a quantitative method, they often line of business it just wasn't neces- This was very much in line with the responses discussed in Posner's article. All in all 63% of the businesses had no quantitative method for inventory. Almost half of them did, however, calculate turnover, reordering points, carrying costs, or through their accounting system. a duty of a software package. inventory reordering costs This too was often mentioned as Usually, the turnover ratios and reordering points were monitored more closely than the costs. Accounts payable was another area which was studied. An overwhelming 87% of the businesses did try to take most or all of 8 the discounts of the discounts available to them. every manager was quick to point out that in the But nearly last couple of years nearly all of their discounts have disappeared or decreased drastically. The typical discount was 1/10, n/30 or maybe 2/10, n/30 if they were lucky. Although they did try managers had no idea credit. Sixty-three abo~t to take the the discounts, cost they percent thought were paying to or very near the specified comprehension that a 2% discount missed most of them thought for trade that the cost to them when they missed a discount, if it was considered equal most of the a cost at all, was 1% or 2%. They had no cost them 37%. Indeed, it quite humorous that I would even ask if tbey would borrow money from the bank at current interest rates in order to take a 2% discount. Fifty-seven percent made no effort at all to slow down their disbursement. or as They often pay as soon as they receive the invoice soon as they have an adequate cash inflow. cash flow was cited most often as the reason for gamble" by holding it until Unpredictable not "taking the the end of the payment period or discount period. In the area of capital most part all. NPV budgeting, the businesses for the did not bother to follow any guidelines or criteria at In particular, only one of the businesses I spoke with used or IRR. That particular business businesses did use their own criteria of sales, used both. based on The other estimated volume earnings, or the accounting formula for ROI. However, 9 for the most part they did not consider the time value and cash flows. The next area was the business type. incorporated. were Sub-S Specifically, corporations. 63% This were Most of the firms were corporations, clearly reflects and the 10% owners' desire to take advantage of the limited liability associated with a corporation. 88% were However, among those which were not incorporated, sole partnerships proprietorships. are much more This likely led me to conclude that to incorporate than sole proprietorships in small business. For everyone of the firms, the primary source of equity was the owner's personal investment with very Other came long-term funds always necessary and allowable. Two debt structure. in their capital of the few others investing. from debt. aspect himself on also prevented secure enough him from to have any One firm in particular had generations and that bank if they were firms refused been in the family for three Unfortunately, a which had never the leveraging a had any grandson prided firm that was to endure several decades of economic shifts. But overall, the businesses considered the local bank the only source of outside long-term funding. Sources and uses of funds can be evaluated often to indicate what area is "eating generating more annually in the up" excessive funds funds than expected. This preparation Financial Position. of The and what area is process is required Statement of Changes in Of the firms I spoke with in the survey, 73% 10 only evaluated ment. sources and uses of funds for the annual state- The others usually evaluated them needed to make a decision. if they felt they were Only 13% made a sources and uses statement on an established time period, such as quarterly or monthly, so they could monitor the business. From a more focused overall findings when the aspect, there are exceptions to the test group is broken down into three 1-9, 10-19, 20 & up. groups by number of employees: In the next section, I will point out those exceptions. Although the overall consensus for the cash budget indicated that over half of the small businesses did budget, in the 10-19 group 70% This indicates that the of the large and not prepare a