Mittal Steel in 2006: Changing the Global Steel Game -DRAFT-

advertisement

PANKAJ GHEMAWAT

RAVI MADHAVAN

-DRAFTJANUARY 15, 2007

Mittal Steel in 2006: Changing the Global Steel

Game

On January 27, 2006, Laxmi Niwas Mittal (LNM) and his son, Aditya Mittal, Chairman & CEO and

CFO respectively of Mittal Steel, prepared for the press conference at which they would announce

Mittal Steel’s unsolicited $22.8 billion bid to acquire the European steelmaker Arcelor. Although

Mittal Steel had been a prime mover behind the consolidation of the industry—and most participants

and observers in 2006 seemed to accept the logic of consolidation—an offer for Arcelor was unlikely

to have been anticipated by the industry. Arcelor had been created in 2001 by the merger of three

European steelmakers—Usinor (France), Arbed (Luxembourg), and Aceralia (Spain)—that were

themselves, in turn, the result of previous mergers in their respective countries. Mittal Steel and

Arcelor were at that point the two largest and most global steel producers; it would have been far

easier to imagine the two giants growing in parallel through other significant acquisitions. For

example, World Steel Dynamics had sketched out a scenario in which Mittal Steel acquires the AngloDutch steelmaker Corus and Arcelor acquires ThyssenKrupp of Germany1. Yet, at the announcement

of the offer on that winter day in London, LNM, described by the New York Times as having “never

been bashful about his global ambitions2,” would present the combination of Mittal Steel and Arcelor

as the next logical step in the evolution of the industry.

“This is a great opportunity for us to take the steel industry to the next level. Our customers

are becoming global; our suppliers are becoming global; everyone is looking for a stronger

global player.”3

A torrent of deals

The amount we will receive for this company [the Kryvorizhstal steel plant] will be 20 per cent higher than

all the proceeds received in all the years of the Ukrainian privatization.

— Ukrainian President Viktor Yushchenko4

I can say that the Ukrainian administration has been very lucky to receive this price.

— Laxmi Mittal, Chairman of Mittal Steel, the winning bidder5

Arcelor will continue to seek to grow through strategically compelling acquisitions; however, management

will not compromise shareholder value in the pursuit of this goal.

— Guy Dollé, CEO of Arcelor, the losing bidder6

________________________________________________________________________________________________________________

Professor Pankaj Ghemawat of IESE Business School and Professor Ravi Madhavan, of the University of Pittsburgh, prepared this case. This case

was developed from published sources. Cases are developed solely as the basis for class discussion. Cases are not intended to serve as

endorsements, sources of primary data, or illustrations of effective or ineffective management.

Copyright © 2009 . No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form

or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of Pankaj Ghemawat.

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

Barely 3 months had passed since Mittal Steel’s previous acquisition. On October 24, 2005,

LNM had announced that Mittal Steel had won the bidding for Kryvorizhstal, Ukraine’s 10million tpy7 capacity steel plant, which produced one-fifth of the country’s steel output.

Kryvorizhstal was a controversial privatization, having been sold in 2004 to former president

Leonid Kuchma’s son-in-law and a business partner for around $800 million. The opposition, led

by Viktor Yushchenko, called the sale a “theft” that gave away a very valuable industrial property

and promised to annul it.8 After the Orange Revolution brought him to power, President Viktor

Yuschenko kept that promise by organizing a second auction—despite resistance from the former

owners who appealed to the European Court of Human Rights, mounting social skepticism about

privatization because of past corruption, and a Parliamentary vote to halt the sale. The new

government wanted to highlight the transparency of Ukraine’s new business culture to potential

investors, and therefore arranged for the auction to be televised live, with President Yushchenko

attending in person.

Mittal Steel, the world’s largest steel company with 59 million tons of crude steel production in

2004, was an obvious bidder in the second auction: it had lost the first auction, in 2004, despite

bidding $1.5 billion, or nearly twice as much as the winning partnership. The other competitors this

time around were a consortium led by Arcelor, the world’s second largest steel producer with 51

million tons in crude steel production in 2004, and LLC-Smart Group, a local investor group

reportedly controlled by a Russian businessman. LLC-Smart dropped out of the auction early on,

leaving Mittal and Arcelor to go head-to-head. The $4.8 billion that Mittal ended up paying greatly

exceeded expectations, with some reports suggesting that the Ukrainian government’s target price

had been around $3 billion.9

The World Steel Industry10

In 2005, the global market for steel was estimated at around 998 million metric tons (mt).11

Although the market for steel comprised several thousand distinct products, they could largely be

grouped into a few broad segments. Semifinished products were at least 8 inches thick and required

further processing. Flat-rolling them yielded plates (more than 0.25 inches thick), or sheet and strip,

thinner products that could be shipped in coils. Other kinds of products that could be formed from

semifinished steel included bars and wire rods, that were even thinner; a wide variety of structural

shapes that were used primarily in construction; and hollow pipes and tubes. Flat sheet was by far

the most important of these segments, both because of the volumes and because it included the

higher-value-added sheet steel for the automotive and appliance sectors. Other major customer

groups included service centers and distributors, and the construction sector. Price, quality, and

dependability were considered the three most important buyer purchasing criteria, although it was

difficult to get qualified by major buyers such as the automobile companies. Higher price realizations

typically reflected a focus on higher-end products, and tended to be accompanied by higher

operating costs.

From a technological perspective, there were three groups of steelmakers: integrated firms that

produced steel by reducing iron ore, minimills that produced it by melting scrap, and specialty

steelmakers that produced stainless steel and other special grades of steel for distinct submarkets and

will not be considered further here. Integrated firms traditionally dominated the industry and

followed a strategy of vertical integration, owning not only steel plants but also iron ore and coal

mines, transportation networks, and downstream processing units. In recent decades, however, many

2

Mittal Steel in 2006: Changing the Global Steel Game

-DRAFT-

had reduced their holdings in upstream and downstream segments so as to focus on the core

business of steelmaking. Minimills operated their scrap-based Electric Arc Furnaces (EAF) at much

lower scales than integrated steelmakers’ blast furnaces, reducing their minimum efficient scale from

millions of tons to several hundred thousand and their capital cost per ton of new capacity from

$1000+ to the range of $200–$300. Minimills had historically had a significant cost advantage over

integrated steelmakers, and had forced them out of low-end products, to the point where in the

United States, the minimills held about 45% of the total market, but continued to face difficulties in

meeting the exacting standards of automotive and appliance manufacturers. The constraints

reflected, in part, minimills’ reliance on scrap steel as primary input: impurities in the scrap steel

tended to reduce the quality of the finished steel and, furthermore, scrap prices had come under

pressure even in markets where scrap had historically been abundant. In the 1970s, the new

technology of Direct Reduced Iron (DRI) began to catch on—this process produced a scrap substitute

from iron ore that could be used to feed the EAF. In its early years, DRI quality had been very

variable, but had improved gradually, and was expected to eventually provide the same clean

metallic feedstock for EAF as the blast furnace, but at a lower cost, and without scrap’s inherent price

volatility and quality problems.12

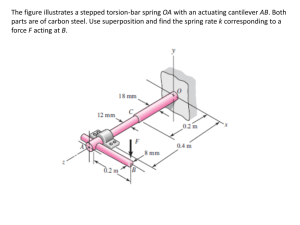

On the whole, steel producers around the world had posted significant economic losses for

decades. Thus, Marakon Associates, calculated that steel had persistently been the most unprofitable

of the major U.S. industry groups between 1978 and 1996 (see Exhibit 1), although economic losses

had since narrowed. The pattern was repeated in most other mature markets. Thus, Mittal Steel’s

comparison of the return on invested capital (ROIC) and the weighted average cost of capital

(WACC) of the 10 largest steel producers worldwide suggested narrower but still chronically

negative spreads, with only the most recent year—2004—generating significant positive returns (see

Exhibit 2). The reasons were various and included fragmentation, very high fixed costs and exit

barriers, generally slow growth and induced excess capacity, limited product differentiation,

intensified competition from minimills and imports as well as substitution threats (which included

less-intensive use of steel as well as replacement by other materials), and the bargaining power of

organized labor and large customers.