cash firms did small prepare one. group weighted the overall data heavily. In accounts receivable management, substantially from the overall the results. which extended credit, most did not try to tion of this. the receivables. In that employee group, attempt to norm The 1-9 as speed receivables. far Overall, 54% as credit 92% 1-9 Among the businesses speed up the collec- group was an extreme case of of the businesses made no This group also deviated from the checking procedures were concerned. had a credit checking procedure; whereas in the 1-9 group, 67% did not. Finally, the overall results of aged the group differed businesses their reflected half receivable, while half did not. Actually, over two-thirds of the medium and large groups did age 11 their receivables, but that was balanced by the fact that three-fourths of the 1-9 group did not. As far as inventory is concerned, in the overall picture 63% did not have a quantitative method to optimize inventory. However, it should be noted that in the 20 & up group, 67% of the firms did utilize a quantitative method. small and medium groups which Also, the manager to costs, and firms. presence of calculate pulled an the inventory turnover Therefore, it was the overall method ratios, result down. which allows the reordering points and carrying costs proved to be in just under half of the This was weighted downward heavily by the 1-9 group which \ reported that 71% of it members did not have an inventory system which could perform those tasks. Looking at the accounts payable, a whole test group did not try group was an extreme case. slow disbursement; to slow little over half of the disbursement. The 10-19 Eighty percent of that group whereas 67% of the did not 20 & up group did try to slow all outlays of cash. As far as capital budgeting results are concerned, the overall picture showed that approximately two-thirds of the firms had no criteria. fairly even, but Actually, it pulled the average down. was the 10-19 and 20 & up groups were the small 1-9 group which once again Eighty-six percent of that group had no criteria. Sources and uses of funds were usually evaluated only on an annual basis for the required accounting reports. However, among 12 the 10-19 group, 50% of the businesses calculated them monthly. The group's effort is outstanding compared to the others in this area. CONCLUSIONS Overall, the survey does indicate that the practices of small business managers in Muncie today are very similar to those in Grablowsky and Rowell's virginia six years ago. survey and analysis For the material tested, in Norfolk, the results of this study have a positive correlation of 0.7113 with the results of Grablowsky and Rowell's survey and analysis. This correla- tion was derived based on the following comparisons. ********************************************************* COMPARATIVE RESULTS TOPICS Variables for correlation equation Prepare a cash budget-----------yes Speed up collection-------------yes Slow disbursements--------------yes Credit check procedure----------no Late charge enforced------------yes Age accounts receivable---------no Quantitative inv. method to optimize inv.-----------------yes Inv. system allows costs & turnover ratios---------------no Take discounts on payables------yes Cost when miss discount---------equal Criteria for capital budgeting--no Primary source of equity--------owner Long-term funds-----------------bank G&R SAMPLE (y) ( x) 30% 34% 34% 95% 50% 34% 40% 27% 43% 46% 27% 50% 6% 37% 54% 69% 40% 50% 100% 100% 53% 87% 63% 67% 100% 100% ********************************************************* There are a few Grablowsky and Rowell. topics which The effect I was unable to compare with of the lack of a credit checking policy would be observable if the specific sales and bad 13 debts figures were Unfortunately, available. owners were not willing to divulge would not release figures invested in inventory which local business that information. relating to Grablowsky They also the amount of capital and Rowell do cite in budgeting was not their study. The subject of criteria for capital limited to NPV, IRR, NTV, PI, or payback methods. primarily due This was done to the fact that from the answers I was receiving, I felt they were using cash their criteria. flows analysis to some degree in However, whenever I would mention the previously listed terms, the manager inevitably did not understand exactly what I meant and "read" too much into the question. The question borrow in order difficult to relating to to take obtain a discount on saying that would borrow. really worth accounts the effort. payable was The managers often if the However, since nesses, the invoices were rarely large; were not not the manager would straight answer from. qualified their answers by enough they a whether or amount was large they had small busi- therefore, the discounts One manager stated that his typical discount would amount to $0.50 per invoice. The findings potential for every small although I of this study are error inherent business tried to in any advertises remain unbiased asked the question different ways to the data in of course survey. the in my limited due the For instance, not yellow pages. And approach, perhaps I different people. Finally, base was fairly small even though it was representative 14 of several small businesses in the two categories which make up a large portion of small businesses. so definite, such as 100%, are The values which seem to be of course subject to change as the data base grows larger. Even with the that Muncie small limitations mentioned, study did show business practices are similar in many ways to the practices in the previous study; evolved. the Hopefully, this thesis small businessmen in the area and and some will see the cular businesses which need improvement. improvements have provide information to area in their parti- 15 QUESTIONS FROM SURVEY 1. Would you classify your business as retail or service? 2. How many employees, including the owner, work for your business? 3. Can you give me from last year? a rounded figure which estimates your sales 4. Do you prepare a cash budget? 5. What is the periodic breakdown within the budget? 6. Do you extend credit to customers and carry ables? your own receiv- 7. Do you try to speed up collections of your accounts receivable? In other words, do you have a policy which encourages customers to pay before the actual due date? 8. Do you have a credit checking procedure for those customers who would like credit? 9. Do you have a charge for late payments? 10. What is the typical charge? 11. Is it strictly enforced, leniently enforced, or not enforced? 12. Do you age your accounts receivable? In other words, do you classify them into groups like less than 30 days, 30-60 days, 60-90 days, etc.? 13. What is the amount of your average bad sales? debt as a percent of 14. What percent of your capital is invested in inventory? 15. Do you use a quantitative method to determine the optimal level of inventory, that inventory level which does not cost too much for you to maintain but is enough to meet customer needs? 16. Does your turnover, costs? inventory system allow you to generate inventory reordering points, ordering costs, or carrying 17. Do you take discounts on your accounts payable? 18. What is a typical discount on accounts payable? 16 19. If you had a choice between (A) missing a discount on an account payable or (B) borrowing from the bank to pay the bill and take the discount, which would you do? 20. When you miss a discount of «their typical discount», what do you consider the cost to you to be? (A) Much greater than «typical discount» (B) A little greater than «typical discount» (C) Equal to «typical discount» (D) Less than «typical discount» 21. Do you try to slow your disbursements? In other words, do you time your payment so that it just arrives at the end of the discount or payment period, or do you attempt to pay you bill as soon as you have enough cash available? 22. When you evaluate a new capital budgeting project, such as an expansion, buying new equipment, carrying a new line of products, or moving to a new location, do you have any formal criteria that you use to decide whether or not the project will be good for your business in the long run? 23. What is your criteria? 24. Do you use IRR, NPV, NTV, PI, or payback? 25. Is your business a sole proprietorship, partnership, corporation, Sub-S corporation? 26. What is the primary source of equity in the firm? 27. Where would you seek them? other long-term funds if you needed 28. Do you evaluate sources and uses of funds more often than for the annual year-end statement of changes in financial position? 