Many observers in or interested in the steel industry thought that after some particularly bad

years in the 1990s, steel industry stakeholders—producers, unions and governments in particular—

had finally begun to move towards the end of the 1990s to bring about some much-needed

rationalization through bankruptcy-linked closures and consolidations. However, demand growth

had also taken a hand: after stagnating in the 700–800 million tpy range in the 1980s and the 1990s,

consumption had steadily increased since 2000 toward the 1 billion tpy mark. But the very recent

spike in industry profitability, in 2004, seemed to have more to do with China’s red-hot construction

sector. China accounted for close to one-quarter of demand and, more importantly, most of the recent

growth in demand (see Exhibit 3). Given the lags in building up domestic capacity to serve apparent

domestic consumption growth rates that had often surpassed 20% in recent years, China had sucked

in an enormous amount of imports. In particular, between spring 2003 and spring 2004, spot prices

for a benchmark sheet product, basic hot-rolled band, had increased from less than $300/ton to

nearly $500/ton in China, from $300/ton to slightly more than $500/ton in the European Union, and

from $300/ton to closer to $600/ton in the United States.13 However, although Chinese demand

continued to grow, prices had stabilized, signs of overbuilding were starting to appear in 2005, and

academic experts predicted that Chinese capacity was likely to flood the world with cheap exports in

all but the specialty grades.14

Longer-run demand forecasting exercises highlighted differences rather than similarities across

regions. Thus, an analysis by Arcelor based on data through 2003 suggested that through 2010,

3

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

demand would stagnate in Japan, and grow at a 1% annual rate in the European Union, 2.5% in the

United States (where demand in the base year of 2003 was particularly low), 4.1% in South America,

5.5% in China, and 6.5% in Asia excluding China and Japan.15

The steel industry presented a somewhat mixed picture along other dimensions of

internationalization as well. Trade in the steel industry was substantial—close to 40% of all steel

production was exported in some years—but close to one-half of it was intra-regional. In terms of

prices rather than quantities, some increases in inter-regional integration had been apparent in recent

years: according to calculations by Arcelor, the correlation of hot-rolled prices between the United

States and the European Union had doubled from 37% over 1994–98 to 74% over 1998–02.

Nonetheless, international price integration was expected to continue to be imperfect because of a

variety of barriers to international trade. Transport costs were the most obvious natural barrier and

were also subject to aggregate capacity constraints: thus, against the backdrop of a general boom in

Chinese trade, the run-up in steel prices over 2003–4 had been accompanied by an escalation of the

costs of ocean transportation to China, from $40/ton of steel to $60/ton. Other natural barriers

included delivery lags and varied product preferences. Tariffs and other policy restraints on trade

constituted the most obvious artificial barriers. While there had been significant reductions in

average posted tariff levels over the previous decades, “temporary” countervailing duties, quotas,

and other distortionary policies such as subsidization of domestic producers or bail-outs remained

common.

The general tendency of governments to support domestic producers reflected both concerns

about preserving employment in a large sector with well-organized labor as well as the specifically

“strategic” status that had historically been accorded to the steel industry. Steelmaking had long been

considered a matter of national pride, as illustrated by the industry saw that the two major

investments that were de rigueur for every newly independent nation were a national airline and a

steel plant.16 As a result, 60% of the world’s steelmaking capacity was government-owned in the

1980s.17

Since then, much of this capacity had been privatized, especially in post-communist countries—

part of a broader cross-industry privatization wave worldwide—and government-owned steel

capacity had declined to 40% of the world total.18 These privatizations provided a basis for increased

cross-border integration through foreign direct investment (FDI) instead of just trade. U.S. Steel’s

acquisition of a steel plant in Kosice, Slovakia, supplied one example: the acquisition raised the share

of non-U.S. production in the company’s total from virtually nothing to nearly 30%—and later helped

keep the company afloat during difficult years at home. Arcelor, the European steel giant and the

second largest steelmaker in the world was formed in 2002 when three formerly state-owned

European steel companies from three different countries were combined: Aceralia (Spain), Arbed

(Luxembourg), and Usilor (France). Arcelor also appeared, however, to be hedging its bets about

inter-regional expansion: thus, it had formed an alliance with Nippon Steel of Japan, the fourth

largest steelmaker in the world, to serve (high-end) global customers.

By far the most dramatic example of growth by acquisition of (primarily) steelmakers being

privatized, in terms of its geographic scope as well as absolute scale, was Mittal Steel, which had

come from virtually nowhere to become the largest competitor in the steel industry with a strategy

that emphasized acquisitions, particularly of steel mills that were being privatized. One perspective

on the scale of Mittal’s M&A activities was provided by 2004, a record year for mergers and

acquisitions in the steel industry as a whole, with a total of transactions worth $31.4 billion. Mittal

Steel accounted for two-thirds of that with a two-stage transaction involving the $13.3 billion merger

of LNM Holdings and Ispat International and the $4.5 billion acquisition of the International Steel

4

Mittal Steel in 2006: Changing the Global Steel Game

-DRAFT-

Group in the United States to create Mittal Steel (the top 2 steel deals of the year) as well as a number

of smaller transactions.19 And while 2004 was an exceptional year, Mittal would clearly again top the

2005 transaction tables with its acquisition of Kryvorizhstal—as it had in most recent years.

Exhibit 4 provides summary operating and financial data for Mittal Steel and its 9 largest

competitors worldwide in 2004, and Exhibit 5 breaks out summary operating and financial for Mittal

Steel by region over 2002–4. Exhibit 6 provides one industry consultant’s subjective summary

assessment of Mittal’s competitive position relative to its largest competitors. The rest of this case

describes Mittal Steel’s evolution over time, how it was managed and organized, and its vision as to

how it would sustain superior performance in the future.

Mittal Steel’s Evolution

LNM’s father, Mohan Lal Mittal, had founded the Ispat Group—Ispat meant steel in Sanskrit—in

Calcutta, India, to trade scrap metals.20 Upon graduating from college in 1970, LNM joined the family

business and was involved in setting up a new steel plant in Calcutta before being asked to oversee

the export business in South East Asia. In 1976, the elder Mr. Mittal had bought some land in

Indonesia with the goal of building a steel mill there; however, he subsequently changed his mind,

and dispatched LNM there with the charge of re-selling the land. When he arrived in Indonesia,

however, LNM was struck by the prospects of imminent growth in the Indonesian economy, which

would boost demand for steel; he successfully convinced his father to stick with the original plan of

making steel there, and stayed on to take charge of the mill.

However, the original idea of building a traditional scrap-based minimill did change under LNM,

who had always worried that traditional minimills’ reliance on scrap steel as exclusive input would

prove to be their Achilles’ heel. LNM decided to invest in a 65,000 tpy DRI (direct reduced iron) plant

alongside the new minimill, even though DRI was a fledgling technology at the time that could not

provide consistent quality levels. Over the years, as DRI technology improved and became more

reliable, LNM’s trust in it as a viable alternative to scrap grew—indeed, he began to refer to his

minimills as “integrated minimills,” i.e., mills that used electric arc furnaces but integrated backward

into DRI production. By the late 1990s, one analyst described Ispat/Mittal’s lead in DRI as “virtually

insurmountable for the foreseeable future,” given that DRI was complicated and hard to copy.21

As its steelmaking capacity was expanded, LNM’s Indonesian mill came to rely on external

suppliers of DRI as well. One such supplier was Iscott, which was owned by the government of

Trinidad and Tobago. Built in 1981 by the state at a cost of $460 million, Iscott was in severe financial

trouble by 1988, with 25% capacity utilization, and weekly losses of $1 million since 1982. As a

customer of Iscott’s, LNM was very familiar with its problems, but could also see the potential value

that could be unlocked by better management. When the government of Trinidad & Tobago invited

him to make a bid for the troubled plant, LNM had no hesitation in expressing interest. However, he

did not have the funds to make an offer for outright purchase; instead, he suggested a 10-year lease at

$11 million a year with the option to buy in the fifth year at an independently appraised price. The

Trinidad government agreed, and LNM quickly embarked on his first turnaround. He brought in 55

DRI experts and managers from around the world, and pumped in nearly $10 million of new

investment in the first three months. Production bottlenecks were remedied and quality rapidly

improved; by the end of the first year, the operation made a small profit after paying for the lease.

With viability regained, Caribbean Ispat was able to secure World Bank financing that allowed it to

increase capacity by 50%. In May 1989, LNM acquired the plant for a price of $70 million.

5

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

The Trinidad experience taught Mittal that a SWAT team of managers and technology experts,

along with a rapid investment program, could turn around such assets fairly quickly, even if the

assets themselves had long lives. The next few acquisitions also focused on troubled state-owned

steel plants using DRI/EAF technologies (see Exhibit 7 for a history of Ispat/Mittal’s major

acquisitions and Exhibit 8 for a financial and operational history). The first, in Mexico, involved a 2.5

million ton steel mill that had cost $2.5 billion and had been started up in 1988, but was running at

barely one-quarter of its capacity and losing $1 million per day. Mittal stepped in to run it, with the

understanding that he would acquire it over time—which, having turned it around quickly, he did in

January 1992, for $220 million.

The large new plant in Mexico generated so much cash as to fund investments of comparable

magnitude in state-owned DRI/EAF steelmakers in Canada and Germany in late 1994/early 1995.

Roughly at that time, LNM and his father agreed to separate Ispat International, LNM’s operation,

from Ispat Industries, the original family business in Calcutta.22 LNM moved his residence and his

corporate office to London, registering the LNM group in Rotterdam. Also in 1995, he paid about

$500 million for Kazakhstan’s Karmet mill, which had 6 million tons of truly integrated liquid steel

capacity that came with not just blast furnaces but large iron ore and coal mines, power plants, and

even some of the social infrastructure (e.g., trams and some schools) for a town with more than

100,000 inhabitants. Described by a Fortune magazine writer as a “Communist catastrophe,”23 the

integrated complex employed 70,000 workers—making it Kazakhstan’s largest private employer—

and produced low-quality steel for the Kazakh and Russian economies. The deal, LNM’s largest to

date, won great attention, not all of it favorable. Robert Jones, the steel editor at Metal Bulletin was

quoted as saying later: “When he went to Kazakhstan, I thought either he was nuts, or saw things

very differently.”24

What Mittal saw at Karmet were very low labor costs ($250–$300/month), large, rich mineral

deposits, location on a railway grid, a booming market in China, whose western border was just 400

miles away and intense personal interest by Kazakh President Nazarbayev, who had started his

career as an engineer at the company, in ensuring that the privatization worked. An injection of

working capital helped get the plant off the barter system to which it had been reduced as well as

funding the payments of back wages to workers, significant investments were made to debottleneck

and expand output, otherwise reduce costs, and upgrade the product mix, and new markets in China

and Iran were developed (35% and 15% of 2003 sales, respectively). According to Mittal, it invested

$700 million on top of the initial purchase price in Karmet by 2003 (some of it financed by

development finance institutions). That year, Karmet shipped 3.75 million tons of steel products and

reported generating $1,189 million in revenues while having pushed operating costs down to the

amazingly low level of $126/ton.a And while mass layoffs had been ruled out by the terms of the

deal, Karmet’s headcount had fallen gradually, to just over 50,000 employees.

In 1997, Ispat International, comprising some of LNM’s steel assets, went public in an IPO but

others, including the Karmet complex, were retained by his privately-held vehicle, LNM Holdings. A

series of other acquisitions followed, initially through Ispat International but starting in 2001 via

LNM Holdings, in apparent breach of an undertaking at the time of Ispat’s IPO that it would carry

out all future acquisitions. In July 1998, in another transaction that dwarfed all previous ones, Ispat

acquired Inland Steel in the United States, with 4 million tons of capacity, for $1.4 billion plus a

planned $800 million in additional investment. While this acquisition brought Ispat higher-end

business in and skills associated with the automotive sector in particular, its results were considered

a The comparable total revenue and operating cost figures for 2002 were $869 million and $114/ton respective. Figures for 2004

were unavailable, but steel prices around the world were generally $100–$200 higher in 2004 than in 2003.

6

Mittal Steel in 2006: Changing the Global Steel Game

-DRAFT-

mixed. Part of the problem was that rivals such as Bethlehem managed to lighten the load of pensions

and other liabilities through bankruptcy-based reorganizations.

LNM Holdings went back on the acquisition trail in 2001, and looked outside the Americas: it

focused on East Europe, with large acquisitions in Romania, the Czech Republic, and Poland, and

smaller ones in Macedonia and Bosnia, but also made large acquisitions in Algeria and, especially,

South Africa. One of the Romanian acquisitions also brought in its wake some unwelcome

controversy. A few months after LNM Holding’s acquisition of Sidex, it was revealed that British

Prime Minister Tony Blair had written a letter to his Romanian counterpart, Adrian Nastase, in

support of LNM’s bid. According to some reports, Blair’s letter helped “trump” a bid by Usinor of

France (one of Arcelor’s predecessors).25 This issue became a major political controversy in the United

Kingdom, especially when it turned out that LNM had made a contribution worth $180,000 to Tony

Blair’s Labor Party during the previous month. The Blair government denied any impropriety in the

matter, arguing that the whole story began with a suggestion from the British Ambassador to

Romania that they should support this British bid. This opened up a new area of debate, about

whether LNM Holdings was indeed a British entity: it was registered in the Netherlands Antilles, had

only 50 employees in London (out of a worldwide total of 100,000 across LNM and Ispat), and LNM

Group turnover in the United Kingdom was not quite 2% of worldwide revenues. While declining to

be formally interviewed, LNM was reportedly outraged by the negative press, insisting that:

I have absolutely nothing to hide. I have a very strong British identity. I have British

companies with a turnover of nearly £40m a year. What is more, I have settled here and raised

my family here. I pay tax here. It’s true I run a multinational group but I have no business

interests in India. So please tell me, what should my identity be?26

Ispat International and LNM Holdings were folded back together in the course of the merger with

Wilbur Ross’s International Steel Group (ISG) in the United States, announced in 2004 and completed

in 2005, that created the world’s largest steelmaker by volume. Wilbur Ross, a veteran investor in

distressed properties, had assembled ISG in 2002 out of the bankrupt steelmaker LTV and other U.S.

steelmakers. Taking advantage of bankruptcy regulations, ISG purchased the assets while only

assuming specific liabilities—in particular, the buyer would be free of the legacy costs of pension

liabilities and other post-employment benefits such as retiree healthcare. (The federal agency Pension

Benefit Guaranty Corporation took over the pension liabilities, although not the retiree healthcare

programs.) By 2004, ISG was one of the largest integrated steel producers in North America. ISG’s

acquisition for $4.5 billion by what became Mittal Steel richly rewarded its investors: ISG shares,

which had been trading at less than $30, were exchanged for $21 in cash and $21 in Mittal Steel

shares. Concurrently, LNM Holdings was absorbed, along with Ispat International, into a publiclylisted entity, Mittal Steel. This involved the payment of a $2 billion dividend to the sellers of LNM

Holdings. The Mittal family continued to own 88% of the shares of the merged entity.

Management and Organization

Mittal Steel emphasized discipline in the deal-making, turnaround, and value creation processes.