17 THE RESULTS OF THE SURVEY ************************************************************* (10-19) (20 & UP) (1-9) OVERALL YES NO YES NO YES NO YES NO Cash budget? 40% 60% 21% 79% 70% 30% 33% 67% Credit? Speed AIR? Credit check? Late charge? Enforced? Lenient? Not enforced? Age AIR? 87% 27% 54% 50% 13% 73% 46% 50% 54% 23% 23% 50% 50% 86% 8% 33% 42% 14% 92% 67% 58% 33% 50% 17% 25% 75% 90% 10% 44% 56% 78% 22% 56% 44% 100% 83% 40% 60% 40% 17% 60% 40% 60% 67% 33% 100% 80% 20% Quant. inv.? Inv sys allow turnover and costs? 37% 63% 21% 79% 40% 60% 67% 33% 47% 53% 29% 71% 60% 40% 67% 33% Disc on Alp? 87% 13% Cost? Little > disc 12.5% Equal to disc 63.0% Less than disc 12.5% Slow disbursements? 43% 57% 79% 21% 100% 83% 17% Criteria for projects? Type of firm? Sole proprietor Partner Corp Sub-S Corp Primary Source of Equity Owner Other L.T. Funds Bank Evaluate S&U? Annually Quarterly Monthly As needed 33% 67% 21% 71% 8% 50% 50% 10% 70% 20% 20% 80% 67% 33% 14% 50% 50% 50% 86% 50% 33% 67% 23% 4% 63% 10% 36% 7% 36% 21% 10% 17% 90% 83% 100% 100% 100% 100% 100% 100% 100% 100% 73% 3% 10% 14% 100% 30% 10% 50% 10% 67.0% ----16.5% 16.5% ************************************************************ - 18 BIBLIOGRAPHY Albert, Kenneth J. How to Pick the Right Small Business Opportunity. McGraw-Hill. 1977. 234 pp. 3rd Br igham , Eugene F. .::.F..,;u:.:;n:.::d:.::a:::m::..:e::..:n~t.:;a==-=-l-=s-=---=o-=f~~F:-:i::..::n:.:.;a==n:..:.c=i=a=I~..:.M:.::a::..;n=..;:a::..og;;t..;e::..:m~e.::;.n=t • ed. The Dryden Press. 1983. 772 pp. Brigham, Eugene F. and R. Bruce Ricks. Readings: Essentials of Managerial Fiance. Holt, Rinehart, & Winston, Inc, 1968. 479 pp. Buchsbaum, Susan. p. 66(6). "A Nation of Shopkeepers." INC. Nov 1985. Planning vs. Control." Churchill, Neil c. "Budget Choice: Harvard Business Review. July/Aug 1984. p. 150(9). Dacey, Joseph M. "How Small Business Copes With Credit Problems." Credit & Financial Management. Nov 1984. p. 21(4). Dible, Donald M. Winning the Money Game: How to Plan and Finance a Growing Business. The Entrepreneur Press. Santa Clara, CA. 1975. 285 pp. Dollar, William E. Purchasing Management and Inventory Control for Small Business. Small Business Management Series No. 41. SBA. 1980. "Financial Management and Formation in Small Business." Business News & Views. July 1984. p. 73(7). Frantz, Forrest H. Successful Small Prentice-Hall, Inc. 1978. 409 pp. Business Small Management. Grablowsky, B. J. "Financial Management of Inventory." Journal of Small Business Management. July 1984. p. 59(7). Hayes, Rick S. and John C. Howell. Business with Government Money. Inc. 1983. 248 pp. How to 2nd ed. Finance Your Small John Wiley & Sons, O'Neill, Hugh M. and Jacob Duker. "Survival and Failure in Small Business." Journal of Small Business Management. Jan 1986. pp. 30(17). Posner, Bruce G. "Hidden Perils In March 1986. p. 113(3). A Volatile Economy." INC. 19 Posner, Bruce G. "Real 1985. p. 129(4). Entrepreneurs Don't Plan." INC. Nov Pryor, John. "What the Small Business Owner Should Know About Accounting." Management Accounting. May 1983. p. 42(4). Schollhammer, Hans and Arthur H. Kuriloff. Entrepreneurship and Small Business Management. John Wiley & Sons, Inc. 1979 • 59 5 pp • in America." "The 200 Best Companies Slutsker, Gary. Nov 4, 1985 • p. 136(4). Forbes. .: S:. .:;t:,!:a:,;t:.,:i: .:s: . ,;t=.:l.: .,;"c~a~l-=..:A=b:.::s:...:;t:..:r:..::a;.:c::..,;t;......:o:::.;f=----=t.:.:h:.::e:..-..--::=:U:.:n:..:i::...;t::..:e~d=--......::;S..::t:.::a~t:,!:e:.::.s • 106 th ed. 1986 . u.S. Dept. of Commerce. Bureau of the Census. 948 pp. Stevens, Mark. "Seven Common Mistakes Small Businesses Make and How to Avoid Them." Working Woman. Jan 1986. p. 44(3). Stevens, Mark. Small Business Mistakes and How to Avoid Them. West Nyack, NY. Parker Publishing Company, Inc. 1977. 187 pp. The State of Small Business: A Report Transmitted to Congress. May 1985. of the President. Udell, Gerald G., Ph.D. Managing the Small Service Firm for Growth and Profit. Small Business Management Series #42. SBA. 1980. Viscione, Jerry A. "Small Company Budgets: Harvard Business Review. May/June 1984. Wingate, John W. and Seymour Growth. Small Business SBA. 1977. Witmer, Scott. "Those Business. Feb 1984. -. Target are key." p. 42(6). Helfant. Small Store Planning For management Series #33. 2nd ed. Pesky Overdue p. 38(2). Accounts." Nation's