Over the years, Mittal appeared to have introduced a number of managerial practices that were novel

to the steel industry—aided by LNM’s injection of non-steel mindsets into his executive team, as

illustrated by his choice of Roeland Baan from oil major Shell to run Mittal Steel Europe. The overall

approach had been characterized as resembling that of a private equity firm more than a traditional

steelmaker.27

7

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

Dealmaking

Mittal focused its acquisitions on the steel industry (and stages upstream), despite the fact that

Business Week had suggested that “the Mittal Method is less about steel than about smart practices.”28

Promising targets were subject to a rigorous due diligence process. A small team, highly experienced

in steelmaking as well as dealmaking, would visit the company to assess the seller’s expectations and

the viability of the assets. Unless the target demonstrated reliable labor and energy supply, Mittal

would not proceed. The due diligence process focused, in addition, on people. In the words of,

Johannes Sittard, a former COO, “We use due diligence to learn about the people who are running

the company and to convince them that joining Ispat is an opportunity for them to grow. These

conversations provide information you will never find in a data room.”29

In the next stage of this gated approach, Mittal Steel worked with the target’s management to

develop a five-year business plan to provide an acceptable ROI. The deal team was drawn from a

core team of 12–14 London-based professionals who had mostly worked together since 1991 and

therefore knew each other well. The deal team managers developed a document that detailed the

investment thesis and the strategic options; if the deal was approved, this document became the

turnaround roadmap.30 And since the deal team managers (from Mittal Steel) knew that they might

end up running the acquired unit, they had an incentive to remain realistic with respect to the

assumptions made in their projections.

Another noteworthy aspect of Mittal’s approach was a patient attitude to deal-making that

emphasized a slow but steady build-up of credibility and relationships that often started well before

any acquisition and could make Mittal the preferred suitor when a deal was near. Its first two

acquisitions, in Trinidad and Mexico, fit this pattern as two relatively large recent ones, in South

Africa and China. In 2002, Mittal Steel took a 35% stake in South Africa’s Iscor, agreeing to supply it

with technology and services as well as to help support other South African government policies.31

Two years later, Mittal assumed full control. Mittal’s recent investment in China seemed to be

following a similar sequence: a 37% stake in Hunan Valin Steel Tube & Wire Co. was obtained just

before the Chinese government declared in a new policy that foreign control of a steelmaker would

not be permitted “in principle.” Mittal Steel was hopeful that this restriction would be relaxed over

time. In the words of Aditya Mittal, LNM’s son as well as Mittal Steel’s president and CFO, “We want

to demonstrate to the Chinese government that we can be a responsible partner. Once they have seen

how we behave and how we are improving the company, I’m sure there will be more opportunities

for us.”32

Mittal sought to add value to this partnership through a variety of mechanisms, ranging from

leveraging global purchasing clout to get Valin better iron ore prices to starting to give some Valin

executives two-year postings at other Mittal Steel plants around the world. Mittal also promised to

license technology for some of its best products, a key Chinese requirement, and donated $5 million

to a university in Valin’s home town. But even while aggressively courting Valin in 2005, Mittal Steel

had in place a nonbinding memorandum for a $100 million plant in the Northeast, which was being

“evaluated.” Aditya Mittal was quoted as saying, “Valin is not exclusive. We see the possibility of

other partners.”33

Turnaround and Integration

Once the deal had closed formally, it was time to move on to the difficult task of turning around

the acquired operation. Mittal Steel’s managers believed that they had established a solid track record

at improving the efficiency of previously poorly managed steel mills (see Exhibit 9 for illustrative

8

Mittal Steel in 2006: Changing the Global Steel Game

-DRAFT-

cost reduction numbers). The turnaround team would oversee this part of the process as well,

spending six months or more in each location, before handing over the stabilized operation to a new

set of managers and moving on to the next acquisition—which gave it a broad understanding of the

range of problems involved in steel turnarounds. Thus, Augustine Kochuparampil, CFO of Mittal

Steel Poland, remarked that half the issues were similar across turnaround situations.34 In particular,

the problems of previously state-run steel companies were typically concentrated in finance or

marketing, not in technical or engineering areas.

What Business Week termed the Mittal Method had six key steps:35

1.

Mittal would replace most incumbent managers with his own executives, charged with

rapidly stabilizing the company’s operations, except where management of the acquired

company was willing to commit to and seemed capable of meeting very aggressive targets,

set by benchmarking to international rather than local standards.

2.

A substantial cash infusion would be made, and credit with suppliers re-established to

ensure a steady flow of raw materials. In Poland, for example, the new CFO personally called

on angry creditors and suppliers to regain their confidence. Eliminating barter deals, which,

while common in many state-run economies, engender corruption and negatively impact

cash flow, was another priority.

3.

Once the commercial operations are stabilized, attention would turn to technical matters.

Mittal Steel’s top engineers would be brought in to improve operations across the board,

including reworking maintenance schedules to reduce downtime.

4.

In terms of products and marketing, production was typically shifted to higher-value items,

and there was an emphasis on selling to end-users rather than to middlemen.

5.

In the next step, integration involved, first, connection of the new plant to global systems

and, over a longer time frame, to the global network.

6.

The final step, also often implemented over a longer time frame, was to prune the acquired

assets, getting rid of non-core operations, as well as gradually cutting back on staff, often

through buyout programs.

Overall, there was a relentless emphasis on rapid, demonstrable results: on stabilizing operations

and achieving profitability within months, rather than years. All of this took place in environments

with which most Mittal managers, many of them originally from India, were unfamiliar. Among the

executive team, the number of interpreters employed in a unit was an informal measure of how well

the integration was going—the fewer the number of interpreters, the better.36 Thus, Mittal Steel

Poland’s CFO, Kochuparampil tried to get all English-speaking managers to learn Polish, himself

putting in two hours of lessons every weekend.37 Systematic efforts to learn from each acquisition

were also part of the process; as Johannes Sittard put it: “We are a small team, and acquisitions are

much of what we do, so post-acquisition assessments are a permanent part of our conversations.”38

Ongoing Value Creation

The principal focus in the dealmaking and turnaround stages fell on one-time value creation,

principally by “importing modern management techniques into previously inefficient state-run

mills.”39 That left open the question of how, once each individual plant was running smoothly and

profitably, Mittal might be able to add further value. Or as some observers put it, how was Mittal

9

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

going to progress beyond a private equity business model into becoming the world’s first true steel

multinational: a company that added value on an ongoing basis by coordinating its operations across

individual countries?

Regional integration was one obvious answer: grouping operations in adjacent countries enabled

them to extract better terms from suppliers of iron ore, coal, and power, helped ensure that they did

not compete for the same customers, and enhanced the reliability of supply.40 The concentration of

acquisitions by LNM Holdings in Eastern Europe between 2001 and 2004 had been premised on just

such logic, and had started to be acted upon. Thus, after the acquisition of Polskie Huty Stali in

Poland, LNM announced a common senior management team for the plants in Poland and the Czech

Republic which, in addition to being in neighboring countries, relied on common iron ore sources

from the Ukraine.

Coordination at the global level was complicated by the 25-nation global footprint. Nevertheless,

Mittal Steel had installed some coordination and communication tools that were beginning to attract

broader attention, such as e-rooms: on line “war rooms” for managers worldwide to post problems

and solutions. Even more important were regular conference calls, which would last for several

hours.41 Every Monday, as many as 120 line managers from around the world would join Mittal’s top

executives in London and discuss (and share information about) prices, customer issues, and

performance. Malay Mukherjee, Mittal Steel’s COO, explained the rationale:

We created the Monday call seven or eight years ago. We have 20 sites, and you have the

manager taking the call and five or six of his people listening in. We made it the first day of the

working week so everyone has to be fully prepared, even on events that have happened over

the weekend.42

The conference call on Monday was followed by another on Tuesday that focused on operational

problems—production, quality, maintenance, bottlenecks, etc.

A forerunner of these calls was the Knowledge Integration Program (KIP), an early Mittal initiative to

“keep stirring the whole organization.”43 The KIP involved twice-yearly meetings in which

(operating and staff) functional representatives from all Mittal Steel plants would meet for 2–4 days

to review performance against targets, highlight accomplishments and setbacks, discuss technical

issues of common interest, update each other on developments in their respective areas, and jointly

commit to future targets44 The venue would rotate among the various plants, and the agenda was set

in consultation with the functional heads. Apart from being an informational forum, the KIP

meetings facilitated the creation and nurturing of interpersonal networks. As one manager from

Mexico put it: “If I have a question, I don’t have to wait until the next KIP meeting. I can make a

phone call or send an email to Canada or Trinidad. I probably exchange at least one email every week

with them.”45 An expanded Knowledge Management Program (KMP) also grew up out of KIP. In

2004, nearly 25 meetings, with over 500 managers attending, were held worldwide under the KMP.46

Of course, LNM himself served as a key coordinator: he routinely logged over 350,000 miles a year

of travel. And yet, some of his executives were beginning to say that they didn’t see as much of him

as they used to earlier.47 The personal as well as organizational costs of coordinating an increasingly

far-flung operation were clearly multiplying. This sharpened the question of whether Mittal Steel was

worth more than the sum of its parts once each piece had been restructured.

10

Mittal Steel in 2006: Changing the Global Steel Game

-DRAFT-

Strategic Vision

While LNM had reason to be proud of his team’s track record at turnarounds, he knew that Mittal

Steel had reached an important turning point in its evolution. Before he bought ISG in 2004, almost

75% of his then 40-million ton capacity was the result of privatization-related acquisitions of

inefficient Soviet-era plants48 Overwhelming though their problems were, turning around such

derelict operations was, by now, fairly straightforward to a team that had done it may times already.

However, ISG was a different story altogether: Mittal had bought it from another master at

turnarounds, Wilbur Ross, and it was not clear how much more stand-alone efficiencies could be

squeezed out of ISG49. The 42% premium paid for ISG also raised the bar for transaction returns. Not

surprisingly, some observers were privately beginning to wonder if Mittal had run out of “lowhanging fruit,” i.e., run out of quick-hit opportunities to create value through restructuring—

speculation that was fuelled both by recent winning bids (e.g., Kryvorizhstal) and losing bids (e.g.,

Erdemir in Turkey where, despite owning 8% of the company, Mittal found itself beaten by a rival

willing to bid more than $1,170/ton of steel production).

Global Consolidation

The principal strategic rationale that Mittal had long offered for its international expansion had to

do with the importance of global scale and scope, broadly defined: according to the company’s

website, it was founded on the philosophy “that to be able to deliver the range and quality of

products customers demand the modern steel maker must have the scale and worldwide presence to

do so competitively.”50 The benefits of being big were supposed to include risk-reduction as well as

the improvement of the poor industry structure described in the “World Steel Industry” section of

this case. Thus, according to LNM, “Consolidation of our industry has already started, but it is

important that it continues so that we can move away from being seen as a volatile and erratic

sector.”

COO Malay Mukherjee noted that a company with one blast furnace would have trouble shutting

it in a downturn but that a company with 20 might be able to idle one or two.51 He also provided

some other indications of the role that consolidation might play in increasing industry attractiveness

by increasing vertical bargaining power:

Iron ore has for many years had pricing set on the basis of international benchmarks, which

have been negotiated annually. In contrast, steel has no global benchmark pricing

mechanism…One driver of the difference between iron ore and steel pricing is that the iron ore

suppliers are much more consolidated and the major players treat the world as one

market…The more fragmented a market, the less transparency and the greater the likelihood

of poor capacity management.”52

Despite initial skepticism, there were some indications that other major steelmakers were

beginning to buy into the logic of global consolidation. As Guy Dollé, CEO of Arcelor, who was

broadly supportive, noted, “Mittal has had a vision for the industry that goes back a long way, well

before the majority of his peers.”53 Support for this point of view derived from the fact that Mittal

itself had boosted its share of global steel output from less than 1% in 1995 to 6% by 2004 as well as

helping increase the share accounted by the top 5 steel producers from 13%—where it had more or

less stagnated since 1980—to nearly 20%.

Looking forward, LNM had increased the concentration levels associated with his “global

consolidation” vision: while he had originally envisioned a handful of steelmakers with 50–60 million

11

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

tonnes of capacity each, as Mittal Steel grew past that level, his vision had shifted to an industry with

5–6 megamajors with 80–100 million tonnes of capacity each. And as he was fond of pointing out,

Mittal Steel intended to be the first to get there.

Vertical Integration

Mittal Steel had always paid considerable attention to upstream inputs, as evidenced by its

involvement from the beginning in the development of DRI as a substitute for scrap. But vertical

integration had recently become far more visible in the company’s pronouncements about its

strategy, partly because of the raw material price increases experienced by the steel industry in the

course of the recent boom: between 1994 and 2004, the cost of coal increased from about $35 to $55

per ton, the cost of natural gas went from $90 to $160 per ton, and the cost of iron ore went from $27

to $38 per ton.54 Against this backdrop of high prices, LNM had recently begun to signal the need for

“re-integrating” the industry vertically. In a May 2005 presentation to investors, Mittal Steel provided

numbers suggesting a unique raw materials integration position relative to its peers—Mittal Steel’s

iron ore integration level was 43% versus 12% average for the top global producers, and coal

integration level was 52% versus a 1% average for the peer group (see Exhibit 10).

Looking at the country level rather than at the company level seemed to suggest that such

uniqueness might indeed be very valuable. Thus, Mittal Steel’s cross-country analyses indicated that

variations in raw materials costs were key drivers of variation in steelmaking costs (see Exhibit 11).

LNM also had a general sense that raw material considerations actually were beginning to drive steel

firms’ strategies in ways that were unprecedented. Much of the world’s iron ore came from Brazil,

India, and Australia. As economic development gathered pace, many of the traditional supplier

nations were beginning to want to add more value at home, i.e., to beef up local steelmaking rather

than export most of their iron ore. For instance, the ex-Soviet CIS nations held almost 34% of the

world’s iron ore reserves, but accounted for only 10% of world steel production. In India, which was

estimated to have significant reserves of high quality iron ore (5.3% of world reserves), but only

produced about 36 mmt of steel, the government was negotiating with several steelmakers in parallel

(including Mittal Steel and South Korea’s Posco) to build multiple 12 million ton capacity steel plants,

with mineral rights being one of the key determining variables. Similarly, China’s steel producers

were venturing abroad in a purposeful search for secure raw material suppliers.

LNM noted that the purchase of Kryvorizhstal, in the Ukraine, could at least partially be justified

in such terms. Kryvorizhstal was located within a large iron ore mine complex with over a billion

tonnes of iron ore reserves. The plant was also almost fully self-sufficient in coke requirements. Thus,

access to low-cost captive raw material sources was assured and, upon closing the acquisition, Mittal

Steel would become the world’s fourth largest mining company if company-wide captive mining

operations were added up. In addition, of course, there were the debottlenecking opportunities

implied by imbalances and underutililized capacity at different vertical stages: although

Kryvorizhstal’s crude steel capacity was 10 million tpy, it had a rolling capacity of only 6 million tpy

and was currently rolling only 4 million tpy of 7.6 million tpy production level into finished steel; the

rest was turned into less attractively priced “re-bar” (reinforcing bars) for construction and other

markets. Mittal Steel also estimated initial synergies in the region of $206 million by about 2007,

spread equally between marketing and purchasing, and the possibility of improving labor

productivity at the rate of 5% per year up to 2010.

One of the open questions that LNM had to deal with was about the value of vertical integration:

Not all steel industry leaders were convinced of the merits of vertical integration. Thus, although

Arcelor had secured the position of the leading producer in Brazil and was also focused on Russia,

12

Mittal Steel in 2006: Changing the Global Steel Game

-DRAFT-

India, and China (it planned to build up these four countries to more than 50% of its sales), it was

dubious about vertical integration per se. In the words of CEO Guy Dollé,

For steelmakers, it is worth[while] to distinguish access to raw materials from ownership of

mines. One can, as we do at Arcelor, have a good and stable delivery of raw materials without

owning the mines. This mining business faces much higher capital intensity than steel

industry, and the business models are different. There is no need to increase the load of the

steel vessel. There is no economic advantage to be integrated, unless transferring results from

upstream to downstream.

Arcelor’s own country-level analyses pointed to workforce costs being the largest drivers of variation

in steelmaking costs (see Exhibit 12).

Such skepticism was understandable since the steel industry had gone through previous cycles of

vertical integration and de-integration. For example, in 2001, U.S. Steel had famously reversed a

century of vertical integration by selling off many of its iron ore holdings. Moreover, LNM was aware

that conventional wisdom held that vertical integration through financial ownership did not make

much sense as a response to high input prices. Yet LNM worried that the problem might not reflect

just a transient hike in raw material prices. Upon analysis, the steel industry’s bargaining position

vis-à-vis its raw material suppliers seemed to him almost as disadvantaged as its bargaining position

vis-à-vis its automotive customers. Thus, the top 5 iron ore producers accounted for over 40% of iron

ore, while the top 5 steelmakers accounted for less than 20% of the market55 If this was a permanent

problem, vertical integration seemed to be the obvious solution, at least to him. However, he needed

to consider carefully how to craft his message to investors and analysts.

Girding for the fight ahead

It was clear, however, that the implications of the Kryvorizhstal acquisition would pale in

comparison to the hostile bid that was about to be announced. LNM had approached Arcelor’s chief

executive, Guy Dollé, on January 13—at dinner in Mittal’s palatial London home—with a proposal

for a friendly deal, which was rebuffed. Mr. Dolle “saw difficulties with the plan.” Subsequently, Mr.

Dolle canceled their next meeting and then did not return his phone call.56 Moreover, although

Arcelor shareholders were mainly institutions—who were in general quite willing to swap shares at

the right price—its ownership and employment stakes were diffused through Luxembourg, France

and Belgium. Indeed, some French officials showed concern right away, saying they heard the

surprise news on the morning of January 27, with no prior warning.57 Mittal Steel’s investment

ratings could be adversely affected if it ended up paying too much for Arcelor. A Fitch Ratings note

later pointed out that while Mittal’s ratings were high for the steel industry, “there are numerous

risks surrounding the acquisition plans, including the high likelihood the price will need to be

raised.”58 If a higher price had to be paid, it was not clear how much additional money Mittal Steel

would be able to raise. The initial offer was based on a €5 billion bank loan put together by Goldman

Sachs and Citigroup, and the company would have $14 billion in debt if the deal went through59.

Finally, there was the issue of Dofasco, the Canadian steelmaker that Arcelor had recently acquired

after beating out ThyssenKrupp in a bidding competition. Given that Mittal Steel already had a high

market share in North America, the combination would almost certainly face anti-trust hurdles in the

US and Canada. One solution would be to sell Dofasco upon the completion of the proposed merger.

At the press conference announcing the bid for Arcelor, it was revealed that LNM had called

Ekkehard Schulz, ThyssenKrupp’s chief executive, on Tuesday, January 24—after learning that

Arcelor had won the Dofasco bid—to offer Dofasco to Thyssen for 68 Canadian dollars a share (as

against the 71 Canadian dollars that Arcelor had paid), assuming that Mittal gains control of

13

-DRAFT-

Mittal Steel in 2006: Changing the Global Steel Game

Arcelor—which was by no means a certainty. Whatever the eventual outcome, the next few months

were sure to be interesting.

14

Mittal Steel in 2006: Changing the Global Steel Game

Exhibit 1

-DRAFT-

Value Line Industry Groups

ROE-Ke Spread

Toiletries/Cosmetics

Drug

Soft Drink

20%

15%

Tobacco

Food Processing

Household Products

Electrical Equipment

Financial Services

Specialty Chemicals

Newspaper Integrated Petroleum Electric Utility - East

Bank

Retail Store

Telecom

10%

5%

0%

(5%)

(10%)

(15%)

0

100

200

300

Tire & Rubber

Electric Utility - Central

Medical Services

Machinery

Auto & Truck

Computer & Peripheral

Paper & Forest

Air Transport

Average Invested Equity ($B)

Steel

400

500

600

700

800

900 1,000 1,100 1,200 1,300

Source: Compustat, Value Line, and Marakon Associates analysis, as reproduced in Ghemawat,

Strategy and the Business Landscape, 1999.

Exhibit 2 Top 10 Steel Producers’ Return on Invested Capital (ROIC) and Weighted Average Cost

of Capital (WACC)

30

25

ROIC

WACC

Percent

20

15

10

5

0

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Source: Mittal Steel Fact Book 2004.

15

DRAFT

Exhibit 3

Apparent Steel Consumption Growth Rates (year-on-year changes)

Hot-Rolled Band: China

Hot-Rolled Band: Rest of World

Long Products: China

Long Products: Rest of World

Source: Peter F. Marcus and Karlis M. Kirsis, “Chinese Steel: Facts and Forecasts, 2002-2010,” World Steel Dynamics, April 2004, p. 18.

-16-

Mittal Steel in 2005: Changing the Global Steel Game

Exhibit 4

DRAFT

Top 10 Steel Producers, 2004

Crude steel production (m tonnes)

Revenues/ton ($)

Implied operating costs/ton ($)

Operating income/ton ($)

Mittal

59

542

421

121

Arcelor

50.6

849

759

90

Nippon

31.4

826

707

119

JFE

31.1

787

687

100

POSCO

31.1

766

596

170

Crude steel production (m tonnes)

Revenues/ton ($)

Implied operating costs/ton ($)

Operating income/ton ($)

Bao Steel

21.4

609

464

145

U.S. Steel

20.8

652

579

73

Corus

19.9

597

557

40

Nucor

17.9

586

491

95

Thyssen Krupp

17.6

1035

946

89

Source: Mittal Steel.

Exhibit 5

Mittal Steel’s Operations by Region, 2002–4

Crude steel production (m tonnes)

Revenues/ton ($)

Implied operating costs/ton ($)

Operating income/ton ($)

Americas

2002 2003 2004

10.7

10.6 28.2

356

383 543

343

370 412

13

13

131

Europe

2002 2003

8.2

10.8

263

353

262

324

1

29

2004

17.6

562

450

112

Asia/Africa

2002

2003 2004

5.9

6.0 13.2

251

382 581

170

264 399

81

118 182

Source: Mittal Steel.

17

DRAFT

Exhibit 6

-18-

April 2004 Positioning of 10 World-Class Steelmakers by Factor Weight

LNM Group†

POSCO

S.K.

31

29

Country

Annual Steel Shipments (million tonnes)

Factor

Cash operating costs

Profitability in 2000-2003+A9

Balance sheet

Dominance country/region

Domestic market growth

Harnessing technological revolution

Access to outside funds

Cost-cutting efforts

Downstream businesses

Environment and safety

Expanding capacity

Iron ore and coking coal mines

Liabilities for retired workers

Location to procure raw materials

Alliances, mergers, acquisitions and JVs

"Pricing Power" with large buyers

Product quality

Skilled and productive workforce

Stock market performance (3-year)

Threat from nearby competitors

Weight

11%

8%

7%

7%

6%

5%

4%

4%

4%

4%

4%

4%

4%

4%

4%

4%

4%

4%

4%

4%

6

5

3

6

6

5

4

10

3

9

7

4

4

5

10

6

5

6

5

5

9

10

9

10

6

9

10

6

6

9

4

3

7

8

8

10

10

10

7

8

Nippon Steel

JFE

Japan

Japan

26

23

6

3

5

7

2

7

7

9

10

9

1

3

4

8

9

8

10

10

5

7

6

3

3

6

2

7

6

10

9

9

1

2

4

8

10

8

10

10

5

7

U.S. Steel

USA

18

4

2

5

5

2

5

4

8

3

9

2

7

5

7

10

5

8

8

9

5

Thyssen/Krupp

Nucor ISG Bao-Steel Anshan Steel Avg.

Germany

USA USA

China

China

16

15

14

11

10 19.3

4

4

4

4

3

7

5

7

7

9

1

2

6

5

9

6

9

9

3

4

1 = least favorable* 10 = most favorable*

* Many of these ratings are subjective and some are duplicative.

Plants in many countries, includes Ispat International.

†

Source: Adapted from Peter F. Marcus and Karlis M. Kirsis, “Chinese Steel: Facts and Forecasts, 2002-2010,” World Steel Dynamics, April 2004, p. 13–14.

5

6

10

5

2

10

10

6

9

9

10

10

6

10

3

6

10

6

4

7

3

8

5

2

5

8

8

2

9

3

4

10

5

10

5

7

8

6

5

8

10

8

7

10

7

9

7

2

9

8

4

8

7

9

8

8

7

7

5

7

6

5

4

10

7

7

9

2

9

10

6

6

7

5

4

5

6

9

4

6.2

5.2

6.0

5.9

4.5

6.9

7.0

8.0

5.3

9.0

4.7

3.9

6.4

6.6

9.0

6.3

7.8

8.4

6.2

5.4

DRAFT

Exhibit 7

History of Mittal Steel Acquisitions

1

ID #

Acquisition (Current name)

1 Trinidad (Mittal Steel Point Lisas)

Additional

Investment, Planned

Ownership Acquisition Price or Actual (USD

Share

Million)

Year

(USD Million)

May-89

100%

70

413

Crude Steel

Output at

2004 Crude Steel

Acquisition*

Capacity*

0.36

1.09

2 Sibalsa (Mittal Steel Lazaro Cardenas)

100%

220

525

0.48

3.63

3.63

3 Sidbec ( Mittal Steel Canada)

4 Hamburger (Mittal Steel Hamburg)

5 Karmet (Mittal Steel Termitau)

6 Irish Steel (Irish Ispat, shut down in 2001)

Canada

Germany

Kazakhstan

Ireland

EAF and DRI technologies

Ispat

EAF and DRI technologies; purchased from IHSW

Ispat/ LNM

Integrated (blast furnace) technology

LNM Holdings

Purchased from the Irish Government; shut down in 2001 due to poor prospIspat

of Irish market for steel and inability (due to trade union resistance) to impl

necessary cost reduction

EAF and DRI technologies; purchased from Thyssen Stahl AG

Ispat

Aug-94

Jan-95

Nov-95

May-96

100%

100%

100%

100%

186

45

500

51

193

95

500

30

1.18

0.85

2.30

0.45

1.63

Undetermined

4.72

N. A.

1.45

0.86

4.64

N. A

Oct-97

100%

78

1.36

Undetermined

1.27

2

Integrated (blast furnace) and EAF technologies

Ispat International

EAF and DRI technologies

Ispat International

Integrated (blast furnace) technology

LNM Holdings

Integrated (blast furnace) and EAF technologies

LNM Holdings

Integrated (blast furnace) technology

LNM Holdings

Downstream operations only (Tubes manufacturer)

LNM Holdings

Downstream operations only (Pipe manufacturer)

LNM Holdings

Integrated (blast furnace) technology

Downstream operations only (Hot rolling and Cold rolling mills)

EAF technology

LNM Holdings

Integrated (blast furnace) and EAF technologies

LNM Holdings

Integrated (blast furnace) and EAF technologies

LNM Holdings

Integrated (blast furnace) and EAF technologies

Mittal Steel

Hunan Valin is one of the largest steelmakers in China

Mittal Steel

Integrated (blast furnace) technology; significant coal and iron ore reserves Mittal Steel

(More than 900M tonnes of iron ore reserves)

Jul-98

Jul-99

Jul-01

Oct-01

Jan-03

Jul-03

Dec-03

Mar-04

Mar-04

Apr-04

Jun-04

Dec-04

Apr-05

Sep-05

Oct-05

100%

100%

99%

70%

76%

71%

70%

97%

83%

81%

50.10%

100%

100%

36.67%

93.02%

4.81

1.27

2.72

0.83

2.54

N.A.

N.A.

5.44

N.A.

0.68

6.43

0.18

14.15

6.05

6.99

5.91

Undetermined

6.40

1.80

3.30

N. A.

N.A.

7.60

N. A.

0.54

8.37

1.22

20.87

7.71

9.07

5.64

1.09

4.68

1.01

3.21

N. A

N.A

5.59

N. A

0.29

6.88

0.07

16.15

6.05

6.99

59.07

83.87

70.31

7 Rurhort & Hochfield (Mittal Steel Rurhort & Mittal Steel Hochfield)

Germany

USA

France

Romania

Algeria

Czech Republic

Romania

Romania

Poland

Macedonia

Romania

South Africa

Bosnia

USA

China

Ukraine

88

1399

107

500

Undetermined

549

1.13

16

532.85

Undetermined

54

1708

178

4500

922

5151

811.5

57

351

Undetermined

356

Undetermined

72

Undetermined

Undetermined

Undetermined

Undetermined

135

Undetermined

Undetermined

Undetermined

TOTAL

* ( Million Metric Tonnes)

List of acquisitions from Mittal Steel Fact Book 2004, "Company History," p. 31, updated from other company sources and news reports in October-November 2005.

Ispat International was floated in 1997; prior to that, the acquisition vehicles appear to have been locally established companies owned by LNM. After 1997, the acquisition vehicles were either LNM Holdings, a private company, or Ispat

istedInt'l,

company.

a publicly

Balance sheet information pertains to Ispat International or, after 2004, to Mittal Steel. LNM debt and equity information is not publicly available.

2

3

2004 Crude Steel

Output*

0.82

Country

Description

Acquiring Entity

Trinidad & Tobago

Electric Arc Furnace (EAF) and Direct Reduced Iron (DRI) technologies; Caribbean Ispat

previously leased from government of Trinidad & Tobago

Mexico

EAF and DRI technologies

Caribbean Ispat/ LNM Jan-92

8 Inland Steel Company (Mittal Steel USA)

9 Unimetal (Mittal Steel Gandrange)

10 Sidex (Mittal Steel Galati)

11 Alfasid (Mittal Steel Annaba)

12 Nova Hut (Mittal Steel Ostrava)

13 Tepro (Mittal Steel Iasi)

14 Petrotub Roman (Mittal Steel Roman)

15 Polskie Huty Stali (Mittal Steel Poland)

16 Balkan Steel (Mittal Steel Skopje)

17 Sidergica Hunedoara (Mittal Steel Hunedoara)

18 Iscor (Mittal Steel South Africa)

19 BH Steel (Mittal Steel Zenica)

20 International Steel Group (Mittal Steel USA)

21 Hunan Valin Steel Tube & Wire Ltd.

22 Kyvorizhstal

1

-19-

DRAFT

Exhibit 8

Ispat/Mittal Financial and Operating History

Shipments (million MT)

1993

1.74

1994

2.66

1995

4.87

1996

5.38

1997

6.58

Sales (million US$)

EBITDA** (million US$)

Operating income (million US$)

Financing cost (million US$)

Net income (million US$)

Net cash provided by operating activities (million US$)

Net cash used in investing activities (million US$)

Cash and short term investments (million US$)

Property, plant & equipment-net (million US$)

Total assets (million US$)

Short term debt (million US$)

Long term debt-including affiliates(million US$)

Shareholders' equity (million US$)

427

N.A

-4

-33

314

N.A.

N.A.

167

1836

2479

588

248

442

784

-37

138

-34

-81

N.A.

N.A.

41

485

1025

255

422

-226

1704

158

337

-29

83

N.A.

N.A.

63

606

1452

299

555

-133

1732

361

268

-41

234

82

-93

279

759

1953

338

877

59

2171 3492

367

511

324

404

-55

-132

236

237

-95

253

-296 -1474

804

525

942 3179

2882 5927

436

549

1104 2400

662

801

Average share price (US$)

Book value per share (US$)

Earnings per share (US$)

N.A.

N.A.

2.83

N.A.

N.A.

-0.73

N.A.

N.A.

0.75

N.A.

N.A.

2.11

N.A.

N.A.

2.02

EBITDA margin

Operating margin

Interest cover***

No. of employees ('000)

No. of countries with major steelmaking operations

New countries added

N.A. -4.72%

-0.90% 17.60%

0.12

4.06

N.A.

3

Trinidad

Tobago (198

Mexico (19

1998 1999

9.79 14.00

N.A.

N.A.

1.93

2000

18.42

2001

16.905

2002

22.269

2003

24.899

20042005 (Estimate)

38.167

54.432

4898

476

308

-184

85

599

-184

317

3333

5966

457

2184

854

6274

887

623

-242

398

740

-281

339

3914

6826

403

2187

1530

5423

212

-37

-235

-199

237

-214

225

4138

7161

470

2262

1106

7080

1125

702

-207

595

539

-360

417

4094

7909

546

2187

1442

9567

1905

1299

-131

1182

1438

-814

900

4654

10137

780

2287

2516

22197

6872

6146

-207

4701

4611

-801

2634

7562

19153

341

1639

5846

N.A.

N.A.

0.71

9.04

2.37

0.62

2.58

1.71

-0.31

2.56

2.23

0.92

4.5

3.89

1.83

17.77

9.09

7.31

3.90% 15.90%

-0.70% 9.90%

-0.2

3.4

19.90%

13.60%

9.9

31.00%

27.70%

29.7

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

N.A

116.3

11

179.4

14

N.A

16

Czech Poland, Sou

Republ Africa, Bos

China, Ukra

9.27% 20.84% 16.90% 14.63% 9.72% 14.10%

19.80% 15.47% 14.92% 11.57% 6.29% 9.90%

11.62

6.54

5.89

3.06 1.67

2.6

N.A.

N.A. N.A.

3

6

7

Canada,

Germany,

Kazakhstan Ireland

Sources: Mittal Steel Annual Reports; Mittal Steel Fact Book, 2004; Company press releases

* Figures relate to various Ispat/Mittal entities as they existed in each period reported

** Operating income+Depreciation+Other income+FOREX

***Operating profit/Financing cost

N.A.

7

N.A.

8

N.A.

9

USA France

N.A.

9

16.34

10

Romani

Algeria, e

from Irela

79.7

10

-20-

Mittal Steel in 2006: Changing the Global Steel Game

Exhibit 9

DRAFT

Post-Acquisition Cost Reductions

Shipments Ō000 mt

Operating Subsidiary

Ispat Nova Hut*

Ispat Annaba

Ispat Sidex

Ispat Unimˇtal **

Ispat Inland

Ispat Duisburg

Ispat Hamburg

Ispat Karmet

Ispat Sidbec

Ispat Mexicana

Caribbean Ispat

Year Prior to

Country

Year Acquired Acquisition

Czech

Republic

2003

2544

Algeria

2001

828

Romania

2001

3 041

France

1999

1 313

USA

1998

4 772

Germany

1997

1 397

Germany

1995

849

Kazakhstan

1995

2 297

Canada

1994

1 174

Mexico

1992

479

Trinidad

1989

358

Cost US$ / MT

2003

Year Prior to

Acquisition

2003

2 868

915

3 837

1 082

4 807

1 280

861

3 750

1 414

3 400

909

237

322

255

322

489

347

309

268

349

279

257

270

259

222

520

425

309

279

126

368

211

206

Source: Company presentation.

* Ispat Nova Hut 2003 Shipments annualized from 11 months data. Acquisition completed on 31st Jan 2003.

** Including Trefineeurope shipments.

Exhibit 10

Raw Material Positions in 2004

60%

Mittal

50%

Average of Top Global

Producers

52%

43%

40%

30%

20%

12%

10%

1%

0%

Iron ore integration level

Coal integration level

Source: Mittal Steel Investor Roadshow Presentation, May 5th 2005.

* Top global steel producers, excluding MittalSteel and Nucor, includes Arcelor, Nippon Steel, JFE,

POSCO, Baosteel, CorusGroup, U.S. Steel, and ThyssenKrupp

**MittalSteel 2004 excludes ISG.

21

DRAFT

Mittal Steel in 2006: Changing the Global Steel Game

Exhibit 11

Mittal Steel Assessment of Across-Country Cost Differences

Source: Mittal Steel Investor Roadshow Presentation, November 10th, 2005.

Exhibit 12

Arcelor’s Assessment of Across-Country Cost Differences

Cost Structure across Locations

250

221

215

209

198

200

29%

28%

30%

19%

13%

26%

192

188

33%

28%

155

150

21%

3%

20%

8%

100

166

1%

1%

1%

25%

33%

1%

9%

1%

1%

141

33%

1%

9%

1%

7%

53%

57%

68%

57%

65%

Brazil &

Argentina

56%

Centr. & E. Eur

52%

Japan

49%

EE (€ zone)

50

EU-15

1%

59%

Production Location

Raw materials

22

Electricity

Workforce

Other

Russia

China

India

NAFTA

0

Mittal Steel in 2006: Changing the Global Steel Game

DRAFT

Source: Adapted from Marc Lacroix, “Steel a long way from globalization,” presentation made at

University of Pittsburgh conference on globalization in the steel industry, April 2004.

End Notes

1

World Steel Dynamics, Truth or Consequences #28, page 51.

2

New York Times, January 28, 2006, “Mittal Steel makes bid for a rival.”

3

New York Times, January 28, 2006, ibid.

4

The Independent, October 25, 2005, “Mittal Splashes out £2.7 billion for Ukraine’s Biggest Steel Producer.”

5

The Independent, October 25, 2005, ibid.

6

Arcelor press release, 24 October 2005.

7

Metric tonnes per year.

8

http://biz.yahoo.com/ap/051024/ukraine_privatization.html?.v%3D17, last accessed November 30, 2005.

9

http://www.guardian.co.uk/ukraine/story/0,15569,1599972,00.html, last accessed November 30, 2005.

10 This section draws heavily on HBS case 9-793-039 “Nucor at a Crossroads,” by Pankaj Ghemawat and

Henricus J. Stander III.

11 Wall Street Journal, October 5, 2005, p. B3J, “Mittal Steel Plans Plant in India After Buying Part of Chinese

Firm.”

12

Ispat International, 1997 Annual Report, p. 14.

13 Peter F. Marcus and Karlis M. Kirsis, “Chinese Steel: Facts and Forecasts, 2002–2010,” World Steel Dynamics,

April 2004.

14 Jinghai Liu, presentation on Chinese steel markets, University of Pittsburgh Workshop on the

Globalization of the Steel Industry, April 2004.

15 “World Steel Demand,” presentation by Armand Sadler, Chief Economist, Arcelor, at University of

Pittsburgh Workshop on the Globalization of the Steel Industry, April 2004.

16

Wall Street Journal, November 21, 2005, p. R9, “Steel: Putting the Pedal to the Metal.”

17

Wall Street Journal, November 21, 2005, ibid.

18

Wall Street Journal, November 21, 2005, ibid.

PriceWaterhouseCoopers, “Forging Ahead: Mergers and Acquisitions Activity in the Global Metals

Industry, 2004.”

19

20 LNM’s early history is based on Don Sull (1999), “Spinning steel into gold: The case of Ispat International

NV,” European Management Journal, August 1999, 17(4), pp. 368-78.

21

The Economist, January 10, 1998, “Making steel.”

22

Fortune, February 7, 2005, “Metal man.”

23

Fortune, 2005, ibid.

24 Businessworld, August 15, 2005, “Once an outsider, Lakshmi Mittal is now changing the face of the global

steel industry,” p. 34.

23

DRAFT

Mittal Steel in 2006: Changing the Global Steel Game

25